Bloomberg reported that Citadel Securities, one of the world's largest market makers, plans to enter the crypto currency market and is seeking to join the market maker lists of multiple crypto exchanges. The news has sparked widespread attention and discussion in the market. As a top player in the global financial market, how will Citadel Securities' entry change the landscape of the crypto market? What opportunities and challenges will it bring?

This article will explore the significance and potential impact of Citadel Securities' foray into the crypto currency market making business through a Q&A format.

Q1. Who is Citadel Securities?

Citadel is currently one of the hottest players in the global financial market. It started as a small hedge fund and has gradually grown over the years to become one of the most profitable investment companies in the history of the financial industry.

Citadel consists of Citadel LLC and Citadel Securities, where Citadel Securities is a global market maker and Citadel LLC is a multinational hedge fund financial services company.

As a core participant in the US stock market, Citadel Securities has become the world's largest stock buyer and seller, accounting for nearly a quarter of US stock market trading volume, involving more than 11,000 US-listed securities and more than 16,000 over-the-counter securities. In August 2024, its stock trading volume even surpassed the New York Stock Exchange.

On April 9, 2024, Citadel Securities was successfully selected for the 2024 Hurun Global Unicorn List with a corporate valuation of 155 billion RMB, ranking 13th, becoming an undeniable giant in the global fintech field.

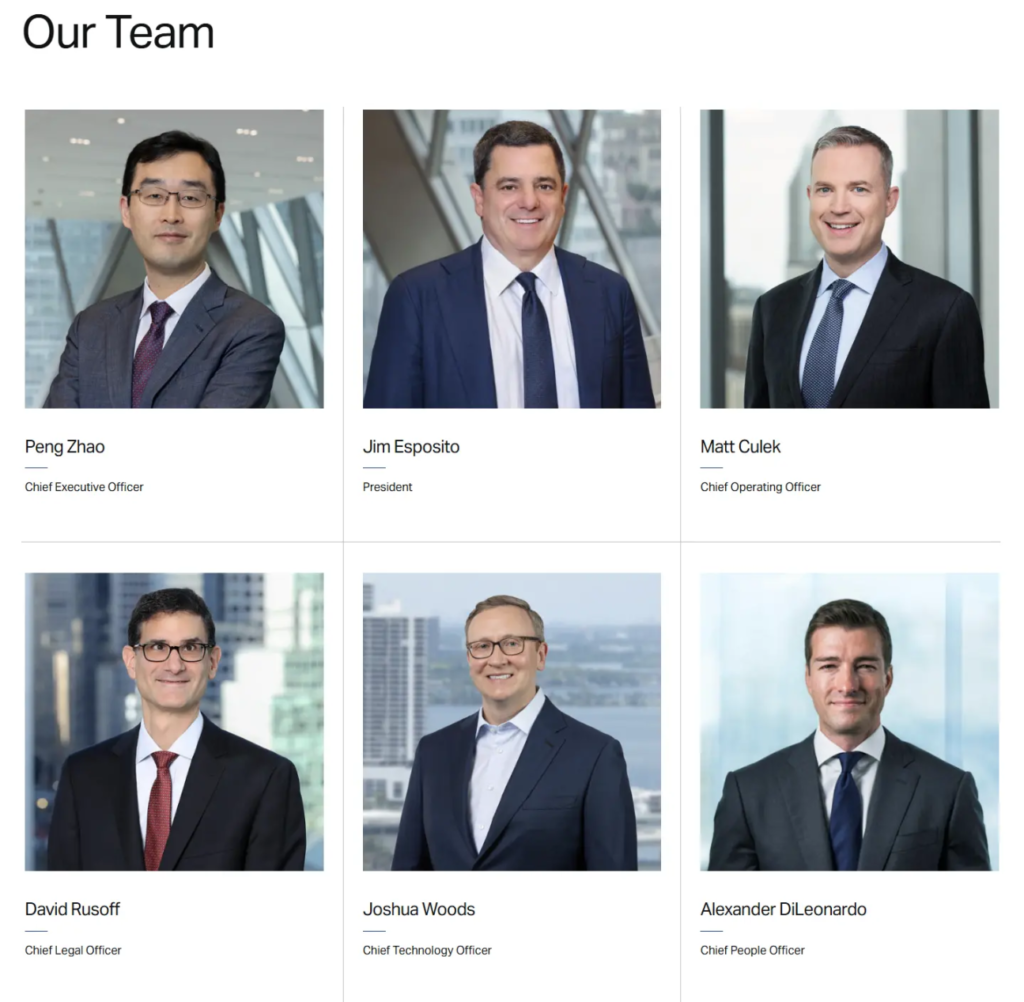

Q2.Citadel Securities Team Background?

Citadel Securities was founded by legendary investor Ken Griffin and is currently led by CEO Peng Zhao. Peng Zhao, born in Beijing, is regarded as a top figure among Wall Street Chinese. He entered Peking University's Mathematics Department at the age of 14 and later obtained a PhD from the University of California, Berkeley. After joining Citadel Securities, he rose from analyst to partner, general manager, and finally CEO in less than 10 years.

Citadel Securities has a highly professional and internationalized team, with a total global workforce of around 1,600 people. 45% of the members hold advanced degrees, and there are about 260 doctoral students, covering more than 40 disciplines, including applied mathematics, computer engineering, bioinformatics, and geophysics. The team members come from about 80 countries, reflecting its global layout and diverse cultural background.

Q3.Citadel Securities' Past Attitude Towards Crypto?

In the past, due to the uncertain regulatory environment in the US, Citadel Securities has taken a cautious attitude towards digital assets and has always avoided getting involved in retail-oriented crypto platforms.

Founder Ken Griffin was once a Bitcoin skeptic, and in 2022, just before the Terra collapse, Griffin stated that Citadel "may enter the crypto industry in the next few months". However, the Terra event and the market crash may have shaken his confidence in the crypto market, and Citadel ultimately did not take any action.

In recent months, Griffin has acknowledged missing the early opportunities in the crypto market, and at the 2025 UBS Financial Conference, he revealed that the company is considering entering the crypto market and serving as a market maker.

Why is Citadel Securities so powerful?

The key to Citadel Securities' success lies in its control over order flow and its in-depth exploration and application of massive data. The company processes transaction information worth up to $450 billion per day and makes decisions through complex predictive analysis and valuation.

Citadel Securities is able to accurately assess the fair value of stocks and options under different market conditions. According to insiders, Citadel invests hundreds of millions of dollars annually in hard technology and quantitative research.

What are Citadel Securities' famous operations?

One of the company's most famous events was the GameStop short squeeze in 2021. Retail investors united to long GameStop stock, successfully suppressing the hedge funds that were shorting the stock, leading to massive losses and bankruptcy for Melvin Capital.

Investigations show that during this process, a large portion of Robinhood's order flow was directed to Citadel Securities. However, Citadel LLC's fund was a partner of Melvin Capital and injected $2 billion into the firm during the crisis. This dual role as a market maker and investor has sparked controversy in the market.

During the most intense days of the short squeeze battle, Citadel Securities' daily trading volume reached 7.4 billion shares, exceeding the industry's daily average trading volume in 2019.

What does Citadel Securities' entry into the crypto market mean?

The community is divided on Citadel Securities' foray into the crypto market, with some seeing it as a positive development, but more leaning towards it being negative.

Positive:

Enhance market liquidity: As a leading global market maker, Citadel Securities' entry can improve the liquidity of the crypto market.

Attract more investors: As a well-known financial institution, Citadel's participation can help attract more investors, especially institutional investors, to the crypto market, further driving capital inflows.

Regulation and compliance: Citadel's operations in the traditional market typically follow strict compliance and regulatory requirements. Citadel's compliance background will accelerate the integration of the crypto market with the traditional financial regulatory system, which may lead to higher KYC/AML requirements for exchanges and projects.

Negative:

Potentially exacerbate market manipulation: Citadel Securities has been controversial for its short-selling operations in the traditional market. Community users are concerned that as a large market maker, its strong market control power may exacerbate the risk of manipulation in the crypto market.

Market transparency: Community members have pointed out that Citadel's short positions are not fully disclosed, with 13F filings only showing long-term holdings, while its market-making short-selling is typically a daily operation rather than a long-term bet.

Increased industry concentration: Citadel Securities' entry may lead to further concentration of market resources in a few large institutions, increasing industry concentration. This may make the market more regulated and efficient, but could also weaken the competitiveness of small and medium-sized participants.

What strategies is Citadel Securities adopting in the crypto market?

Citadel Securities plans to join the market maker lists of several mainstream crypto exchanges, including Coinbase Global Inc., Binance Holdings, and Crypto.com. Once approved by the relevant exchanges, Citadel Securities plans to first establish a market-making team outside the US.

The company's ultimate push and interest in the crypto market may be influenced by the introduction of new regulations in the coming months.

What is Citadel's current involvement in the crypto market?

In 2023, Citadel Securities quietly entered the crypto market through EDX Markets. EDX Markets is a crypto exchange launched by Citadel Securities, Charles Schwab, and Fidelity Investments, and is only open to institutional investors.

EDX Markets uses a traditional market structure to process crypto transactions, providing institutional investors with a familiar execution and settlement model.

How will Citadel Securities' entry change the crypto market landscape?

The difficulty for retail investors to profit will increase, and the "grassroots tactics" of retail investors may be further marginalized. Opportunities and resources will be more concentrated on large institutions and high-net-worth investors, and the disadvantages of retail investors in terms of information, technology, and capital will become more apparent, significantly increasing the difficulty of profiting.

The survival pressure on small and medium-sized market makers will increase, as Citadel Securities will exert tremendous pressure on the existing small and medium-sized market makers. Leveraging its massive financial resources, advanced algorithmic trading systems, and global resource network, it is likely to dominate in terms of liquidity provision and trading execution efficiency. Many small and medium-sized market makers may be forced to exit the market due to their inability to compete.

Additionally, Citadel Securities' entry may also trigger a reallocation of non-market-making institutional capital.

Why did Citadel Securities enter the crypto market later than its competitors?

Unlike competitors such as Jane Street and Jump Crypto, Citadel Securities previously maintained a distance from crypto assets. However, as regulatory pressure intensified in 2023, companies like Jane Street and Jump have been scaling back their business footprint in the US crypto market, providing an opportunity for Citadel Securities to fill the market gap.

Citadel's delay in entering the crypto market may have been due to its consideration of market structure and regulatory risks. Its recent expansion of crypto-related business also reflects its adaptation to the evolving US regulatory environment.