BlackRock CEO hopes SEC will "approve quickly" the tokenization of bonds and stocks: What does this mean for the cryptocurrency industry?

BlackRock CEO Larry Fink stated that he is "very bullish on cryptocurrencies" and urged the U.S. Securities and Exchange Commission (SEC) to "approve quickly" the tokenization of assets. Is this good news for the cryptocurrency industry?

Larry Fink, the CEO of the world's largest asset management firm BlackRock, said he hopes the U.S. Securities and Exchange Commission (SEC) will quickly approve the tokenization of bonds and stocks. In an interview with CNBC on January 23, Fink expressed strong support for digital assets and emphasized their potential in democratizing investments.

The question is, will this transformation of traditional assets into tokens benefit the cryptocurrency industry? Which areas are likely to thrive as a result? And which projects may face more intense competition?

Undoubtedly, the 24/7 global trading and transparency of blockchain technology offer advantages for assets such as bonds and stocks. However, this initiative depends on regulatory updates and approvals from relevant government agencies. More importantly, regulated assets may not be fully compatible with Decentralized Finance (DeFi).

The impact of tokenization on stablecoins, meme coins, DeFi, and decentralized oracles

If tokenized bonds can provide stable returns, they may pose a challenge to stablecoins, as these digital assets are pegged to real-world interest rates. This development will introduce new tools to the financial markets, competing with stablecoins for liquidity and user trust, while also attracting investors seeking actual returns.

Similarly, tokenized stocks like GameStop or AMC can serve as on-chain assets with price volatility and operate through community-supported mechanisms, similar to the characteristics of meme coins. This evolution may impact retail trading platforms, as investors may prefer regulated but still speculative stock tokens over purely speculative meme coins.

GameStop (GME) and AMC Networks (AMC) in 2021. Source: TradingView / Cointelegraph

The integration of tokenized bonds and stocks can also expand the product range of existing DeFi platforms, potentially driving an increase in Total Value Locked (TVL). This will impact decentralized exchanges and lending protocols, as they can incorporate traditional asset classes, creating new revenue streams.

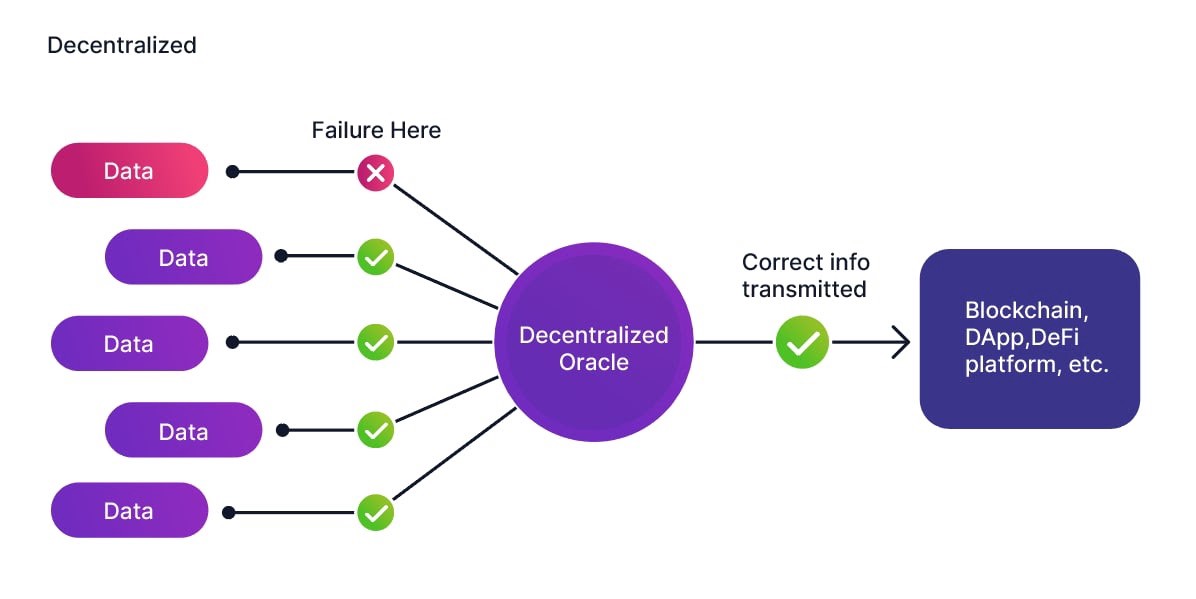

By tokenizing real-world assets, direct ownership and pricing data can be embedded into the native structure of the tokens, reducing the reliance on external oracles. This change will also affect blockchain data providers, as the on-chain assets themselves will be the source of relevant data.

The tokenization of bonds and stocks will significantly expand the pool of assets available for on-chain derivatives, impacting those decentralized exchanges and lending platforms that aim to provide diversified markets. Synthetic tokens mimicking these securities can also bypass certain regulatory barriers, opening up new opportunities for margin trading and yield generation.

Tokenization of stocks and bonds may take longer than expected

Despite the aforementioned advantages, tokenized securities must overcome multiple regulatory hurdles, such as Know-Your-Customer (KYC) requirements, accredited investor restrictions, and compliance with securities laws. Rules and listing limitations in specific regions may hinder their widespread adoption, and some on-chain data coverage still relies on oracles.

Furthermore, legal uncertainties and potential vulnerabilities in smart contracts may undermine investor trust. As a result, many DeFi protocols have been forced to implement stricter regulations, limiting the free-flowing nature typically associated with cryptocurrencies and slowing down widespread adoption.

The appointment of U.S. Senator Cynthia Lummis as the chair of the Senate Banking Committee's Digital Assets Subcommittee on January 23 may accelerate legislation related to the tokenization of stocks and bonds. Lummis is known for her pro-cryptocurrency stance and is expected to foster collaboration between the SEC, Treasury Department, Commodity Futures Trading Commission (CFTC), Financial Industry Regulatory Authority (FINRA), and state-level securities regulators.

Nevertheless, caution is warranted regarding the statements made by BlackRock CEO Larry Fink, as BlackRock has a significant interest in driving the tokenization of real-world assets. This change may expand the buyer base for U.S. listed stocks and bonds, and BlackRock is one of the top investors in these assets. Additionally, the company may also act as an intermediary, performing custodial or administrative functions.