Introduction

BTC has recently broken through an important price level, shaking the entire cryptocurrency market. Although in the short term it shows strong upside potential, market analysts and experts remain cautious about the future trend, warning that an adjustment or bear market may arrive within a few months. Meanwhile, industry leaders like Binance CEO Richard Teng are optimistic that BTC will set a new all-time high by 2025. This article will analyze BTC's trend, market sentiment, and potential future changes from multiple perspectives.

Recent BTC Market Dynamics and Future Trend Analysis

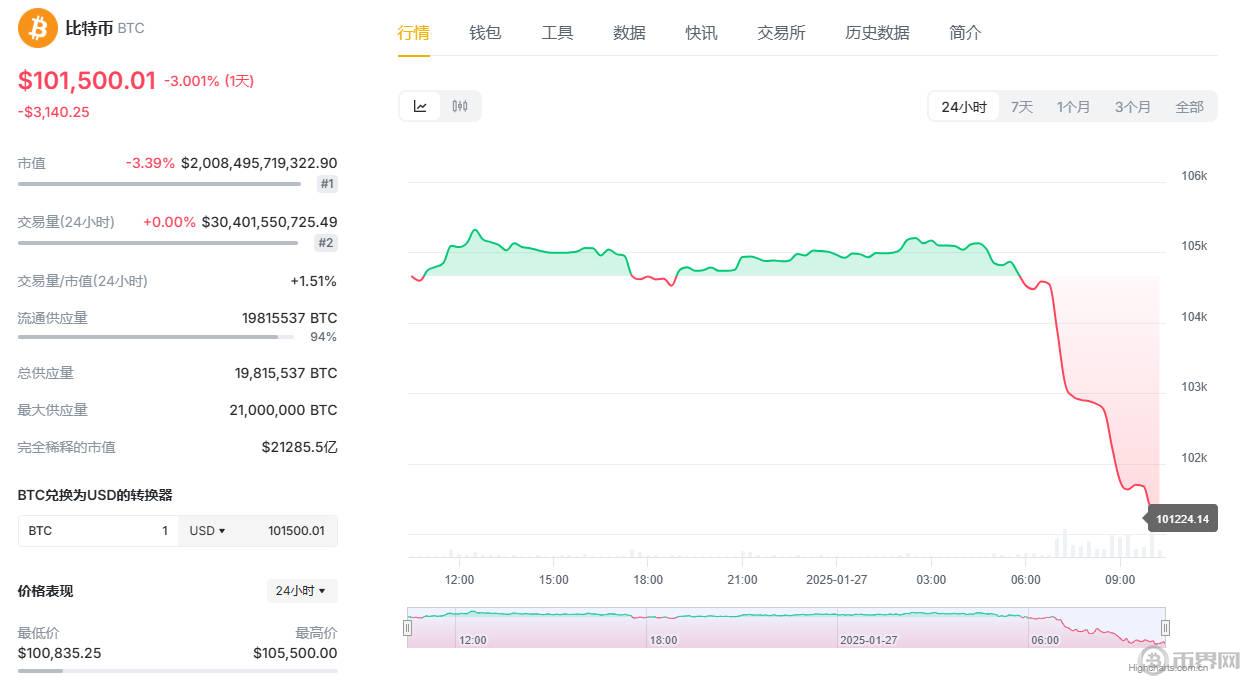

Recently, BTC has been consolidating above $100,000, breaking through this historical resistance level and attracting widespread market attention. According to the latest market data and technical analysis, BTC's price seems to be at a critical turning point. Currently, $109,000 is considered the next major resistance for BTC, and the market remains uncertain whether it can break through this resistance.

Bear Market Warning: Potential Adjustment Period Within 90 Days

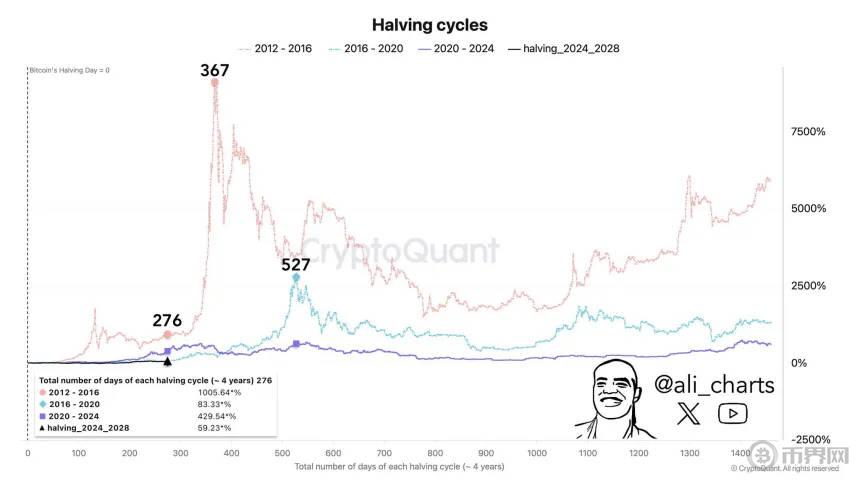

Market analyst Ali Martinez has issued a warning about BTC potentially entering a bear market. Based on his observations, BTC's price cycle is closely related to the halving event, and in the past, major market adjustments have followed each halving. Combining the historical data of BTC's halving cycles, Martinez predicts that BTC may enter a bear market within the next 90 days. This warning is based on the price fluctuation patterns after BTC's halvings, particularly the trends in the past few cycles, which may be repeated in the current cycle.

By comparing the BTC halving cycles between 2012 and 2016, Martinez points out that BTC has currently entered day 276 of this cycle, indicating that the market may be about to experience a correction, especially if the price has the potential to break through $200,000. Based on the Wyckoff method technical analysis framework, he believes that BTC is currently in the final moments of the distribution phase, the consolidation period after the price increase. If the price continues to rise, it may fluctuate between $140,000 and $200,000, but may ultimately experience a significant pullback.

High Risk and Potential Upside

Despite the above warning, BTC still exhibits a certain short-term upside potential. According to the Mayer Multiple indicator, BTC's current price is at a relatively high level, and this indicator has often signaled market tops in the past. However, the current Mayer Multiple level indicates that BTC may still have room for further growth, potentially reaching a peak of around $182,000, suggesting that the market may still have further upside before reaching the top.

Recently, BTC's performance in the market has been quite active. In the past 24 hours, BTC's price has experienced significant volatility, briefly touching a high of $105,424 before retreating to $101,957. This price fluctuation has led to a large amount of liquidation in the market, with over $128 million in BTC long positions being forcibly closed, indicating the uncertainty in the market and the cautious sentiment of investors.

Changes in the U.S. Regulatory Environment: Driving BTC to New Highs

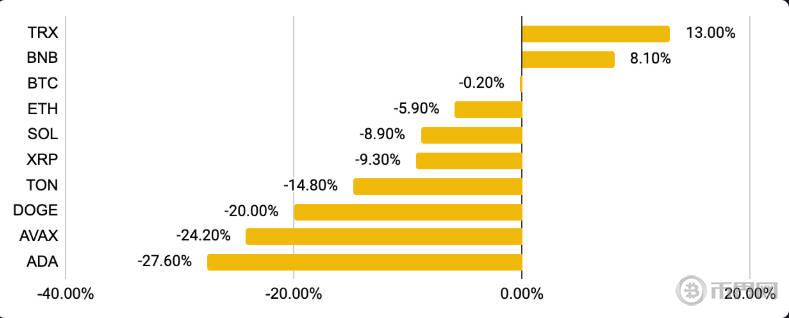

Amidst the market uncertainty and price volatility, Binance CEO Richard Teng has expressed optimism about BTC's future. He stated at the World Economic Forum in Davos, Switzerland, that BTC will set a new all-time high by 2025, attributing this prediction primarily to the Trump administration's support for the cryptocurrency industry. Teng pointed out that the U.S. government under President Trump has taken a series of measures to provide regulatory clarity for the cryptocurrency market, particularly in the areas of stablecoins, CBDCs (central bank digital currencies), and digital finance technology innovation. The chart below shows the monthly price performance of the top 10 tokens by market capitalization.

He believes that recent leadership changes and policy adjustments at the U.S. Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC) have created a more favorable environment for the cryptocurrency market. Teng specifically mentioned Trump's campaign promise to establish a U.S. strategic BTC reserve, a policy that is expected to further strengthen investors' confidence in BTC and lay the foundation for BTC's recovery in 2025.

Conclusion

Although BTC's recent market volatility and technical indicators show growth potential, analysts generally remain cautious about the future trend. In the short term, the market may experience price corrections or even enter a bear market, especially if BTC's price reaches $200,000. However, policy support and market trends may also drive BTC to set new all-time highs in the coming years, particularly with the potential for a strong upward trend in 2025.