Last week, the theft of nearly $1.5 billion from Bybit shocked the entire cryptocurrency industry. To address the crisis of trust, multiple mainstream exchanges have successively raised the annualized yields of mainstream cryptocurrencies, especially the ETH financial earning products, in order to boost user confidence in centralized exchanges.

At the same time, the cryptocurrency market is accelerating its downward trend. According to CoinGlass data, on February 25, the total contract liquidation volume across the network approached $1.15 billion. The violent market fluctuations have greatly increased the trading risks for investors. Rather than rushing into the market, it would be wiser to seek more stable hedging strategies, and these newly launched high-yield financial earning products have become a good choice. Especially for holders of mainstream cryptocurrencies and USDT-holding users who are waiting and watching, earning stable interest income to hedge against coin price losses while retaining ammunition to wait for the next bull market is obviously a more sensible approach.

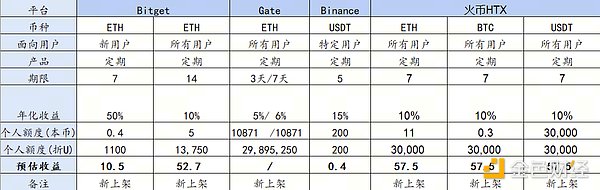

Recently, Binance, Huobi HTX, Bitget, and Gate have all launched new financial earning products. The four exchanges have different focuses in terms of cryptocurrencies, annualized yields, and quotas. Which one has the largest interest rate hike and the most sincerity?

Comparison of New Financial Earning Products

Overall, Huobi HTX's 10% annualized BTC, ETH, and USDT 7-day fixed-term products can bring the highest estimated returns. Huobi HTX provides each user with a purchase quota of the equivalent of 30,000 USDT for each of the three products, while also increasing the annualized interest rate. If a user fully subscribes to one of the 7-day fixed-term products, they will receive 57.5 USDT in earnings upon maturity.

In addition, Huobi HTX is the only exchange among the four that has launched a high-yield BTC financial earning product, which gives it an edge in product diversity.

Bitget's ETH 14-day fixed-term product has the same 10% interest rate as Huobi HTX, but the quota is only 5 ETH, which is inferior to Huobi HTX's 11 ETH. However, its 7-day fixed-term ETH product has an annualized yield of up to 50%. But this product is only available for new users, and the quota is only 0.4 ETH, so the estimated earnings are only 10.5 USDT.

Gate has also focused on ETH products, with the annualized yields of its 3-day and 7-day fixed-term products reaching 5% and 6%, respectively. Although there is no quota limit, the annualized yields are lower compared to Huobi HTX and Bitget.

Binance has launched limited-time promotional spot products for USDT, ETH, and SOL, but compared to other exchanges, the attractiveness of its ETH spot product is slightly insufficient, with a maximum of only 2.1%. The USDT spot product has a larger interest rate hike, with an additional amount tier added compared to before, with a yield of 4.15% for this part. However, the interest rate of Binance's USDT spot product is not superior to other exchanges.

Comparison of Stablecoin Spot Products

In addition to the aforementioned new financial earning products, the earning capacity of USDT spot products is also an important indicator for evaluating the attractiveness of the financial business of major exchanges. Binance's USDT spot product has been mentioned in the previous section and will not be repeated here. Bitget and Huobi HTX's USDT spot products are at a similar level, with the former having a better interest rate, at 12.9% annualized for the amount tier (500 USDT) and 4.9% for the amount outside the tier. The latter is stronger in having a higher amount tier (1,000 USDT), with 10% annualized for the part within the tier and 4% for the part outside. Gate's current USDT spot product has an annualized yield of around 4%, with an additional 10% annualized bonus for the part within 500 USDT.

In terms of other stablecoin spot products, Binance's FDUSD and Bitget's USDC also have certain competitiveness. Huobi HTX is currently providing a high 20% annualized yield subsidy for the decentralized stablecoin USDD, making it a noteworthy stablecoin financial product.

Note: This article does not constitute investment advice.