Ohio is considering a new bill that would allow the use of digital assets such as cryptocurrencies, stablecoins, and Non-Fungible Tokens (NFTs) for payments without additional taxes, promoting the development of the blockchain industry.

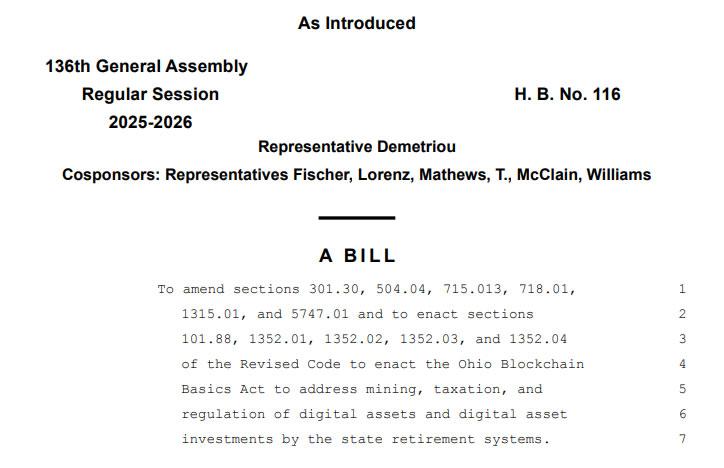

In Ohio, State Representative Steve Demetriou and a group of lawmakers introduced Ohio House Bill 116 on February 24th, aiming to facilitate the use of digital assets as a payment method. The bill proposes to amend existing laws to prevent cities from imposing additional taxes or fees on digital asset transactions beyond the current taxes applicable to fiat currency transactions.

This means that Ohio residents can use Bits, Blocks, Non-Fungible Tokens (NFTs), Staking, and other digital assets to purchase goods and services without additional tax burdens, except for existing taxes such as sales tax and state tax.

Potential Impact on the Blockchain Ecosystem in Ohio

Bill 116 goes beyond just tax exemptions for digital asset transactions. It also includes other important provisions, creating a more comprehensive legal framework for the blockchain industry in Ohio.

Specifically, the bill states that no state agency or local government can prohibit the acceptance of digital assets as a form of payment for goods and services. This protects the rights of businesses and individuals to choose their payment methods and encourages wider adoption of digital assets in the economy.

Additionally, the bill addresses the right of citizens to self-custody their digital assets, allowing them to use hardware wallets or personal wallets and participate in Staking activities. Recognizing the right to self-manage digital assets contributes to increased trust and security for users, driving the development of the digital asset market.

For the mining and trading of digital assets, the bill also provides specific regulations. Mining, Staking, and trading of digital assets will not require a Money Transfer License under Ohio's current laws.

Individuals are allowed to mine cryptocurrencies in residential areas, subject to urban planning regulations, while mining businesses can operate in industrial zones and be protected from discrimination through local planning changes. These regulations create a clear and stable legal environment for digital asset-related activities, encouraging investment and development in this field.

Another notable point in Bill 116 is the requirement for the Ohio Retirement System. This fund is required to assess the risks and benefits of investing in cryptocurrency ETFs and report back to the legislature within 1 year. This is a cautious step, but also reflects the Ohio government's interest in the potential of cryptocurrencies to diversify investment portfolios and optimize returns for the retirement fund.

Ohio's actions follow a series of recent initiatives related to cryptocurrencies that the state has implemented. From proposing to allow the state to accept cryptocurrencies for tax and fee payments, to considering the establishment of a strategic Bitcoin reserve fund, Ohio is clearly demonstrating its ambition to become a leading center for blockchain and cryptocurrency in the United States.