Author:DeFi Dave

Compiled by: TechFlow

The rise of the platform economy has helped many small startups grow into today's tech giants, based on a seemingly counterintuitive phenomenon: they do not own any of the core assets required for their business. The classic examples are Uber not owning any of the vehicles in its fleet, and Airbnb not owning any of the rooms on its platform. These companies, through the power of the market, precisely match service seekers with providers, whether it's short-distance travel in the city or temporary accommodation. Compared to traditional companies that need to handle complex logistics such as vehicle maintenance and licensing approvals, these platforms can focus on optimizing technology, improving user experience, and increasing efficiency, thereby achieving unlimited business expansion.

A similar dynamic exists in the on-chain world. On one side are users seeking yield, and on the other side are protocols and participants providing yield, promoting high annual percentage yields (APYs) through various strategies. However, whether it's through leveraged debt positions (CDPs), interest on government bonds (T-Bills), or market strategies like basis trading, a single strategy will encounter bottlenecks when it comes to achieving large-scale delivery.

The Story of Two (Limited) Designs

Traditional projects typically rely on endogenous design, with their yields coming from the demand for the platform's use. For example, lending markets and perpetual contracts depend on users' leverage appetite, while the token flywheel effect requires new investors to continuously buy governance tokens. However, if the platform lacks demand (whether it's leverage demand or token purchase demand), the liquidity supply will not be able to generate yield. This design is similar to Ouroboros, unable to transcend itself to achieve sustainable development.

As for the newer exogenous strategies, protocols often pose the wrong question: which strategy can achieve the greatest scale? In fact, there is no strategy that can be scaled indefinitely. When the alpha is exhausted, all strategies will eventually become obsolete, and developers will have to go back to the design stage.

So, what should stablecoins focus on? As the core hub for capital formation, stablecoins need to consider how to efficiently allocate capital and how to ensure the safety of users' funds. To achieve true success, the blockchain ecosystem needs a flexible and secure stablecoin solution.

Enter CAP

CAP is the first stablecoin protocol that outsources yield generation in a programmatic manner and provides comprehensive protection.

Who Constitutes CAP?

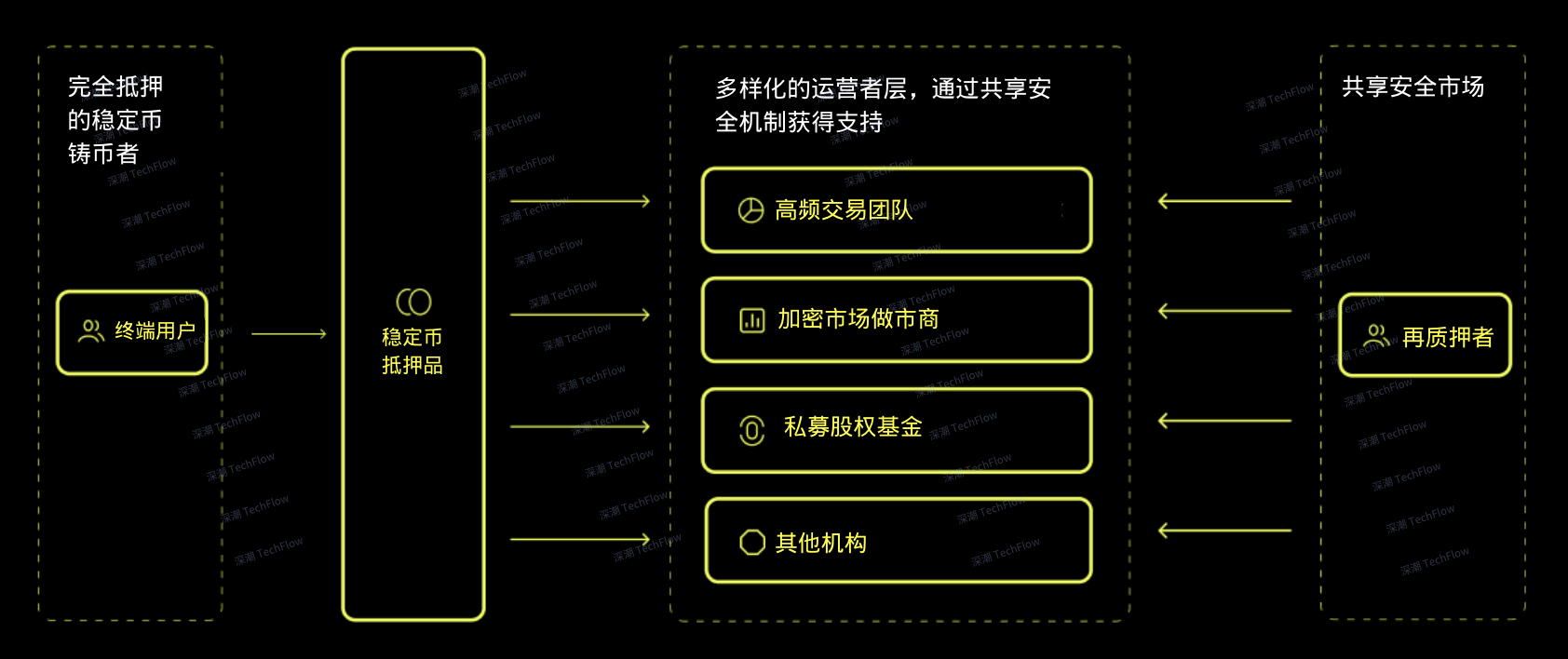

The core of the CAP system is composed of three types of participants: minters, operators, and restakers.

Minters: Minters are stablecoin users who hold cUSD. cUSD can always be redeemed 1:1 for its underlying collateral assets, USDC or USDT.

Operators: Operators are institutions capable of executing large-scale yield generation strategies, including banks, high-frequency trading (HFT) firms, private equity firms, real-world asset (RWA) protocols, decentralized finance (DeFi) protocols, and liquidity funds.

Restakers: Restakers are capital-locked pools that provide security guarantees for the operators' activities to protect stablecoin users, and in return, gain the right to use their restaked ETH.

(Original image from DeFi Dave, compiled by TechFlow)

How CAP Works

CAP's smart contracts explicitly define the operating rules for all participants, including fixed requirements, penalty mechanisms, and reward mechanisms.

Stablecoin users deposit USDC or USDT to mint cUSD at a 1:1 ratio. Users can choose to collateralize their cUSD to earn yield, or use it directly as a dollar-pegged stablecoin. cUSD can always be fully redeemed.

An institution (e.g., a high-frequency trading firm with a 40% threshold yield rate) chooses to join the CAP operator pool and plans to obtain a loan through CAP for its yield strategy.

To become an operator, the institution must first pass CAP's whitelist review and convince the restakers to delegate their funds to them. The total amount of delegated funds determines the capital limit the operator can access. Once the institution has obtained sufficient "coverage" through delegation, it can withdraw USDC from the collateral pool to execute its exclusive strategy.

At the end of the loan period, the institution distributes the yield to stablecoin users according to CAP's benchmark yield rate, while also paying a premium to the restakers. For example, if the benchmark yield rate is 13% and the premium is 2%, the institution can keep the remaining yield (25% in this case).

Users who collateralize their cUSD will accumulate interest through the operators' activities, which can be withdrawn at any time.

The Motivations of Each Participant

To understand the operation of CAP, it is not enough to only know the behavior of the participants; it is more important to understand their motivations for participating.

Stablecoin Holders

Stable Yield Without Frequent Switching: CAP's market-set interest rates allow users to continuously earn yield without the need to frequently switch protocols, even if market conditions change or the protocol becomes obsolete.

Security Guarantee: Compared to CeFi and DeFi applications that promise high yields but result in user fund losses, CAP provides higher security. Users' principal is protected by the immutability and adequate collateralization of the smart contracts, rather than relying on trust.

Operators

Zero-Cost Access to Additional Capital: The capital provided by CAP does not require a cost basis, allowing yield market makers to earn higher returns compared to traditional LP models, while also increasing the total value locked (TVL) of DeFi protocols, the assets under management (AUM) of private credit funds, and creating more possibilities for cross-domain arbitrageurs.

Restakers

New Use Case for Locked ETH: Since ETH is often locked on L1, its use cases are limited. By restaking ETH, users can delegate it to operators and participate in active validation services (AVS) like CAP.

Yield Paid in Blue-Chip Assets: CAP allows restakers to autonomously set the premium to compensate for the risks they bear. These premiums are paid in blue-chip assets like ETH or USD, rather than inflationary governance tokens or off-chain loyalty programs. As a result, the restakers' yield is not limited by the project's market capitalization and has unlimited growth potential.

Existing Risks

Any new opportunity comes with risks, so understanding the potential risks of CAP is particularly important:

Shared Security Market Risks: CAP is based on shared security markets like EigenLayer, so it may be affected by the risks of these platforms.

Underlying Asset Price Volatility: If USDC or USDT lose their peg, users will face price volatility risks. However, this risk exists even without CAP.

Risks from Third-Party Cross-Chain Bridges: When users use cUSD on other chains through cross-chain bridges, they may face risks from the third-party bridges. However, CAP itself is not directly exposed to these risks.

Smart Contract Risks: CAP does not rely on custodians or human regulation, but rather protects users through the rules of smart contracts. However, users must bear the risks of potential flaws in the smart contract logic, even if the code has been audited.