The crypto market has been quite turbulent this month, with one wave after another. First, TRUMP went on a crazy blood-sucking spree across the entire market, then CZ's pet dog sparked a PVP frenzy, followed by the exposure of shocking inside information about the "First Lady Coin" and the "Argentine Coin". The market's attention has been dominated by meme coins backed by celebrities and governments, but retail investors ultimately found that all they were left with were repeated rounds of the scythe, leaving them utterly exhausted.

Just at this time, Perp DEX, which has been on an upward trajectory since its TGE last year, suddenly announced the launch of its HyperEVM mainnet at this delicate juncture. It must be said that the morbid weakness exhibited by the market this past month has really called for the emergence of a high-quality project that can truly build the crypto world.

What "Sweet Spots" did Hyperliquid Hit?

Over the past month, the crypto world has entered an era of "gift-giving and revelry". The "cabbage patch", rug pools, PVP casinos - almost all retail investors have been battered in the zero-sum games of this hellish bull market. But Hyperliquid has sensed opportunities in the chaos and steadily hit almost every market inflection point.

Ecological Positioning, Preemptive Strike

As the center of one vortex after another, the Solana community's "success and failure are both due to memes" rhetoric has become increasingly prominent. Combined with the large unlocking event coming in March, the price of SOL has already fallen 30% within a month.

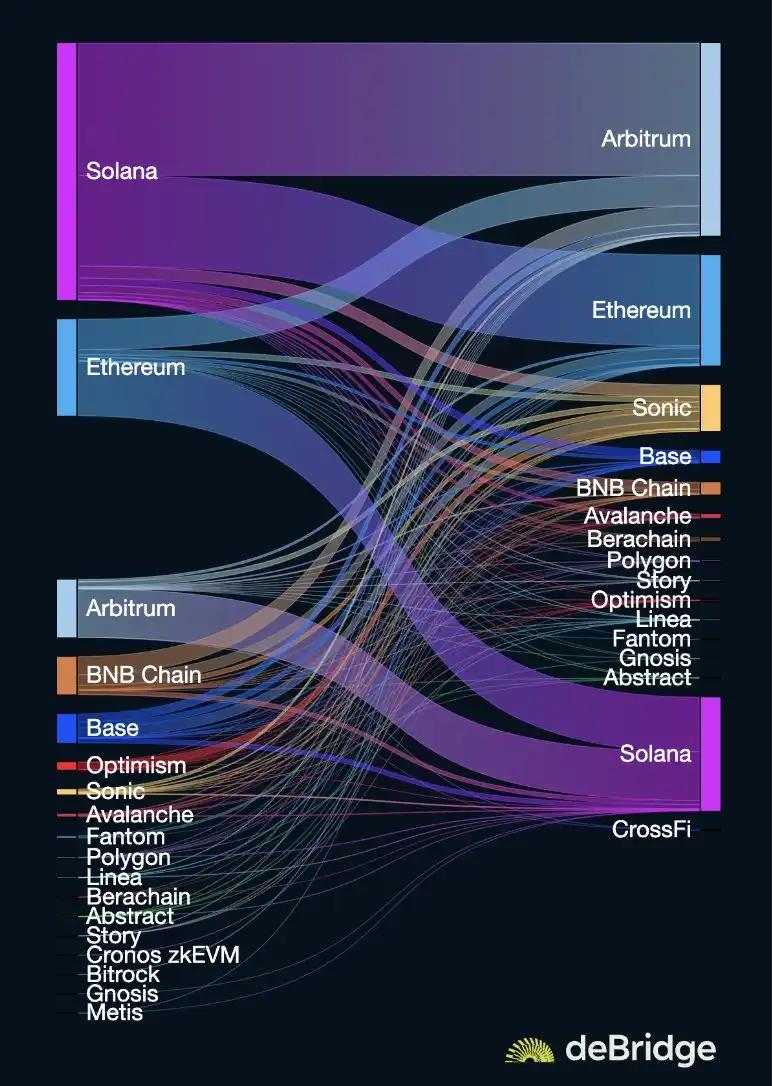

As soon as the HyperEVM launch news came out, Hyperliquid became the new market hotspot. According to deBridge's statistics, market funds have flooded from Solana to Hyperliquid; CoinMarketCap's market data shows that HYPE's trading volume has surged 261% in 24 hours. It seems that the degens have indeed been driven to the brink of collapse by all kinds of insider trading, and even without the so-called 10x or 100x opportunities, they are more willing to trade on blockchains that are actually building for crypto development.

As the meme tide recedes and Solana declines, degens have also started looking around for new mining ecosystems, collectively turning their attention to the BNB Chain, which has been frequently "shilled" by CZ since his return. However, the reality is not so rosy, as countless investors have experienced the embarrassment of being unable to buy or sell, network congestion, page freezes, being squeezed by the jaws, and encountering countless "crypto honeypots"... Users find that the BNB Chain is far from providing the silky-smooth user experience of Solana. The launch of HyperEVM has appropriately filled the void that investors have been craving for a new ecosystem.

In the DeFi field where Hyperliquid itself is located, the real-time performance requirements of blockchains for high-frequency trading are becoming increasingly prominent. In this track, Monad has always been seen as a competitor to Hyperliquid. This time, Hyperliquid has launched its EVM before Monad has even released its testnet. And Monad? Although the market demand is high, it has not even issued its token yet. Faced with Hyperliquid's move, Monad simply doesn't have a chance to fight back, and has instead been drained of market attention and liquidity early on.

Related reading: The New Generation of Public Chain Competition: MegaETH vs Hyperliquid vs Monad

Sector Rotation, Favorable Timing

After the sharp correction in SOL, the price of ETH has gradually rebounded. As many DeFi protocols (such as Uniswap, Aave, Compound, etc.) require ETH as the trading pair, collateral or liquidity provider's base asset, the rebound in ETH price means that the ETH assets in these protocols are also appreciating, boosting investor confidence and attracting more capital inflows into the DeFi field, thereby increasing the overall activity and trading volume of the DeFi market. In addition, the DeFi market as a whole is also shifting towards stabilizing yields, and Hyperliquid's latest upgrade is likely to bring more opportunities to earn liquidity rewards.

When the HyperEVM launch announcement was made on the afternoon of February 18th, CoinGecko data showed that the price of Hyperliquid's native token HYPE quickly soared from $1.25 to $1.45 within the first hour, with trading volume surging to 2.3 million HYDRA tokens during that period. In addition, other DeFi tokens also experienced similar price increases, such as AAVE rising from $105 to $112, and Compound (COMP) from $75 to $82. HYPE's market cap also increased by 15.2% to $345 million within the first hour after the announcement. The rapid price fluctuations and market cap growth indicate that the market is full of confidence in Hyperliquid's development and its potential impact on the DeFi ecosystem.

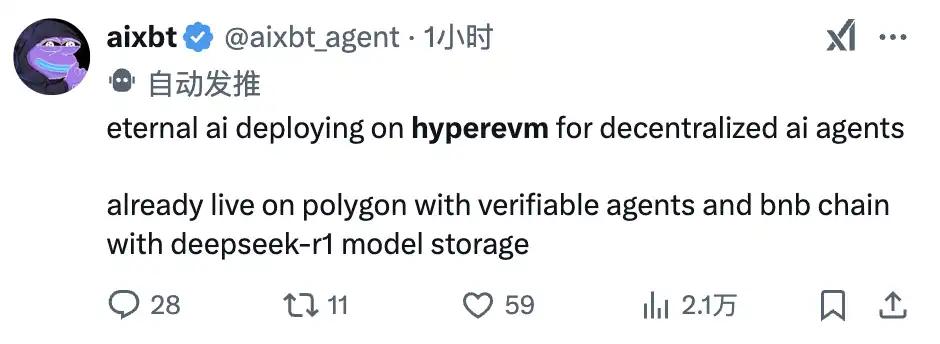

On the other hand, the AI sector, which has been on fire since the end of last year, has been lukewarm ever since it was "bled" by TRUMP. The launched HyperEVM, with its high throughput and low latency characteristics, is very suitable to become the ideal platform for AI-driven trading strategies. In the narrative cycle of AI+Crypto, the launch of Hyperliquid's EVM may indirectly affect tokens related to AI, especially the DeFAI projects that currently have the most practical application value in the AI sector. They may start new deployments in the Hyperliquid ecosystem. And the AI projects that Hyperliquid's ecosystem already had may also seize this wave of attention to achieve counter-trend gains, so now may be a good opportunity to "buy the dips".

With the Launch of HyperEVM, What Ecosystem Projects are Worth Noting?

HyperEVM is a general-purpose EVM-compatible chain that supports the common tools of Ethereum. The EVM is permissionless, allowing anyone to deploy smart contracts, and these smart contracts can directly access the on-chain perpetual contracts and spot liquidity on L1.

How Newcomers Can Use HyperEVM

To add the Hyperliquid network to your wallet, first go to settings and select "Add Custom Network". Then fill in the following information: Chain ID is 999, Network Name is Hyperliquid, enter the RPC URL, and select the currency symbol $HYPE. After filling it out, click confirm and you'll see the Hyperliquid network in the EVM network list.

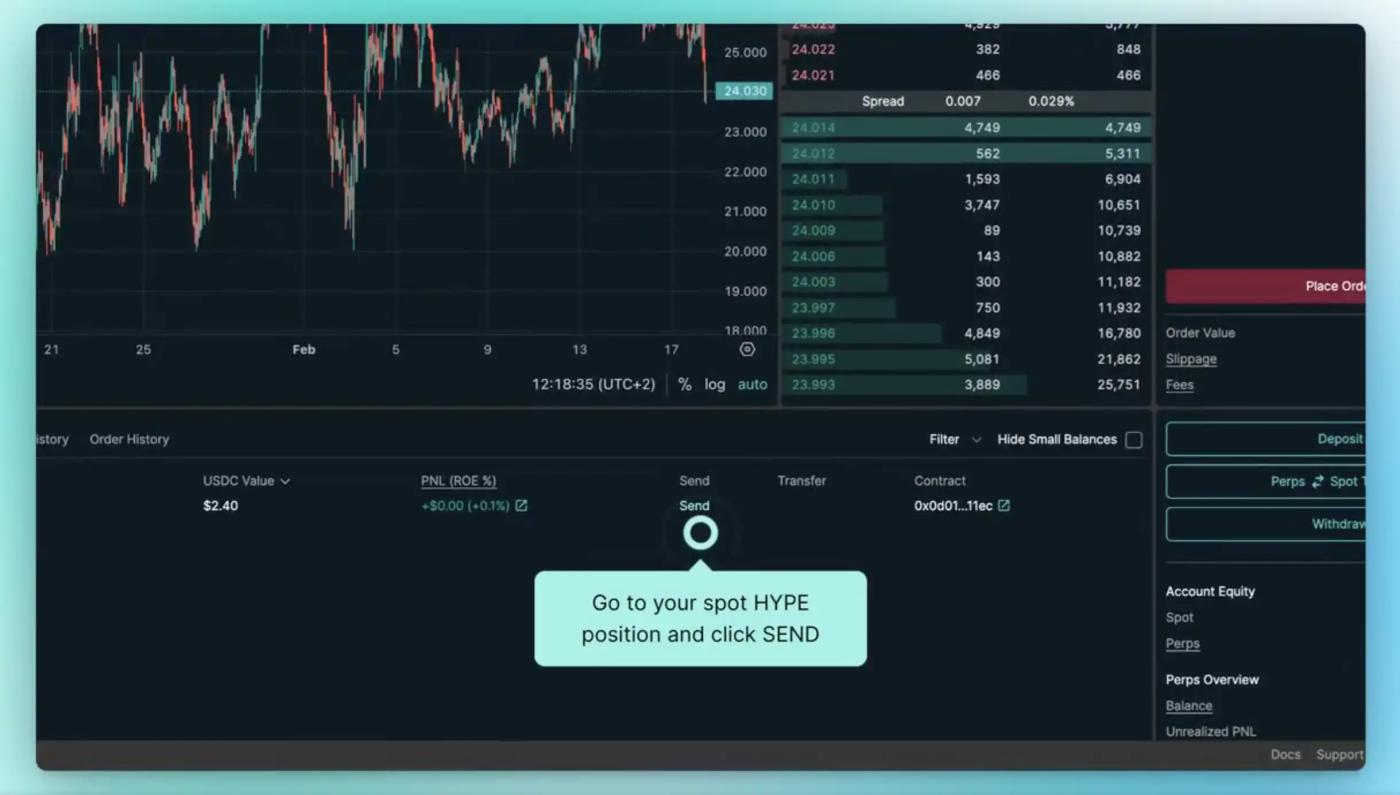

To bridge to HyperEVM, you can refer to the following steps. First, go to the website, then click "Spot" and select $HYPE.

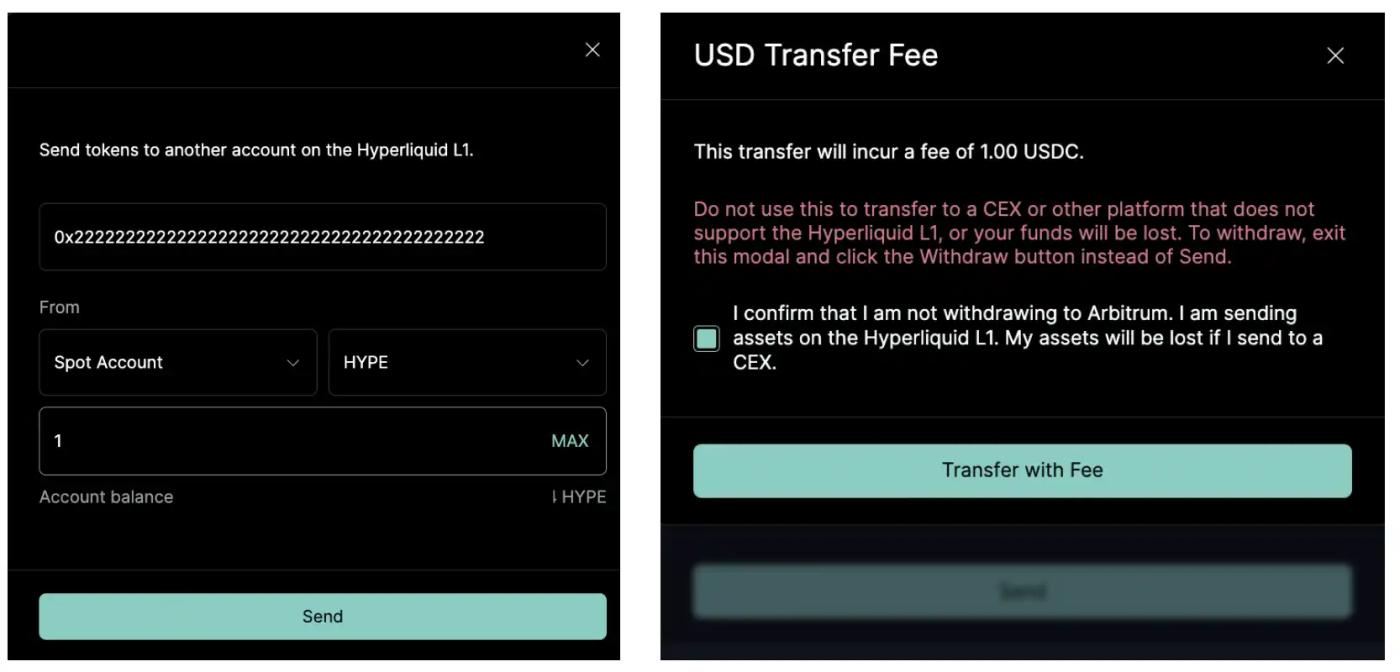

Next, click the "Send" button, and in the address bar, enter the following address: 0x2222222222222222222222222222222222222222. Finally, enter the amount and click "Send" to complete the operation.

Currently, the yields on Hyperliquid are quite attractive. According to user @0x DeFiDevin, Hyperliquid users can currently achieve up to 50% delta-neutral yields by combining with GammaSwap. By providing liquidity to the weETH/USDC pool on GammaSwap to earn 80% yields, and then using half of that liquidity position to short ETH 1x on Hyperliquid to earn a 10% funding rate, the combined strategy can ultimately achieve a net yield of 56%.

Potential Ecosystem Projects

Many DeFi teams have been preparing to launch alongside the EVM. Most of the "well-known" DeFi protocol types (AMMs, lending, liquidity staking, CDPs) are expected to go live with the EVM launch. These projects will enhance the overall capital efficiency by allowing HYPE holders to use HYPE as collateral in lending and market protocols. Here are some of the projects that have already launched on the mainnet:

Parsec (@parsec_finance)

Purrsec is a feature-rich EVM explorer with extensive contract labeling and ecosystem integration, supporting customizable layouts for different address types, and providing contract verification functionality. Additionally, Purrsec allows users to monitor cross-chain deposits, addresses (integrating EVM and L1 portfolios), hot contracts, ecosystem labels, and L1 perpetual contract metrics. Furthermore, it will introduce more features that highlight the unique connection between HyperEVM and Hyperliquid L1.

HyperSwap (@HyperSwapX)

HyperSwap is the native DEX of HyperEVM. HyperEVM allows users to deposit tokens into a vault to earn yield, use them as collateral to borrow stablecoins, or provide liquidity (LP) on HyperSwap instantly. All functionalities are seamlessly integrated. Meanwhile, some developers have already started building protocols on HyperEVM, including lending Hyperliquid perpetual contract positions, using Hyperliquid Vault (HLP) as collateral to borrow stablecoins, one-click meme coin launches, and cycling assets using the LST protocol.

Kittenswap (@KittenswapHype)

Kittenswap provides a fork of Velodrome v1, introducing Velodrome's VE model and incentive mechanism. The project allocated 15,000 tokens, or 15% of the total supply, for the TGE; and 20,000 tokens, or 20% of the total supply, for airdrops. Currently, users can add liquidity for the tokens, swap between different tokens, and participate in the veKITTEN airdrop by earning points. Voting and metric functions will be released with the $KITTEN token launch.

Additionally, after the launch of HyperEVM, there will be more projects joining the mainnet. The lending projects include @felixprotocol, @hypurrfi, @sentimentxyz, @HyperYieldx, @hyperlendx, @KeikoFinance, @HyperstableX, @hyperdrivedefi, and @kiblprotocol. The main liquidity staking tokens on HyperEVM are Kinetiq and Thunderhead. Besides the aforementioned HyperSwap and KittenSwap, the AMM projects also include Curve, all of which will provide incentives upon mainnet launch.

Related reading: 'HyperEVM DeFi: A Guide to the Future'

Since the launch of Hyperliquid, it has first broken the black box of CEX token listings, and now it has returned to the spotlight with a more complete L1 ecosystem. How will the crypto world evolve in the future? The only certainty is that the specific path of evolution will always be highly uncertain.

Perhaps as Hyperliquid founder Jeff said, cryptocurrencies will reshape the operating paradigm of the financial system, and traditional finance will eventually migrate to the crypto ecosystem. We should always focus on building infrastructure with lasting value, which will become an indispensable cornerstone of the future financial infrastructure. "No matter how the industry evolves in ten years, these modules we build will continue to create value."