Since 2020, MicroStrategy, which has risen to fame for its continuous Bitcoin purchases, has now announced a major brand overhaul at a critical juncture in its strategic transformation, renaming itself "Strategy" and claiming to be the "world's first and largest Bitcoin asset management company".

At the same time, the global asset management giant BlackRock has also quickly followed suit, increasing its stake in Strategy to 5%, reinforcing its growing institutional interest in Bitcoin.

Previously, MarsBit had written a detailed article on how MicroStrategy developed and how it was valued - "Not Producing, Just Hoarding Coins": MSTR's Latest Financial Report Reveals the Capital Thickening and High Premium Valuation Model of MicroStrategy.

This article will analyze the core logic behind Strategy's transformation from four perspectives: brand repositioning and financial data, institutional investor actions, strategic leverage operations, and regulatory policies, as well as the interpretation of Strategy's brand repositioning and financial report.

Brand Repositioning and Positioning Upgrade

At the Q4 2024 earnings conference call held in the early morning of February 6th Beijing time, the original MicroStrategy announced its official name change to "Strategy" and proposed a new brand positioning, clearly stating that it is the "world's first and largest Bitcoin asset management company".

The new brand image adopts a stylized "B" letter and a distinctive orange main color tone, which not only echoes the symbolic meaning of Bitcoin, but also conveys a vibrant and intelligent corporate spirit.

Key Points of Q4 2024 Financial Report

The financial report data shows that in Q4 2024, Strategy recorded a net loss of $670.8 million, with a loss per share of $3.03, while in the same period last year it achieved a profit of $89.1 million, with earnings per share of $0.50.

The main reason for the loss is the sharp increase in Bitcoin impairment expenses, which reached $1.01 billion this quarter, compared to only $39.2 million in the same period last year.

In addition, the operating expenses (including impairment losses) of this quarter reached $1.103 billion, an increase of nearly seven times year-on-year. As of December 31, 2024, the company's cash and cash equivalents were $38.1 million, slightly lower than the same period last year.

Although the traditional software business revenue has declined slightly (the total software revenue in the fourth quarter was about $121 million, down 3% year-on-year, and the total annual revenue was about $464 million, down 7% year-on-year), the company has experienced explosive growth in its Bitcoin assets.

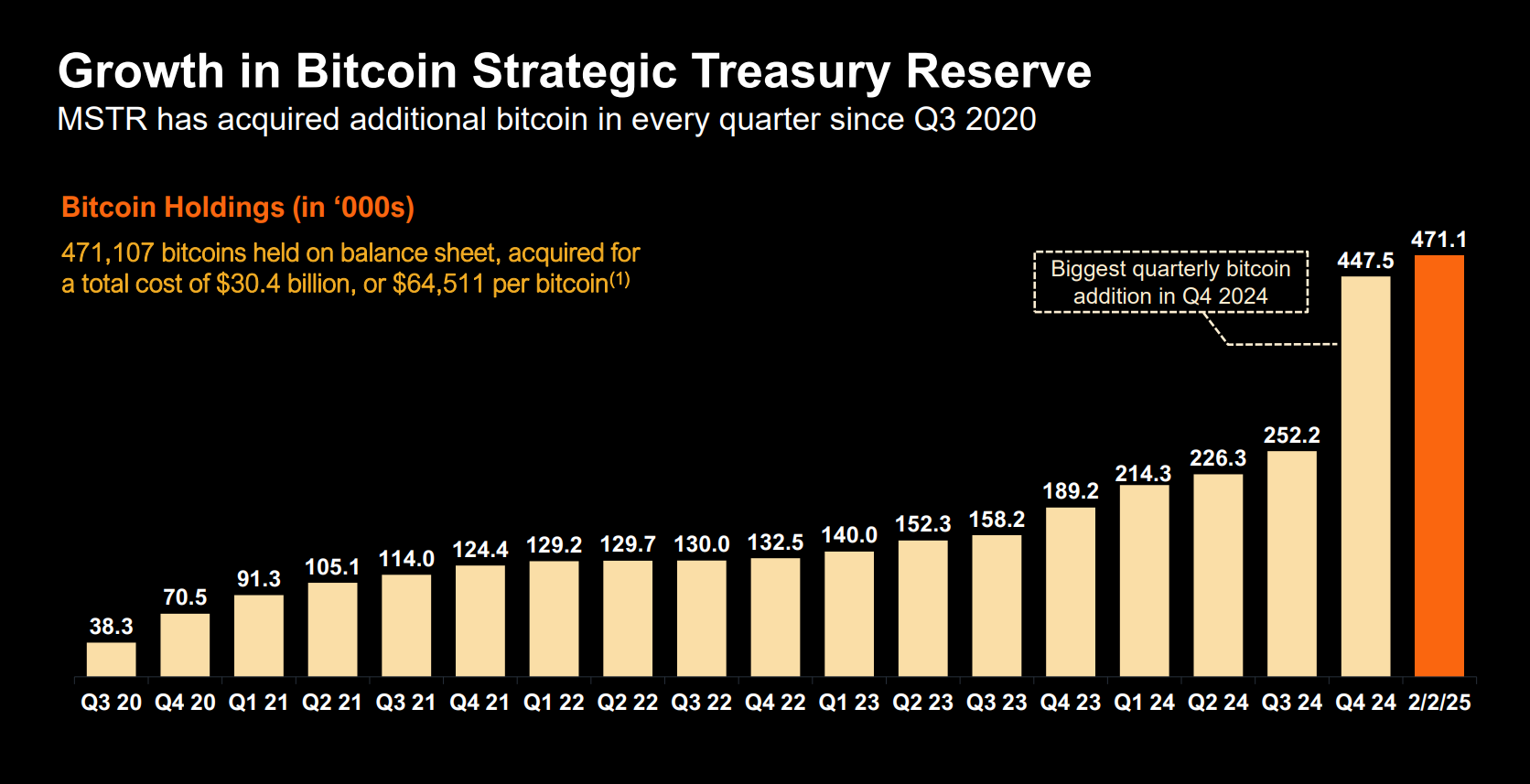

Within just three months, Strategy purchased 218,887 BTC at a total cost of $20.5 billion, rapidly expanding its Bitcoin holdings. As of January 24th, its Bitcoin holdings have reached 471,107 BTC, with a total market value of about $44 billion to $48 billion, and a total cost of about $30.4 billion. Since August 2020, the company has been continuously increasing its Bitcoin holdings every quarter, with a cumulative purchase of over 258,000 BTC, fully demonstrating its confidence in the long-term growth prospects of the Bitcoin market.

New Key Performance Indicators and Capital Raising Plan

In the conference, Strategy introduced several new key performance indicators (KPIs) to quantify the performance of its Bitcoin investments.

Among them, the "Bitcoin Yield" measures the percentage change in the company's Bitcoin holdings and the assumed number of outstanding shares over a certain period. In 2024, the company achieved a 74.3% Bitcoin yield, and has raised its annual yield target for the next three years from the previous 6%-8% range to 15%. In addition, the company has also established "Bitcoin Gain" and "Bitcoin $ Gain" as indicators, and has set a target of $10 billion for "Bitcoin $ Gain" in 2025, providing a clear quantitative standard for investment performance.

At the same time, the "21/21 Plan" launched last October clearly stated that over the next three years, the company will raise a total of $42 billion, of which $21 billion will come from equity financing and another $21 billion will be obtained through the issuance of fixed-income securities. In Q4 2024, the company raised $15 billion through equity issuance and $3 billion through convertible bond issuance, a total of $18 billion, cumulatively completing $20 billion of the capital plan, providing a solid financial guarantee for future large-scale Bitcoin purchases.

Heavyweight Actions of Institutional Investors: BlackRock Increases Holding

BlackRock's Increase in Holding and Market Reaction

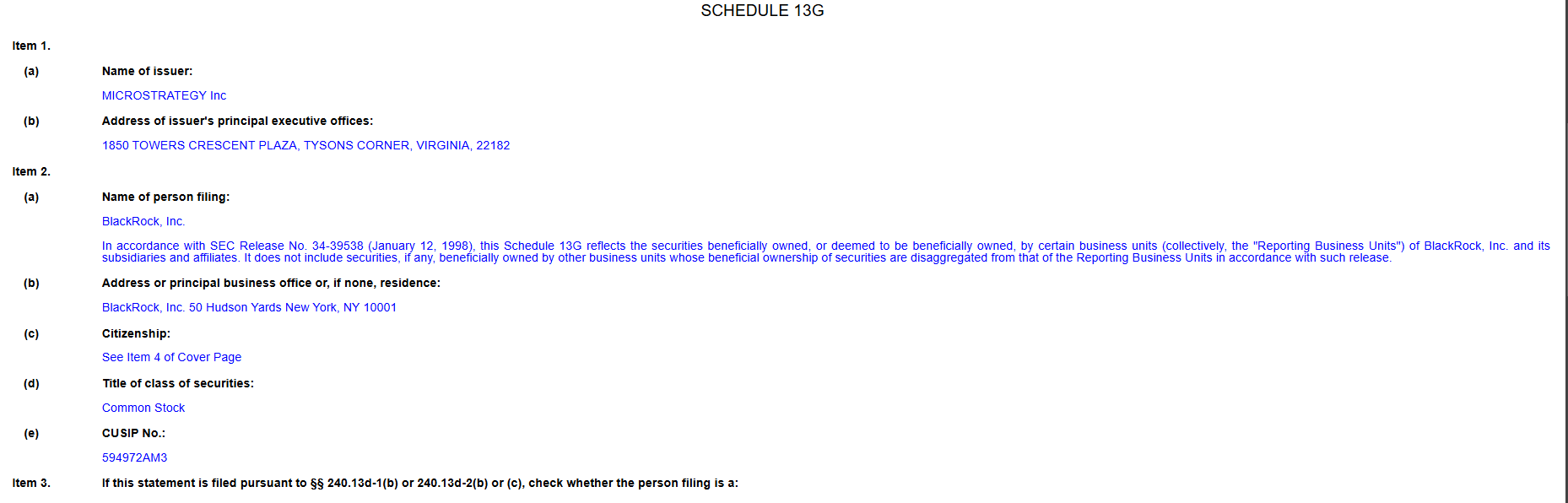

The day after Strategy announced its brand repositioning and financial report, the global asset management giant BlackRock quickly took action. According to a filing with the U.S. Securities and Exchange Commission on February 6th, BlackRock has increased its stake in Strategy to 5%. This move not only demonstrates BlackRock's high recognition of Strategy's strategic transformation and the prospects of Bitcoin investment, but also conveys the strong confidence of global top-tier institutions in the future of digital assets.

As soon as the news was released, Google Finance data showed that Strategy's stock price rose more than 2.8% in pre-market trading, further boosting market sentiment.

The Leverage Effect of ETFs and Institutional Capital

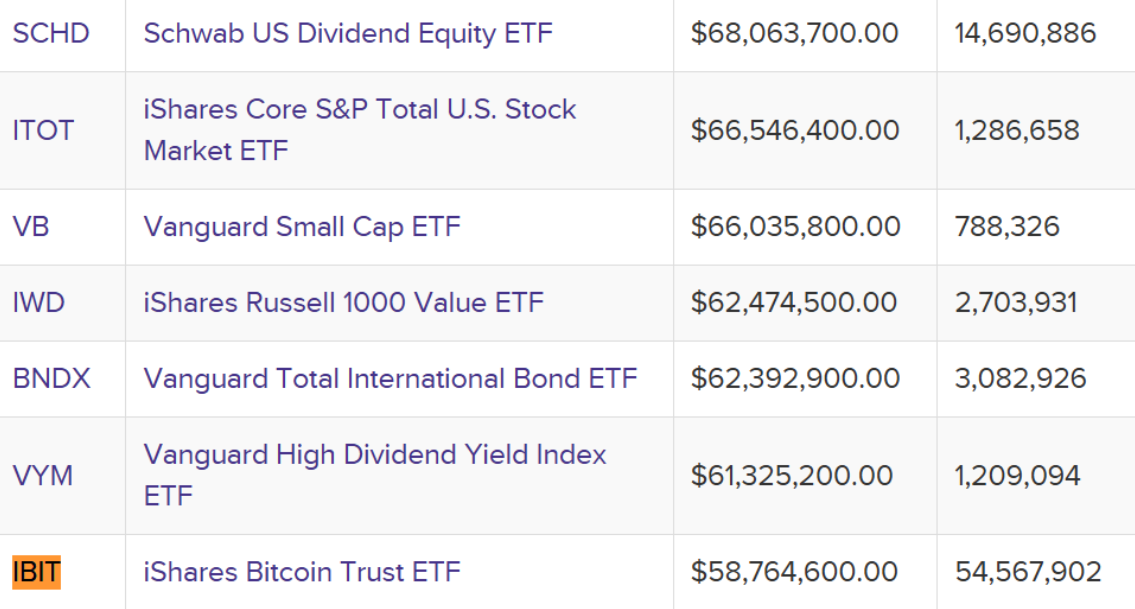

The world's largest ETF. Source: ETF Database

BlackRock's move is not only reflected in the direct increase in its stake in Strategy, but its Bitcoin exchange-traded funds (ETFs) have also shone brightly in the market. Data shows that as of January 31st, BlackRock's managed Bitcoin ETFs rank among the top globally;

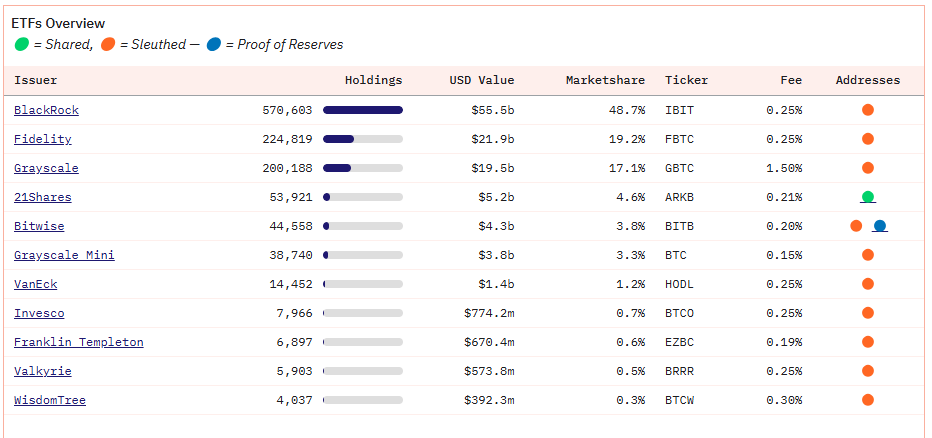

Market share of U.S. Bitcoin ETFs. Source: Dune

Dune data shows that BlackRock's controlled Bitcoin ETFs account for more than 48.7% of the total holdings of U.S. spot Bitcoin ETFs, with a market value of over $55.5 billion. As a convenient and transparent investment tool, ETFs allow traditional retail investors to participate in digital asset investment with low thresholds, while also providing a direct channel for institutional capital to enter the Bitcoin market. Statistics show that in less than a month after the debut of ETFs, Bitcoin prices have re-broken $50,000, with ETF capital accounting for about 75% of new investment funds, fully demonstrating the important role of institutional capital in driving the development of the digital asset market.

"Smart Leverage" Strategy and High Volatility Positioning

Faced with market uncertainty and complexity, Strategy has adopted a "smart leverage" strategy. Unlike traditional companies pursuing stability, Strategy deliberately maintains a relatively high volatility, with a target volatility even higher than Bitcoin itself (around 80 to 90).

The core of this strategy is: by continuously increasing Bitcoin holdings and combining equity financing and convertible bonds and other financing methods, the returns on Bitcoin investments can be amplified, while also attracting investors seeking high returns. The company has also set key indicators such as Bitcoin yield and Bitcoin dollar gain to provide scientific basis for internal operations and investor evaluation.

Capital Raising and the Advancement of the "21/21 Plan"

Since the launch of the "21/21 Plan" last October, Strategy has actively raised huge amounts of capital through various channels, planning to raise a total of $42 billion over the next three years, of which $21 billion will come from equity financing and another $21 billion will be obtained through the issuance of fixed-income securities. In Q4 2024, the company raised $15 billion through equity issuance and $3 billion through convertible bond issuance, a total of $18 billion, cumulatively reaching $20 billion. This efficient fundraising initiative not only demonstrates the company's excellent execution in the capital market, but also provides a solid financial backing for its future large-scale Bitcoin purchases.

New Dynamics in Regulatory Policies and Bitcoin Reserve Legislation

Against the backdrop of large-scale institutional capital entry and corporate strategic transformation, some U.S. states are accelerating the exploration of Bitcoin reserve-related legislation to provide legal protection for the application of digital assets in the public domain.

According to Cointelegraph, Kentucky became the 16th state in the U.S. to enact Bitcoin reserve legislation on February 6.

Similarly, Illinois has also announced a five-year Bitcoin reserve bill that requires setting a minimum Bitcoin holding strategy. These state-level legislative initiatives not only provide policy guidance for the use of Bitcoin in public reserves, but also set a benchmark for future national and even global digital asset regulation.

Although various states have successively introduced relevant regulations, how to classify Bitcoin reasonably is still a problem that urgently needs to be solved. Regulatory authorities such as the U.S. Securities and Exchange Commission, the Federal Reserve, and Congress need to jointly discuss whether Bitcoin should be defined as a commodity, security, or a new asset class. This classification issue will directly affect the regulatory approach to Bitcoin, the market operation mechanism, and the future allocation of institutional capital. In the short term, regulatory uncertainty may lead to market volatility; but in the long run, a clear legal framework can help improve market transparency, reduce investment risks, and drive the digital asset market towards a more mature and stable direction.