Author: Ignas, Crypto KOL

Compiled by: Felix, PANews

Last weekend was probably the craziest weekend in the crypto space. The following 10 charts provide a visual understanding:

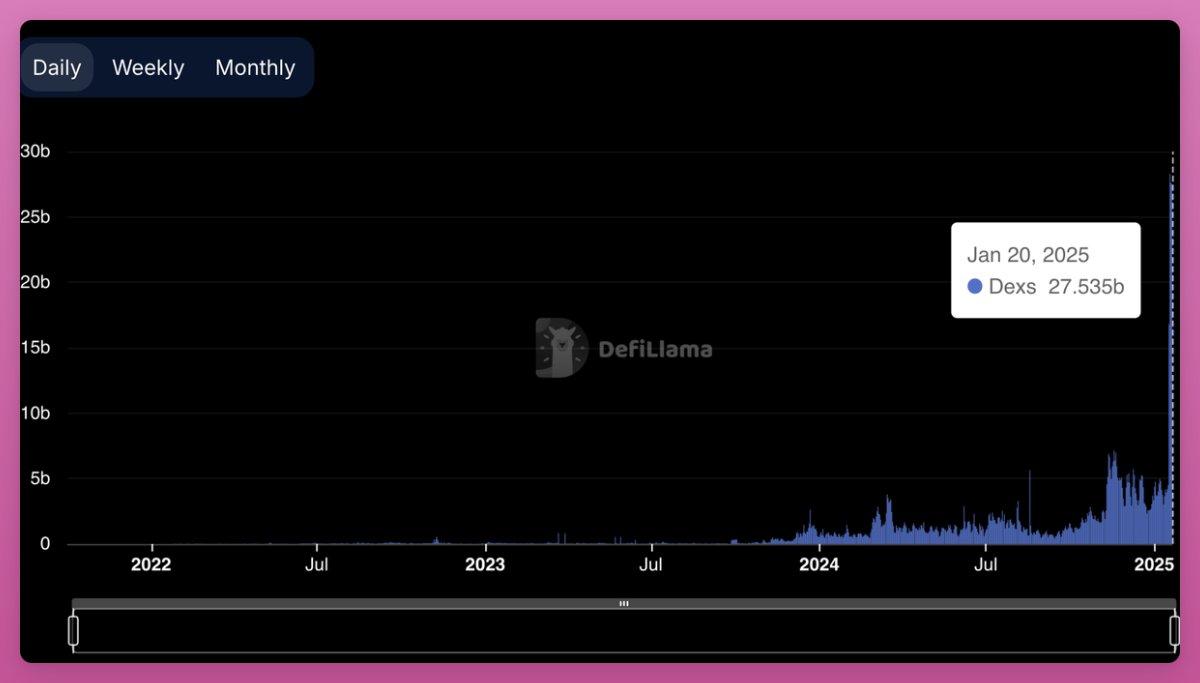

Record-breaking DEX trading volume:

The DEX trading volume on the Solana network reached $27 billion, far exceeding the $5 billion on ETH.

The DEX trading volume on Solana jumped from an average of around $5 billion to $27 billion, an increase of 5.4 times.

As a result, the DEX's spot trading volume relative to CEX reached a historical high of 19%.

Price discovery is happening on DEX, not CEX.

Funds are flowing from Arbitrum to Solana, ETH, and Base.

The Solana network saw a net inflow of $153 million, while Arbitrum lost $405 million in a week.

The following chart is another way to visualize the Solana traffic.

DeBridge analysis shows that about $300 million flows into Solana per week, mainly from Ethereum, Base, and Arbitrum.

The outflow from Solana reached around $140 million.

Phantom reported over 8 million requests per minute.

Phantom users' trading volume was $1.25 billion, with 10 million transactions.

Assuming Phantom's current fee rate is 0.85%, the Swap fee would be $10.6 million.

On the day of the TRUMP token launch, the SOL/ETH pair saw the largest single-day gain of 2021, a 25% surge that further dampened the morale of the Ethereum community and increased the pressure for reform within the Ethereum Foundation.

However, Solana is not all good news:

- Average fees have increased 20-fold

- Many people couldn't even complete transactions

The high fees are very beneficial for SOL stakers.

A total of $57 million in fees were paid, but most of it was $33 million in priority fees and $23.5 million in Jito Tips (Jito validator tips).

Importantly, SOL burned around $16.7 million, a record.

Don't use "ultra-sound money" as an excuse, as the weekend's burn rate was 81% of the SOL issuance, much higher than normal.

The following chart shows the Solana burn rate:

Overall, this was a crazy weekend for Solana, with TRUMP, MELANIA, and SOL dominating the market. Meanwhile, the market sentiment around ETH has turned negative again.

Related reading: The Trump Family Strikes Again! "First Lady Coin" MELANIA's Market Cap Briefly Exceeds $10 Billion, Multiple Token Details Spark Market Controversy