Introduction

In early 2025, the Solana network reached a major milestone - its stablecoin total supply broke through the $10 billion mark for the first time, setting a new record. This growth not only signifies Solana's strong rise in the stablecoin market, but also reflects the increasing prosperity of the blockchain ecosystem. Particularly driven by the issuance of USDC, Solana's stablecoin supply has soared by nearly 110% in just a few months. At the same time, the price of Solana's native token SOL has also risen, breaking through $260 and reaching a new all-time high.

Solana Stablecoin Supply Exceeds $10 Billion

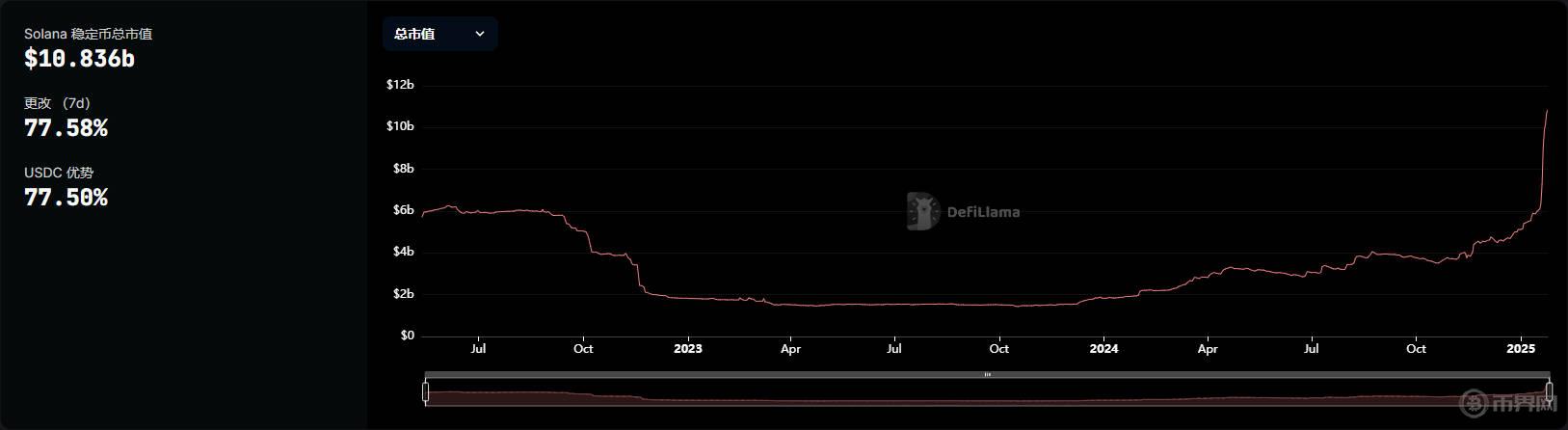

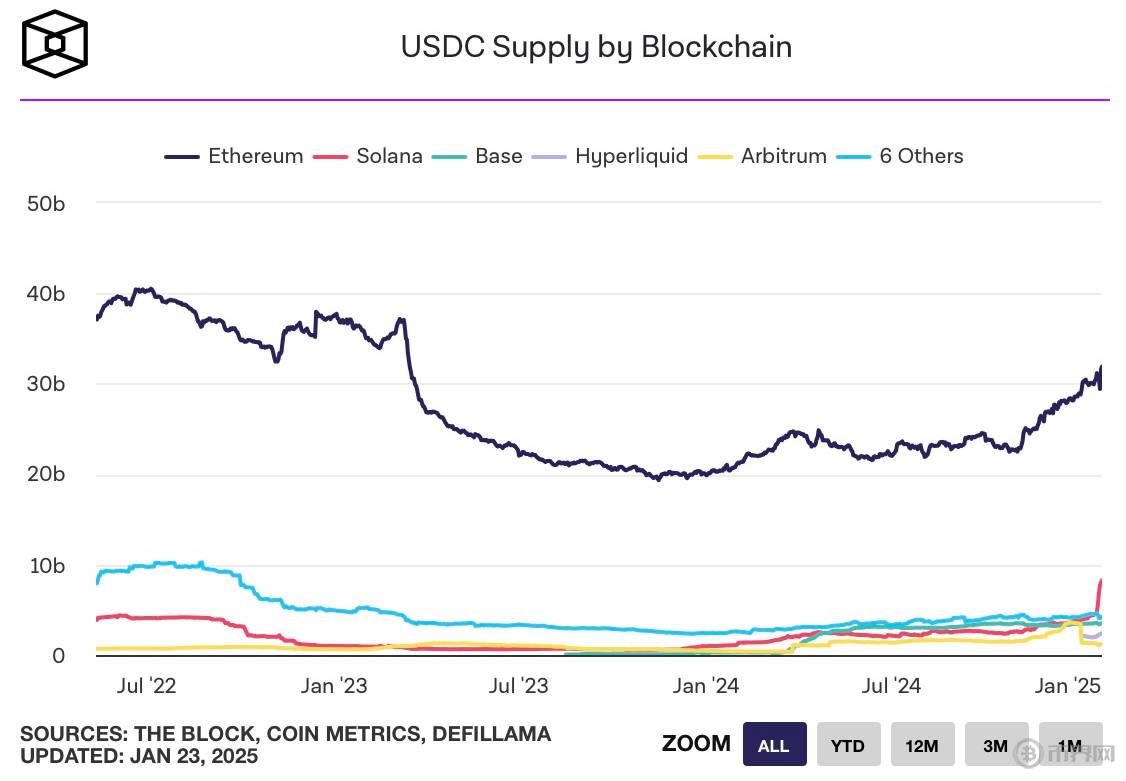

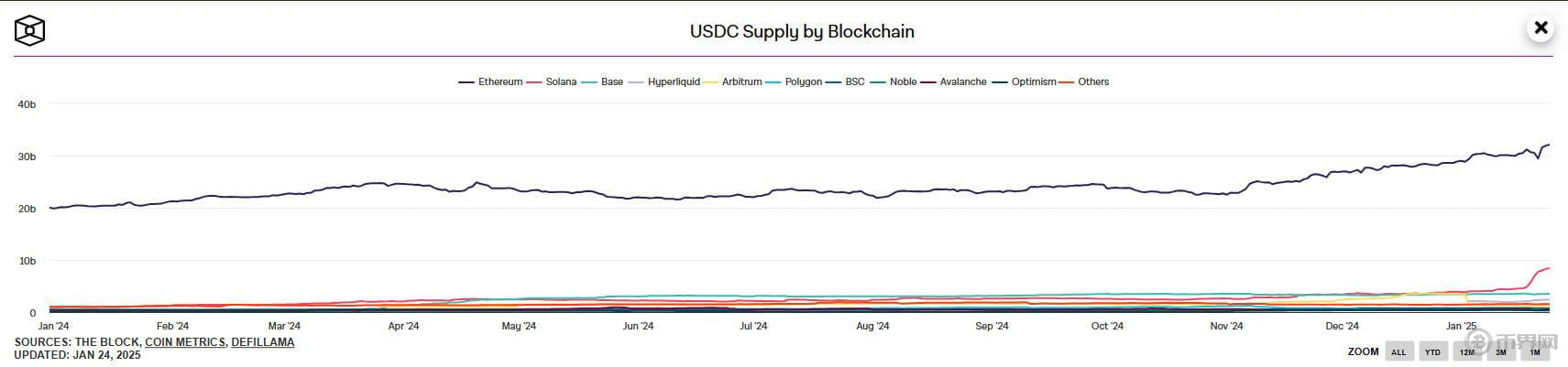

According to DeFiLlama data, the total value of stablecoins on the Solana network has soared by about 110% since January 2025, from $5.1 billion at the beginning of the year to $10.8 billion. In comparison, Ethereum currently has $115 billion in stablecoins, BNB Chain has $7 billion, and Base and Arbitrum have $3.8 billion and $3.1 billion respectively. This growth in Solana is mainly driven by the USDC issued by Circle.

On-chain data shows that in the past week, Circle has minted about $3.5 billion in USDC on Solana, resulting in USDC dominating nearly 80% (about $8 billion) of Solana's stablecoin supply. The market cap of USDC has nearly doubled, from $4.2 billion to $8.2 billion. In comparison, Tether's USDT occupies about $1.96 billion on Solana.

Trump's Crypto Policy and Solana Ecosystem's Rapid Growth

The launch of the Trump family's memecoin on the Solana network has further driven the growth of the Solana ecosystem. The Block's research head Eden Au said, "The growth in Solana's stablecoin supply is mainly driven by retail interest in Trump's memecoin." The launch of these memecoins has brought a large amount of trading activity to Solana, further driving the use of the network and the price increase of Solana's native token SOL.

Solana's daily transaction fees reached a record high of $33 million during the Trump memecoin frenzy, and Solana's native token SOL also broke through $260, setting a new all-time high.

Solana Price Continues to Rise: Market Sentiment and Technical Analysis

With the implementation of Trump's crypto policy, Solana's price has continued to rise. The price of the SOL token has risen by more than 22% in the past week, and has risen by over 38% since the beginning of the year. According to CoinPedia's analysis, Solana's price trend indicates that the market sentiment remains bullish, and with the push of the Solana ETF, the future price of SOL may break through $500.

Technical indicators show that Solana's simple moving average (SMA) is continuously supporting its price, indicating that there is strong buying pressure in the crypto market. The RSI (Relative Strength Index) also shows that Solana's price is approaching the overbought region, which may signal further price increases or a short-term correction. If the bullish sentiment continues, Solana may retest its $270 resistance level and potentially break through the $300 target price.

However, the bullish market sentiment is also accompanied by some concerns. With the surge in trading activity on the Solana network, some investors are worried that the network may face congestion issues, especially with the increase in memecoin trading volume. If the network becomes overloaded, it could have a negative impact on Solana's long-term development and affect the price trend of SOL.

Solana Faces Both Challenges and Opportunities

Solana's ecosystem future is filled with both opportunities and challenges. The memecoin supported by Trump has undoubtedly brought a large number of active users and trading volume to the Solana network, but network congestion and changes in market sentiment could also put pressure on the SOL price. Solana's on-chain indicators show that although the price has declined, it is still maintained at a relatively high level, and market participation is also continuously growing.

For investors, Solana's technical and fundamental aspects both show strong growth potential, but they also need to be aware of the possibility of corrections or market volatility. The continued growth of Solana's stablecoin supply will further drive the development of the network's ecosystem, especially in the DeFi protocols and memecoin markets.

Solana's Long-Term Growth Potential

Solana's current achievements in stablecoins and SOL price are a direct result of the Trump crypto policy. As the usage and trading volume of the Solana network continue to increase, the network may see more innovation and growth opportunities. Although facing the risks of network congestion and market sentiment fluctuations, Solana's strong performance in the stablecoin sector and the potential of the Solana ETF still make it one of the crypto assets that the market is closely watching.

In the future, whether Solana can maintain its strong growth and whether the SOL price can break through $500 will require close monitoring of market dynamics and Solana network development. With the continuous progress of DeFi, memecoins, and Solana's own technology, Solana is expected to continue to occupy an important position in the crypto market.