Solayer is an advanced solution designed to maximize staked assets on the Solana blockchain. This platform optimizes resource utilization, operational efficiency, and generates superior yields without affecting the liquidity of the funds.

With a focus on providing precise tools for developers and users, Solayer enriches the Solana ecosystem by integrating advanced restaking mechanisms and becoming a hub for various financial products.

Solayer is a restaking protocol operating on the Solana blockchain. It allows the reuse of staked assets to secure additional services on the network. This proposal stems from the need to optimize staking, increase yields without affecting the liquidity of the funds.

This mechanism is based on the conversion of SOL tokens into sSOL, a liquid asset that provides access to various applications in the ecosystem, from decentralized exchange liquidity strategies to lending programs and collateral provision.

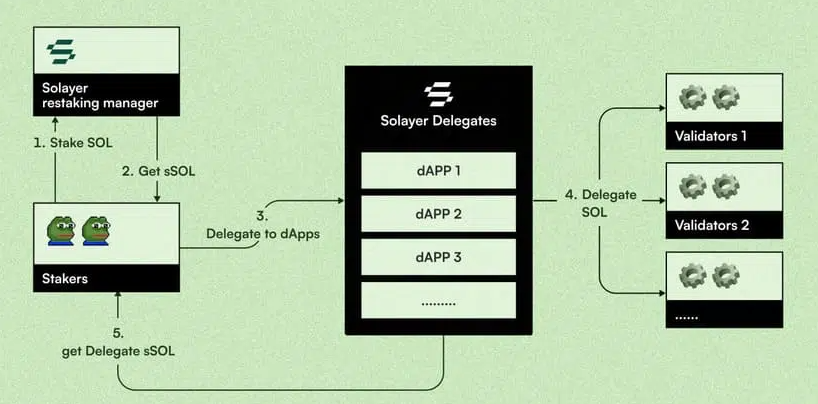

The restaking process is carried out through a pool management system that monitors the flow of assets and is responsible for issuing tokens representing the staked funds. Users deposit their SOL tokens and receive sSOL, which can be used simultaneously in multiple activities.

The technical structure of the protocol includes specialized organizational components that manage both the conversion and allocation of assets. This organization facilitates the accurate allocation of resources and the distribution of rewards, optimizing the use of staking and ensuring network efficiency.

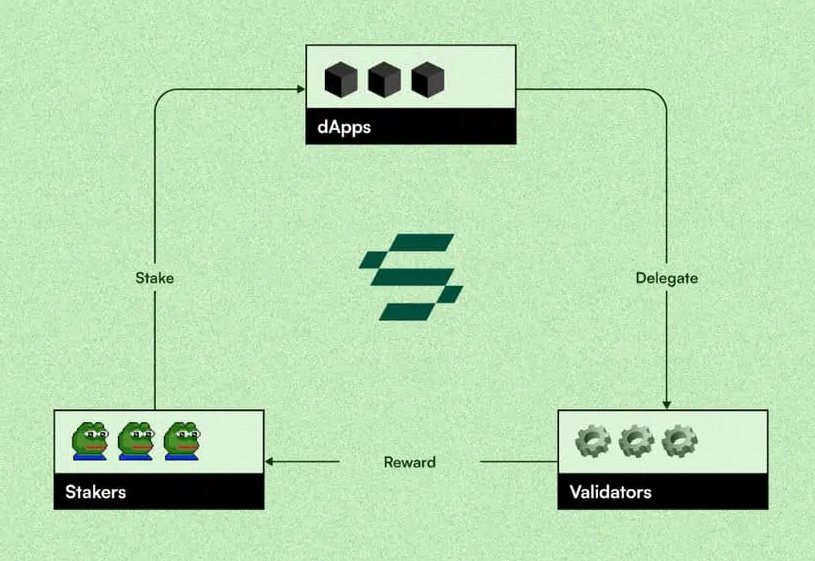

The system is based on a mechanism called Stake-weighted Quality of Service (SwQoS), which prioritizes transaction processing. This benefits decentralized applications (dApps) that require continuous operational performance during high-demand periods, ensuring the network's operational capacity remains optimal. The integration of this system allows the Solayer infrastructure to respond agilely to network changes and additional verification requirements.

A unique feature of Solayer is the use of decentralized Automated Validator Selection (AVS) systems. AVS automatically selects validators based on performance and reliability criteria, eliminating dependence on a centralized entity and strengthening the system's resilience.

Asset management is handled through a delegation management system, responsible for assigning sSOL tokens to validators and ensuring the correct validation processes are performed. Additionally, an accounting module accurately calculates the rewards generated, ensuring transparent and error-free distribution.

Solayer incorporates customizable unbonding processes, allowing users to manage their investments without facing extended lock-up periods. These processes have a maximum duration of 2 days, providing flexibility in fund management.

Similarly, an emergency escape mechanism is implemented to ensure the safety of assets in the event of errors or abnormalities, providing a secure and efficient withdrawal path.

Solayer supports the use of liquid staking tokens (LST) other than SOL, including Marinade-SOL (mSOL), Jito-SOL, Blaze-SOL (bSOL), and Infinity-SOL (INF).

The integration of these tokens follows a similar conversion process as the SOL to sSOL conversion, creating an intermediate token suitable for the delegation process and reward generation.

This compatibility provides users with a variety of tools, allowing different staking forms to benefit from the restaking infrastructure.

By unifying the management of various tokens within a single system, this protocol reduces the fragmentation of liquidity pools and minimizes the costs associated with converting between assets, resulting in a smoother user experience and improved operational efficiency, directly benefiting users.

The development of Solayer is not limited to optimizing staking but also extends to creating new financial products. The introduction of sUSD, a synthetic stablecoin backed by real-world assets such as U.S. Treasury bonds, provides a stable investment option and generates passive income.

With a yield of around 4%, sUSD offers an attractive alternative for those seeking safe exposure without the volatility risks associated with traditional cryptocurrencies.

Solayer's performance is evidenced by the growth of its Total Value Locked (TVL), reaching $367 million in early December 2024. This figure reflects the trust of users and the protocol's ability to capture significant investment volumes in a short period.

The early adoption and rapid TVL expansion demonstrate the effectiveness of the reward distribution mechanisms and asset management, delivering benefits to the system's users.

The protocol employs automated algorithms to select validators and allocate resources, ensuring accuracy and security in its operations. Customizable unbonding processes and emergency mechanisms are implemented to address any abnormalities that may arise in the network.

These technical elements work in combination, providing a robust environment where enhancing efficiency and protecting assets are top priorities.

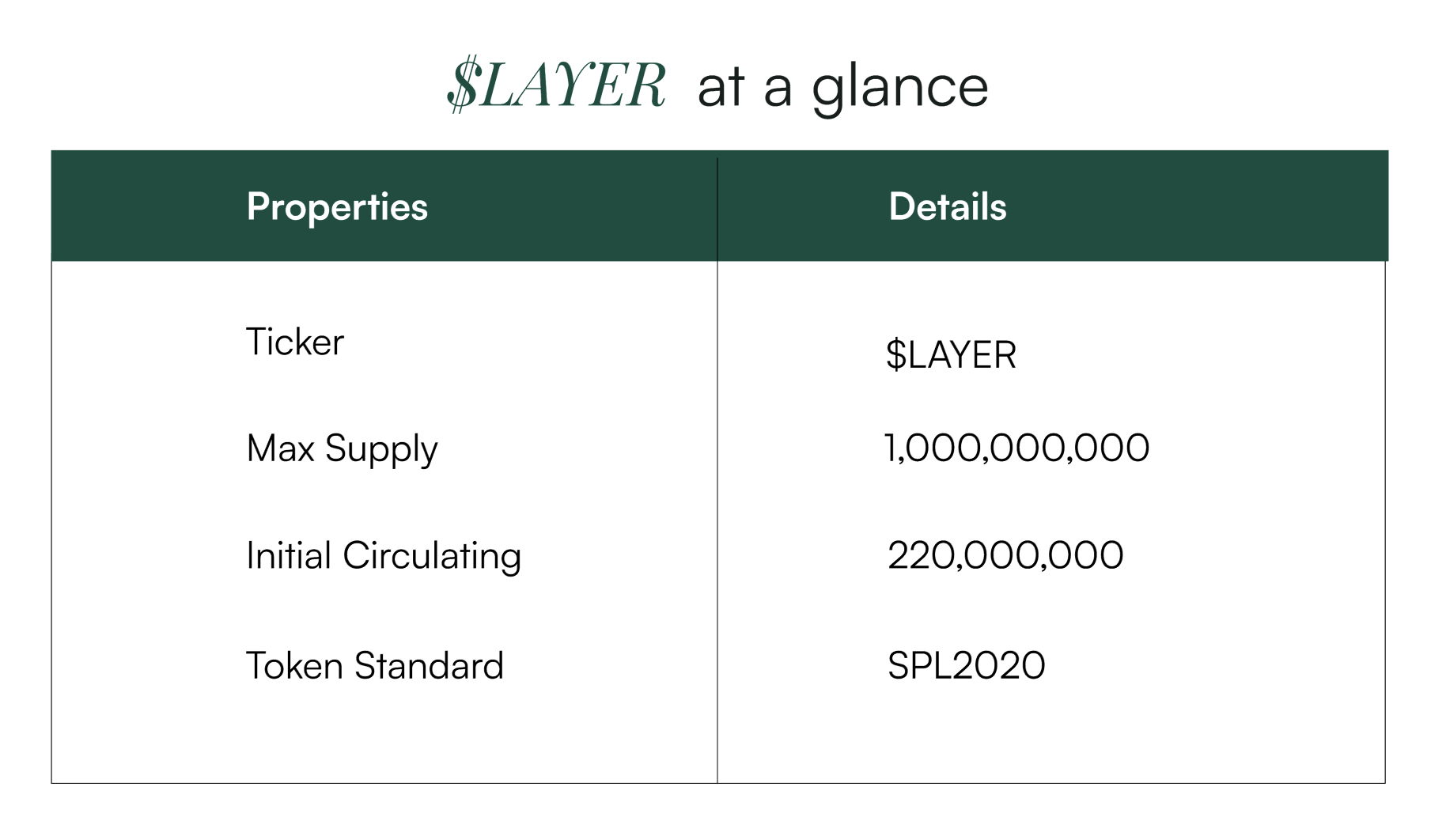

The Solayer TGE and token distribution event on February 11 marks an important milestone, with speculation about a potential airdrop for early participants.

To ensure decentralization, the LAYER token is distributed through both a community Emerald Card sale and a genesis airdrop for early users.

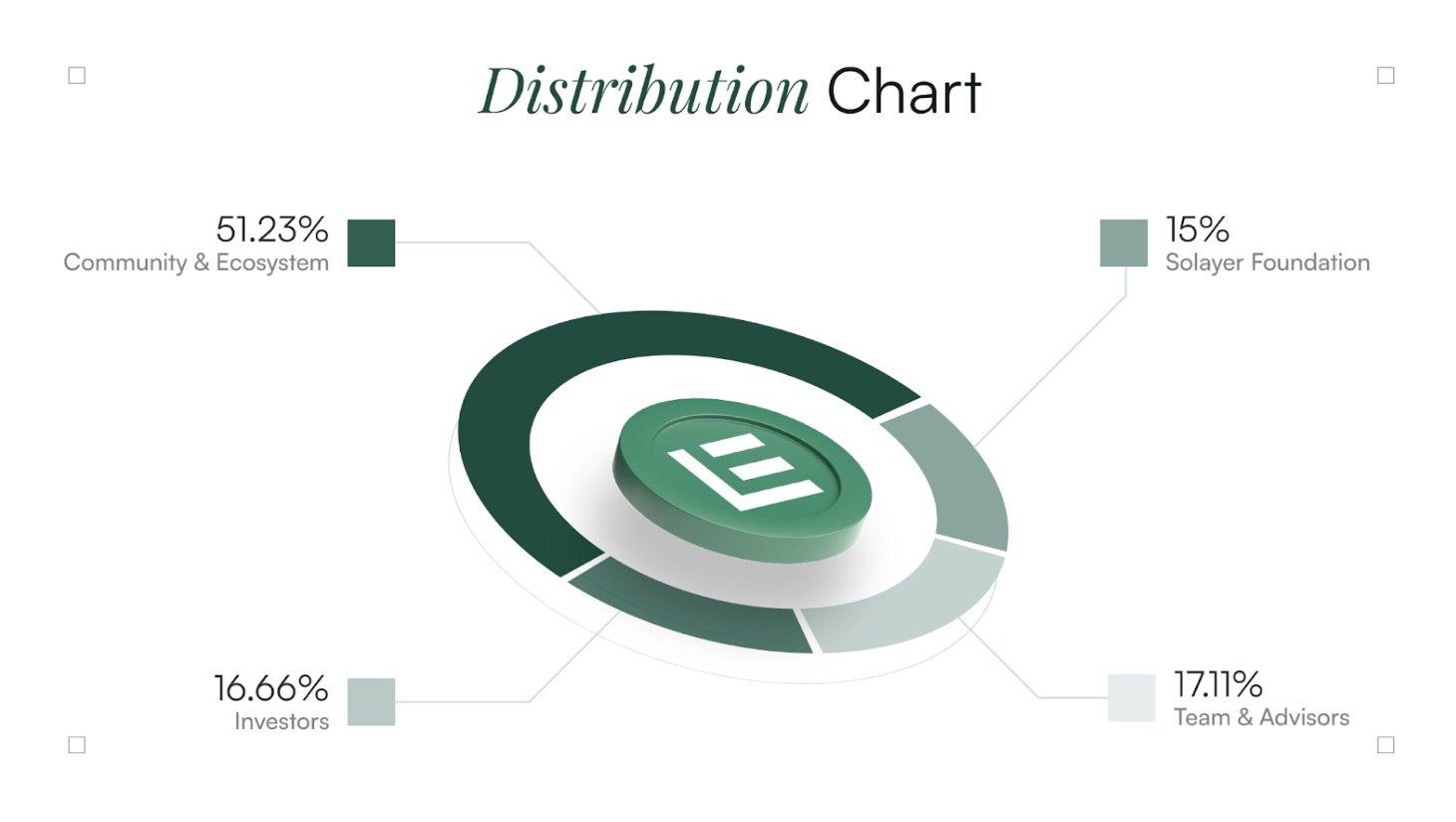

The maximum supply of LAYER will be 1,000,000,000 tokens, distributed across three main categories, with an initial circulating supply of 220,000,000 LAYER:

Community & Ecosystem (51.23%)

Core Contributors

Investors

Fund

Solayer is a comprehensive solution that helps optimize the use of assets that have been Staked on the Solana network. Each component of the system performs its specific and specialized function, allowing for harmonious integration and delivering efficiency to the reStaking infrastructure.

The deployment of advanced technologies enables Solayer to adapt to the dynamic and competitive environment. Ultimately, in addition to optimizing the capabilities of Solana, it also creates new opportunities for DeFi enthusiasts by providing developers and users with precise, secure tools to address future challenges.

Disclaimer: This article is for informational purposes only and is not investment advice. Investors should do their own research before making decisions. We are not responsible for your investment decisions.

Join Telegram: https://t.me/tapchibitcoinvn

Twitter (X): https://twitter.com/tapchibtc_io

Viet Cuong