At the beginning of 2025, the crypto market has once again been swept up in a new round of frenzy, like "sifting the sand to find the gold." Have you recently seen that elusive "feeling of getting rich quick" in the market fluctuations? Or have you started to wonder: can this seemingly endless wealth feast really continue?

"Speculation is like a battlefield, where the victor is king and the loser is a bandit." This "investment philosophy" is not only heard on Wall Street, but also applies to the Altcoin market. Imagine the meme coin craze of 2021, the rise and fall of NFTs in 2022, the strong outbreak of Ordinals in 2023, and the wealth drama of AI Agents in 2024 - it seems to be constantly staging the "largest capital bubble in human history."

As the ancients said, "Extremes must revert." Regardless of how the market fluctuates, we must always face a truth - the end of the bubble is often more abrupt than its birth. Today, we are not just discussing a "virtual asset," but examining a modern-day "mirage" driven by hot money, emotions, and technology. If you stand close enough, you may see the bubble forming and think it's a glittering future; but if you stand far enough, you'll see it burst, leaving only "shattered illusions" - this is just a "reshuffle" in the normal state of the capital market.

Today, let's talk about how to find our own position between the frenzy and collapse of this bubble, and walk a path of rationality and profitability. 2025 may be a critical juncture for us to transition from the "retail era" to the "professional investor era." On this path, some will become the winners of history, while others can only become the "dust" eliminated by the market.

So, are you prepared to embrace the baptism after the bubble bursts, or are you going to strike while the iron is hot in the bubble feast?

The Curtain Falls on CEX, Chain-based Trading Takes the Stage: The Professionalization of Speculation

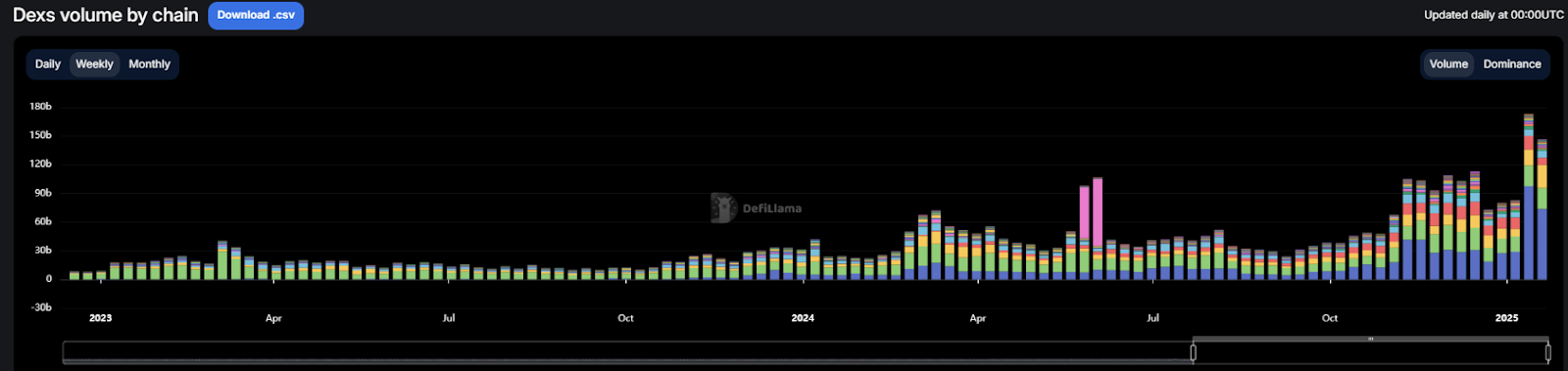

Total trading volume of various blockchain Dexes

Looking back, the CEX (centralized exchange) era of the Altcoin market was like a "street-side game" - anyone could join, the rules were simple, the threshold was low, and everyone could join the fun. But with the gradual maturity of decentralized technology, on-chain trading has gradually taken the stage, and the complexity and competitiveness of the market have been directly upgraded to a professional-level Texas Hold'em - it's not about "gambling on luck," but "competing with brains." According to data from defillama, DEX trading volumes have repeatedly hit new highs, especially on Solana, which has become the first blockchain to surpass $200 billion in monthly trading volume, making one sigh: on-chain trading is the true "core driving force" of this industry.

The Professional Texas Hold'em Trading Ecosystem

The complexity and competitiveness of on-chain trading makes it more like a professional-level Texas Hold'em match. Newcomers and veterans have clear divisions of labor here, and the key to success lies in precise strategies and strict risk control. The three core features of the on-chain trading ecosystem are:

Starting with small capital, testing the waters with small-cap projects

For newcomers, the first step in on-chain trading is not to blindly chase hot tracks or high-cap assets, but to participate in small-cap projects with small amounts of capital to get familiar with market rules. In this process, newcomers can gradually accumulate a sense of the on-chain environment.

Accumulate quickly in favorable conditions, and cut losses promptly in adverse conditions

When the market is favorable, rapidly expanding one's Bankroll is a common strategy for professional players; but once they encounter a rug (scam project) or consecutive losses, top players will choose to downgrade operations decisively, reduce risk exposure, and preserve capital for the next opportunity.

Experience replaces luck

The initial stage of on-chain trading is full of risks, and early losses are almost inevitable. However, as experience accumulates, professional players gradually master the market rhythm and reduce the probability of long-term losses through systematic analysis and strategies.

The Survival Space for Newcomers is Rapidly Shrinking

The current on-chain market is not friendly to newcomers, and the ecosystem has undergone huge changes compared to the bull market of 2021 and the beginning of 2024:

High-risk meme coins and crypto honeypots are rampant

Meme coins have become the first stop for newcomers due to their high volatility and strong speculative nature, but the vast majority of projects peak immediately after launch and then quickly go to zero. According to data from AI Aunt, more than 90% of new projects have gone to zero within a day since the beginning of 2025.

Newcomers are more susceptible to KOL (Key Opinion Leader) backlash

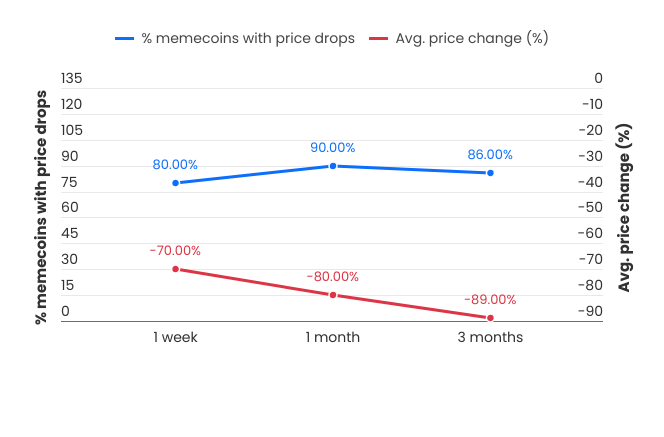

Interestingly, according to the latest research by Coinwire, 76% of the Altcoin KOLs on the X platform have promoted those meme coins that have now gone to zero, and two-thirds of the projects have completely disappeared from the market. Even more shocking is that among these 377 KOLs, only 1% of the promoted projects achieved a tenfold increase - this is almost the same as "winning the lottery." The remaining 80% of the projects fell by 70% within a week, and 90% of the projects lost 80% of their value within a month, while 86% of the tokens directly plummeted more than 90% within three months.

Interestingly, according to the latest research by Coinwire, 76% of the Altcoin KOLs on the X platform have promoted those meme coins that have now gone to zero, and two-thirds of the projects have completely disappeared from the market. Even more shocking is that among these 377 KOLs, only 1% of the promoted projects achieved a tenfold increase - this is almost the same as "winning the lottery." The remaining 80% of the projects fell by 70% within a week, and 90% of the projects lost 80% of their value within a month, while 86% of the tokens directly plummeted more than 90% within three months.

Especially for those large KOLs with over 200,000 followers, the effect of their meme coin promotions is the worst. Data shows that the projects they promoted lost an average of 39% in one week, and the loss rate soared to 89% in three months. These data make one have to ask: are these KOLs providing value to investors, or are they just earning traffic for themselves? Obviously, the former is much less likely.

Looking at the Bubble Stage of On-chain Speculation from the Historical Path

Reviewing the history of each round of speculation fever in the Altcoin market, we can easily find that they mostly exhibit a typical cycle of "initial heat - inflation - bubble - burst." Each wave of fever is like a flash of lightning, quickly igniting the market and attracting capital inflows, but the accumulation of bubbles is often accompanied by the inevitable outbreak of risks.

2021: The Crazy Rise of Animal Coins and Celebrity Coins

2021 was a crazy year for the Altcoin market, especially the rise of meme coins, which pushed the Altcoin market to an unprecedented high. Dogecoin and Shiba Inu, the "animal coins," quickly became the hot topic of global investors. Especially Dogecoin, which once reached a market capitalization of over $90 billion under the Twitter push of Tesla founder Elon Musk, far exceeding many traditional companies. The rapid rise of these meme coins was not supported by actual technology, but merely relied on social media and KOL hype to attract a large number of retail investors.

However, with the influx of imitators and more celebrities launching meme coins, the BNB ecosystem saw one honeypot after another, and the market's speculative enthusiasm gradually waned, causing the bubble to burst rapidly.

2022: The Rotation of the NFT Market

The NFT market experienced an unprecedented boom from the end of 2021 to the beginning of 2022, attracting a large number of investors and speculators. Whether it was blue-chip NFTs like BAYC or collaborations between celebrities and artists, they all created amazing market returns in a short period of time. However, as 2022 entered the second half of the year, the heat of the NFT market quickly subsided, and the bubble began to emerge.

According to OKX's NFT market data, the current trading volume of NFTs has dropped to less than 1/20 of its peak period, reflecting the recession of the NFT craze. More surprisingly, the value of over 99% of NFTs has now been reduced to zero, and many previously high-priced NFT projects, such as early PFP series and virtual land NFTs, have almost all fallen back to their original point, even lower than the original issue price. The NFTs that were once considered "future artworks" or "digital collectibles", including those issued by well-known brands and celebrities like Nike, have ultimately become sunk costs for investors as the market cools down.

This phenomenon fully exposes the speculative and short-term driven nature of the NFT market. From the initial "hold on and it will be your turn" to the current "all you have left is a low-price sell-off", the market's rotation speed is extremely rapid, and the release of the speculative bubble has caused many investors to pay a heavy price. Although many projects have strong community and brand effects, they lack actual application scenarios and market demand support, leading to their ultimate failure to survive in the market elimination race.

2023: The Ebb of Ordinals - The Bursting and Liquidation of the Bubble

Ordinals, as an emerging track in the Bitcoin ecosystem, have once become the focus of the market. Its original intention was to store text and data on the Bitcoin blockchain, using Bitcoin's security and decentralization characteristics to create a new form of digital assets. This innovative concept quickly attracted a large amount of capital inflow, and the "native NFTs" in the Bitcoin blocks became the new darling of investors.

However, with the market's excessive pursuit, the real application scenarios of Ordinals have never caught up, and the demand has become overly concentrated on short-term speculation. Especially after the Ordi price broke through $90, the Ordinals market entered its most frenzied weeks. Almost everyone was rushing to "mint Ordinals", creating various forms of asset issuance. During this period, the Ordinals market was filled with a greedy atmosphere of quick profits, and every minting seemed to bring huge returns, making the market flourish.

However, it was this blind pursuit that led to the inflation of the bubble. As the enthusiasm of market participants was excessively released, the value of Ordinals gradually deviated from its original intention, and the speculative sentiment continued to heat up. Eventually, the market's supply and demand imbalance, the rapid depletion of liquidity, and the price also began to plummet, with the Ordi price falling from its peak of $90. The peak of the Ordinals market was quietly formed in just a few weeks after this "explosive growth".

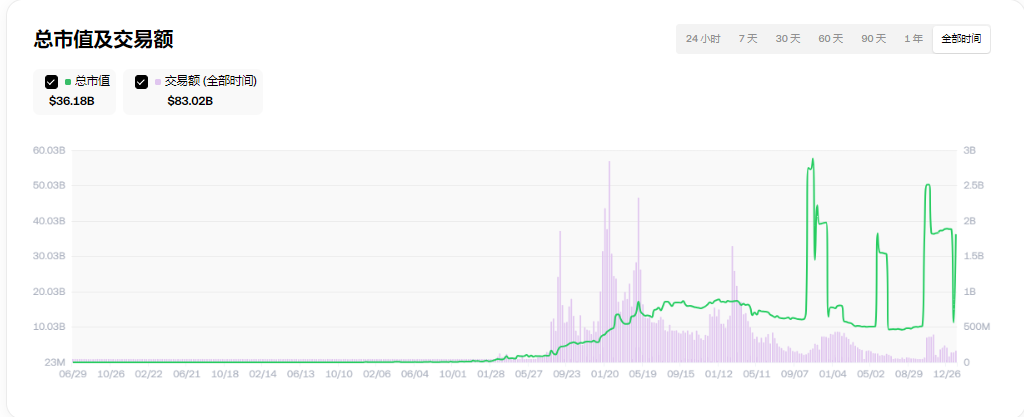

Ordi price has fallen below $20

The ebb of Ordinals marks the bursting of the market bubble. The withdrawal of speculative capital has left the market without support, leaving only Ordinals assets lacking in actual application value. This process not only shrinks the wealth of investors, but also directly reflects the market's speculative sentiment - the bubble can ultimately not bear the excessive fantasy.

The collapse of the Ordinals market has become a typical microcosm of the crypto market in 2023: the inevitable liquidation of over-speculation, short-sighted frenzy, and lack of in-depth applications.

Late 2024 to 2025: The Rise and Overvalued Bubble of AI Agents and AI MEME Tracks

AI technology has gradually become a hot topic in the crypto market in 2023, especially the rise of "AI Agent" projects. For example, GOAT, Ai16z and other AI-driven projects have attracted a large amount of capital through explosive social media dissemination in a short period of time. However, many investors have ignored the infrastructure construction, product-market fit (PMF), and actual implementation capabilities of AI projects, resulting in a large number of projects with strong narratives but lacking practical application scenarios.

"Those who rush to AI at high positions are just waiting to die when they get the VC plate", this sentence reveals the bubble risk of the AI track. Many AI projects have seen their market capitalization soar under the push of capital, but the final landing effect has not been able to match the expectations. Take some AI+DeFi projects as examples, although they claim to change traditional industries through decentralized computing power sharing and data autonomy, the high valuations behind them lack a robust business model and user base.

Previously, the DeFi farms with unlimited APR once attracted a large amount of capital inflow, but ultimately most of them were reduced to zero in the ruthless market baptism. The AI track may not be able to escape this fate. With the crazy influx of capital and the market's over-hype, the high valuations of many AI coins will face the risk of bubble bursting.

In the short term, we may still see an outbreak, but in the medium and long term, many AI projects may, like the past DeFi farms, enter the "forgotten corner". But there will also be some protocols that stand out, becoming the new cornerstone of the on-chain economy. Just like Aave, Uniswap and Chainlink a few years ago, they successfully occupied the core position of the crypto economy and became the industry benchmark through their unique value propositions and strong ecosystems. Similarly, in the AI Agent track, there will also be some quality protocols that will emerge from the market baptism and lay the foundation for the future blockchain world.

Trump's Coin: The Last Carnival of the On-Chain Market?

Draining Market Liquidity

$TRUMP has attracted a large amount of capital in the short term, but the consequence is the depletion of funds for other on-chain projects. The capital diversion effect has exacerbated the high-risk nature of the market.

Since Trump announced the launch of his coin on January 18, 2025, the volatility of the crypto market has become more and more obvious. According to CoinGecko data, the total market capitalization of the AI Agent track has plummeted from $17 billion to the current $12.9 billion, a drop of more than 24%.

At the same time, TradeView data shows that the market capitalization of all Altcoins excluding Bitcoin has also dropped from $1.55 trillion to $1.44 trillion, losing more than $70 billion in market value. More worryingly, excluding the Top 10 projects in the crypto market, the total market capitalization of Altcoins has also experienced a dramatic shrinkage, from $384 billion to $339 billion, a decline of nearly 12%.

A Signal of Waning Speculative Sentiment

All this is behind the huge market disruption caused by the Trump family's coin issuance. The original intention may have been to inject "certainty" into the crypto circle by introducing a huge off-chain capital, but the reality is far from it. Investors who originally hoped to drive capital outflow and further boost market vitality through the issuance of Trump coins are gradually realizing that the involvement of the Trump family has actually stirred up the "liquidity pool" of the market, causing a large-scale capital outflow and market uncertainty.

Similar hot spot events are often a sign that the market hype is coming to an end. Historically, the frenzied "rush to launch projects" stage of the NFT market in 2022 was also the time when speculative sentiment peaked.

Investor Breakthrough Strategies: From Blind to Rational

Faced with the high uncertainty of the on-chain market, investors need to abandon short-term thinking and shift from chasing hot spots to focusing on long-term value. Here are a few practical strategies:

Avoid Chasing Bubble Tracks

For overheated meme coins, Ordinals, and high-valued AI projects, try to minimize capital exposure and avoid becoming the bag holder.

Focus on Product-Market Fit

Before investing, consider whether the project truly meets market demand, rather than just being driven by narratives.

Diversify Investments and Manage Risks

Allocate funds reasonably to avoid major impact on overall assets due to the failure of a single project.

Learn On-Chain Tools and Improve Cognitive Abilities

Become proficient in using on-chain data monitoring tools (such as GMGN) to identify manipulative behaviors and avoid potential risks.

Lock in Profits and Control Emotional Fluctuations in a Timely Manner

When the market rebounds, do not be blinded by greed, lock in profits in time, and ensure the safety of funds.

Trump's Crypto Order: Has the Cyclical Top of On-Chain Assets Arrived?

Currently, the hype around on-chain assets is gradually subsiding, and the market is transitioning from a narrative-driven bubble phase to a more calm value discovery period. In this process, investors must maintain a clear mind, focus on long-term logic and in-depth research on PMF (product-market fit). After all, only rationality and patience can help us find a sustainable way to survive in the new ecosystem after the storm.

In the early hours of today, Trump issued the first Crypto Executive Order, further clarifying the policy direction of the U.S. government.

Looking at this Executive Order, the current on-chain asset market is at a critical "turning point", especially in the areas of stablecoins and decentralized finance. Although this order provides some support for these areas, it also reveals the U.S. government's more cautious and rule-oriented stance on regulation. This gradual policy clarification may bring short-term policy stimulus to the market, driving a certain degree of upward movement. However, as the regulatory framework is gradually improved and working groups are established, assets with stronger speculation (such as on-chain meme coins) will face greater pressure.

Therefore, the author believes that the current on-chain asset market is approaching a cyclical top. Factors such as market speculation, tightening liquidity, technical bottlenecks, and regulatory risks may trigger a bubble burst or market correction. In this context, my trading strategy will be to reduce positions in a timely manner, lock in some profits, and shift the focus to potentially undervalued projects. I will prepare to face market volatility, maintain flexibility, and seize investment opportunities after the adjustment in a timely manner. Under strict risk control, maintain a stable operational mindset to cope with possible market fluctuations and prepare for the next potential opportunity.