Many people have been discussing Trump's issuance of a cryptocurrency recently.

They say he is the President of the United States, so why does he still need to issue a cryptocurrency to reap profits?

Today, we will take a serious look at why Trump wants to issue a cryptocurrency.

1. The Past and Present of MAGA

The story begins with MAGA.

Everyone should be familiar with Trump's campaign slogan MAGA (Make America Great Again), right?

But many may not know that Trump is paying tribute to Reagan:

Reagan's campaign slogan in 1980 was "Let's Make America Great Again".

The United States in 2024 is quite similar to the United States in 1980, as both face a formidable pursuer on the international stage. Reagan faced the Soviet Union, while Trump faces China.

Reagan and his successor, George H.W. Bush, used a consecutive 12-year term to bring down the Soviet Union and establish the United States' global hegemony.

This time, MAGA is also planning to use Trump's 4-year term and Pence's 8-year term, a total of 12 years, to reshape the United States' leading position.

2. The End of the Globalization of U.S. Debt

To understand what Trump will do next, we must first discuss the problems the United States is facing.

The core problem for the United States is that it has too many "little brothers" who keep asking the "big brother" for money.

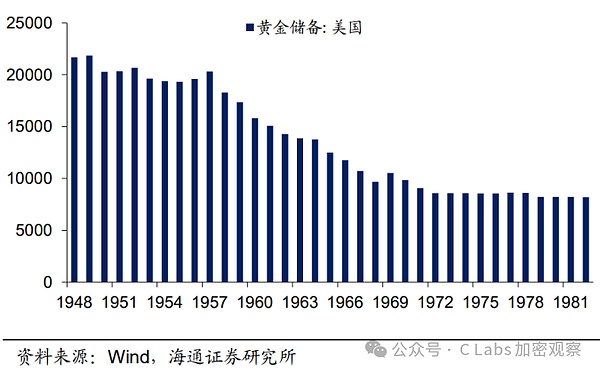

This problem began at the end of World War II, when the United States, with 70% of the world's gold reserves, implemented the Marshall Plan, using the U.S. dollar backed by gold to provide large-scale aid to these "little brothers" to prevent them from joining the communist camp.

By 1972, the United States' gold reserves could no longer support this, so the U.S. dollar was decoupled from gold.

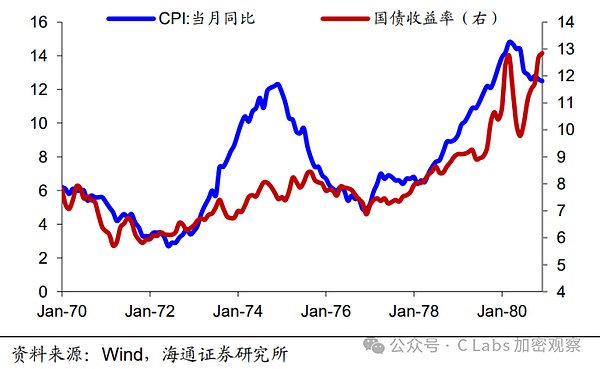

Thereafter, the United States entered the second turbulent era of the 20th century, with inflation rates easily soaring above 10%:

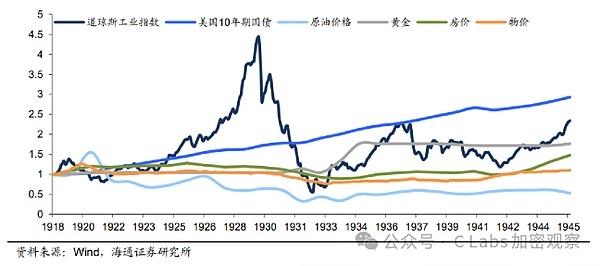

Why is it called the second turbulent era? The first was the Great Depression around 1930:

It seems that the United States experiences a turbulent era about every 50 years.

Each turbulent era requires a great president to come up with a new strategy that can last for about 50 years.

This 50-year cycle is what we call the Kondratieff cycle.

Reagan made two changes:

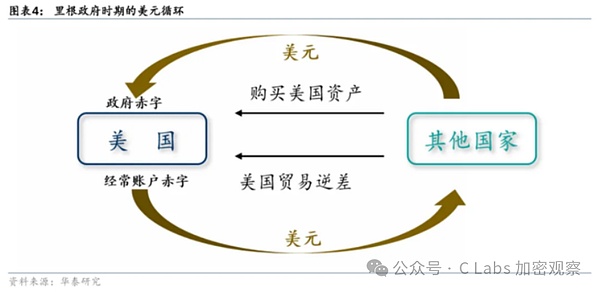

One is that the "little brothers" still need to be supported, but not by the United States' gold reserves, but by borrowing and issuing debt.

The other is that this money is not given away for free, but the "little brothers" need to produce goods or provide services for the United States in exchange for this money.

This has three advantages:

1. The aid given to the "little brothers" is no longer unconditional, but in exchange for goods and services, so the United States is not losing out.

2. The money the United States spends is printed by issuing national debt, and the next generation will have to pay it back, so the current generation is quite happy about it.

3. The "little brothers" will dutifully purchase U.S. debt, and the U.S. dollars spent will come back to the United States.

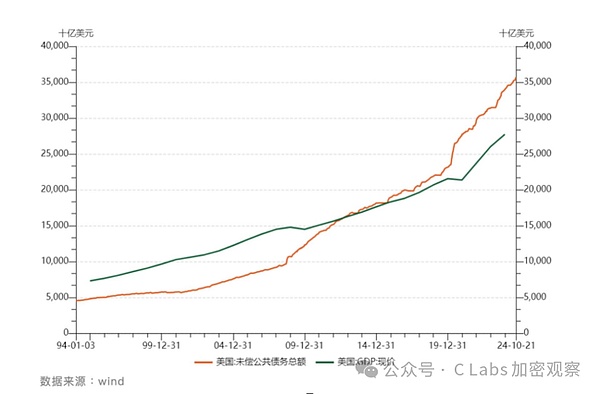

This system has been running for nearly 50 years, and the time to pay back the debt has arrived:

If it were not for the recent excessive spending, the U.S. debt era could have lasted for about 50 years.

But by 2024, the United States' expenditure on servicing the national debt interest will exceed $1 trillion, accounting for a quarter of its revenue, more than military and social security spending.

3. The New MAGA Era: Raising Taxes, Selling Cryptocurrencies

Trump's think tank has certainly seen this imminent problem. Continuing to support so many "little brothers" is difficult to sustain.

If a new turbulent era is about to emerge, they are eager to start the new MAGA era.

The essence of MAGA is to no longer support so many "little brothers".

After all, the United States has been supporting these "little brothers" for nearly a hundred years, no wonder the current international situation is described as a once-in-a-century change.

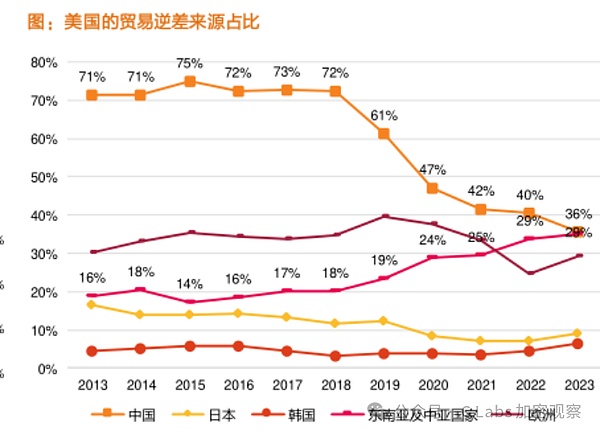

In terms of policy, it means reducing trade deficits, or simply put, the "big brother" also needs to tighten its belt.

1. Tightening the belt means reducing imports, the most effective way is to raise tariffs.

2. Opening up means expanding exports.

But raising tariffs is a double-edged sword, as other countries will also raise tariffs on the United States.

This time, Trump is going to play the cryptocurrency card.

The essence of this cryptocurrency card is to have U.S. companies sell cryptocurrencies.

Especially if these cryptocurrencies issued by U.S. companies are under CFTC regulation and considered commodities, then every cryptocurrency sold to people outside the United States will be counted as an export for the United States!

And other countries will find it difficult to impose tariffs on them!

It must be said that Trump's team has a very clear understanding of the cryptocurrency industry, as tokens are the ultimate product of most AI projects.

If major U.S. tech companies that tell stories issue cryptocurrencies, how much revenue can they bring to the United States each year? And this money doesn't even need to be paid back.

In the past, when we put AI and cryptocurrencies together, some people would say that the cryptocurrency circle is just riding on the hype of AI.

Recently, the newly appointed "Crypto Czar" of the White House, David O. Sacks, has the full title of "White House AI and Crypto Czar".

There is a deep meaning in putting AI and cryptocurrencies together.

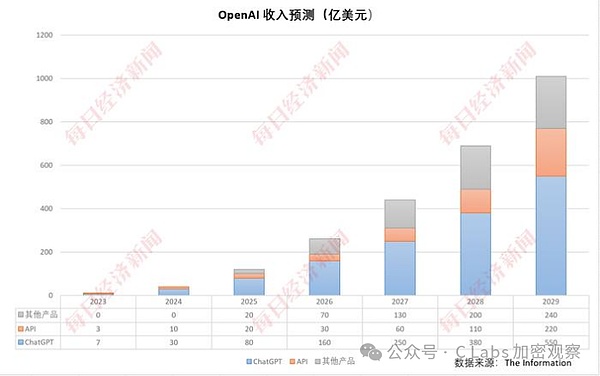

The most powerful AI platform in the United States, ChatGPT, only has an annual revenue of $4 billion, mainly from user subscriptions of $20 per month or $240 per year.

But what if, and I say if, OpenAI issues a cryptocurrency, and each interaction with ChatGPT requires consuming this cryptocurrency as Gas fees, how much would you buy?

Certainly not just $240 per year, I would at least invest tens of thousands of dollars!

So why does Trump support CFTC regulation of cryptocurrencies rather than SEC?

Because if these cryptocurrencies are classified as commodities, then selling them to foreigners is considered an export, which can help reduce the trade deficit and earn U.S. dollars.

And other countries will find it difficult to impose tariffs on them!

How to ensure that U.S. companies can maximize their revenue from selling cryptocurrencies? It's simple, just provide policy support.

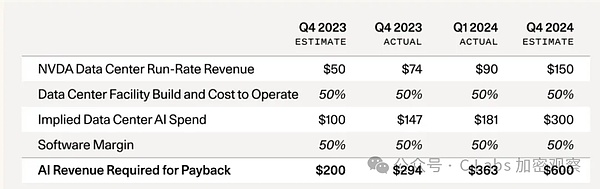

And this move may even help save the AI industry, which is on the verge of a serious revenue crisis:

Currently, the world's major AI unicorn companies are all in the United States:

If these AI giants can issue cryptocurrencies, they will surely attract global investors, and the revenue from selling cryptocurrencies can not only be counted as sales revenue, but also help the United States repatriate a large amount of U.S. dollars without diluting the equity of these AI giants' investors.

4. Issuing Cryptocurrencies Himself to Allay Concerns

Currently, many tech giants still have concerns about issuing cryptocurrencies, as the SEC's previous fines on the cryptocurrency industry are still fresh in their minds.

Now, with Trump, the President himself, issuing a cryptocurrency, the FDV may be $40 billion, but the real capital inflow is only about $10 billion.

To attract U.S. dollar inflows through cryptocurrency issuance, the scale needs to be at least in the hundreds of billions of dollars.

Therefore, other major companies must follow suit in the future.