Your crypto boats, or bags, are no longer being lifted by a rising tide. The old rules don’t apply, and simply participating is no longer enough. “OGs” are in an increasingly unfamiliar environment.

The launch of $TRUMP memecoin had me reflecting on the past cycle and I drew some, maybe premature, conclusions:

liquidity in crypto lacks depth

rotation accelerates

price targets are the only thing people believe

markets holding onto top-down interference from the government (liquidity, regulation etc.)

bottom-up works mostly for memecoins but is short-lived

grifts are understood as grifts prospectively thus less effective

zero-sum turns negative sum as $TRUMP liquidity rush decreased total mkt cap of crypto

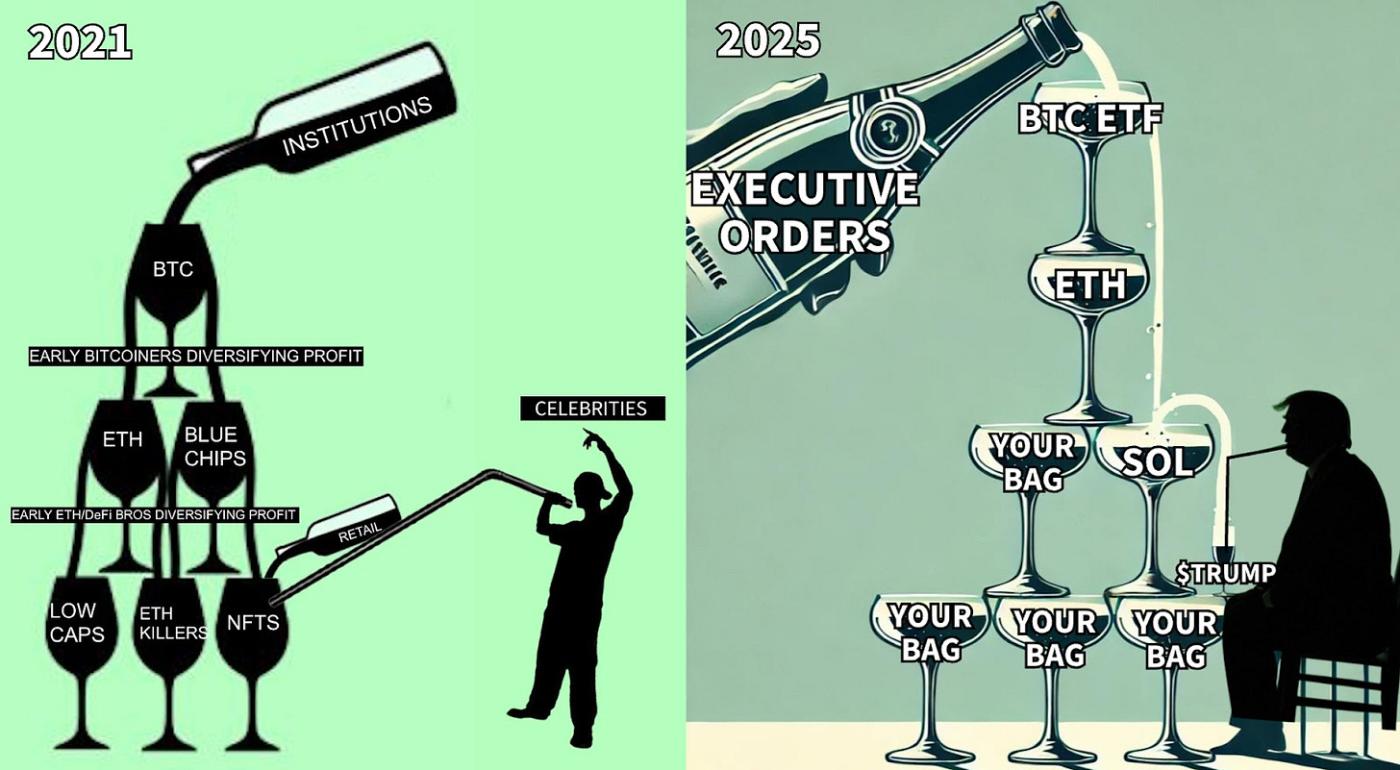

On a whim, I made an ironic comparison to the last cycle to capture the moment crypto experienced when the soon-to-be president of the USA dropped a memecoin.

Let Me Take You Back To 2021

These were the golden days. Cue Push It To The Limits. Portfolio managers were literally buying Lambos, we were riding the (3, 3) wave to infinity and buying reasonably sized houses, MEV searchers were making millions on a slow weekend, NFTs mints were impossible to get into, everybody wanted to be like Kyle & Su as the supercycle was confirmed.

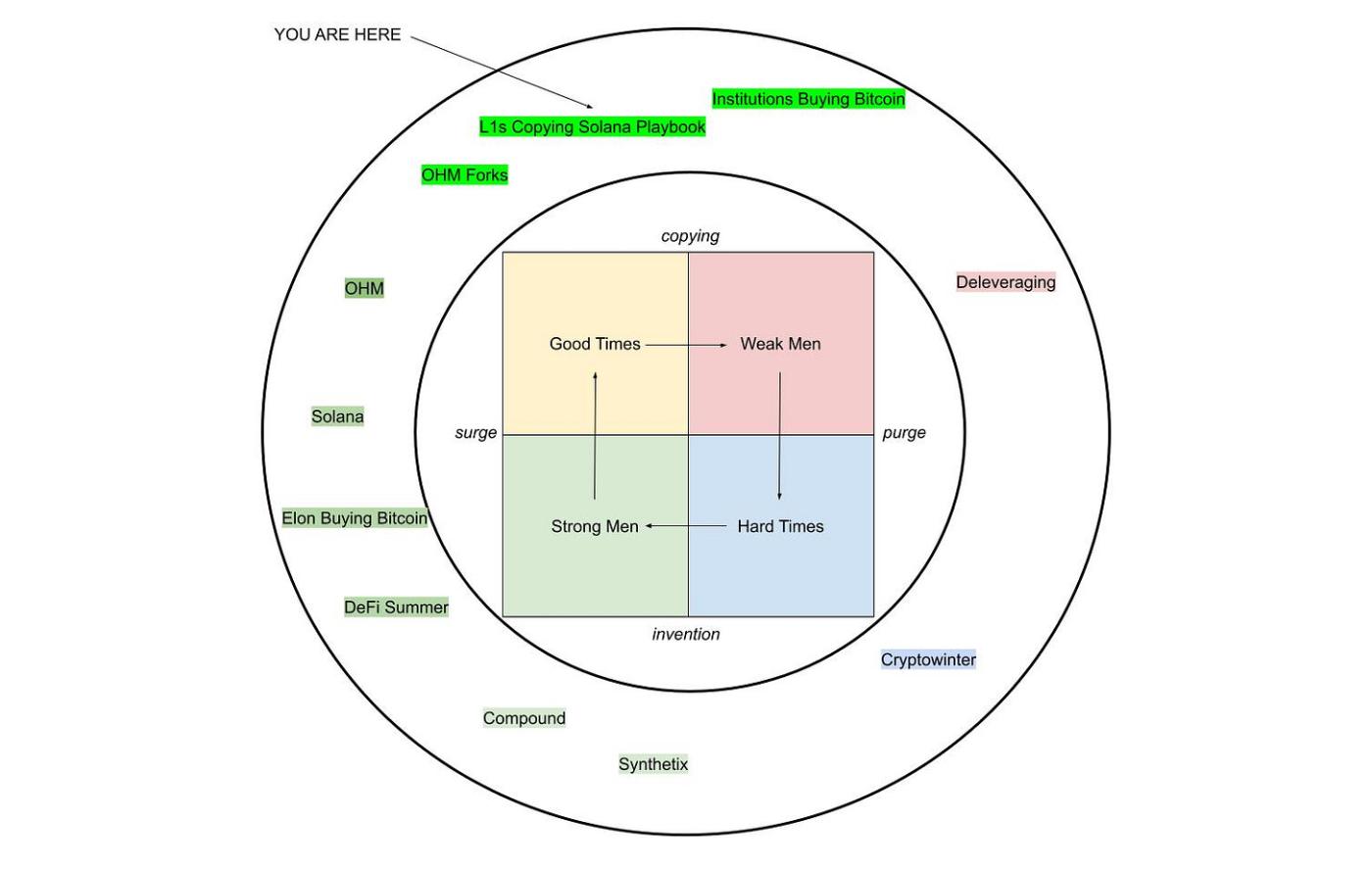

I would say deep down we all knew it was going to end one day but I personally was postponing to admit the reckoning is closer rather than further. We ran our venture fund from $11M to $330M in 2 years by barely selling anything on the move up. The fund was mostly liquid yet we took only small profits. I did not think the top was in yet. The diagram I made back in late 2021 describes clearly what I got wrong.

I thought the institutions would come and buy BTC marking the cycle top. That only happened at the inception of the next cycle. “Institutions buying BTC” was the catalyst to bullish sentiment in late 2023. In this diagram I omitted NFTs that should be inserted somewhere between Solana and OHM, however, technically OHM’s (3, 3) mania was built on the same principle as NFTs and correlated in timing.

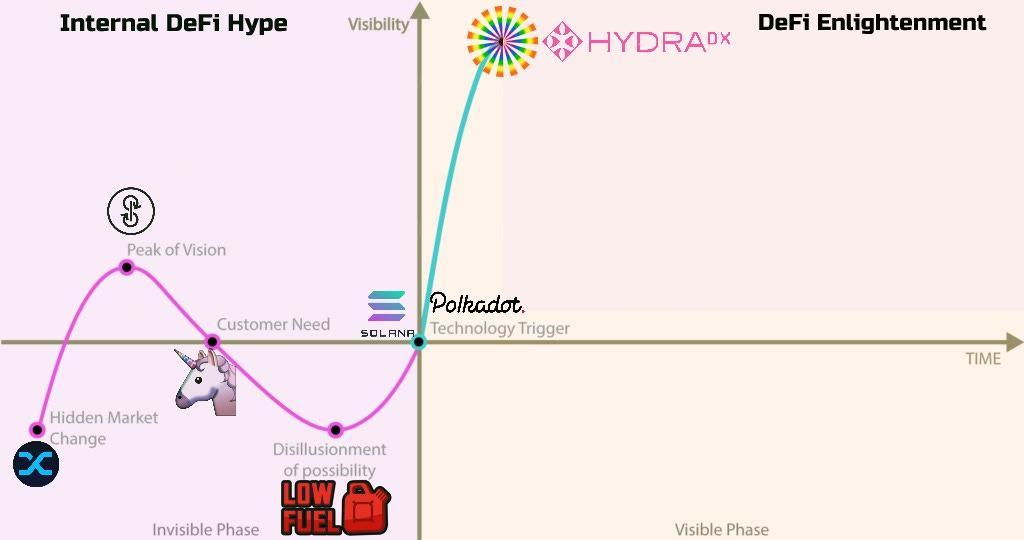

To go even further back in time, in September 2020, post-DeFi Summer mania, I believed new technology (Solana and Polkadot specifically) would actually enable DeFi at scale. I was biased as I was involved with HydraDX, today called Hydration, which was on its way to becoming a liquidity parachain (rollups on Polkadot).

Given that Polkadot emphasized technological purism, decentralization and economic overengineering (parachain auctions) while Solana emphasized performance and commercialization - a winner has transpired 4 years later.

Although I don’t think these are mutually exclusive, one is becoming a hallmark of onchain commercialization (memecoins) while the other is culturally irrelevant (but good tech bro, congrats). Today SOL is miles ahead eyeing up dethroning ETH. Yet every time certain investors tout flippening — it marks its top. Nevertheless, the liquidity effects prevail in ecosystems favoring scalability.

In the end, the internal DeFi hype did not materialize into DeFi enlightenment. What followed starting in 2023 was peak degeneracy from a financial perspective but a goldmine from the commercialization or entertainment perspective. I am unsure about whether the current state of memecoins is net value creative or value extractive but my best comparison is celebrities or influencers launching their own commercial products.

The last cycle ended suddenly as worsening macro led to the unravelling of toxic credit flows inside of crypto. The destruction of DeFi yields and the first crypto too big to fail crash of LUNA led to liquidity evaporating. At the end of 2022, we learned who was swimming naked as the biggest scam in crypto transpired. FTX was the final reset.

Regulatory inquisition made the outlook very bleak. DeFi becoming a legitimate tool of financial institutions was impossible. More sinister or degen ways of manifesting the technological innovation of DeFi transpired — memecoins. This has been the first instance of crypto-native commerce.

Web3 as an idea has died. It was shown to be an overengineered trying-to-fit-a-square-peg-in- a-round-hole approach. “Twitter but onchain” and any attempt at social media was buried by the interest in the simple memecoin casino. Building what people ought to use instead of what they actually want turned out to be a bad way to attract users.

Also building on the idea that people migrate from Web2 to this abstract idea of Web3 was false. Proliferation of AI just solidified what crypto thought of as Web2. What remained was the “join if you can’t beat them” approach.

New Beginnings Or Closing The Chapter

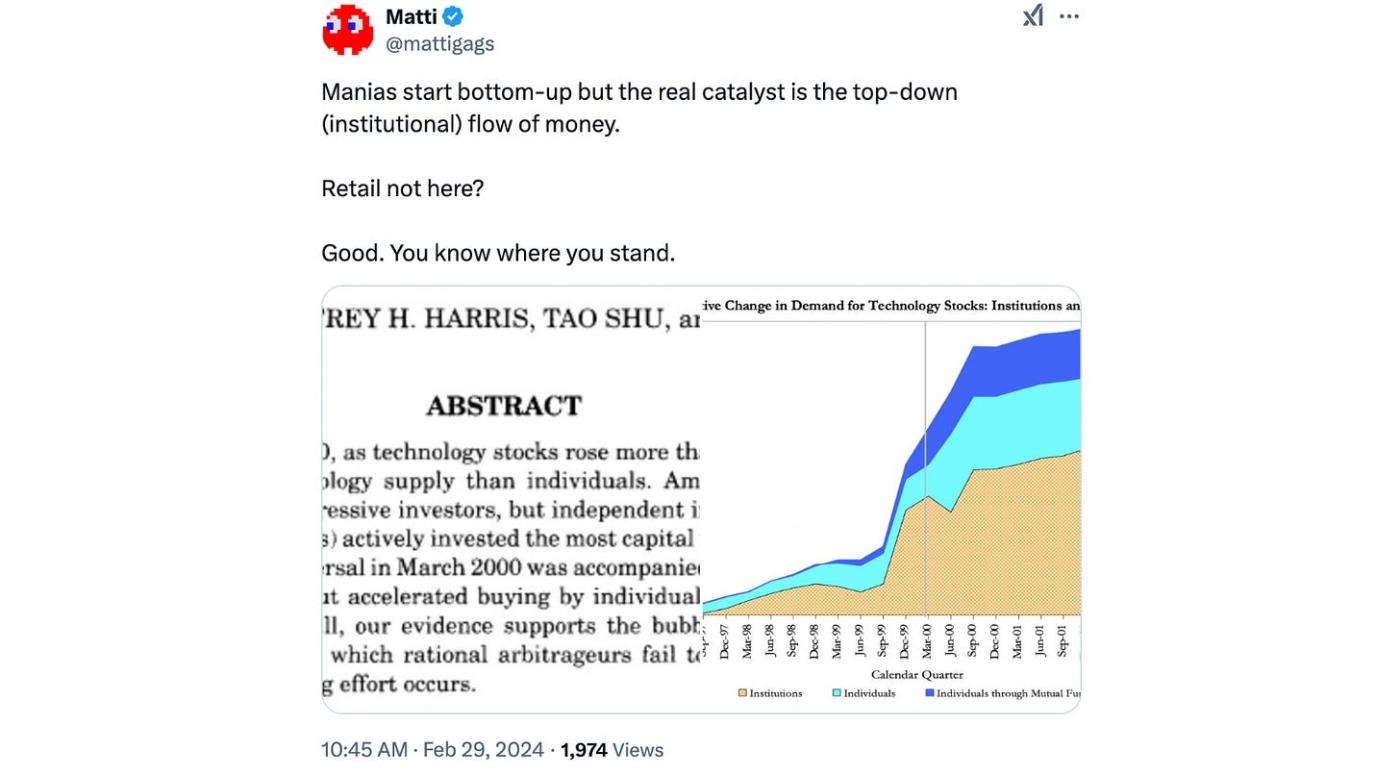

The last cycle started with a clear innovation trigger of DeFi and ended for the obvious reasons mentioned above. This cycle began with a top-down inflow of ETFs that indirectly led to animal spirits chasing high returns mostly in memecoins.

In mid 2023 many investors expressed the desire to invest in the Solana of the next cycle unbeknownst to the fact that Solana itself was the Solana of the next cycle. The fact that it enabled the best playing field for liquidity-enthused traders made it win again. I view memecoins as a hybrid of OHM’s (3, 3) and NFTs, the yield is abstracted away, but the same ponzinomics applies while striving to become a cultural artifact.

Midway through 2024 crypto pegged itself to the success of Donald Trump’s presidential campaign. Again, clinging to a favorable top-down intervention, crypto half-admits it is out of innovation. Some blame regulatory uncertainty but I do not think innovation requires any kind of certainty. One can argue that it prohibits the previous innovation trigger (DeFi) from fully playing out.

Before the Trump election rally, we had a moment of some promising novelty. Agents and DeSci come to mind (bags!). Yet I don’t think that either is complete in its current iteration, these were very promising design spaces for innovation. Lots of bottom-up onchain activity led me to briefly think of GOAT as the YFI moment of this cycle.

The general market rally post-November 5 has pushed the prices in these novel categories higher and it also seemed to attract memecoin trader liquidity. However, the short-termism and general insecurity of investors and traders make any lasting trend impossible. The optionality of narratives incentivizes rotation as no one is forced to commit to anything.

For those hoping that retail will come back en masse – retail does not like volatility, they require a consistent price action. If we’re going to have wild swings we’ll be seen largely as grifters. Retail did not join in the Dotcom bubble because it was a grift but because it was seen as a technological revolution.

At An Impasse?

Through the Girardian lens, we might be entering a crisis as “a clear view of the inner workings indicates a crisis in the system; it is a sign of disintegration.”

$TRUMP seemed to have provided a fleeting moment of retail interest as Moonshot onboarded 400k users in a span of 24 hours. Also, a brief look at Google trends shows interest sparking. However, the grift was revealed as a grift, fortunately, or unfortunately, before a real retail mania could have started.

This leaves us hanging. Some are waiting for the next leg up while some are bracing for a bear market. One thing is certain – everyone watches the administration’s next move. In a span of days or weeks, we might get the answer to whether the ETFs and regulatory clarity are just a final leg to the unfinished business of the last cycle or actually a new beginning.

From a VC perspective, this cycle lacks a pure technological innovation trigger and rests on a regulatory trigger thus making it seem like an extension of the previous bull market rather than a bull market of its own.

One can say it’s semantics but I think the difference in outcome might not be subtle. If we’re closing the chapter we might enter a disillusionment. If it's an opening chapter we could enter a Dotcom bubble-like equivalent. What price-action we would actually need for people to stop top-calling every other day? – A bull market of massive proportion.

But a Girardian reading of the situation would suggest that bifurcation is a sign of the mania coming to an abrupt end:

“A clear-eyed view of the bubble cycle—an enterprise that starts out fabulously overhyped, and gradually grows into the hype—would lead to collapse, so participants rely on self-reinforcing collective delusions to maintain their esprit.”

Understanding the existing bifurcation as insiders vs insiders rather than insiders vs outsiders might suggest that this is not yet a broader hype. But can we get there with insiders derisking significantly because they got burned diamond-handing in the past cycle? Do outsiders even care any more to call us out?

The key insight lies in recognizing if the past months have been only an insider hype preceding a broader hype ahead of us or not – crypto is a skem and we need years to actually deploy technological innovation.

It is possible that we’re still heading into crypto's dotcom bubble. However, that is a function of liquidity rather than innovation. It is a question of what price would convince the retail to join the mania en masse and if fresh institutional inflow can send it there.

That threshold is high.