Author: Biraajmaan Tamuly, CoinTelegraph; Translator: Taozhou, Jinse Finance

Since reaching a historic high of $295 on January 19, the SOL price has fallen by 50%. The 42% drop in February was also the largest monthly decline since the FTX exchange collapse in November 2022.

Solana's 4-hour chart. Source: Cointelegraph/TradingView

While the uncertainty surrounding the unlocking of Solana's 11.2 million tokens and the LIBRA memecoin scandal may have played a role in the current decline, there are some fundamental reasons that can better explain the recent adjustment.

Solana's total locked value (TVL) has fallen by $5 billion since January 25

Solana broke through a record-high $10 billion total locked value (TVL) in January, and has been on a downward trend since reaching that peak. After reaching a TVL of $12 billion, it has now dropped to $7.13 billion.

Solana TVL and on-chain transaction volume. Source: defillama

Data from defillama shows that the subsequent decline in TVL was mainly led by Raydium, which fell by 60% in less than a month. Other major decentralized applications, such as Jupiter DEX, Jito Liquidity Staking, and Kamino Lending, fell by 25%, 46%, and 33% respectively.

This directly impacted Solana's on-chain transaction volume, which has dropped from $97 billion per week in the second week of January to just $7 billion this week.

These indicators suggest that there has been a significant shift in trust in the Solana ecosystem, leading to a sharp decline in activity over the past month.

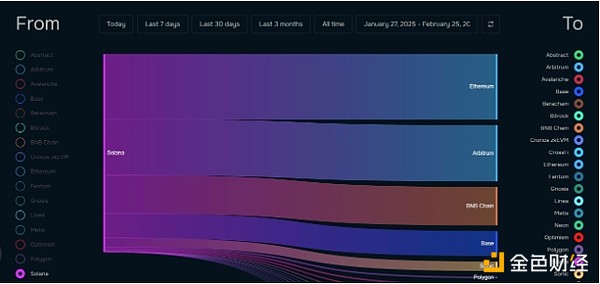

$500 million shifted to Ethereum, Arbitrum, and other blockchains

The collapse of SOL price and network activity has led to a major shift in trader interest, with most moving liquidity to other chains. Over the past 30 days, traders have moved nearly $500 million to other chains, with Ethereum, Sonic, and Arbitrum being notable blockchains.

Data on Solana outflows to other chains. Source: debridge.finance

Crypto analyst Miles Deutscher emphasized that Solana's fee consumption has dropped to a one-month low of $177,000, and stated that "people are tired of getting ripped off in the casino, and a lot of people have left the table."

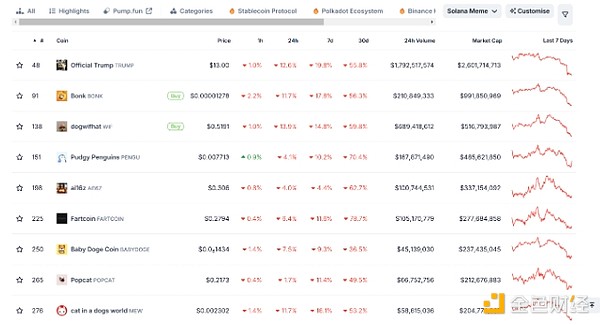

Memecoin collapse

At its peak influence, Solana's memecoin reached a total market value of $25 billion in December 2024. Its current value has now dropped to $8.3 billion, plummeting 23% in the past 24 hours.

Solana memecoin on CoinGecko. Source: X.com

After Pump.fun issued 7.5 million tokens and generated $550 million in revenue, most memecoins in this market have fallen 80% to 90%. While SOL is not a memecoin, the rise and fall of these tokens have impacted its valuation.