Author: Scof, ChainCatcher

Although Twitter currently only has one project introduction, and the founder and investors are unknown, Unit has already attracted the attention of many crypto KOLs including ZhuSu. Since its launch, it has attracted over $50 million worth of BTC inflow into Hyperliquid, and crypto KOL @chameleon_jeff even reposted and commented that the launch of Unit has brought Hyperliquid one step closer to accommodating all financial assets.

So, what is this so-called "protocol designed specifically for Hyperliquid"?

What is the Unit protocol?

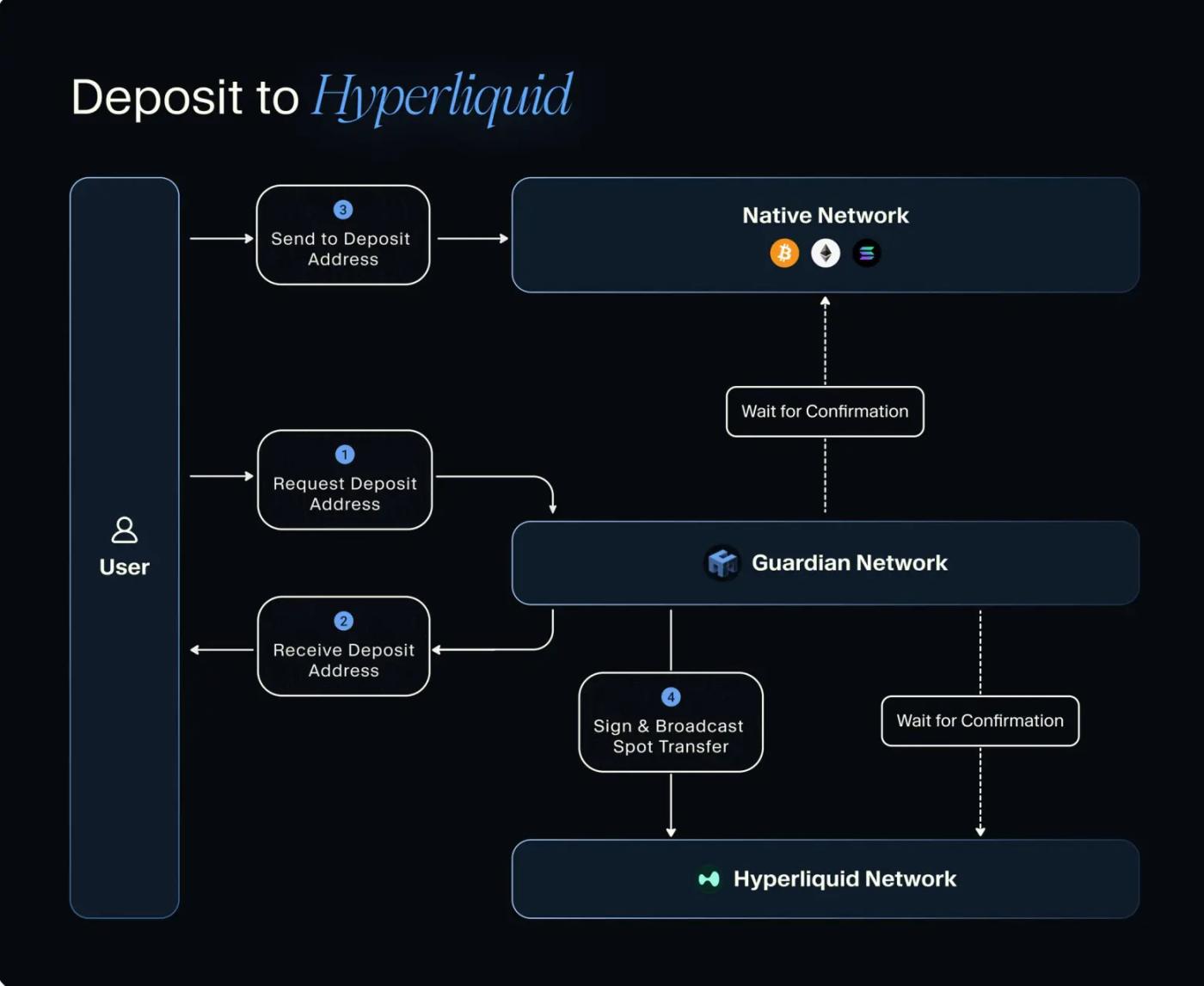

Unit is the asset tokenization protocol layer in the Hyperliquid ecosystem, committed to realizing the seamless cross-chain circulation of native assets across multiple chains. As the underlying infrastructure designed specifically for Hyperliquid, Unit uses technological innovation to connect the flow channels between mainstream crypto assets (such as BTC, ETH, SOL) on their native blockchains and Hyperliquid. Users can complete the following core operations:

- Direct deposit: Transfer BTC/ETH/SOL from personal wallets or exchange accounts to Hyperliquid, with a current minimum deposit of 0.002 BTC

- Free trading: Trade mainstream assets or exchange them for USDC on the Hyperliquid spot order book

- Native withdrawal: Directly withdraw assets to any address on the target chain

Architecture Analysis

The Unit protocol adopts a distributed architecture design, with the core consisting of two major modules: the Guardian Guardian Network and the Agent smart agent.

Guardian Network

- Decentralized verification: A 2/3 threshold multi-party computation (MPC-TSS) network composed of independent operating nodes, where all operations require consensus from the majority of nodes

- Full-chain data verification: Each node independently runs a native chain indexer to real-time verify the finality of on-chain transactions

- Secure key management: Private key fragments are distributed and stored in secure enclaves such as AWS Nitro, eliminating the risk of single point of attack

- Leader-follower mechanism: Pre-selected leader nodes coordinate proposals, while follower nodes independently verify all instructions, with relay servers only responsible for information transmission

Agent

- Chain service module: Monitor cross-chain deposits, confirm transaction finality, and construct broadcast transaction packages

- Flow management engine: A state machine-based multi-step execution framework to ensure strict sequential execution of protocol operations

- Consensus service layer: Implement t-of-n arbitration rules (default 2/3 threshold), where critical operations require signature confirmation from the majority of nodes

- Wallet manager: Coordinate MPC key operations, manage encrypted private key fragments, and execute threshold signatures

What problems can Unit solve?

As the neutral infrastructure of the Hyperliquid ecosystem, Unit, through its distributed architecture design, achieves the native cross-chain circulation of mainstream assets while ensuring security. Its technological breakthroughs respond to the community's long-term demand for spot trading, providing underlying support for the innovation of on-chain financial products. By combining traditional CEX-level functionality with DeFi native features, Unit is improving the efficiency of decentralized trading.

At the same time, the implementation of Unit unlocks multi-dimensional application scenarios for the Hyperliquid ecosystem:

- Unified trading experience: Users can complete spot and perpetual contract trading on the same platform, supporting cross-asset hedging with portfolio margin

- Improved capital efficiency: Through the portfolio margin mechanism, it enhances capital utilization and promotes the growth of overall platform trading volume

- On-chain financial infrastructure: Provide verifiable CLOB liquidation solutions for DeFi protocols, supporting DAO on-chain treasury management

- Derivative innovation: Realize spot Delta hedging and real-time option settlement, build the infrastructure for spot-futures basis trading

These advantages are directly reflected in the trading fees. According to a tweet by crypto KOL @smartestmoney_, a comparison table created by @hyperunit shows that trading BTC, ETH and other mainstream currencies on Hyperliquid will be 10 to 25 times lower than on traditional CEXs.

Currently, the official has not disclosed more project-related information. The mainnet launch has already supported users to deposit or withdraw BTC through self-custodial wallets or centralized exchange accounts, and the functions to support ETH and SOL will be launched in the near future.