One of the hottest sectors in the Sonic ecosystem is the Shadow Exchange, whose native token $SHADOW has seen its market capitalization rise from around $5 million to the current $31.84 million, an increase of over 500% in a week. Currently, Shadow Exchange has a total of 457 liquidity pools, with a 7-day trading volume of $557 million and a single-day high of $171 million.

While other chains have been distracted by the ongoing Meme market, Sonic Labs has focused on the development of DeFi. Sonic has announced several new initiatives to incentivize DeFi projects in its ecosystem, leading to a 500% increase in TVL on the Sonic chain in the past month. In just two months, Sonic has grown from 0 to over $500 million in TVL, with a net inflow of $110 million in external capital, primarily from Solana, followed by Base and ETH. The DEX trading volume on Sonic has also exceeded $1 billion.

Shadow Exchange is a Sonic-native concentrated liquidity layer and exchange. Within Sonic's high-speed, low-cost EVM-compatible Layer 1 ecosystem, Shadow Exchange, as one of its core trading protocols, has improved the traditional ve(3,3) model to the x(3,3) incentive model, attracting the attention of a large number of investors.

Sonic-related reading: TVL increased fivefold in a month, can AC make Sonic the new DeFi yield hub?

Familiar (3,3), but with an x

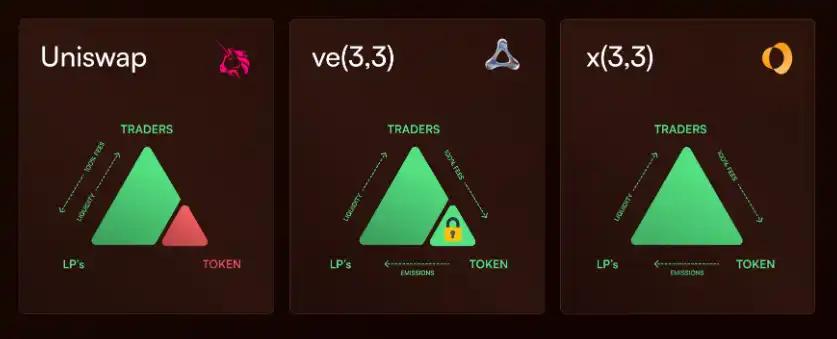

The history of DeFi has always been marked by repeated attempts to solve the "DEX trilemma", i.e., how to coordinate the incentive mechanisms between traders, liquidity providers, and token holders. While Andre Cronje's ve(3,3) model theoretically solved this problem by balancing the incentives of all participants, the long-term lock-up period created a high-friction system that forced users to lock up tokens to fairly participate in the incentive model.

Uniswap focuses on a simple two-party system: traders and liquidity providers (LPs). ve(3,3) improves on this by appropriately adjusting the incentive measures and the rights of token holders, but obtaining these incentives is unfair and heavily biased towards the protocol.

The x(3,3) model solves these problems, allowing users to exit at any time and removing the lock-up constraints through incentives. Users can participate in governance by staking platform tokens and vote on the emission weights of liquidity pools, and voters can receive fee sharing and additional "bribery rewards" to incentivize long-term token holders to actively participate in ecosystem building. The diagram clearly illustrates the entire DeFi model flow:

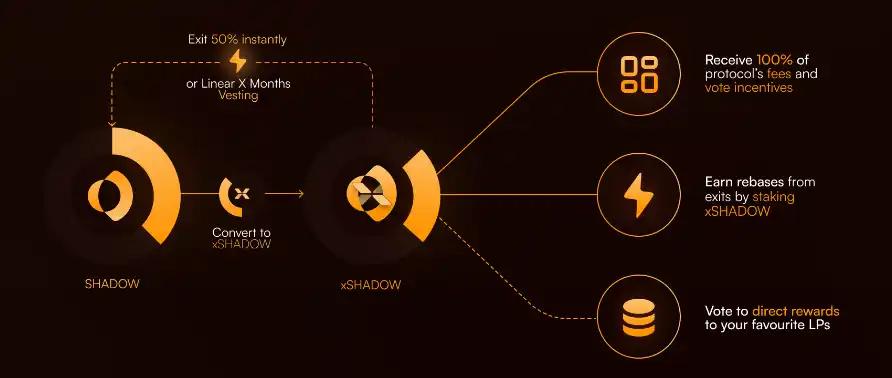

The $SHADOW token is the most primitive token, which can be freely exchanged with other currencies. $SHADOW can be exchanged 1:1 for the xSHADOW token, which is the core of the entire model. xSHADOW stakers can vote to directly allocate rewards to LP pairs, and by staking, they can also receive 100% of the protocol fees, voting rewards, and exit penalties.

In terms of user exit, Shadow has implemented a unique player-versus-player (PvP) re-basing mechanism, where the exit penalty flows to the xSHADOW stakers. When a user prematurely exits their xSHADOW position, 100% of the forfeited tokens will flow to the existing xSHADOW stakers in proportion to their positions. In terms of token selection, users can claim SHADOW with good liquidity to enjoy the default APY, or non-liquid xSHADOW to enjoy a 2x APY.

Users can convert xSHADOW to SHADOW at any time: immediate conversion (50% penalty) or conversion within the user-selected vesting period (on a ratio, e.g., 3 months = 1:0.73). The longer the vesting period, the more favorable the conversion rate, with a full 6-month vesting period allowing a 1:1 conversion with no penalty.

Voting Incentives

xSHADOW holders receive rewards by actively participating and voting. When holders vote on the gauge to support liquidity, they will share the fees generated by that liquidity on a pro-rata basis, as well as additional voting incentives provided by the protocol to attract participation. The primary purpose of the xSHADOW token is to guide the distributed token rewards through voting to increase liquidity. For example, if 100,000 xSHADOW are distributed in a single period, and 10% of all votes are allocated to the SHADOW/USDC pair, that pair will receive 10,000 xSHADOW tokens, which will be linearly distributed to the liquidity providers of that pair throughout the period.

Liquidity Staking

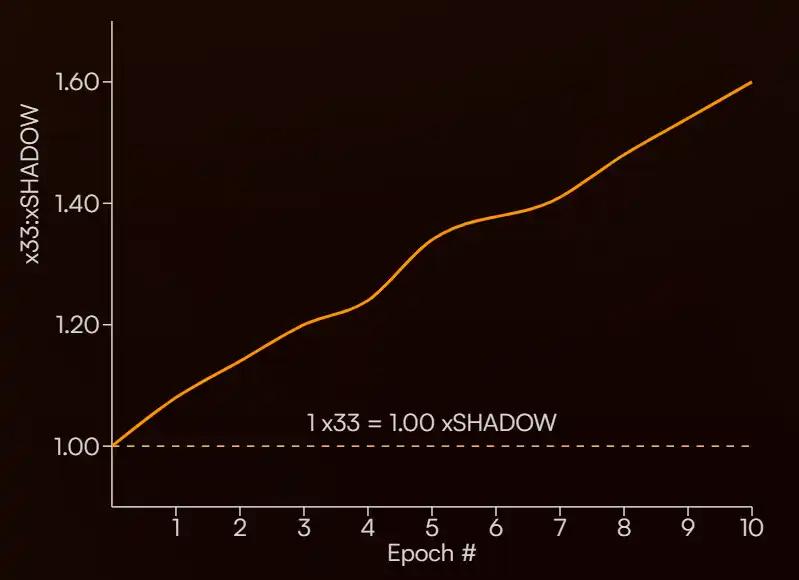

Shadow's design aims to eliminate the frictions in the ve(3,3) model, with managing voting positions being one of the biggest sources of friction. After xSHADOW is used for liquidity staking, it can mint $x33, which simplifies the process of automated voting and reward claiming without interfering with the core xSHADOW mechanism. The $x33:xSHADOW ratio starts at 1.00:1.00 and gradually leans towards $x33 as rewards from fees, voting incentives, and resets accumulate. At the end of each period, the rewards from fees and voting incentives will be automatically sold to increase the $x33:xSHADOW ratio. While $x33 provides instant liquidity, it cannot escape the exit penalty of xSHADOW. As a liquid staking version of xSHADOW, the market price of $x33 will naturally reflect the immediate exit fee structure and cannot trade below the redemption value of xSHADOW.

Shadow has adopted a unique player-versus-player (PvP) approach, improving on the traditional ve(3,3) anti-dilution model, aiming to protect xSHADOW holders from dilution while incentivizing them to maintain their positions and participate in the continued success of SHADOW. Stakers who stay longer in xSHADOW will earn more fees, voting incentives, user and emission exit rewards. Users can exit their positions at any time, ensuring that rewards flow to those who value and actively participate in it. This mechanism not only encourages avoiding premature exits but also ensures that the remaining participants are rewarded for their loyalty and active participation.

With the rapid growth of Sonic chain's TVL (13-fold increase since early 2025 to $357 million) and the endorsement of core developers like Andre Cronje, Shadow Exchange is poised to become a benchmark for the next generation of DeFi trading protocols, leveraging the ecosystem's momentum. Shadow Exchange is not only a technical testbed for the Sonic chain but also a frontline of DeFi governance and liquidity innovation, providing a new paradigm for traders, liquidity providers, and project teams.