24-Hour Frenzy: The "Explosive" Rise of the BNB Ecosystem

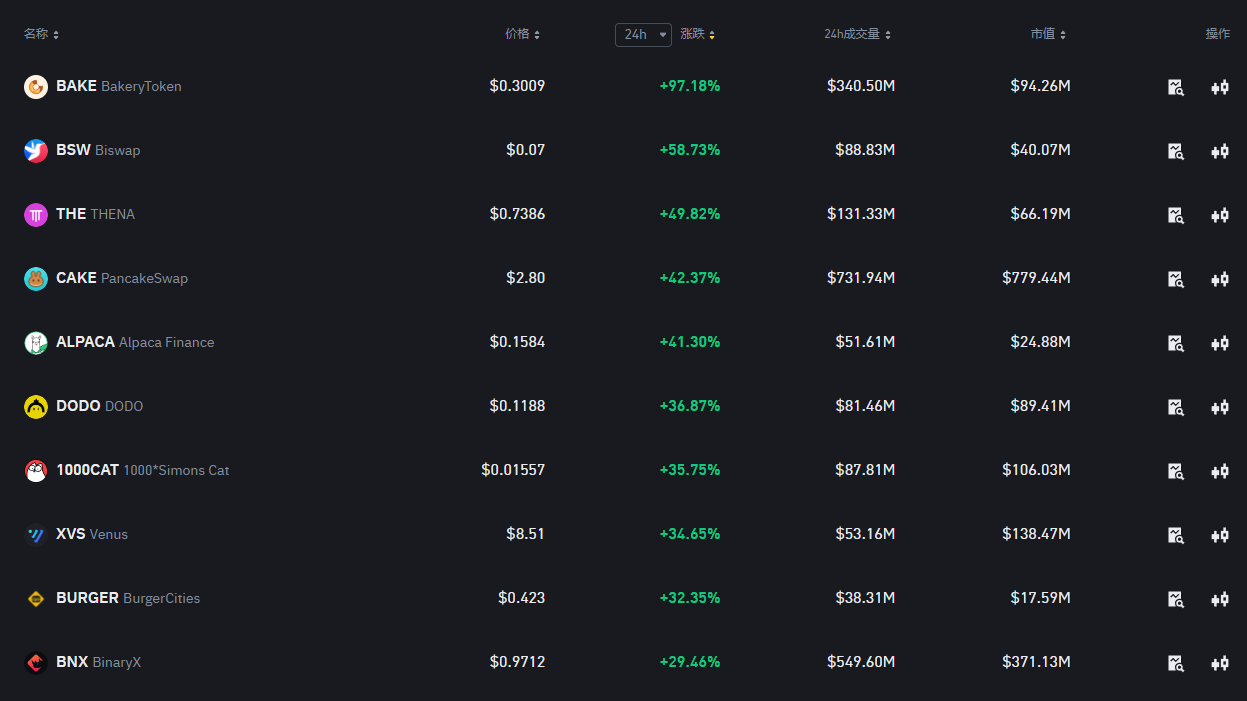

On the morning of February 13, 2025, the Binance platform token BNB broke through the $700 mark, reaching a high of $708, with a 24-hour increase of 12.06%. Its market capitalization exceeded $103 billion, surpassing traditional giants like Sony. This frenzy was not limited to BNB itself, as multiple tokens in its ecosystem collectively staged a "frenzy mode":

The trigger for this collective uprising was the restart of the Meme season in the BNB Chain ecosystem, but it concealed three deeper logics: strengthened deflationary mechanisms, technological breakthroughs, and the resonance of community consensus and capital leverage cycles. We can analyze this phenomenon from the following perspectives.

Strengthened Deflationary Mechanism: The Burning Strategy that Empowers BNB

The surge in BNB is inseparable from the ingenious deflationary mechanism behind it. The BNB burning mechanism, from the initial periodic burning to the current "real-time burning" mechanism, has continuously strengthened the upward momentum of its price. Particularly in the fourth quarter of 2024, the BNB burning volume reached a new high of 2.6 million (about $18.2 billion), the highest in BNB's history, marking an important breakthrough in the BNB ecosystem's deflationary strategy.

Furthermore, the "real-time burning" mechanism has further increased the pressure for price increases. This means that every time a user conducts a on-chain transaction, 0.05% of BNB will be automatically burned. As the trading volume of BNB increases, the burning volume also continues to grow, thereby driving up the market price of BNB. This mechanism forms a self-reinforcing cycle - each burning reduces the total BNB in the market, further increasing the scarcity and value of the remaining BNB.

Technological Breakthroughs: The High Performance and Low Cost of BNB Chain

The technological progress of BNB Chain is one of the important reasons driving the surge in BNB.

On February 11, BNB Chain released its 2025 technology roadmap, which revealed that BNB Chain's goal is to reduce transaction latency by shortening block time from three seconds to sub-second levels, while maintaining high network throughput and the ability to process 100 million transactions per day.

In 2025, BNB Chain will continue to collaborate with the community, accelerate the advancement of artificial intelligence using BSC and Greenfield, and further optimize and integrate developer tools.

Through continuous technological innovation, BNB Chain has gradually transformed from an "Ethereum backup" to a high-performance, public chain-level blockchain platform. One of its most important technological breakthroughs is the launch of the zkBNB testnet. By adopting zero-knowledge proof technology (zk-SNARKs), BNB Chain's TPS (transactions per second) reached over 9,000, while gas fees were significantly reduced to $0.001, making it one of the fastest EVM chains.

According to Lookonchain data, BNB Chain processed 68.3 million transactions in the past 30 days, making it the #1 EVM (compatible) chain by 30-day transaction volume.

BNB Chain can now process a large number of transactions, and the fees users need to pay for on-chain operations have also been reduced to a minimum. This improvement in cost-effectiveness has not only enhanced the user experience, but also brought higher participation willingness from more developers and institutions.

The MEV Guard feature launched by PancakeSwap is also part of the technological breakthrough. This feature uses dedicated RPC nodes to shield against sandwich attacks, significantly reducing transaction slippage (the deviation between the transaction price and the market price). This technology has greatly improved the trading experience for ordinary users and further enhanced the competitiveness of the BNB Chain ecosystem.

In addition, Binance's other flagship product, Binance Squares, has also undergone a major update. In addition to the previously disclosed features like viewing positions and profit and loss analysis, it will now include trading history in the form of achievements. This means that all KOLs or traders registered on Binance can showcase their real-time positions and publish their views for others to track.

Capital Leverage Cycle Resonance: The Strong Involvement of the Capital Market

The participation of the capital market is undoubtedly another important factor driving the surge in BNB and its ecosystem tokens. As the price of BNB has continued to rise, more and more capital has begun to flow into the BNB Chain ecosystem. Especially the involvement of market makers, hedge funds, and sovereign wealth funds, which has greatly enhanced the liquidity and stability of the market.

According to on-chain monitoring data, Binance's OTC dark pool saw 4 BNB block trades exceeding $50 million in the 24 hours before the BNB surge. The buyers of these trades are suspected to be hedge funds from Asia and sovereign wealth funds from the Middle East, further demonstrating the strong attention of large capital to the BNB market.

On February 13, BNBChain announced the hosting of the BNB AI Hackathon, which is an open-ended event. Excellent projects have the opportunity to win $10,000 in cash prizes and $50,000 in Kickstart funding, as well as the chance to be included in the fifth BNB Incubation Alliance (BIA) or the BNBChain MVB accelerator program.

At the same time, market makers like Wintermute and Amber Group have also started injecting over $300 million in liquidity into the BNB Chain ecosystem, focusing on hot tracks like GameFi and SocialFi. The influx of these funds not only promotes the prosperity of the BNB ecosystem, but also accelerates the diversified development of BNB ecosystem platforms and applications.

Meme Coin Fever: CZ's Changing Attitude Towards Memes

In addition to technological innovation and capital market support, a tweet from CZ (Changpeng Zhao) has also ignited the market's FOMO to some extent. A few days ago, CZ asked his followers on X platform about how to create a Memecoin. This simple question sparked a heated response from fans, immediately triggering a Memecoin frenzy and marking CZ's shift from dislike to acceptance of MEME.

The rapid rise and quick listing on Binance of TST token is a testament to this.

Recommended reading: The TST Token Plunges 70%, Is $0.16 the Entry Point or a Bottomless Pit?

According to GMGN data, at least four different Memecoins have emerged, including Cleo, Biggie, Semyon, and Maui. These Memecoins have seen their market capitalization grow rapidly, with over 5,000 buyers. Although these Memecoins have high volatility and market uncertainty, they reflect a phenomenon - the crypto market is driven not only by technology and capital, but also by the influence of social media.

Legal Challenges: The Suspension of SEC Litigation and Regulatory Pressure

Although the surge in BNB has brought spring to Binance's ecosystem, the accompanying legal challenges have also attracted high market attention.

However, the decision to suspend the litigation case between Binance and the U.S. Securities and Exchange Commission (SEC) for 60 days is undoubtedly a positive signal for BNB. The suspension of the litigation provides more time for the parties to await the report of the newly formed Cryptocurrency Task Force, which will help provide a clearer regulatory framework for the industry.

This suspension means that both parties have more time to re-examine the current case and adjust their response strategies based on future regulatory developments. Especially in the context of the crypto industry facing stricter regulation, this delay allows Binance and market participants to better assess the impact of policy changes on their business and the market. The market generally believes that with the release of the Task Force report, the regulatory environment for the cryptocurrency industry will be further clarified, providing clearer legal guidance for Binance and its ecosystem, which will help alleviate market concerns about future regulatory uncertainty.

In addition, Binance has denied the allegations of selling a large portion of its reserve assets, emphasizing that the so-called "asset sales" are merely accounting adjustments.

For investors, this clarification has to some extent enhanced market confidence and reduced the panic caused by the potential loss of assets. As regulations and regulatory policies become clearer, CZ may have new development opportunities in compliance, which further supports the healthy development of the BNB ecosystem. Therefore, the suspension of the SEC lawsuit is a good opportunity for BNB to make adjustments and optimizations in the uncertain legal environment, which helps to alleviate the negative expectations of the outside world about CZ's future and creates favorable conditions for it to continue to expand its market share and drive innovation.

The Spring of the BNB Ecosystem: Challenges and Opportunities Coexist

In general, the surge in BNB and the prosperity of its ecosystem mark the arrival of the "spring" of the BNB ecosystem.

For investors, this is not just a story about the rise in the price of BNB, but also about how the entire cryptocurrency industry finds an adaptive path in a constantly changing environment. With the injection of more capital and technology, whether BNB can continue to maintain its market advantage remains to be seen. But it is certain that the BNB Chain ecosystem represented by BNB is becoming an important force that cannot be ignored in the cryptocurrency market.

In the next few months, the market will face a key battle over the BNB ecosystem. Whether it is technological breakthroughs, capital flows, or the introduction of regulatory policies, they will have a profound impact on the development of the BNB ecosystem. Investors and industry practitioners need to focus not only on short-term price fluctuations, but also on the long-term potential and continuous innovation capabilities of the BNB ecosystem.