Contract Launch: A Capital Performance Art of "Russian Roulette"

While the crypto farmers are still struggling with "is it a blessing or a curse to list on Binance", the exchanges have long since penetrated the secret of wealth: only open contracts, not spot. This "all profit with no investment" trick can be called the ultimate version of the "free lunch" in the crypto world.

Recently, MyShell (SHELL)'s contract suddenly went live on major exchanges, but the spot is nowhere to be found, like it was eaten by a dog. This "contract flies first, spot limps" trick has made the farmers collectively fall into the philosophical three questions: "Who am I? Where am I? Should I open a contract?"

According to the clues, this operation may have three possible explanations:

1. Binance Buried Theory: Binance may not even be aware of the "cap effect" of its contract market on the spot price, or simply pretending to be the "little white rabbit in the contract world", after all, the farmers' memory only lasts 7 seconds, and you can short if you don't like it.

2. Team Offended Theory: The MyShell team may have become the "disliked" in the exchange circle, such as not paying enough listing fees, not cooperating with market making, or the CEO replacing the exchange boss's Moutai with Laoshan Baihua Shexiacao at a dinner party.

3. Conspiracy Theory: The team is playing a big game, using the contract to harvest the profit pool, while testing the market sentiment, paving the way for the spot launch - "the contract is the bait, the spot is the net, and the farmers are the fish".

Exchanges that have currently listed Shell spot

But the truth may be simpler: the exchanges and the project party are playing a "expectation management" conspiracy. The signal released by the contract launch is "we will eventually list the spot, but you can play with it first", which not only allows the holders to hedge, but also allows the speculators to enter, and at the same time uses the contract price to pave the way for the spot pricing. As for why not list the spot? It may be that the team is holding a big move (such as faking ecosystem data), or the exchange wants to collect a wave of fees to fatten itself first.

Secondary Gambling: Listing on Binance or Going to Hell?

The fate of MyShell's token price is essentially a life-and-death gamble revolving around "whether or not to list on Binance", and the chips on the table are the sunk costs of the BSC ecosystem:

1. Sunk Costs Kidnap Valuation

Airdrop Cost: MyShell's airdrop tasks have been going on from the Beta season to the 11th season, with millions of users earning points until their hands are sore, and if the token goes to zero, the community can spray the project party's ancestral graves.

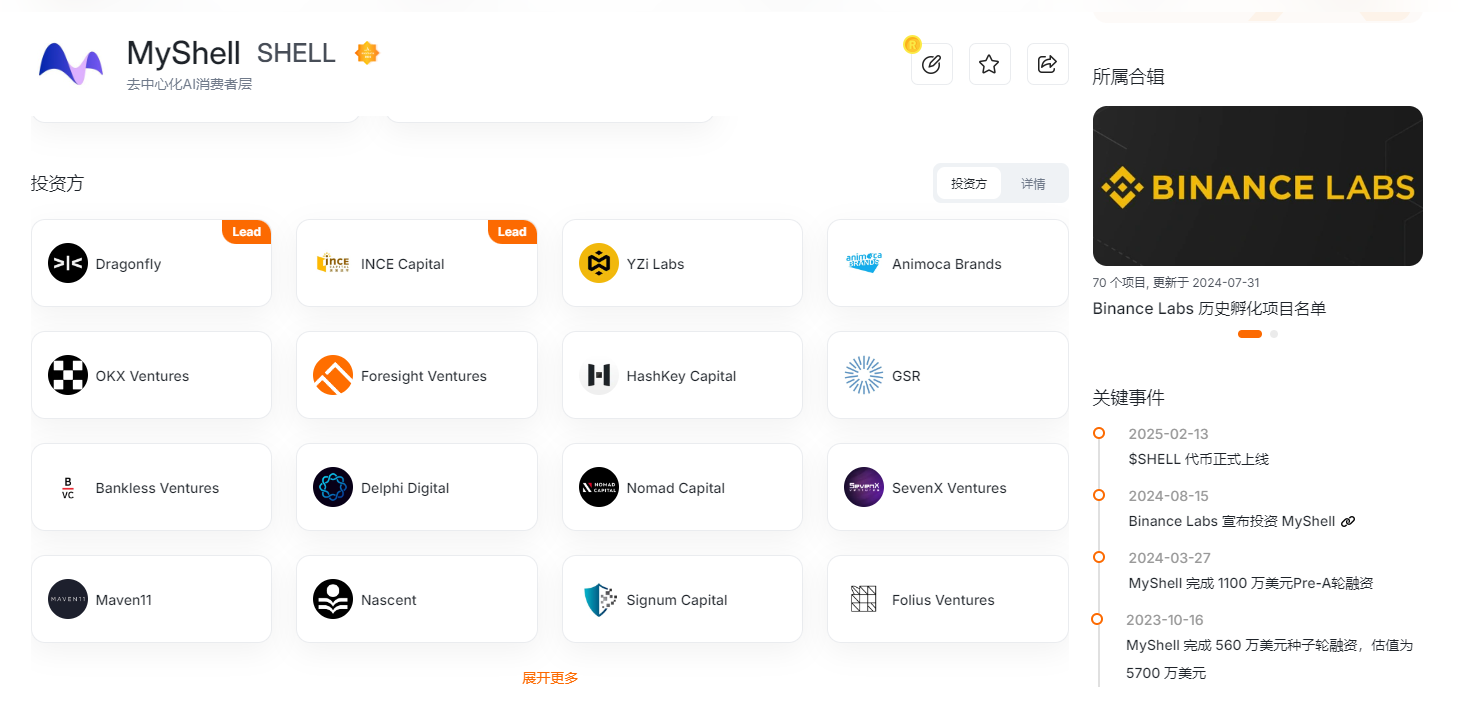

VC Cost: MyShell has raised over $16 million in three rounds of financing (seed round $5 million, PreA round $11 million), with the last round valuation at $57 million. If the current market cap falls below $200 million, the VCs will lose their pants.

Binance Ecosystem Cost: As a Binance Labs incubated project, MyShell previously sold 40 million $SHELL on PancakeSwap's IDO, accounting for 4% of the total supply. The price of each $SHELL was 0.00003175 $BNB, with a target of raising 1,270 $BNB. Calculated at the current price of 1 $BNB ≈ $700, it is equivalent to an IDO valuation of $22 million, but the result was the collection of over 65,221 $BNB, which is 51 times oversubscribed. But now Myshell hasn't even listed on the major exchanges' spot, it's hard not to sigh that this "ecosystem revival grand plan" is just a joke.

Conclusion: This is not a matter of whether the project party wants to cut or not, but the capitalists must first ensure that they are not counterattacked before cutting the farmers.

2. Exchange Game Theory

BSC Strategic Demand: Binance has been crazily promoting the BSC chain recently, with the BNB price returning to its high point, but the chain lacks "fundamentally strong" assets. MyShell, as a "AI+BSC+51 times oversubscribed" star project, is simply the "politically correct spokesperson" of the Binance ecosystem.

Nomad Capital's Behind-the-Scenes Pusher: MyShell's on-chain liquidity is deployed by Nomad Capital, and Nomad's founder Eric was once a core decision-maker at Binance. This relationship is equivalent to the classic script of "former senior executives starting a business, with the old company backing them up".

Trading Volume Support Signal: The first day's on-chain trading volume was over 40M, and it is still maintaining over 1M per hour at the current 120M market cap, with traces of capitalist support - "the capitalist is there, the dream is there". In the traditional model, Binance Mega Drop and Launch Pool require a large amount of airdrops, which leads to a price drop after the project goes live, which is the way Binance has been criticized recently and directly affects the secondary market investors. If the capitalists are really willing to support the price, then $SHELL can drive the on-chain growth from the bottom up.

So if the expectation is that Myshell can be listed on Binance's spot, referring to cases like COW and Cetus, the on-chain price may 4-6 times, with a market cap hitting the $500M-$700M range; if it is stuck at exchanges below Bybit, the valuation will align with $KOMA or $VINU (below $100M), with a drop of over 90% from the high point.

Product Power Revisited: AI Filter or Productivity Revolution?

MyShell claims to be a "decentralized AI service platform", but how real is its combat power?

1. Technical Highlights

Open Source Models: Self-developed MeloTTS (text-to-speech), OpenVoice (voice cloning) and other 3 models, with nearly 20K Github stars.

Multi-Modal Support: Integrated over 100 models including GPT4, Claude, Stable Diffusion, supporting text, image, and voice AI generation.

Data Pie-in-the-Sky: The official claims 5 million users, 200,000 creators, and 200,000 AI Agents deployed on the platform, with the hottest "Arcane Filter" being used once every 4 seconds.

2. Weaknesses Exposed

Weak Application Scenarios: 90% of the 200,000 AI Agents are "photo to GTA style", "write love letters" and other entertainment tools, far from the "productivity tools".

Token Economic Loopholes: Users only need to pay a small amount of SHELL, but creators earn $4,000 per month - the selling pressure is far greater than the demand, and the economic model is like "using a leaky bucket to fetch water".

Fierce Competition: Similar projects like Virtual have already carved out their positions, and MyShell's differentiation is limited to "more down-to-earth", but being down-to-earth may also become "hell-like".

In summary, MyShell is like a tricycle with a V12 engine, it can run, but whether it can climb Akina Mountain depends on whether the capitalists are willing to push it.

Valuation Metaphysics: From "VC Kidnapping" to "Exchange Game"

The current SHELL price is $0.4, with a circulating market cap of about $105 million (circulating supply 270 million), and its valuation logic is full of magical realism. We can benchmark it against Virtuals Protocol, which has also only listed contracts on Binance:

Virtuals Protocol (VIRTUAL): Market cap $750 million, focusing on the AI Agent market. If MyShell claims "we are the BSC version of Virtuals Protocol", a valuation halved would be reasonable, but VIRTUAL has a technical moat, while MyShell only has a "filter moat".

At the end of the day, MyShell (SHELL) is essentially an "AI filter" in the crypto world - on the surface, it is a glamorous algorithmic revolution, but at its core, it is the quantum entanglement of capital and retail investors. It can be the savior of the BSC ecosystem, or it can be the sacrifice for the trading platform's KPIs; it can be the PPT masterpiece of VC's pie-in-the-sky, or it can be the leverage coffin of contract gamblers.

When the narrative of technology collides with the black box of exchanges, and when the AI ideal becomes a tool for market capitalization management, the story of Shell has long since transcended the rise and fall of a single coin, becoming a microcosm of the various facets of the crypto world: there is no faith here, only the pricing of faith; there is no future, only bets on the future.