I. Reshaping the Economic Model: Capital Migration Triggered by Inflation Rate Dynamics

In the blockchain world, token economics has always been the sharpest double-edged sword.

The SIMD-0228 proposal, which will be voted on on March 6th, is trying to complete the genetic reorganization of the Solana economic model through a reverse adjustment mechanism of "staking ratio-inflation rate". When the staking rate exceeds the critical point of 33%, the annualized inflation rate will decrease from the current 4% to 1.5% in a step-by-step manner. This design is essentially creating a "capital reservoir" - the higher the staking amount, the less new tokens will be released, and the lower the dilution pressure on holders.

This reminds one of the Federal Reserve's quantitative tightening policy, but the cruelty of the crypto world lies in the fact that its adjustment cycle is compressed to the minute level. According to CoinMetrics data, the current Solana network has an annualized issuance of about 32 million SOL. If the proposal is passed, in a scenario where the staking rate exceeds 40%, the new token release will plummet to less than 12 million.

This drastic contraction in supply, combined with the impending institutional capital influx from the introduction of CME futures, may form a "Davis double-hit" in the supply-demand relationship.

But the flip side of the coin is equally alarming: the average daily income of validators may plummet from the current 0.83 SOL to 0.04 SOL, and the operating cost coverage line may jump from 30,000 staked tokens to 90,000. This is essentially a test of the limits of capital efficiency - when only 458 out of more than 1,300 validators can cross the survival threshold, the large-scale clearance of small and medium-sized nodes will be inevitable, and the network may enter an accelerated channel of "oligopolization" and "institutionalization".

II. Market Long-Short Tug-of-War: The Double Squeeze of CME Futures and the FTX Legacy

The SOL futures contract launched by the Chicago Mercantile Exchange (CME) on March 17 is reshaping the capital landscape of the crypto market.

Historical experience shows that the 30-day gain after the launch of Bitcoin futures was 65%, and the launch of Ethereum futures even triggered a 92% short-term surge. But this time it's different, as Solana is facing the "precise detonation" of the FTX legacy: the unlocking of 11.2 million SOL (about $2 billion) on March 1 is forming a sustained selling pressure, which is counteracting the institutional demand for building positions in the CME.

This long-short tug-of-war is clearly reflected in the on-chain data:

A whale transferred 494,153 SOL (about $71.95 million) to Coinbase Institutional in a single transaction, which could either signal an OTC block trade or the market maker's liquidity reserve for the futures launch.

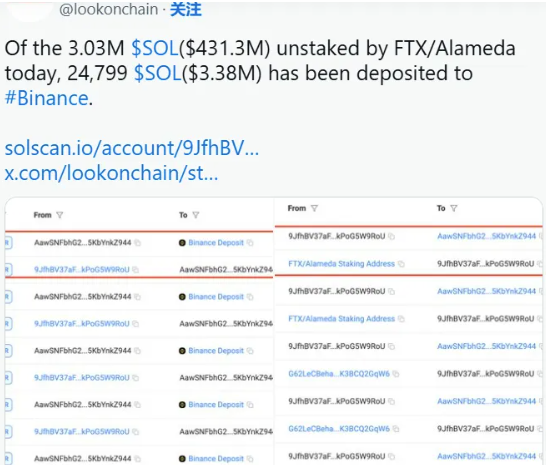

More worryingly, FTX-affiliated addresses have recently released 3 million SOL from staking and are continuously transferring them to the Binance exchange. This "dull knife slicing meat" style of selling is eroding the positive expectations of technical upgrades.

Technical indicators show a typical "crocodile mouth" pattern: the 9-day EMA forms a resistance at $145, the MACD green bars are emerging but lack volume, and the RSI is at 39.65 on the oversold edge. This divergence between the technical and fundamental aspects is reminiscent of the market anxiety before Tesla's Bitcoin purchase in 2021 - smart money is waiting for the liquidity restructuring triggered by the CME opening.

III. Institutional Undercurrents: From VanEck's Prophecy to the U.S. Crypto Strategic Reserve

VanEck's $520 year-end target price is not a castle in the air, but is rooted in the "crypto strategic reserve" that the U.S. government is building. On March 2, Trump announced that SOL will be included in the national digital asset reserve, and the value of this political endorsement far exceeds the technical upgrade itself - it means that Solana is beginning to have the attribute premium of a "digital sovereign bond". Grayscale's holding data shows that the proportion of SOL held by institutions has soared from 17% in 2024 to 34%, and this "compliance migration" is reshaping the valuation model.

But the Damocles sword of regulation is always hanging overhead. The SEC's determination of whether SOL is a security is still pending, and the launch of CME futures has actually added chips to the regulatory game: referring to the approval path of the Bitcoin ETF, the probability of the SOL spot ETF being approved has increased from 35% to 62%. This regulatory arbitrage space is attracting institutions like Pantera Capital to set up a $500 million dedicated fund to stake out the ecosystem in DeFi, NFT and RWA.

Interestingly, Multicoin Capital, as the main proponent of the SIMD-0228 proposal, holds a 26% share of the Jito staking pool across the network. This "both referee and player" layout exposes the deep-seated motivation of capital groups to achieve an increase in their holdings through economic model reform - when the inflation rate drops by 80%, the actual purchasing power of their held SOL will experience exponential growth.

IV. Technical Aspects and Ecological Variables: From Firedancer to Layer2 Breakthrough

The "barrel effect" of Solana is exposed in its technical upgrades: while the Firedancer upgrade is touted to increase TPS to the million level, its real mission is to solve the stability defects exposed by the network collapse in 2021. The introduction of dynamic resource sharding and AI early warning systems is essentially rebalancing the "high performance" and "high availability" scales. This underlying architectural overhaul is more strategically valuable than the surface throughput numbers.

The layout of Layer2 also demonstrates Solana's survival wisdom. Drawing on Ethereum's expansion path, the introduction of the ZK-Rollup solution not only compresses transaction costs to the $0.0001 level, but more importantly, it is building an "sovereign chain + application chain" ecological matrix. When the trading volume of DEXes like Raydium and Orca exceeds $100 billion, the modular architecture is evolving Solana from a "public chain" to a "blockchain application store".

But the prosperity of the ecosystem is hiding hidden worries: MEV (Miner Extractable Value) income has accounted for 57% of the total revenue of validators. This income structure dependent on arbitrage transactions will become more fragile after the implementation of the priority fee allocation reform in SIMD-0123. Validators may be forced to turn to the off-chain transaction market, which is at odds with the network's pursuit of transparency - the economic cost of technical upgrades is reshaping the distribution pattern of the entire value chain.

V. Future Projection: Critical Point Operations in the Bull-Bear Transition

Standing on the spatial-temporal coordinates of March 5, 2025, Solana is in a quantum superposition state of "Davis double-hit" and "death spiral". From the analysis of CME futures premium, FTX selling pressure attenuation cycle, and technical upgrade implementation, the second quarter may present a "first suppression, then rise" trend:

1. Short-term Pain Period (March 6-17)

The expected chaos triggered by the validator vote may suppress the price to the $130-135 range, combined with the FTX's average daily sale of 30,000 SOL, forming a stage bottom. But the SAR indicator shows strong support below $130, and a plunge may actually create a golden pit.

2. Liquidity Restructuring Period (March 17-31)

The launch of CME futures will trigger a tug-of-war between two types of capital: arbitrage capital will harvest the premium through "spot long + futures short", while compliant institutions may establish strategic positions through futures. Referring to the history of Ethereum futures, this stage may see a 15-25% pulse-like surge.

3. Ecological Verification Period (After April)

Firedancer testnet data and Layer2 TVL growth will become price anchors. If the DEX monthly trading volume breaks through $200 billion and the staking rate stabilizes above 40%, VanEck's $520 target will enter the realization channel.

Operation Suggestions

For investors with different risk preferences:

- Aggressive type: Establish a 10% bottom position at the current price of $147, double the position when it falls below $135, and hedge half of the position before the CME futures are launched.

- Conservative type: Wait for the daily line to stabilize above the 9-day EMA (currently $146.2) and then build a position in three batches, with a stop-loss set at the previous low of $125.

- Institutional type: Construct a "bull market spread" portfolio through CME futures and over-the-counter options, using the 5-8% implied volatility premium to hedge policy risks.

History always rhymes, but never simply repeats. As Solana walks the tightrope of technological revolution and capital games, the true winners will always be those who can see through the essence of "rule rewriting". The $147 at this moment may be standing at the origin of a new round of value discovery.