Introduction

In early 2025, the optimistic sentiment in the US stock market drove the S&P 500 to a new high, while the cryptocurrency market was under pressure and sluggish, with meme coins experiencing wild fluctuations. Against this backdrop, Sonic ($S) stood out with its price increase and technical upgrades, becoming the focus of the market. This article will analyze its performance and potential.

Monday was Presidents' Day, a US federal holiday, so the stock market was closed. After the market opened on Tuesday, the overall market sentiment was relatively optimistic, with the S&P 500 index rising 0.24% to a new all-time high, and the Nasdaq Composite also rising slightly by 0.07%.

In contrast to the strong performance of the US stock market, the cryptocurrency market was under pressure and corrected.

Recently, the entire cryptocurrency market has been experiencing a downward trend, with overall market sentiment appearing sluggish, and trading volume and investor confidence being impacted to a certain extent. At the same time, the meme coin market has been like a roller coaster, with prices soaring and plunging, and the magnitude of the fluctuations is astonishing, leaving many investors feeling at a loss in the face of such uncertainty. However, in such a weak and volatile market environment, the token S has emerged and exhibited a remarkable growth momentum. Not only has its price performance been stable and rising, but the activity and support of its underlying community have also added a lot of highlights to this token. Compared to the fluctuations of other tokens, the outstanding performance of S has undoubtedly injected some vitality into the current sluggish cryptocurrency market, becoming one of the focuses of investors.

I. $S Price is Brewing an Upward Trend, with Promising Potential

Sonic is an EVM Layer-1 blockchain platform evolved from Fantom, focusing on providing high-performance and scalability for decentralized applications. The platform supports the native token $S, which is used for transaction fees, staking, governance, and running validators. After the new network is launched, users holding the old FTM token will be able to convert it to $S at a 1:1 ratio.

Main Features:

High Performance: Sonic has the ability to process over 10,000 transactions per second, with sub-second completion times, making it suitable for high-demand applications in areas such as gaming and finance.

Interoperability: The platform emphasizes seamless interaction between different blockchains.

Developer Incentive Measures: Sonic Labs plans to implement various incentive programs to attract developers and promote innovation within its ecosystem.

II. Fantom Upgrades to Sonic, with Comprehensive Optimization of the Fundamentals

Three-aspect Upgrade

-Fantom Virtual Machine (FVM)

-Storage System (DataBase)

-Bridge (Sonic Gateway)

1) On-chain Internal Optimization:

- Blockchain Scalability Challenge: Existing blockchains face trade-offs between decentralization, security, and scalability, and Fantom plans to achieve a balance among the three.

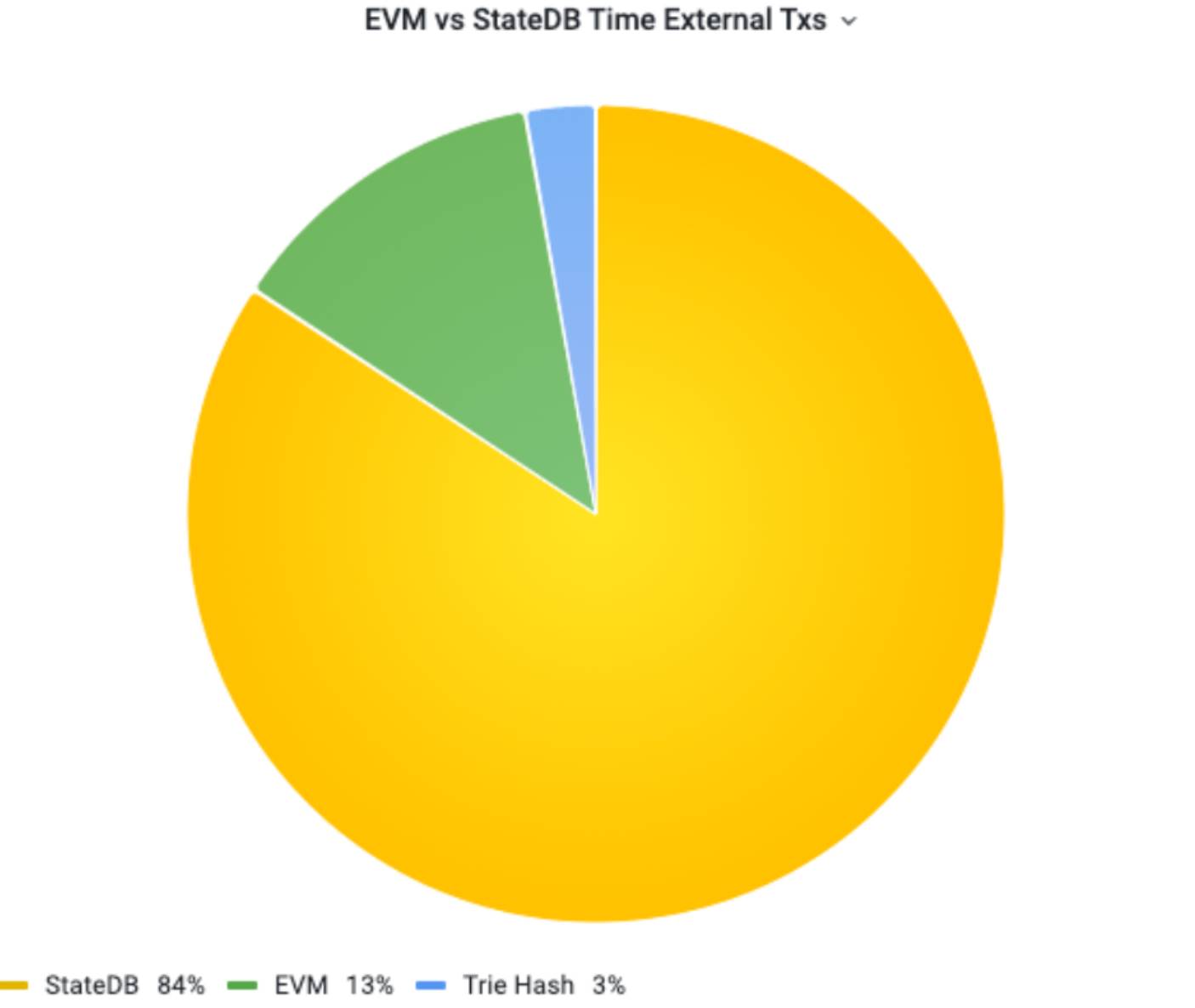

- Bottleneck Analysis (Aida Project): By testing 40 million blocks, it was found that the EVM only accounts for 13% of the processing time, while the StateDB accounts for 84%, making the storage system the main bottleneck.

- Storage Upgrade (Carmen Project): The existing Merkle Patricia Trie (MPT) scheme has performance bottlenecks, so Fantom has adopted a new file-based StateDB to optimize storage efficiency.

- Fantom Virtual Machine Upgrade (Tosca Project): FVM replaces EVM, supports Solidity and Vyper compatibility, and adopts "super instructions" to improve execution efficiency.

Test Results:

- The FVM solution increases transaction speed by 8.1 times and reduces storage usage by 98%, significantly optimizing network performance.

- By upgrading the storage and virtual machine systems, Fantom has improved its transaction processing capabilities and reduced node operating costs, further enhancing on-chain scalability.

2) Off-chain Optimization:

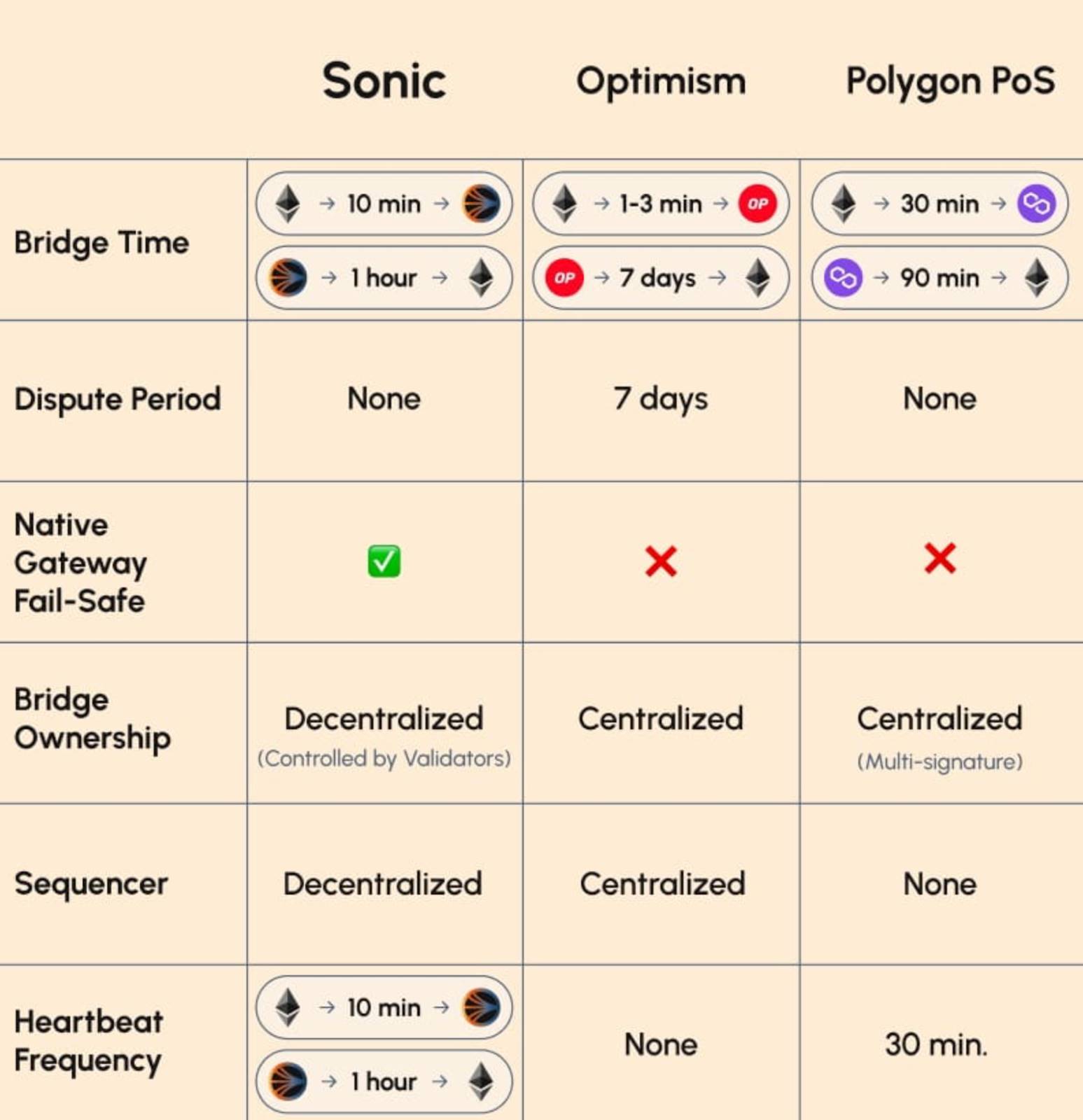

Sonic Gateway is a decentralized cross-chain bridge designed specifically to connect the Ethereum and Sonic networks, aiming to enhance interoperability and eliminate user custody risks.

Key Features of Sonic Gateway:

- Allows secure transfer of ERC-20 assets between Ethereum and Sonic.

- Transfers from Ethereum to Sonic take about 10 minutes, and from Sonic to Ethereum take about 1 hour.

Security Mechanisms:

- Built-in Fault Tolerance: If the gateway is unavailable for 14 consecutive days, users can retrieve their assets on Ethereum.

- Monitors the gateway's status through inter-chain "heartbeat" signals to ensure the safety of user funds.

Compared to Layer-2 Solutions:

- Sonic provides a faster transfer experience, without the need for a challenge period, and has instant finality, which is superior to the typical 7-day challenge period of Optimistic Rollup solutions.

User Benefits:

- Allows users to access native assets (such as BTC, ETH, SOL) on Sonic, without relying on wrapped assets.

Different from the Operation Mode of Layer-2:

- Sonic runs as a Layer-1, not as an extension layer of Ethereum, using Merkle proofs to verify asset status instead of relying on Ethereum's consensus mechanism.

Efficient Data Storage:

- Only stores Merkle root hashes and block heights, greatly reducing Ethereum's data storage burden and improving on-chain efficiency.

III. Sonic's TVL Soars, Ecosystem Growth Accelerates

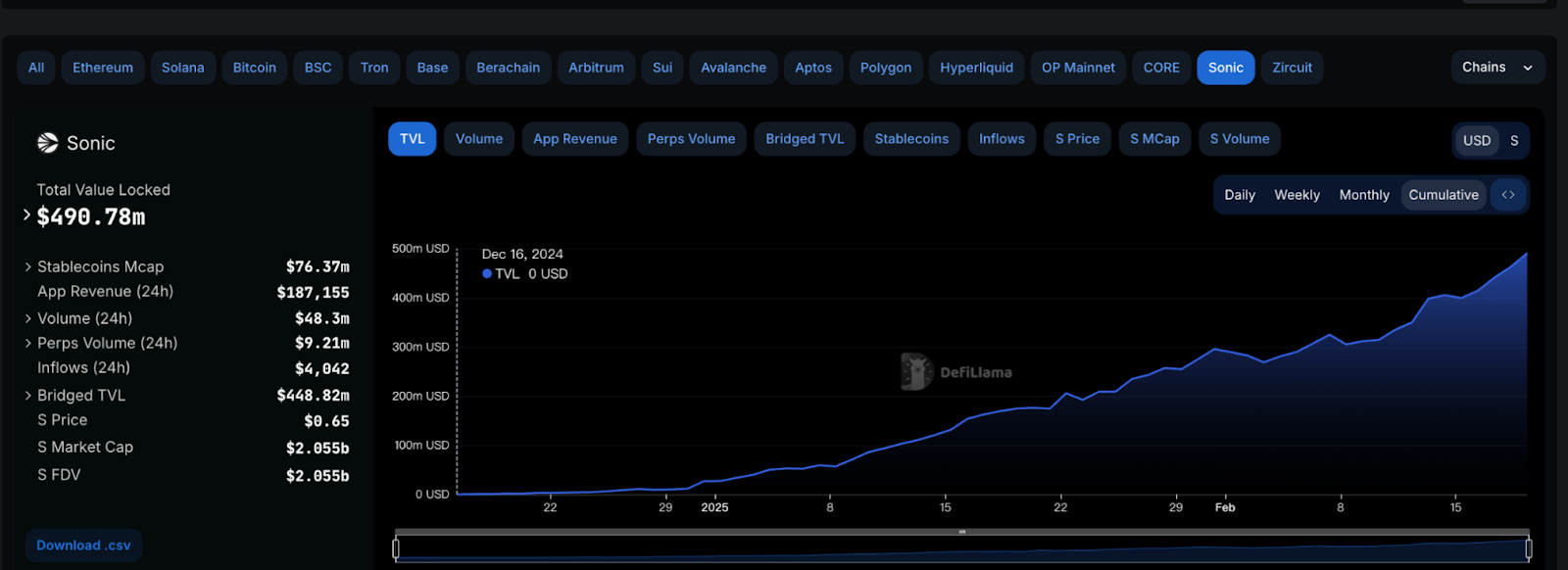

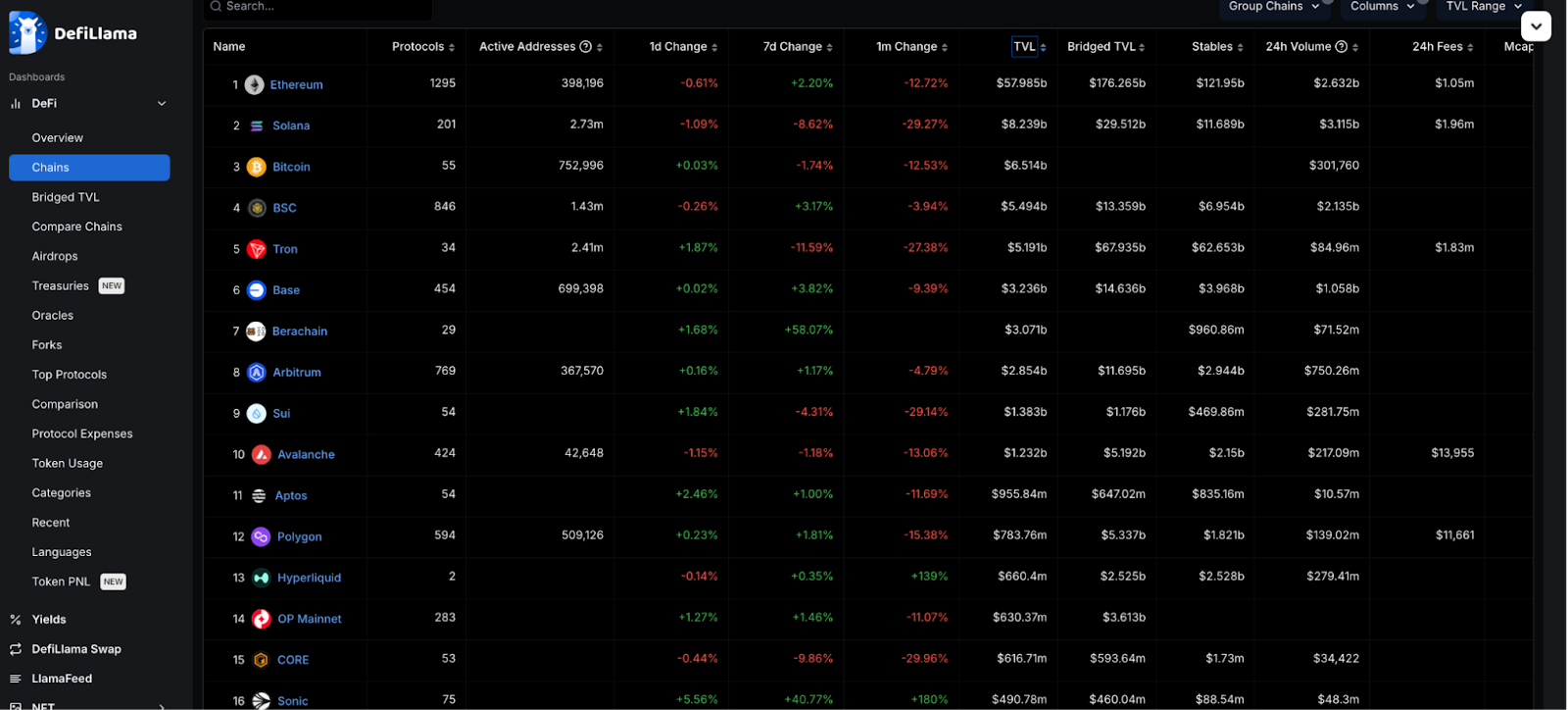

According to the latest data from the defillama platform, Sonic currently ranks 16th in the total value locked (TVL) across all blockchains, demonstrating its strong performance in the decentralized finance (DeFi) ecosystem. More notably, Sonic's TVL growth has reached a remarkable 180% in the past month, indicating a significant increase in market confidence and capital inflow into the platform. Furthermore, compared to the TVL level in December last year, Sonic's total value locked has nearly tripled, highlighting its accelerated expansion in the DeFi domain and investors' optimistic expectations for its future prospects. This growth not only reflects the platform's own development momentum but also the continuous influx of market capital into the Sonic ecosystem, further consolidating its competitive position in the industry.

IV. Sonic's On-chain Data is Active, with Solid Price Support

According to the transaction volume data provided by SonicSca:

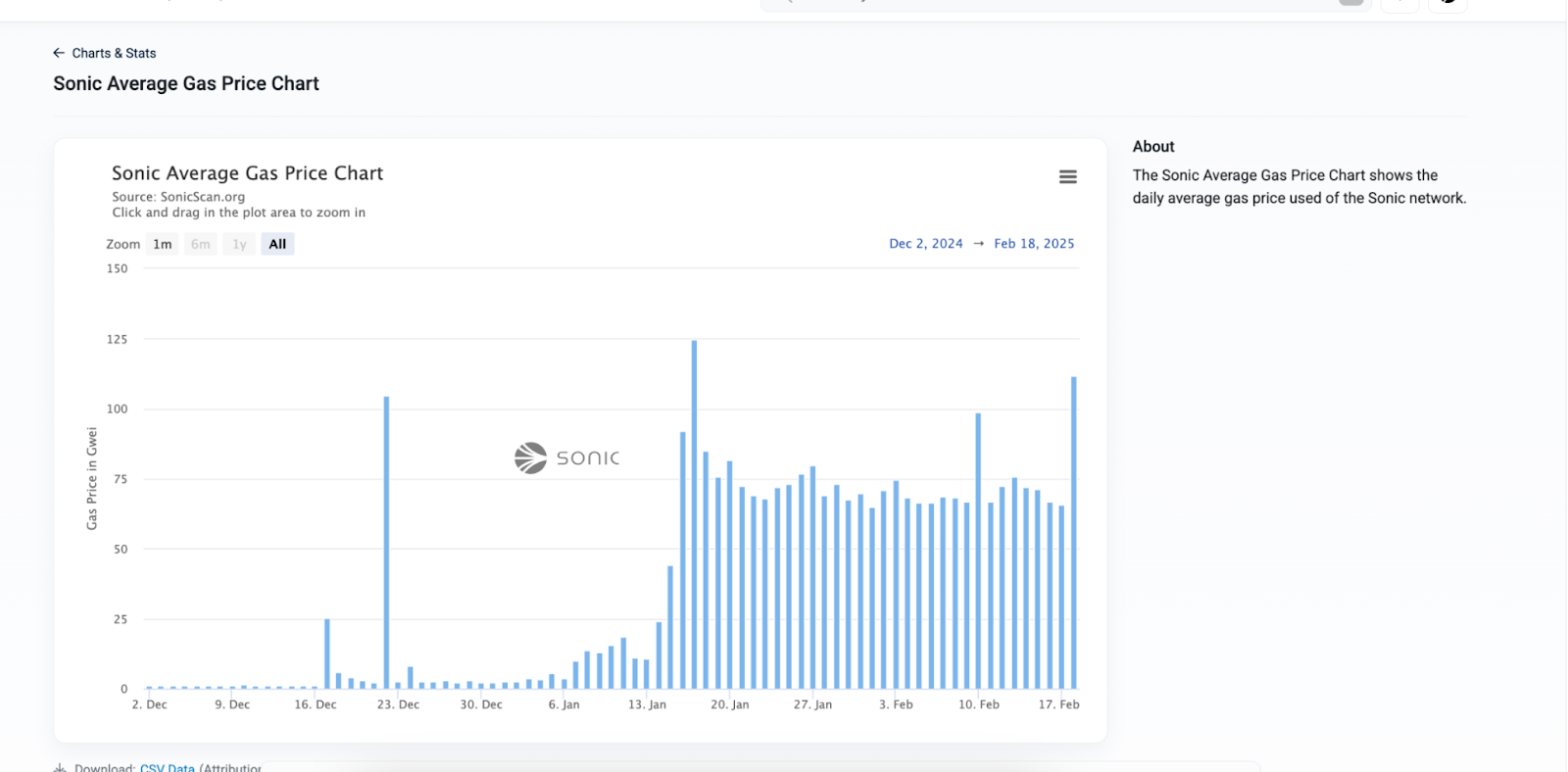

The highest transaction volume on the Sonic chain occurred on January 13, 2025, reaching 975,252 transactions. After December 16, the transaction volume began to grow significantly, followed by volatile growth; after reaching a peak on January 13, the transaction volume has declined somewhat, but still remains at a relatively high level; in early February, the transaction volume has slightly rebounded, with increased market activity, returning to a growth trajectory, and worth monitoring the subsequent development; the gas usage chart also leads to a similar conclusion, where the Sonic network experienced an active growth period from December to January, reaching a gas usage peak in mid-January. Starting in February, although the gas usage has fluctuated, it has still maintained a relatively high level, indicating that the network remains active.

Although the TVL has achieved significant growth, and on-chain data has shown robust performance, the price of $S has been suppressed by the moving average since its launch at the beginning of the year, and has not fully reflected the improvement in fundamentals. It was not until February 8th that the price ended the downward trend and began to rebound. However, the current price is still far below the historical high. If $S can maintain above the $0.57 support level and steadily rise along the moving average, the subsequent trend is expected to further strengthen, with a target of around $0.72.

In summary, since the name change from Fantom, Sonic has shown a strong development momentum. Its total locked value (TVL) has achieved significant growth in a short period of time, the on-chain data activity has increased, indicating a rapid expansion of the ecosystem and an increase in user participation. Nevertheless, the price of $S has not yet fully reflected these positive fundamental changes. As market attention on Sonic increases, and its continuous optimization in technology and ecology, the price of $S is expected to rise further in the future. Investors should closely monitor market dynamics and on-chain data to seize potential upside opportunities in this rapidly rotating market.

Reference links:

FVM doc:

https://blog.fantom.foundation/fantom...

Bridge (Sonic Gateway) doc: