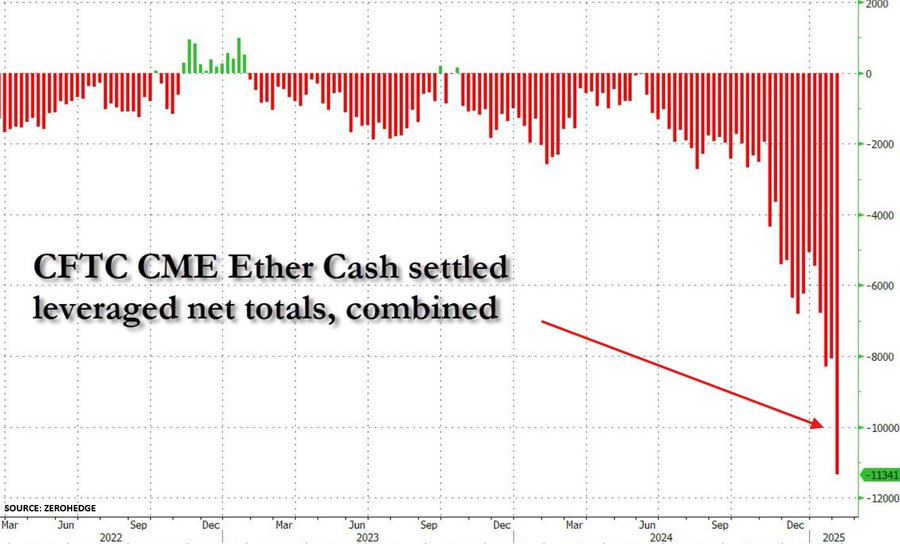

The global capital market review magazine The Kobeissi Letter posted on social media platform X earlier yesterday (10) stating that the short positions on Ethereum (ETH) in the market have increased by 40% in just one week, and have increased by 500% since November 2024, which is the first time that Wall Street hedge funds have taken such a large-scale short position on Ethereum, unprecedented in scale.

What did the shorts see?

The Kobeissi Letter supplemented that in fact, from multiple data and fundamentals, Ethereum should not be so pessimistic, these data include:

- Ethereum's capital inflows are very high, even when the short positions expanded in December 2024, Ethereum's capital inflows were huge within three weeks, even setting a record of $85.4 billion in a single week;

- Ethereum's trading volume has been performing strongly, with trading volume surging during the second day of the inauguration of US President Trump and the market crash in early February;

- The Trump administration and regulatory agencies have been very friendly in their regulatory attitude towards Ethereum.

Further reading: Trump's second son hinted that there will be a major ETH event today, WLFI added 14,000 ETH last night

So why are the shorts still keen on shorting Ethereum? The Kobeissi Letter gave possible reasons including:

- Potential market manipulation;

- Common risk hedging;

- Pessimistic expectations about Ethereum itself.

Well-known Ethereum OG clears Ethereum

Additionally, it is worth mentioning that in the current FUD around Ethereum, Qiao Wang, the co-founder of the Web3 accelerator and founder community Alliance DAO, recently stated in a Podcast that at present, not only many investors, but even many developers have turned to the public chain Solana, and he himself, as an OG who has held Ethereum for ten years, has also cleared this asset entirely:

Solana is easier to attract users, and for developers familiar with EVM, the transition to Solana is not easy, requiring learning a whole new set of tools, but even so, they still feel it is worth it.

I actually held Ethereum from the Genesis Block, but I cleared it all last year, I held it for a full 10 years, you can imagine, holding an asset for 10 years, but suddenly feeling that its growth potential is almost exhausted.

Additionally, according to Cointelegraph reported slightly later yesterday (10), Ethereum's daily transaction fees have also fallen below $1 million, the first time since September 2024, and the second time since 2020, indicating that the market demand for ETH is still in a depressed state.