This article is machine translated

Show original

[The Block Size War (Deepening Edition)]

-Who controls the Bitcoin protocol?-

Chapter 19

On June 30, 2017, a big blocker event called ‘The Future of Bitcoin Conference 2017’ was held in Arnhem, Netherlands. Speakers included Jihan Wu (@jihanWu), Andrew Stone of BU, Craig Wright (@Dr_CSWright), and Amory Sechet (@deadalnix).

youtube.com/playlist?list=PLW5...

Amory Sechet introduced the project under the title, “Back to Basics.”

The project is said to increase the block size while applying optional replay attack protection that allows undesired parties to remain on the original chain, and it is called “Bitcoin ABC.”

youtu.be/By0w43NQdiY?si=SaazNu...

On July 12th, the BitcoinABC client was released, and unlike the previous clients (BitcoinXT, Classic, BU), there was no fixed miner signal for August 1st. And it also added replay attack protection.

It also had ASICBoost, so big blockers cheered.

On July 17th, viaBTC (@viaBTC) announced a mining pool for Bitcoin ABC.

This new coin was called ‘Bitcoin Cash’ and its ticker was ‘BCC’.

(It was later changed to BCH because a real multi-level coin called Bitconected used BCC.)

On July 23, Ben Delo, co-founder of BitMEX (@BitMEX), asked Bitcoin ABC to make replay attack protection mandatory. Amory Sechet rejected the request several times because it was a claim from small blockers, but eventually accepted it because he needed the support of the exchange.

After a long battle of pride, the two sides peacefully split the chain.

Since Bitcoin Cash's initial hashrate would be weak, Amory Sechet added DAA (Emergency Difficulty Adjustment).

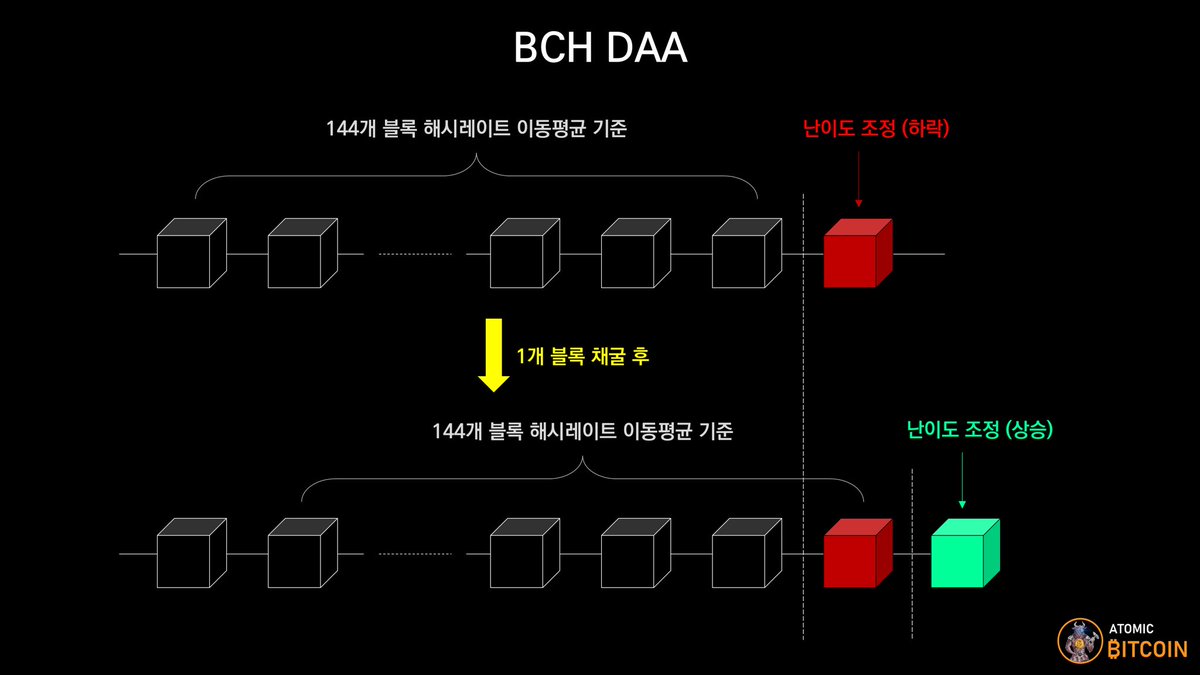

DAA: It continuously changes the difficulty of the next block based on the average hashrate of 144 blocks (24 hours).

However, Bitcoin is less affected by difficulty in 2016 block units, but Bitcoin Cash was 144 blocks (24 hours), so the difficulty fluctuated greatly for each block. In addition, since the two coins were mined with the same miner, when Bitcoin's mining difficulty changed (2016 blocks), Bitcoin Cash's difficulty fluctuated rapidly.

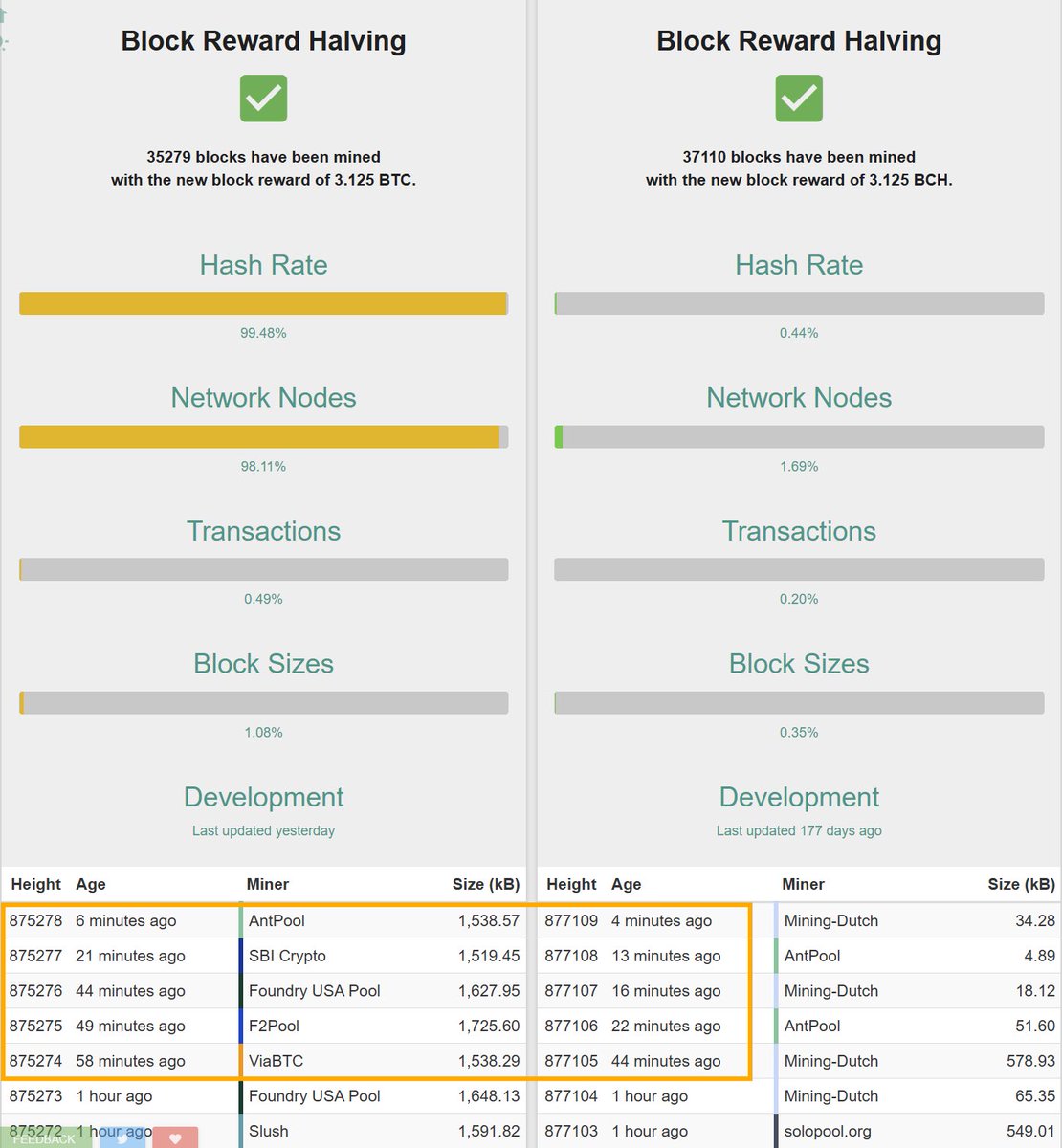

Bitcoin Cash initially had a low hash rate, so miners flocked to it, and the hash rate continued to increase, and the block generation speed was proportionally faster. Eventually, it was more than 10,000 blocks ahead of Bitcoin, and the block rewards were quickly exhausted, and this problem has not been solved even now.

On August 1st, the chain split began, and the first block of Bitcoin Cash was numbered ‘478559’, and the miner message written in the block was ‘Welcome to the world, Shuya Yang!’ (Shuya Yang’s identity has not been revealed yet). Block number ‘478561’ is interesting, as the message was an address in Hong Kong.

The address was ‘269-273 Hennessy Road Wan Chai Hong Kong’ and it was near me so I went there and met Ben Delo there and he also said he had seen the message and came looking for me. At what looked like a construction site, one person said it was the idea of the building owner and that it was to promote a meeting space.

And the big blockers were delighted because they got a new coin called Bitcoin Cash, which the small blockers had no control over. The small blockers called it ‘Bcash’ to disassociate it from Bitcoin, and the big blockers hated it so much that they promoted Bitcoin Cash as the original Bitcoin.

Since the chain split after the hard fork, people who had Bitcoin also ended up with the same amount of Bitcoin Cash.

Small blockers expected that Bitcoin Cash would fall to around 2% of Bitcoin because it had no value.

However, the actual strategy of small blockers was more sophisticated.

Small blockers said they would not sell Bitcoin Cash right away. This was a strategy to make it look like Bitcoin Cash had been successfully established, as they did not want big blockers to despair of Bitcoin Cash and come back to Bitcoin, causing problems such as blindly opposing SegWit.

Bitcoin Cash came out so quickly that exchanges were not prepared. As a result, each exchange had different policies. In the case of Bitfinex, the Bitcoin Cash payout ratio changed depending on the Bitcoin futures position, and Bitcoin loans did not have to be repaid with Bitcoin Cash.

It makes no sense now, but back then, everything was a mess.

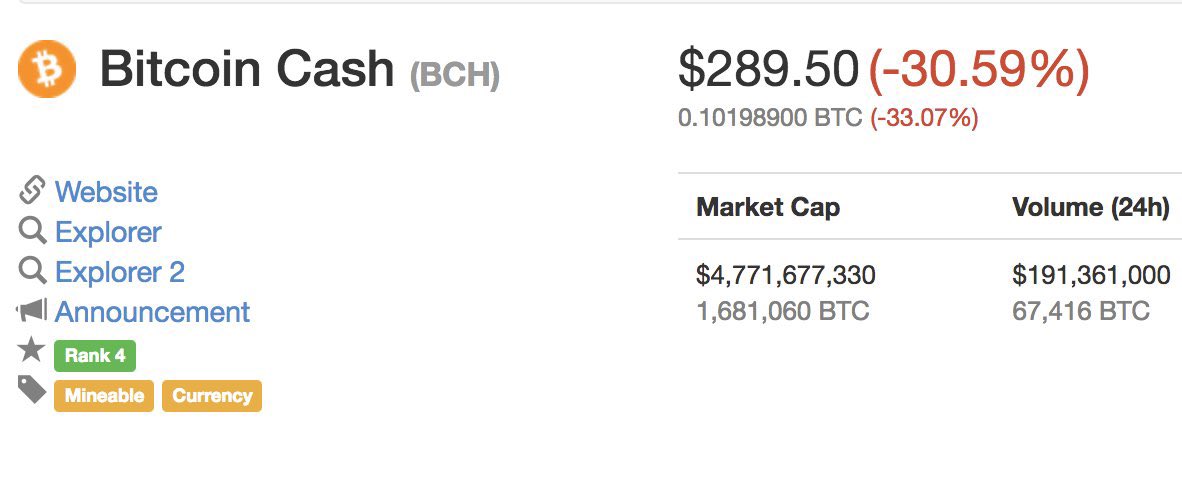

On August 6, 2017, Bittrex received a Bitcoin Cash deposit, and it crashed by almost 30% while throwing Bitcoin Cash.

It showed a phenomenon where Bitcoin Cash crashed every time it was mined. Traders also saw profits from this pattern.

The fluctuation of Bitcoin Cash gradually decreased, and the price was between 7% and 15% of Bitcoin.

Members of Dragon’s Den sent a message that the price of Bitcoin Cash should not fall below 7% of Bitcoin.

It was the first hard fork split, so everyone did not understand it, but the theory was as follows.

If the price of Bitcoin Cash is 1% of Bitcoin, a big blocker can make Bitcoin Cash a competitor to Bitcoin with just 210,000 Bitcoins before the split. Conversely, if the price of Bitcoin is 10% of Bitcoin, 2.1 million Bitcoins would be needed. Therefore, it is maintained at 7% of Bitcoin price.

I met with big blockers who claimed that Bitcoin Cash was a threat to small blockers and a means to pressure New York Agreement Phase 2 (2mb). The big blockers were still miscalculating. Exchanges did not want this burden (2mb hard fork of Bitcoin) after the DAO incident.

Moreover, small blockers were claiming that the very creation of Bitcoin Cash was a violation of the New York Agreement and was invalid. This was true, as big blockers had also signed up to maintain only one chain.

Chapter 20 twitter.com/atomicbtc/status/1...

Sector:

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content