Key Points:

- Pectra is the next major upgrade to Ethereum, involving changes to the Execution Layer (Prague) and Consensus Layer (Electra). It is expected to launch on the testnet in February to March, and is planned to activate the mainnet in April.

- This upgrade brings optimized staking mechanisms, improved Layer-2 scalability, and user experience (UX) enhancements, laying the foundation for future upgrades.

- Key changes include increasing the validator staking limit, more flexible staking withdrawals, enhanced account abstraction, and higher blob throughput, which will help improve network efficiency and security.

Introduction

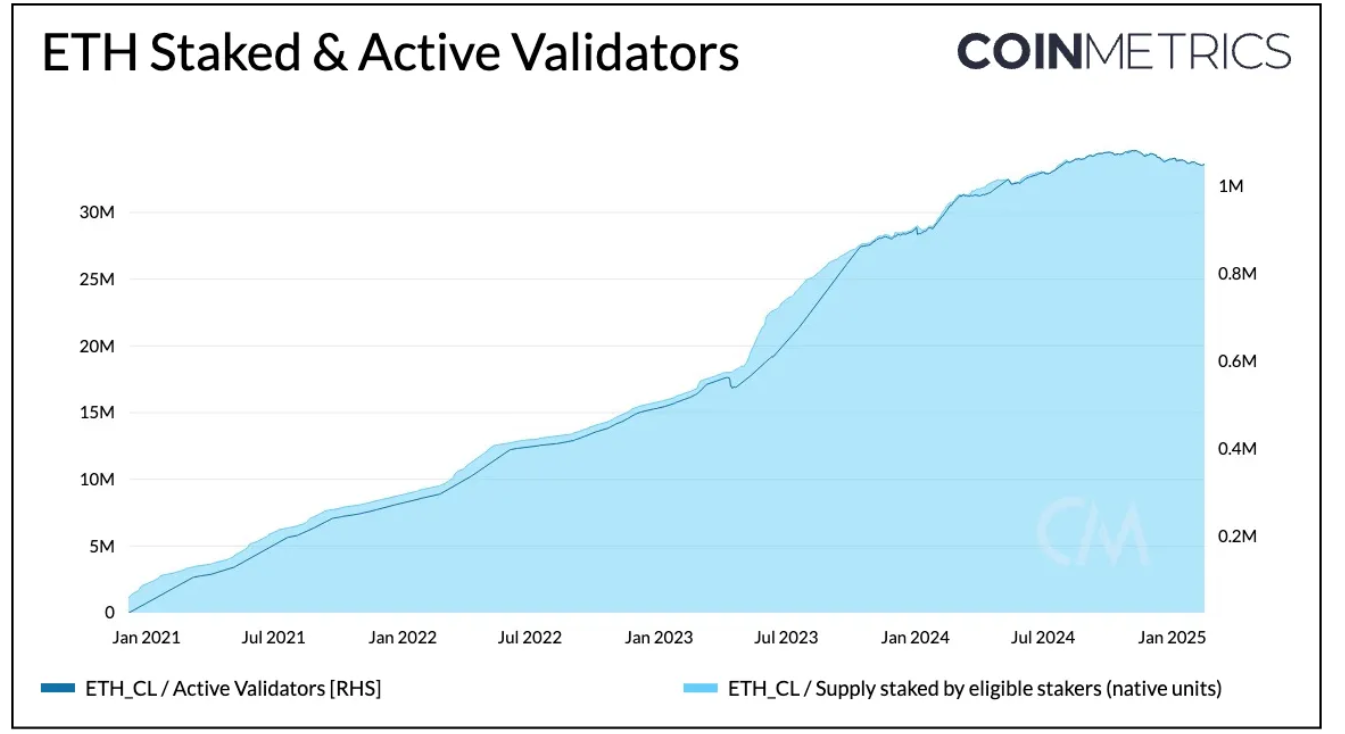

Nearly 29 months after "The Merge", 22 months after "Shapella", and 11 months after "Dencun", Ethereum is about to see its next major upgrade - the Pectra hard fork. As the world's largest Proof-of-Stake (PoS) blockchain, Ethereum currently has around $90 billion in ETH staked, a stablecoin market size of over $135 billion, and around $4 billion in tokenized assets. With continuous iterative upgrades, Ethereum is constantly evolving.

Pectra is expected to be the Ethereum hard fork with the most EIPs involved in its history. Following last year's Dencun upgrade, Pectra further introduces a series of new features to optimize user experience (UX), improve validator operations, and support further Layer-2 expansion, indicating that this upgrade will have a broad impact on the entire Ethereum ecosystem.

In this edition of Coin Metrics' State of the Network, we will delve into the key changes in Pectra and explore its implications for users, stakeholders, and investors, to help you prepare for the mainnet upgrade in April.

What is Pectra? Why is it important?

Similar to previous Ethereum upgrades, Pectra also involves changes to the Execution Layer (EL) and Consensus Layer (CL). Its name reflects this dual upgrade: "Prague" represents the Execution Layer, named after the host city of Devcon 4; "Electra" is derived from a star in the Lyra constellation, symbolizing the Consensus Layer upgrade.

Pectra was initially envisioned as a large-scale upgrade, with a plan to include up to 20 EIPs. However, as development progressed, Pectra was split into two phases to better optimize and manage its complexity. The upgrade is now in its final stage, expected to launch on the testnet in February to March, and is planned to activate the mainnet in early April.

Before delving into the specific EIPs, we need to understand the core focus areas of Pectra. This upgrade primarily focuses on optimizing staking and validator mechanisms, user experience (UX), and Layer-2 scalability, laying the foundation for Ethereum's future development.

Staking and Validator Optimization

This upgrade includes three important EIPs aimed at optimizing the validator operation experience under Ethereum's Proof-of-Stake (PoS) mechanism:

EIP-7251: Increase Maximum Effective Balance

The current Ethereum staking design limits the effective balance of validators to 32 ETH, meaning that independent stakers must stake in fixed increments of 32 ETH, which is also the staking limit for a single validator. Rewards for balances exceeding this limit are not counted as active staking. EIP-7251 will increase the Maximum Effective Balance (MaxEB) to 2048 ETH, allowing individual validators to stake any amount between 32 ETH and 2048 ETH. This change is expected to bring the following benefits:

- Increased staking flexibility: Stakers can now compound their entire balance, rather than being limited to multiples of 32 ETH. For example, a validator staking 33 ETH will have all 33 ETH counted towards rewards, improving capital efficiency and operational flexibility.

- Reduced number of validators: Currently, Ethereum has a total of 1.05 million active validators. This EIP will allow large operators to consolidate their validators, which is expected to reduce the number of validators and alleviate the network burden caused by a large number of validators.

- Reduced network load: While a high number of validators helps enhance decentralization, it also increases bandwidth and computational requirements. Increasing the MaxEB can form a more efficient validator set, reducing the overhead of peer-to-peer communication.

EIP-7002: Execution Layer Triggered Withdrawals

EIP-7002 expands the functionality of validators and complements the EIP mentioned above. This EIP allows validators to trigger withdrawal operations and partial withdrawals directly through their Execution Layer (0x01) withdrawal credentials. Validators have two keys: one for performing validator duties, and another for accessing and managing staked funds. Previously, only the activation key could trigger withdrawal operations, but now the withdrawal credential address can also trigger withdrawals, allowing validators to make larger withdrawals while reducing their reliance on node operators.

This change enhances the validators' control over their funds and provides support for fully trustless staking pools, thereby improving security and decentralization.

EIP-6110: On-Chain Validator Deposits

EIP-6110 simplifies the onboarding process for new validators by improving the handling of deposits between the Execution Layer (EL) and Consensus Layer (CL). Currently, when a new validator makes a deposit in the Execution Layer (EL), they must wait for the Consensus Layer (CL) to recognize and process it before activation, resulting in a certain delay. EIP-6110 allows the Execution Layer to directly pass validator deposits to the Consensus Layer, eliminating the additional verification process and reducing the activation delay from about 9 hours to 13 minutes.

This optimization improves the efficiency of validator onboarding and accelerates the overall network responsiveness.

Blob Scaling and Layer-2

EIP-7691: Increase Blob Throughput

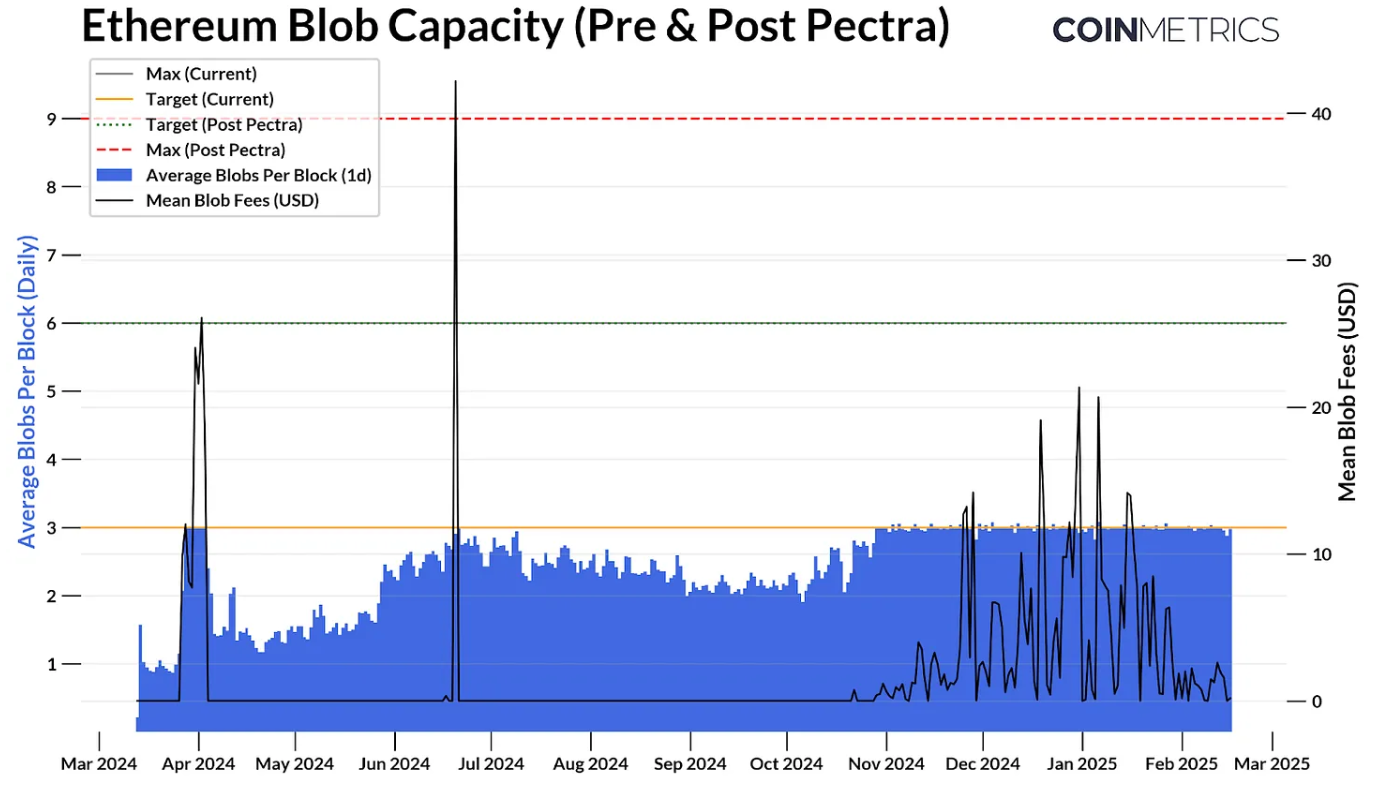

In addition to validator improvements, Pectra also makes critical adjustments to Ethereum's data availability and scalability. Last year's Dencun upgrade introduced Blobs as an efficient data storage mechanism, primarily used to store data from Ethereum Layer-2 rollups. Currently, Blob usage has consistently reached capacity limits, leading to increased transaction fees and limiting throughput.

EIP-7691's proposed throughput increase will address this bottleneck, enhancing Ethereum's ability to store and transmit large-scale data, supporting more Layer-2 transactions, and improving the overall network performance.

EIP-7691: Increase Blob Throughput (continued)

Currently, the Ethereum network's target is an average of 3 Blobs per block, with a maximum of 6. EIP-7691 will increase this target to 6 Blobs per block, with a maximum of 9, thereby expanding data storage capacity and improving throughput and scalability. This change will reduce data storage costs, lowering Blob fees for Ethereum L2s and ultimately reducing end-user transaction fees.

EIP-7623: Increase Calldata Cost

EIP-7623 is another complementary EIP to the Blob adoption. Before the introduction of Blobs, Layer-2s used calldata to store data, and they occasionally still use calldata because it is more cost-effective in certain cases. However, by increasing the cost of calldata, this change aims to encourage Layer-2s to fully adopt Blob space, making Rollup transactions more efficient.

The combined effect of these two EIPs will drive broader adoption of Blobs in Ethereum and optimize Layer-2 performance, thereby enhancing the network's overall scalability and cost-effectiveness.

User Experience (UX) Improvement

EIP-7702: Externally Owned Account (EOA) Code Deployment

EIP-7702 is a highly anticipated change that brings Ethereum closer to account abstraction. This proposal is expected to significantly improve User Experience (UX) and wallet functionality by allowing Externally Owned Accounts (EOAs) or user wallets to temporarily act as smart contract wallets. This enables them to execute logic similar to smart contracts, providing users with greater flexibility while offering higher programmability for wallets and applications.

After the Pectra upgrade, users and developers can leverage EIP-7702 to:

- Batch Transactions: Bundle multiple transactions or user operations into a single transaction. (e.g., approve and swap tokens in a single transaction).

- Gas-less Transactions: Allow account X to pay the transaction fees on behalf of account Y, or have a "pay-the-master-contract" to cover gas fees for users.

- Conditional or Sponsored Transactions: Implement spending controls, automate operations, or sponsor transactions based on set conditions.

While we have covered the most impactful changes in Pectra, there are several other EIPs that have also optimized the network. These include EIP-2513, EIP-2935, EIP-7549, EIP-7865, and EIP-7840, all of which aim to improve efficiency and reduce network resource consumption.

Conclusion

Ethereum is once again preparing for a major upgrade - one that involves the highest number of EIPs in its history. The Pectra upgrade aims to enhance Ethereum's capabilities across several critical areas, including the transition towards Account Abstraction, improved validator operations, increased network efficiency, and gradual expansion of Layer-2 Blob usage. At the same time, as Vitalik Buterin emphasized in his recent blog, while Ethereum's roadmap is centered around Rollups, it is still expanding Layer-1. With the gas limit increased to 36 million, further expansion is expected to enhance the network's censorship resistance, throughput, and scalability.

While the Pectra changes are primarily technical, many may be curious about how these changes will impact the valuation of ETH. Historically, ETH's price movements during past upgrades have been traceable, but market sentiment - whether in the crypto market or the broader financial market - often has a greater influence than the direct changes to Ethereum's economic model. Nevertheless, the Pectra upgrade will undoubtedly drive Ethereum's adoption, and as we cross this milestone, we will revisit its impact on key network metrics, ecosystem stakeholders, and ETH as an asset.