Author: Weilin, PANews

In the current cycle, the adoption of Bitcoin by institutions has become a closely watched trend. A Fidelity survey shows that there is a large untapped demand for Bitcoin adoption. Under the influence of the approval of the Bitcoin ETF in the US and the shift in regulatory policies, governments and large funds around the world have begun to view Bitcoin as a strategic reserve asset. The US may establish a Bitcoin strategic reserve, and more and more countries and institutions may follow suit, which may give rise to a completely new financial paradigm, and the institutional adoption of Bitcoin is at a critical turning point.

Core introduces dual staking through the Fusion upgrade, coupled with its yield-generating ETP and CoreFi strategies, to provide solutions for the real yield of Bitcoin. Messari recently released Core's growth metrics for Q4 2024, which shows that in the Bitcoin ecosystem, with the expansion of the user base, there is a trend of Bitcoin transforming from institutionalization to consumer chain.

Current Status of Institutional Investment in Bitcoin: Large Untapped Demand, at a Critical Turning Point

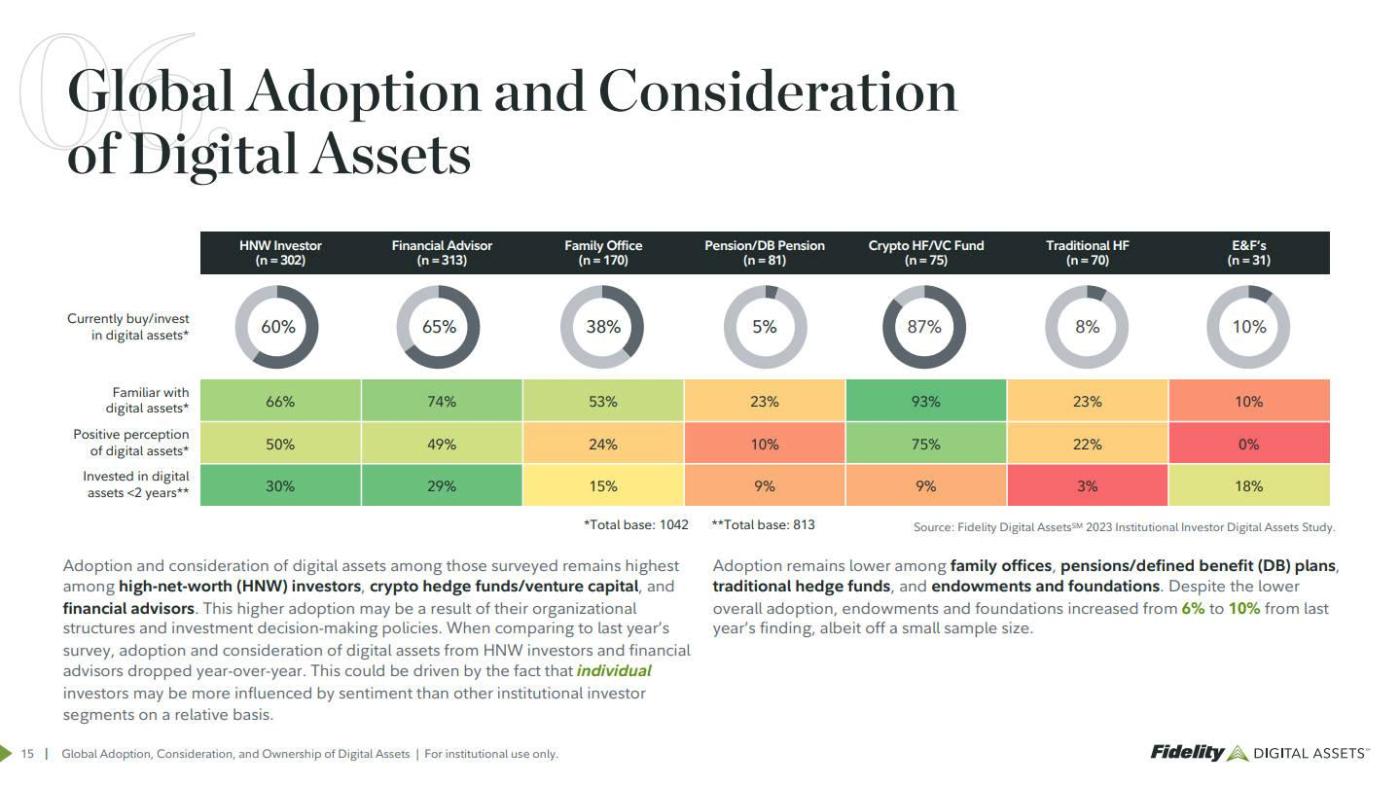

A survey released by Fidelity Digital Assets in June 2024 shows that institutional investors' interest in Bitcoin is gradually increasing. This survey surveyed more than 1,000 institutional investors around the world the previous year. In the survey, 60% of institutions said they have some knowledge of digital assets, and 51% said they are currently investing in digital assets. In 2019, only 39% of institutions had some knowledge of digital assets. Among US investors in 2019, only 22% were investing in digital assets.

If we analyze these data in depth, we can find two types of investors. On the one hand, there are institution-driven investors, such as high-net-worth individuals, investment advisory firms, crypto hedge funds/VCs, 70-80% of whom have already invested in digital assets. On the other hand, there are large institutions, such as pension funds, traditional hedge funds, endowment funds, and foundations, unfortunately, the proportion of which is still in the single-digit percentage range. The current Bitcoin market capitalization is about $2 trillion, and the adoption of Bitcoin by institutional investors is at a critical turning point, with a large untapped demand.

In 2024, well-known institutions such as Strategy (formerly MicroStrategy), BlackRock, ARK Invest, and Fidelity have enhanced the market presence of Bitcoin through strategic investments and innovative financial products (such as Bitcoin ETFs). As of January 24, Strategy holds 471,107 Bitcoins, with a total cost of about $30.4 billion. Throughout 2024, the company also purchased an additional 258,320 Bitcoins.

With the approval of Bitcoin spot ETFs and the support of the Trump administration for crypto assets, more and more large companies and institutions are starting to adopt Bitcoin reserve plans. Companies like Strategy, MARA Holdings, and Riot Platforms have all incorporated Bitcoin into their financial reserves, and cryptocurrencies are gradually being integrated into mainstream conversations. Under the leadership of the new US government, both state and federal levels are exploring plans to hold Bitcoin as a reserve asset, and it is expected that the new regulatory model will further drive the adoption of Bitcoin by institutions.

From the asset characteristics, Bitcoin provides high returns (9800% over 8 years), although it is accompanied by higher risk and volatility, but its correlation with traditional assets is relatively low, making it an ideal tool for portfolio diversification. Compared to traditional alternative assets such as real estate and art, Bitcoin has obvious advantages in terms of liquidity, transparency, and divisibility.

How Core Enhances the Real Yield Solution: Fusion Upgrade Introduces Dual Staking, Yield-Generating ETP and CoreFi Strategy

Institutions invest in Bitcoin through direct purchase, Bitcoin futures, ETFs, custody services, BTCFi and Bitcoin-related stocks. Core provides institutions with the option of BTCFi staking, which can safely and stably generate yields.

In April 2024, the Core blockchain first integrated the non-custodial Bitcoin staking function, allowing users to stake Bitcoin and earn yields while retaining full control over their assets. This native mechanism can generate Bitcoin yields without introducing additional trust assumptions.

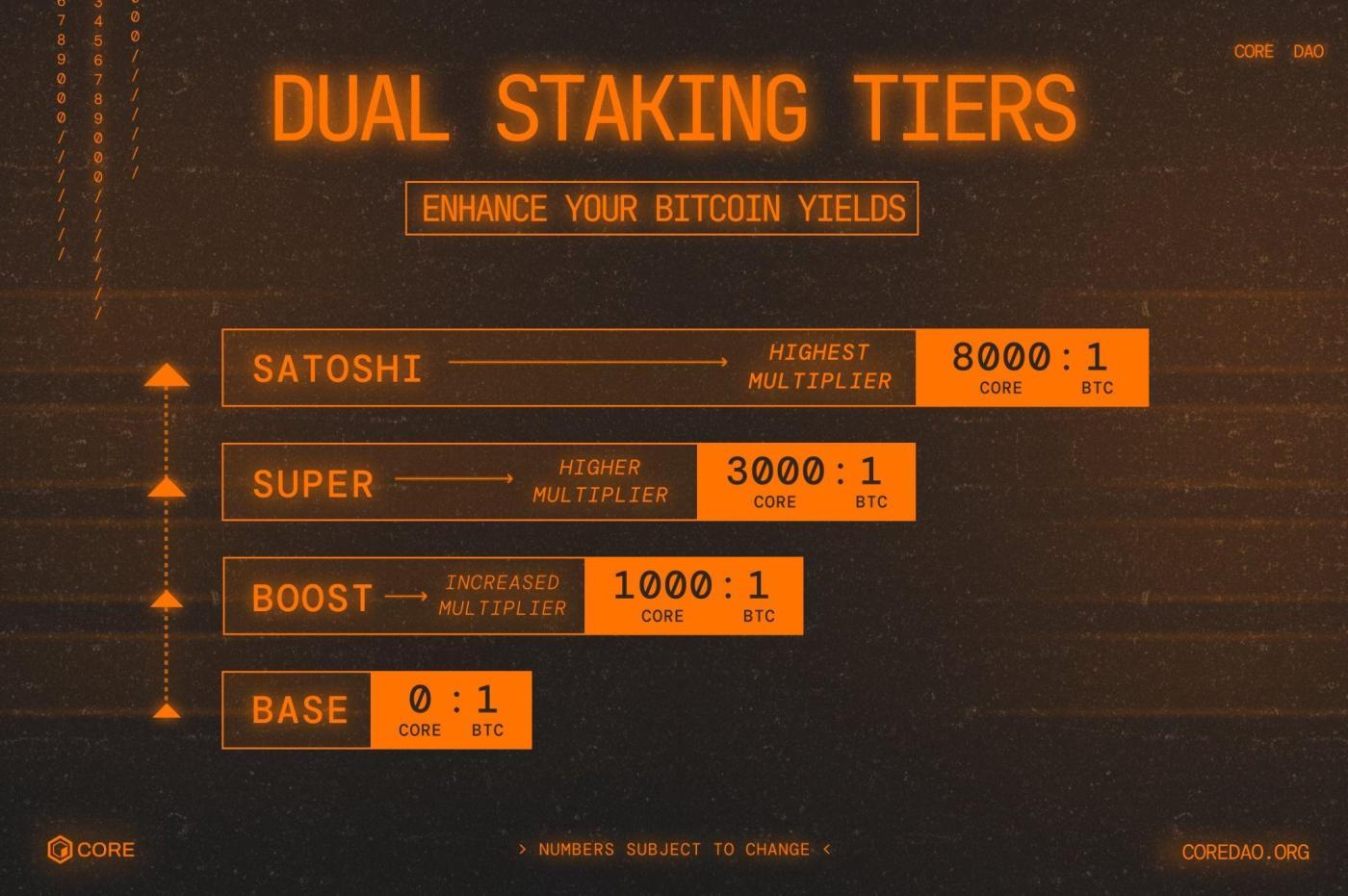

On November 19, 2024, Core launched the Fusion upgrade, which PANews has introduced as bringing new market opportunities for Core in the Bitcoin ecosystem. The launch of the dual staking product aims to address the issue of imbalance in the community reward distribution that may arise when Bitcoin stakers lock up their assets and receive CORE token rewards through the validator nodes. Especially in the case of large-scale institutional staking of Bitcoin, the released CORE rewards will increase accordingly. Based on this background, in order to encourage Bitcoin stakers to re-stake the CORE rewards they receive, the dual staking provides higher annualized yields (APY) to enhance user participation.

To further enhance the yield generation of non-custodial Bitcoin staking, the dual staking mechanism, by simultaneously staking Bitcoin and CORE tokens, unlocks higher yield tiers. Due to the fixed daily CORE issuance, users who stake both Bitcoin and CORE will receive higher reward tiers. The reward increase is tied to the amount of CORE tokens staked, encouraging Bitcoin stakers to deeper engage in the Core ecosystem and maximize yield returns for loyal users.

Recently, Core has also launched its first yield-generating Bitcoin exchange-traded product (ETP), providing investors with the opportunity to earn yields through non-custodial Bitcoin staking. Through a partnership with Valour, a subsidiary of DeFi Technologies, this ETP offers investors a 5.65% yield, becoming an important avenue for institutional investors to enter the BTCFi ecosystem.

On February 4, DeFi Technologies has entered into a binding letter of intent with CoreFi Strategy and Orinswift Ventures to drive a reverse takeover, which will allow the combined entity's common shares to be listed on the Cboe Canada stock exchange. The Core Foundation will contribute $20 million worth of CORE tokens to strengthen CoreFi's financial reserves. Meanwhile, CoreFi plans to raise an additional $20 million through concurrent financing to accelerate its development in the BTCFi technology field.

In addition, Core has also established partnerships with custody service providers such as Fireblocks, Copper, Cactus, and Hashnote to support the dual staking. Inspired by the successful experiences of Strategy and Metaplanet, the CoreFi strategy provides institutional investors with a regulated investment approach to leverage Bitcoin and CORE yields.

On February 18, the Core Foundation, in collaboration with Maple Finance, BitGo, Copper, and Hex Trust, announced the launch of lstBTC. lstBTC will become a new type of liquid, yield-generating Bitcoin token on the Core blockchain, designed specifically for institutions, aiming to generate yields from idle Bitcoin. By converting Bitcoin into a productive asset, lstBTC provides a way for holders to convert tens of billions of dollars into yields while maintaining security, compliance, and liquidity.

Institutions can mint lstBTC by depositing Bitcoin with trusted custodians such as BitGo, Copper, or Hex Trust. lstBTC generates yields while maintaining full liquidity - institutions can trade, transfer, or use lstBTC as collateral. Upon redemption, holders will receive their original Bitcoin plus proportional yields, directly deposited into their custody accounts.

The unique features of lstBTC include:

Designed specifically for institutions, unlike other Bitcoin yield solutions, there is no need for asset transfer or unnecessary risk-taking.

No need to change custody arrangements - institutions can continue to hold Bitcoin with their existing custodians.

Real BTC yields - through Core's dual staking mechanism, yields are denominated in BTC without the need to move Bitcoin out of custody.

Fully liquid and scalable - lstBTC can be traded, transferred, or used as collateral, while the underlying Bitcoin continues to generate yields.

Designed specifically for institutional use cases - seamlessly integrated into existing and new investment portfolio strategies to enhance returns.

Data-driven new trends: Core leads Bitcoin adoption, transitioning from institutional investment to consumer chain

As the hype and speculation gradually subsides, the blockchain industry is more inclined to focus on practical applications and genuine user growth. Core is becoming the consumer chain of Bitcoin, driving the real-world application of Bitcoin and achieving sustained user growth.

According to a third-party report by the renowned research firm Messari, in Q4 2024, Core's DeFi TVL (USD) grew 90% quarter-over-quarter, reaching $811.8 million. Avalon Labs ranked first in the DeFi TVL rankings, followed by Colend and Pell Network. Pell Network launched its Bitcoin restaking feature in August, bringing new growth momentum to the Core ecosystem.

Core's BTC staking (USD) grew 31% quarter-over-quarter, reaching $730.5 million. The growth was mainly driven by the 500 Bitcoin staked through Core's non-custodial Bitcoin staking product, which was launched in April.

Core's daily active addresses grew 160% quarter-over-quarter, reaching 249,700. By the end of Q4, Core's cumulative total of unique wallets reached 34.8 million. Fees grew 97% quarter-over-quarter, reaching $235,000.

In Q4, Core released the Fusion upgrade, introducing dual staking and LstBTC. In Q4, 1,298 Bitcoin and 16.5 million CORE were dual-staked, accounting for 22% and 19% of all Bitcoin and CORE staked on the Core network, respectively.

Based on the data performance, Core has achieved genuine user growth and sustained demand for block space, outpacing its competitors. Looking ahead, Core's Q1 focus will be to further develop relationships with custodial/institutional partners.

As the Bitcoin ecosystem sees the trend of a consumer chain, Core is leading this transformation, driving the real-world application and adoption of Bitcoin. Through innovative staking mechanisms, yield-generating financial products, and a strong partner network, Core not only provides a stable income channel for institutional investors but also creates more participation opportunities for ordinary users. In the future, as the regulatory environment becomes clearer and technology continues to advance, Core is expected to continue playing an important role in driving the transition of Bitcoin from an investment tool to a consumer chain.