Original | Odaily (@OdailyChina)

Author | Golem (@web3_golem)

Over the past year, CoinW's business has seen significant growth. Internal data shows that in 2024, CoinW added over 1.14 million new users, with total trading fees exceeding $175 million and total trading volume exceeding $305.7 billion, a year-on-year increase of 716.01%. According to CoinGecko's exchange ranking data, CoinW ranks 23rd among the world's 217 crypto exchanges.

Although CoinW is an established exchange founded in 2017, it still maintains innovative vitality. Over the past year, it has launched its own trading product PropW, reduced its order fees to as low as 0.01%, introduced a Telegram signal copy trading bot, and offered advanced limit orders, continuously improving the user experience, which is also a key reason for CoinW's significant business growth in 2024.

Next, we will introduce CoinW's innovations and product updates over the past year in detail.

Innovations and Product Updates Over the Past Year

PropW: Discovering Trading Talents, Achieving Win-Win

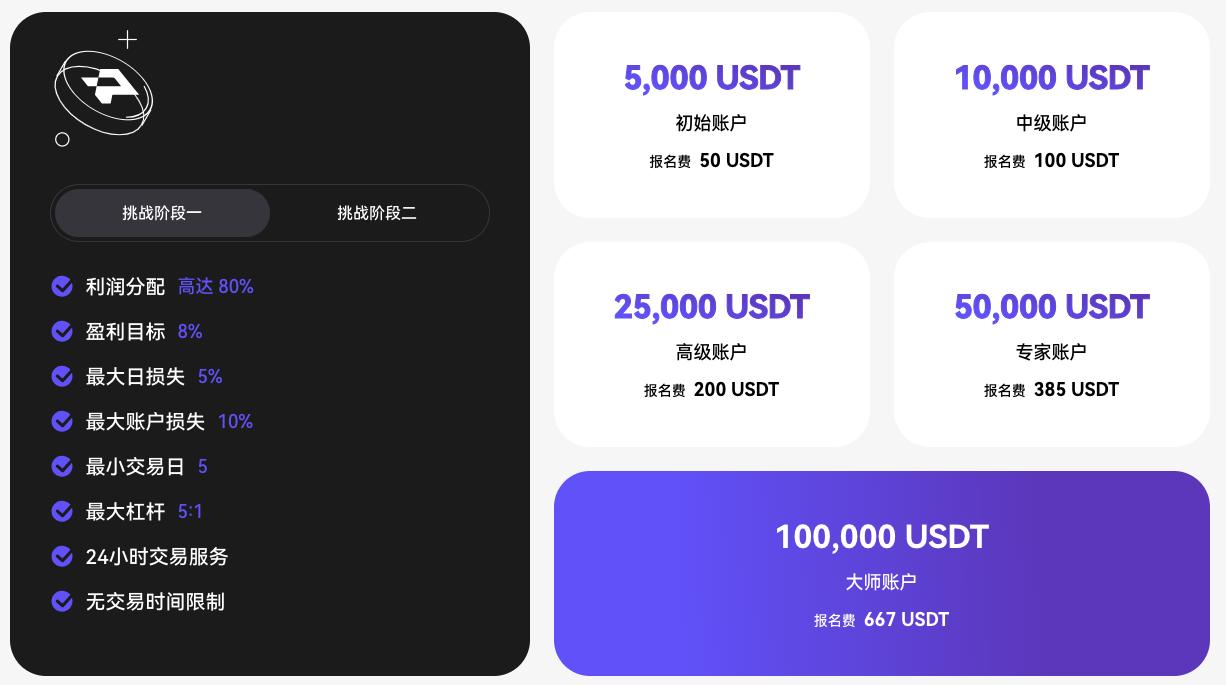

PropW, launched by CoinW on April 24, 2024, is a proprietary trading product where users can trade using the platform's own funds after paying a registration fee and passing a trading test. The fund size ranges from $5,000 to $200,000, with a profit distribution of up to 80%, and users who reach their profit target can also get a full refund of the registration fee.

Meanwhile, PropW has set up flexible challenge modes, with a profit target of 8% and a maximum account loss of 10% in the regular mode, and a profit target of 10% and a maximum account loss of 6% in the difficult mode.

PropW has developed a unique evaluation process for platform traders. Traders who complete the challenge or meet the conditions can manage the platform's funds for trading, eliminating certain financial risks for individual traders while maximizing their trading potential (with a maximum profit distribution of 90%), achieving a win-win between the platform and users.

In 2025, CoinW plans to further refine the PropW product, including increasing the maximum account limit (beyond the current $200,000) and launching API trading, continuously improving the user trading experience.

Order Fees Permanently Reduced from 0.04% to 0.01%

On November 15, 2024, CoinW announced a permanent reduction in its futures trading order fees from 0.04% to 0.01%, while the taker fee remains at 0.06%. Binance Futures' order fee is 0.03%, while CoinW has reduced it to 0.01%, undoubtedly enhancing the trading experience for platform users and boosting the profitability of high-frequency traders and volume-based strategies.

Especially for regular users, the 0.01% order fee can reduce the cost of dollar-cost averaging (DCA). For example, if a DCA user invests $10,000 per month in BTC futures contracts, the monthly fee using Binance would be $3, while using CoinW the monthly fee would only be $1. This difference will reduce the trading costs for long-term investors.

For the entire market, reducing order fees and encouraging users to trade through limit orders can also help improve overall market liquidity.

Automated Tools and Advanced Limit Orders

In 2024, CoinW continued to improve its products to enhance the user trading experience. In October, CoinW launched a series of futures trading strategies, including Martingale (buying the dips in market corrections), CTA (real-time monitoring and execution based on indicators like MA, MACD, and BOLL), and contract grid strategy (24/7 automated "buy low, sell high" or "sell high, buy low" strategy).

Users can easily adopt these strategies with one-click automation, whether they are beginners or advanced users. According to official website data, CoinW's strategy trading currently has 4,694 cumulative users, with total user earnings exceeding $440,000.

In December 2024, CoinW released a Telegram signal copy trading bot. Users don't need to download the CoinW app, but can directly link their Telegram account and wallet to perform contract copy trading, with an intuitive and smooth interface and seamless execution, suitable for both individual traders and teams.

Additionally, to provide users with a better trading experience, CoinW also launched three advanced limit orders as early as 2023: take-profit/stop-loss limit order, IOC (immediate-or-cancel), and FOK (fill-or-kill).

The take-profit/stop-loss limit order is used to set specific take-profit or stop-loss prices, and will only be executed when the market price reaches or exceeds the set limit price.

IOC means the order must be partially or fully executed immediately, and if the order cannot be fully or partially executed upon receipt, it will be canceled.

FOK means the order must be fully executed, otherwise it will be canceled entirely. FOK orders require complete matching upon submission, and if they cannot be fully executed under current market conditions, they will be immediately canceled.

The take-profit/stop-loss limit order is suitable for users to control their profits or losses, IOC is suitable for traders who want to enter or exit the market quickly, and FOK is suitable for large-volume traders who want to execute orders at a specific price, and the order will be canceled if it cannot be fully executed.

These three order types work together to provide traders with greater precision and flexibility in their trading strategies.

Conclusion and Outlook

Over the past year, CoinW has significantly enhanced its platform competitiveness through a series of innovative initiatives, particularly in terms of products and services, with PropW and the 0.01% order fee being CoinW's highlights. On one hand, PropW provides users with a low-risk trading opportunity, helping traders maximize their earnings using the platform's capital support; on the other hand, CoinW's low-cost trading fees will also continuously attract high-frequency traders and DCA traders to join the platform.

Looking ahead to 2025, CoinW will continue to focus on enhancing user accessibility and empowering global traders, launching more products to provide users with a more inclusive and user-friendly trading environment. In terms of community interaction, CoinW also plans to hold more regional events to enhance interaction with global users and launch more localized activities and services based on different regional needs.

Based on past cycle experiences, each bull market may see a "crypto exchange reshuffle", and CoinW, after 7 years of development, not only remains on the table, but is also highly likely to disrupt the crypto trading landscape through innovation in the future. We look forward to seeing what's to come.