Author: Xiyou, ChainCatcher

Editor: Nianqing, ChainCatcher

Recently, there has been an increasing number of news about the public sales of Bit projects. It is worth noting that these Bit project public offerings have not chosen the early IC0 platform Coinlsit as the sales platform, but have turned to the new generation of IC0 platforms that have quietly emerged, such as Echo, Legion, and Buidlpad, and these platforms have already established influence in the overseas Bit community. Well-known Bit projects such as Ethena, Usual, Monad, Initia, MegaETH, Fuel, and Solayer have all raised funds for the community through these platforms. Many overseas Bit community users frankly admit that participating in the financing activities of these emerging IC0 platforms has become their main way of obtaining returns.

On January 18, the IC0 platform Buidlpad created by a former executive of Binance completed the public sale of its first project Solayer (LAYER), and the final funds raised reached $57.3 million, an increase of 545.24% over the original plan of $10.5 million.

On January 13, the founder of the Echo platform, Cobie, revealed an interesting phenomenon: some VCs are trying to put pressure on Bit projects to prevent them from providing discounts or conducting community sales to investors through platforms like Echo. In response, the IC0 platform Legion incubated by Delphi Labs expressed resonance and confirmed that there are indeed VCs preventing projects from conducting public offerings.

Although VCs are trying to resist Bit projects' participation in IC0, this precisely reflects that these IC0 platforms have already gained a certain influence and have occupied an important position in the minds of Bit projects and the community. For a long time, the Bit community has been plagued by "high valuation, high FDV, and low liquidity" of VC Tokens, but these platforms provide users with early opportunities to participate in projects.

On the same day, Buidlpad stated that due to the overwhelming number of registered users participating in the Solayer public offering, its website was forced to temporarily suspend KYC, and the offering time had to be postponed.

All of this seems to herald the dawn of a revival in the Bit IC0 field.

The "Public-Private Placement" Echo Bit Angel Investor Community Alliance

Echo is a Bit financing platform created by Bit KOL @Cobie. Cobie, whose real name is Jordan Fish, joined Lido in 2021 to be responsible for TVL growth, and is considered by the community to be one of its co-founders. He is also the initiator of the Web3 podcast program UpOnly, and has interviewed many big names in the Bit circle, such as Vitalik Buterin, Michael Saylor, and Mark Cuban, becoming a prominent figure.

In March 2024, Cobie announced the release of the Echo platform's test version and completed the first financing transaction: Ethena raised $300,000 through Echo.

Unlike the previous large-scale public IC0 platforms (such as Coinlist), Echo is not an open fundraising platform for retail investors, but more like a Bit investor community alliance. On the Echo platform, supporting users create their own investment communities as lead investors, and share their investments with the group members to invest together, and then the lead investors can extract a certain percentage of the investment returns.

The working mechanism of Echo's products is similar to the joint investment product Syndicates launched by the US startup fundraising platform AngelList, aiming to allow individual angel investors to raise funds like VCs finding LPs, and then get a certain percentage of the investment returns, allowing those with less money but more resources to play the role of VCs. Therefore, Echo is also known as a Bit angel joint investment platform.

The early financing amounts on Echo are usually concentrated in the hundreds of thousands of dollars, and the number of participating investors is also mostly around dozens, more suitable for the angel round and VC financing stages of early projects.

Currently, users who want to use the Echo platform to invest in projects need to go through KYC procedures such as email, wallet, and X account.

It is worth noting that the project fundraising on Echo is all private placement, without disclosing any details, without marketing or promotion, and only qualified investors can see the transactions. Investing users need to join the group created by the lead investor to obtain fundraising information, and those who want to become lead investors generally need to be invited by Echo, and well-known figures in the Bit industry are more likely to be invited.

It is reported that the CEO of The Block, Larry Cermak, and the founder of Aave, Marc Zeller, have already created their own Echo communities, and users who want to join not only need to be tested, but also need to meet certain conditions to obtain specific investment opportunities within the group.

Since its launch, more than 30 Bit projects have raised funds through Echo, including Ethena, Morph, Usual, Hyperlane, OneBalance, Wildcat, Sphere, Dawn, Derive, Monad, Initia, and MegaETH. On January 17, the decentralized trading platform GTE_XYZ also raised $2.5 million through the Echo platform.

Among them, the $10 million financing of MegaETH through the Echo platform in December was the most concerned, attracting the attention of the Bit community. According to an interview with MegaETH co-founder Shuyao Kong, MegaETH first achieved its $4.2 million financing target on Echo in just 56 seconds, and then decided to raise an additional $5.8 million on Echo, which was completed in 75 seconds.

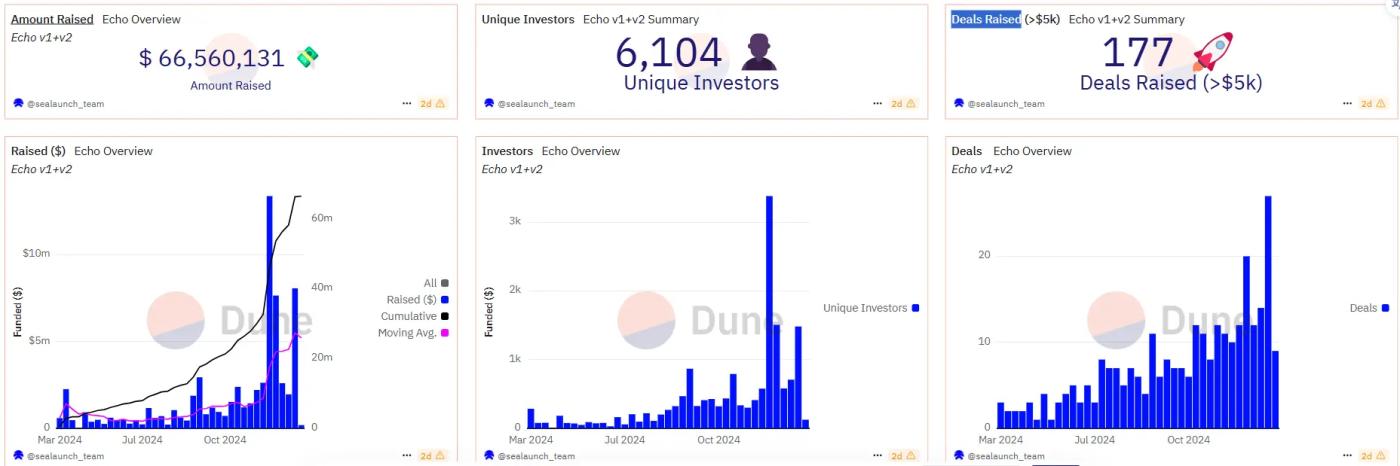

According to Dune's statistical data, as of January 17, the total financing amount completed on the Echo platform has reached $66.6 million, with 6,104 investing users, and 177 financing transactions of more than $5,000. The average financing amount per transaction is about $360,000, with an average of 130 participants per transaction, and an average investment amount of $3,130 per user.

Based on the publicly available investment project information, Bit community users have summarized that Echo's lead investor recommendation mechanism and profit-sharing model make trustworthy investment more democratized, and the platform tends to choose high-potential projects supported by the Bit elite circle.

Legion, the Bit KOL Investor Alliance Incubated by Delphi Labs

Legion is a chain-based IC0 platform incubated by the Bit venture capital firm Delphi Labs, aiming to build a set of investor reputation systems to allow projects to decide the amount of investment and discount benefits to be allocated to investors. The platform announced the completion of a $2 million seed round financing in August 2024, led by Cyber Fund, with participation from AllianceDAO, Delphi Labs, and LongHash.

The specific implementation is that Legion provides an aggregated on-chain and off-chain reputation system called Legion Scores, which assigns a Legion score to each user on the platform to reflect the user's value capabilities in multiple aspects.

After registering on the Legion platform, users will receive a score by connecting their social accounts such as X, wallet addresses, and submitting personal capability information or resources they can provide to the project. Currently, Legion's scoring is based on data in four areas: social media influence, development experience, on-chain interaction experience, and investment history and appreciation experience.

Through the Legion score, investors prove their past transaction capabilities and data status, and project parties can customize financing requirements based on project needs, using each investor's on-chain and off-chain standards to customize allocation, whitelist, discounts, etc., only allowing specific investor groups to participate, such as early projects can choose users with large social media influence and resources and capabilities as the initial participants in the project community. If a user is allocated but does not invest, their investor score will be lowered.

According to investment community users, Legion is more inclined towards KOLs with a large fan base. Therefore, Legion is also seen as a Bit KOL investment alliance.

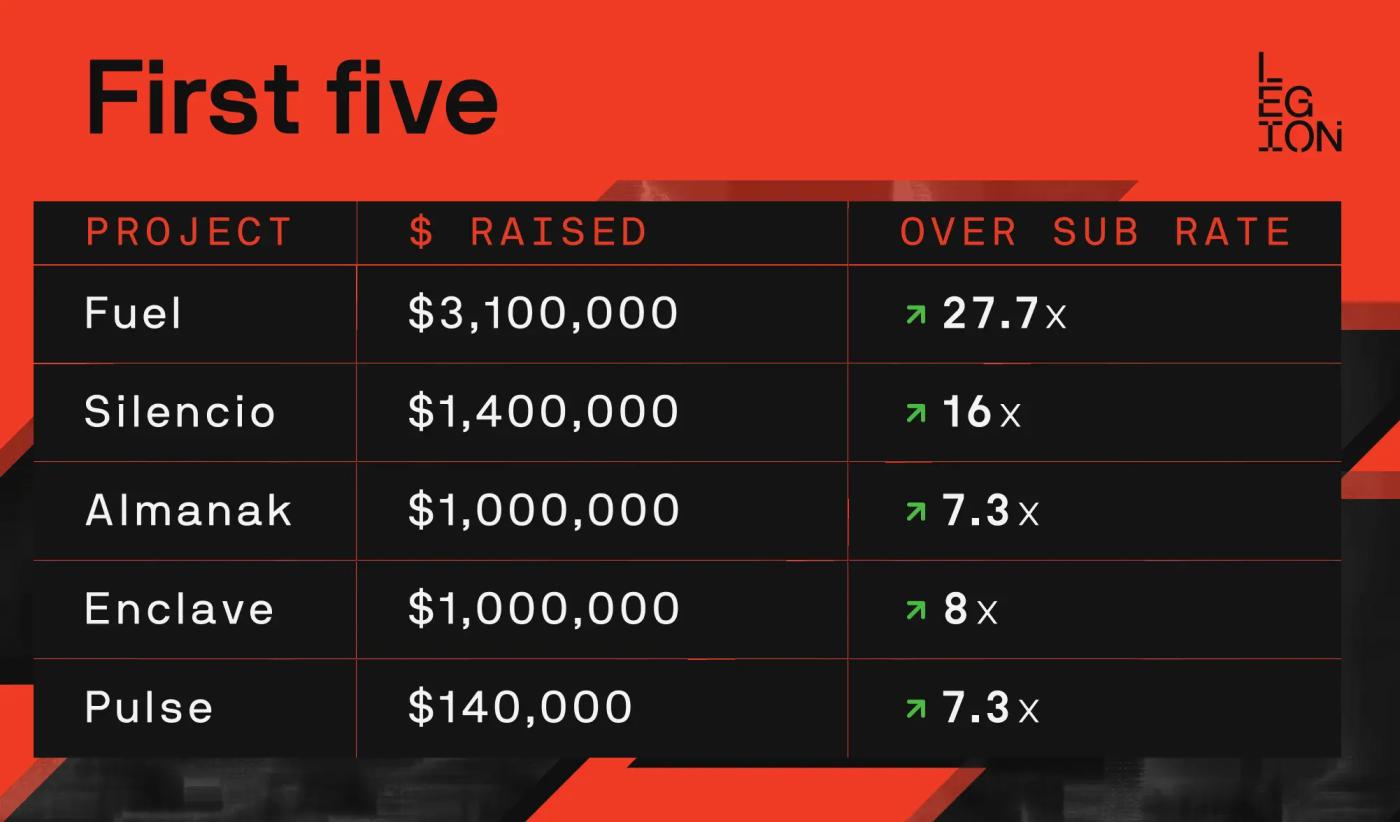

On January 15, Legion's official X social media stated that in the six months since its launch, the Legion platform has completed fundraising for 5 Bit projects, including: the modular L2 network Fuel, the DePin network Pulse, the DePIN project Silencio, the privacy computing Enclave, and the AI Agent platform Almanak.

Among them, Fuel was launched on the Bitget exchange on December 14, and the price once surged to $8 after listing, with the return on investment for those who invested through Legion exceeding 27 times. It is the blessing effect of Fuel that has brought Legion into the Bit community.

Buidlpad, the Public Offering Platform Created by a Former Binance Executive

Buidlpad is an IC0 platform created by Erick Zhang, a partner at Nomad Capital, who was previously the head of Binance Research Institute and responsible for the Lanuchpad platform. In December 2024, he announced the launch of the Buidlpad public offering platform for KYC-compliant users in non-restricted regions.

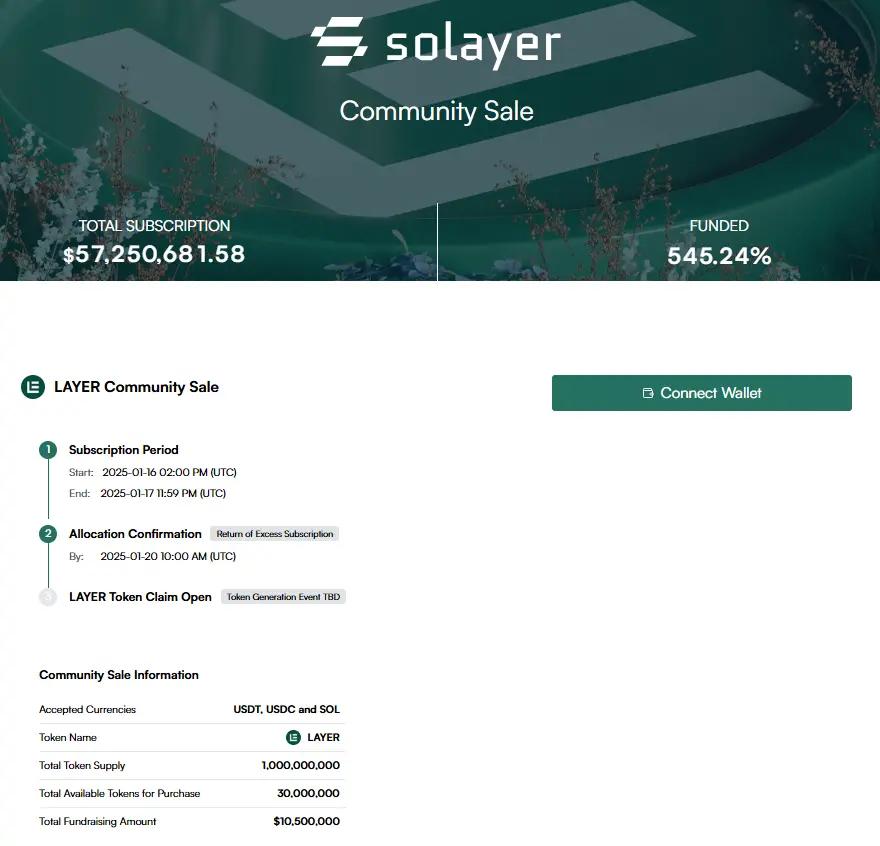

On January 10, Buidlpad announced that the Solana ecosystem's re-pledging protocol Solayer will conduct a public sale of LAYER Tokens on the platform on January 13, which is the first public sale on the Buidlpad platform since its launch.

However, on January 13, Buidlpad stated that due to the large number of registered participants on the platform (15 times higher than expected), the Solayer subscription start time was postponed to January 16.

According to the disclosed information, Solayer plans to raise $10.5 million with a valuation of $35 million, providing 30 million Tokens, with each Token priced at approximately $0.35. Except for the whitelist, which can receive up to $5,000 worth of SOL purchase rights, other participants need to purchase a minimum of $50 worth of SOL, and the maximum purchase is limited to $2,000 worth of SOL.

On January 18, the Solayer (LAYER) public sale ended, with the final funds raised reaching $57.3 million, 545.24% more than the original plan of $10.5 million.

Similarly, users need to go through KYC authentication to use the Buidlpad platform.

However, compared to financing platforms like Echo and Legion, the Buidlpad platform is more user-friendly, suitable for players who meet the KYC qualifications, and more like the previous ICO aimed at the general public.