Who is shorting ETH?

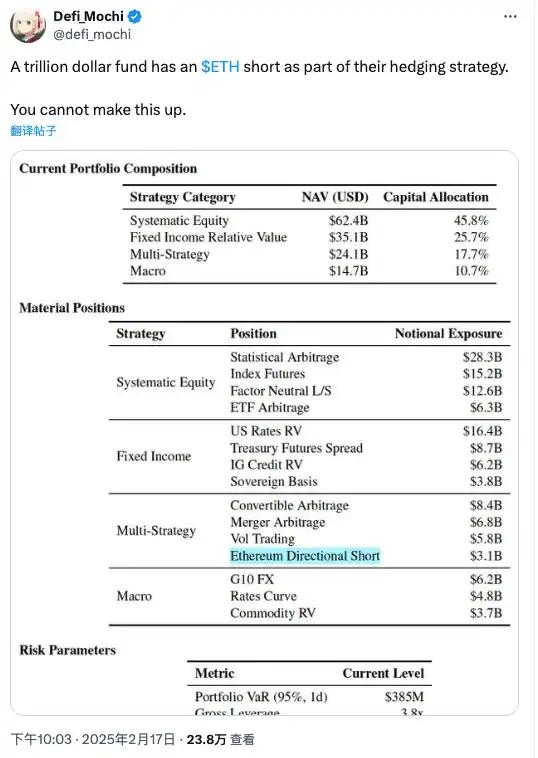

Recently, a mysterious institution's asset allocation table was leaked, and it is noteworthy that a "31 billion US dollar Ethereum short position" is clearly marked in the "multi-strategy" investment portfolio.

So the question is, who is the holder of this 31 billion US dollar Ethereum short position?

BlockBeats has found various sources of this asset allocation table and speculated on the two most likely candidates:

First, it is Bridgewater Fund. Some other leaked data is consistent with this asset allocation table, and Bridgewater's CEO Ray Dalio has expressed interest in cryptocurrencies and is a BTC maximalist, which is somewhat in line with the logic of shorting ETH.

Another most discussed possibility is Citadel Securities, which we focus on today.

One "big guy" fell, and another "big guy" came

If you still remember Black Monday in August 2024, that crash triggered by Japan's interest rate hike.

Japan's first interest rate hike since the end of the negative interest rate policy caused the yen-dollar exchange rate to soar, and the reversal of arbitrage trading triggered massive liquidations. The global financial market collapsed instantly, the Japanese stock market plummeted 9%, the Nikkei index triggered the circuit breaker twice, and recorded the largest single-day decline in eight years. The stock markets in South Korea and Taiwan were also not spared, and the cryptocurrency market was also hit hard, with BTC once falling below $50,000 and ETH plummeting more than 25%, directly wiping out all its gains for the year.

But the fact that just the impact on the Japanese economy alone caused the collapse of cryptocurrencies is obviously not convincing enough for everyone, until some old players revealed the inside story.

As the crypto king who appeared earlier than SBF, BitMEX co-founder Arthur Hayes posted on social media that through channels in the traditional financial field, he learned that a certain "big player" was liquidating their crypto assets.

Although he did not explicitly mention the name, the community's pointer is already quite clear, which is Jump Trading and its cryptocurrency department Jump Crypto. Since June last year, the US Commodity Futures Trading Commission (CFTC) has already begun investigating Jump Crypto. In addition to facing regulatory pressure, Jump Crypto is also deeply embroiled in several controversial events. First, the collapse of FTX caused huge losses for Jump Crypto. In addition, Jump was also under the scrutiny of regulators for its involvement in the TerraUSD stablecoin collapse incident.

As the CFTC investigation deepened, Jump Crypto's young CEO Kanav Kariya announced his resignation, and Jump's official Twitter account also stopped updating, seemingly announcing Jump's gradual withdrawal from the crypto industry.

However, while one "big guy" fell, another "big guy" has arrived.

Yesterday, market maker Citadel Securities announced plans to enter the cryptocurrency market making business. Like a relay race of traditional financial giants, as Jump Crypto withdrew, Citadel Securities, also from a traditional finance background, chose to take over the baton of the crypto market.

Jump and Citadel, as representatives of traditional financial giants, have similar backgrounds and strategies. Both companies started with market making business, with Jump occupying a place in the financial market through high-frequency trading, and Citadel relying on hedge funds and equally high-frequency quantitative analysis to become one of the world's largest market makers. When Jump entered the crypto market, it brought a strong technical team, hardware equipment and financial support, and Citadel also has these advantages.

Citadel Securities, the largest market maker on Wall Street, the myth

Citadel Securities is one of the largest market makers on the New York Stock Exchange. Its daily trading volume accounts for nearly 35% of the US stock trading volume, equivalent to the daily turnover of the Shanghai and Shenzhen stock markets, with an annual revenue of around $7 billion. Related reading: Why is Citadel Securities so good at attracting money?

In addition to Citadel Securities' market making business, the main business of the entire Citadel is hedge funds, managing $65 billion in assets. It is the technology-savvy faction of the hedge funds, and in addition to focusing on the fundamentals of investment value, it analyzes the market through a large amount of information and various mathematical models, and is said to invest tens of billions of dollars in models and hardware every year.

According to LCH Investments data, in 2022, the top 20 hedge fund companies generated a total of $22.4 billion in profits (after fees), with Citadel ranking first with $16 billion in profits in 2022, setting a new annual return record for a hedge fund company. The latest data shows that Citadel still ranks first in terms of net profit and valuation ranking among all global hedge funds since its inception, with Bridgewater Fund ranking fourth.

Data source: LCH Investments

Citadel founder Ken Griffin's net worth is as high as $45.9 billion, ranking 22nd on the Forbes 400 list and 31st globally, and he even made the bold statement: "We do print money."

And the CEO of Citadel Securities has a name similar to the crypto tycoon, called Peng Zhao.

Compared to Citadel founder Ken Griffin's experience, Peng Zhao's resume is more likely to hit the sweet spot of every Asian person: he entered the junior class at the age of 10, was admitted to the Peking University Mathematics Department at the age of 14, and then went to the University of California, Berkeley to pursue a doctoral degree.

In 2006, Peng Zhao joined Citadel, and with his outstanding mathematical talent, he quickly rose to prominence. By 2017, he had taken the CEO position and become one of the most trusted people of founder Ken Griffin.

During the four years Peng Zhao served as CEO, he quintupled Citadel Securities' net trading revenue, a growth rate that is almost unimaginable. Under his leadership, Citadel Securities not only occupied a more advantageous position in the market, but also brought the company's profitability to an unprecedented level.

Peng Zhao's name has also suddenly become a synonym for the top student in the study abroad circle from more than a decade ago. Related reading: Citadel Securities CEO Peng Zhao: The Peak of Chinese on Wall Street, Life Opened Up Since Age 10

According to the memories of the overseas students at the time, in the old Sichuan restaurant in Chinatown, the overseas students were chewing on spicy beef while excitedly talking about Peng Zhao: "On the Chicago landmark Lakeshore, he bought two luxury condos facing Lake Michigan and combined them, worth over $10 million." They all hoped to become the next Peng Zhao.

Citadel's "Covert Infiltration" with Sequoia and Paradigm

Citadel's official entry into the crypto circle is much later than its competitors, after all, Jane Street and Jump Trading established their digital asset businesses in 2017 and 2021 respectively. Apparently due to regulatory issues, Citadel's connection with the crypto market has been "underwater" all the time.

In 2021, there was a very high-profile event in the crypto circle. Sotheby's held an auction to sell a 1787 edition of the US Constitution. At that time, 1,700 crypto players formed a decentralized organization called ConstitutionDAO, collectively crowdfunding $43 million through social media to try to auction off this copy of the US Constitution, and derived the PEOPLE token.

But unfortunately, they did not succeed in buying this constitution, and the highest bidder was Citadel's founder Ken Griffin.

In 2022, this billionaire accepted the first external investment for Citadel Securities, completing a $1.15 billion financing round with a $22 billion valuation, led by old acquaintances in the crypto industry, Sequoia Capital and Paradigm.

Sequoia Capital partner Lin Junrui will join the board of directors of Citadel Securities, and Paradigm co-founder Matt Huang said they will work with Citadel Securities to expand their technology and expertise to more markets and asset classes, including crypto assets. However, at the time, Griffin, in order to avoid regulatory issues, still claimed to the media that Citadel Securities had not yet entered the cryptocurrency trading business.

However, this answer obviously did not cover up the traces of Citadel's quiet layout in the crypto industry. It was from that year that Citadel officially began to test the waters of the crypto industry and established a dedicated crypto business department.

First, Citadel Securities' global business development director Jamil Nazarali was transferred to become the CEO of Citadel's crypto business, and he began to cooperate with another top market maker Virtu Financial, the fund giant Charles Schwab, and Fidelity on digital asset trading and brokerage business.

Then in June 2023, they officially launched their jointly launched cryptocurrency trading platform EDX Markets, with Jamil Nazarali as the CEO. The trading platform is focused on "non-custodial" and "retail-free" trading, with only Bitcoin, Ethereum, Litecoin and Bitcoin Cash as the trading targets.

In addition to Jamil Nazarali, Citadel has also cultivated many elites closely related to the crypto circle. For example, Brett Harrison, the former president of FTX US who left due to management issues with SBF, also served as the technical director of Citadel Securities and brought a lot of technological innovation to the company.

However, Griffin himself has had a rather contradictory attitude towards cryptocurrencies. Earlier, he had publicly stated that he was cautious about cryptocurrencies and believed that they had no real value. But in a recent interview, he admitted that he regretted not investing in Bitcoin early on, and if he could see a clearer value, he might have bought these assets long ago.

The reason for Citadel Securities' foray into the crypto field is not as complicated as we might imagine. Politically "standing on the right side" has further deepened its connection with the crypto world. After Trump was elected president, especially his support for the crypto industry, many traditional financial giants, including Griffin, have seen the huge potential of crypto. Like most crypto whales, Griffin firmly supported the Republican Party during the 2024 election cycle, and was one of the top five donors to the Republican Party, second only to Elon Musk.

Citadel's shorts, from the stock market to the crypto circle

Going back to the topic we discussed at the beginning of the article, why was the institutional asset allocation sheet holding "31 billion dollars in Ethereum short positions" suspected to be from Citadel?

In addition to its recent more active moves in the crypto industry, Citadel's name is always closely associated with "shorting". There are particularly many rumors about their shorting in the market.

As early as the stock market crash in 2015, there were rumors that foreign short-selling forces were one of the culprits behind the sharp drop in the A-share market. At the time, the China Securities Regulatory Commission investigated many accounts and temporarily suspended a batch of trading accounts suspected of affecting securities trading prices or other investors' investment decisions.

Among them was an inconspicuous company: Citadel (Shanghai) Trading Co., Ltd. According to the national enterprise credit information publicity system, this Citadel company is a wholly foreign-owned enterprise, with Citadel as the shareholder. After a five-year investigation and negotiation, Citadel finally agreed to pay $100 million to reach a settlement agreement with the Chinese regulator. At the time, a well-known overseas financial blogger Zerohedge revealed that Citadel was closely connected with the Federal Reserve, often holding secret meetings, and was actually a tool for the Federal Reserve to control market stability. They used high-frequency trading and other means to push up the US stock market.

Looking at 2021, when Robinhood banned retail trading during the GameStop (GME) stock crisis, Citadel's name appeared again at the center of many questions. Retail investors believed that Citadel, through its financial support of Robinhood, manipulated the confrontation between retail and institutional investors. Although Ken Griffin denied these allegations at the hearing, the close relationship between his company and Robinhood still could not quell these allegations.

It should be known that Citadel Securities is not an ordinary market maker. Its relationship with Robinhood is ostensibly a client-supplier relationship, but behind the scenes, Citadel provides Robinhood with a large amount of order flow. All of this was exposed in the GameStop incident. Because Citadel paid Robinhood millions of dollars to execute these trades, it naturally became the "behind-the-scenes manipulator" in the minds of retail investors.

In fact, Citadel's shorting operations over the years have already made it a "hidden manipulator" in the market.

Even in 2023, Terraform even accused Citadel of possibly participating in the shorting of UST, ultimately leading to the de-pegging of UST in May 2022, and demanded that Citadel Securities provide some key trading data. Even though Citadel firmly denied any direct connection with the UST collapse.

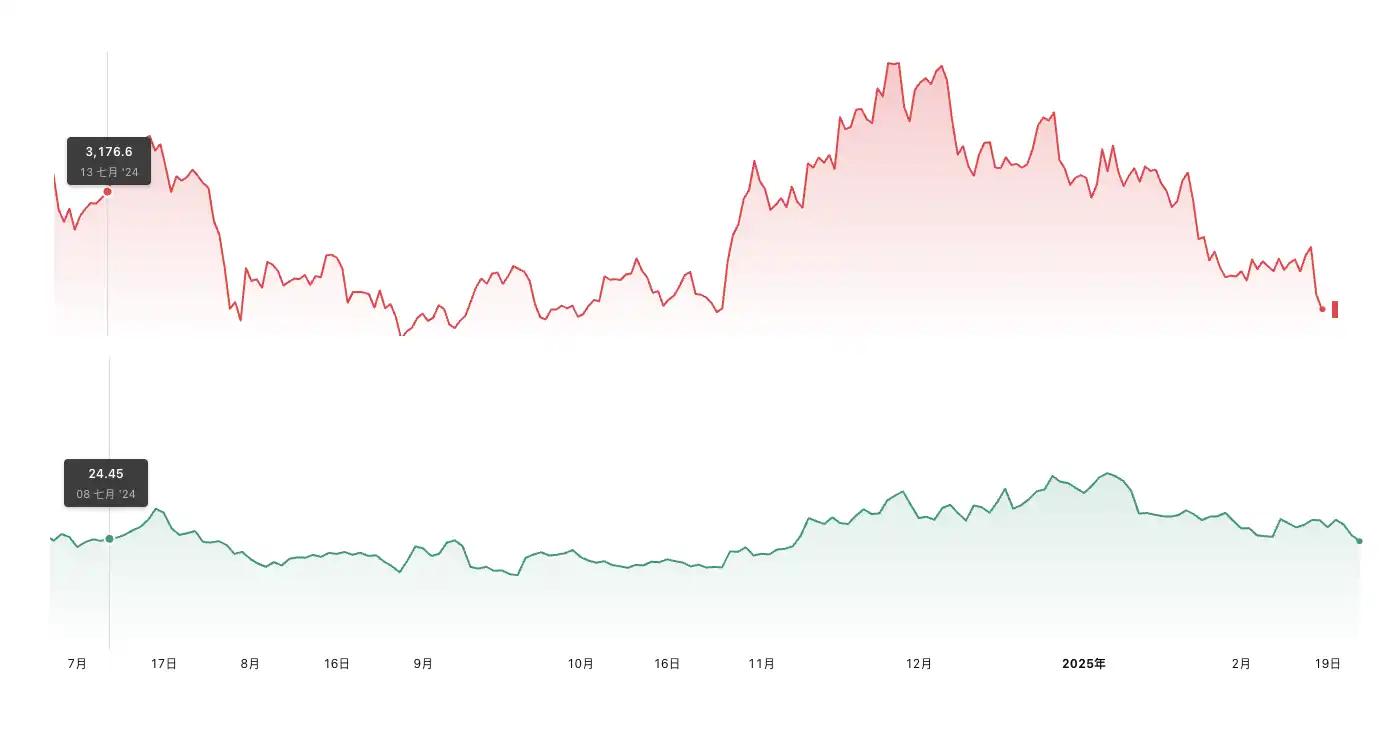

"No wonder the price trend of GME is so close to ETH," a community member pointed out that Citadel Securities plays an important role in it, using the same strategies and tactics for market making. Indeed, since July 2024, the price trend of ETH has been almost the same as the stock price of GME.

Top: ETH price trend; Bottom: GME price trend

No wonder Citadel Securities has recently been suspected of being one of the institutions that shorted ETH.

But to be fair, as a top-tier hedge fund, the possibility of holding a large amount of ETH spot on one hand and shorting ETH to achieve risk hedging on the other hand also exists. From this perspective, this may also be a good thing, after all, their spot holdings are the main position, and shorting is just an auxiliary strategy, with the goal of ensuring the steady appreciation of their assets.

And this also indirectly corroborates the current widespread rumor of "ETH big warehouse change", where Wall Street giants are gradually building positions and becoming the new crypto big players. The game and competition between crypto market makers is still ongoing.