FTX will conduct the next round of repayments on May 30, 2025, after the first round of payments on February 18, with 98% of creditors committed to receiving at least 118% of the claimed value.

More than two years after the shocking collapse of the cryptocurrency industry, the FTX exchange has officially launched the process of repaying creditors. According to the announcement on February 18, the second distribution round will apply to creditors in Group 5 (Customer Claims) and Group 6 (General Unsecured Claims). This payout includes customers who had assets trapped on the platform at the time of bankruptcy, as well as service providers and other trading partners.

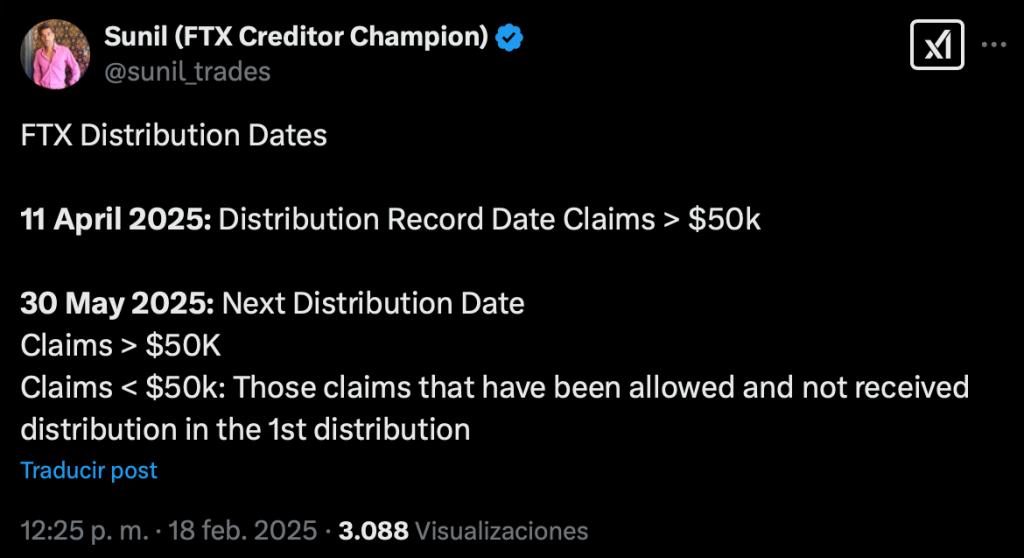

Creditors need to complete the claims verification process by April 11 to be eligible for the next round of repayments. According to Sunil Kavuri, a representative of the FTX victim group, the May payout will apply to claims over $50,000, requiring creditors to select a distribution agent by the April 11 deadline.

The first repayment, which began on February 18, is for the "Convenience Class" - creditors with claims under $50,000 - and is expected to receive payment within 1-3 business days. John J. Ray III, the FTX Recovery Trust administrator, emphasized the patience and cooperation of customers, and affirmed that efforts to recover assets and make payments to other creditor groups will continue.

FTX's recovery plan aims to repay between $14.5 billion and $16.3 billion (as of May 2024 statistics), ensuring that 98% of creditors receive at least 118% of the claimed value.

The cryptocurrency exchanges Kraken and BitGo are assisting in the repayment process, requiring creditors to complete identity verification (KYC), submit necessary tax forms, and register on their platforms to receive funds. FTX also warned users about the risk of receiving phishing emails impersonating official information from the exchange.

The repayment progress of FTX is attracting the attention of the cryptocurrency market, as the prices of Bitcoin, Ether, and other altcoins have decreased by 2.1% in the past 24 hours. Over the past two years, many creditors have sold their claims. According to Mr. Purple, a creditor representative, some may hesitate to reinvest in cryptocurrencies after the shock of the FTX bankruptcy and the need for liquidity after their assets were frozen for an extended period.