Although Trump has been fully supportive of cryptocurrencies, discussing cryptocurrency strategic reserves, and mentioning $SOL, $ADA and $XRP, the market has still seen a significant decline afterwards...

Is this just a false breakout before the next wave of an uptrend, or have we really entered a bear market?

This is my view. A discussion thread.

On Sunday, the cryptocurrency market welcomed a bullish surprise from Trump.

Trump posted content about cryptocurrency strategic reserves on Truth Social, mentioning Altcoins like SOL, ADA and XRP.

A few hours later, he also posted that BTC and ETH will be part of the cryptocurrency strategic reserves.

This was completely unexpected, and the cryptocurrency market began to surge.

BTC soared from $85K to $95K, ETH rose 20%, XRP and SOL rose 30%, and ADA skyrocketed over 70%.

But this rally did not last too long.

With the opening of the US market yesterday, BTC and other Altcoins began to decline, and by now they have erased all the gains made after Trump's announcement.

Now the biggest question is: was that rally a false breakout, or are whales manipulating the market to buy in at lower prices?

Before drawing a conclusion, let's analyze the bullish and bearish scenarios for the cryptocurrency market.

➙ Bullish scenario

➔ 1. Cryptocurrency strategic reserves:

Although the gains after Trump's announcement have disappeared, the post itself is something that no one could have imagined a few years ago.

The president of the world's largest economy openly supporting cryptocurrencies proves that cryptocurrencies can no longer be ignored.

But this is not just a simple tweet.

First, the issue of the US cryptocurrency strategic reserves is a matter of "when" rather than "whether".

This is a huge wake-up call for all the countries that have been bearish on cryptocurrencies.

Trump's single tweet has already prompted many countries to start paying attention to cryptocurrencies, accelerating discussions about potential adoption.

Just as whales have been pre-positioning for some major upgrades in cryptocurrencies, I believe the US cryptocurrency strategic reserves will also be pre-positioned by other countries.

My best guess is that many small and medium-sized countries will announce some form of cryptocurrency strategic reserves in the coming months.

➔ 2. Fiscal liquidity injection:

Cryptocurrency market participants have been waiting for Quantitative Tightening (QT) to end since Q4 2024.

In the last FOMC meeting, Powell clearly stated that there will be no Quantitative Easing (QE) until rates reach zero.

Additionally, the expected timing of the end of QT has been pushed back from March to June, which is a bearish signal for risk assets.

But there is another liquidity injection that has started since last month.

I'm talking about the TGA (Treasury General Account).

Recently, the US government debt has reached the $36 trillion ceiling, meaning the government cannot borrow more money until Congress raises or suspends the debt ceiling.

But the US government still needs to spend more money, so what is the solution?

This is where the TGA (Treasury General Account) comes into play, which is essentially the US government's checking account at the Federal Reserve.

Currently, there are nearly $560 billion in the TGA.

Since borrowing is temporarily not feasible, the government will directly spend from the TGA to keep operations running.

This will increase bank reserves and liquidity, which is bullish for asset prices.

According to some estimates, this liquidity has already started entering the market and will continue until mid-April 2025.

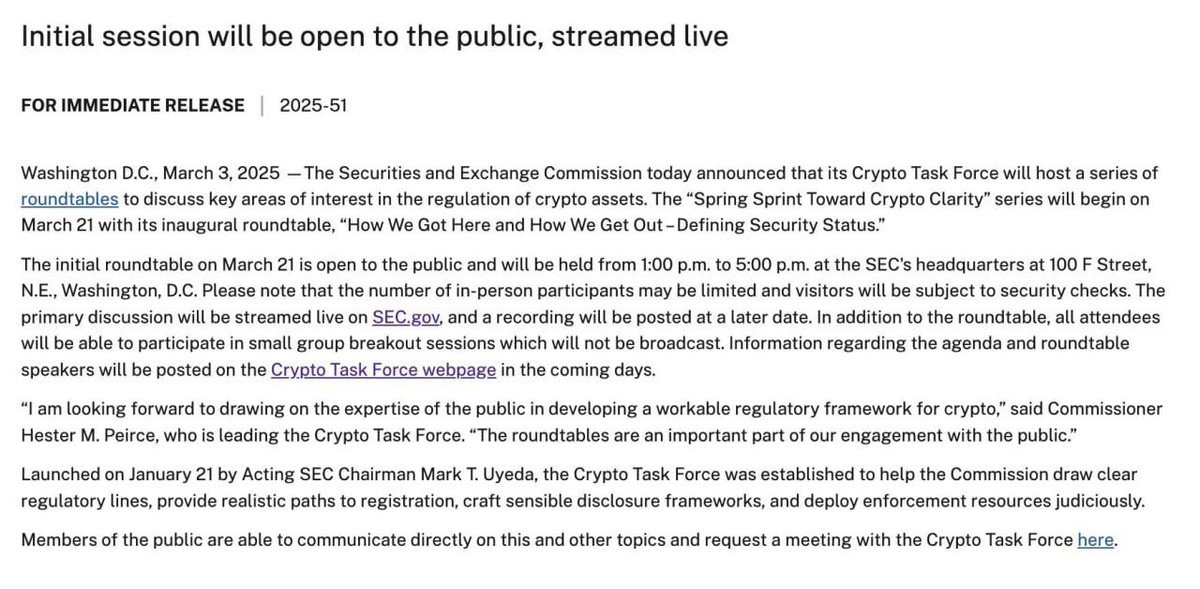

Crypto-friendly SEC

After Trump's victory, it was widely expected that the new administration would appoint a crypto-friendly SEC chair, and so far, they have not disappointed.

Over the past eight days, the SEC has closed investigations into Coinbase, Kraken, Uniswap, Yuga Labs, and ConsenSys.

Not only that, they are also reviewing securities laws to provide much-needed clarity for Altcoins.

Furthermore, the SEC will hold its first cryptocurrency roundtable on March 21st, something we never imagined under Gensler's SEC chairmanship.

If that's not enough, the SEC is actively reviewing multiple Altcoin ETFs, some of which may be approved in Q2 2025.

So, basically, we have a crypto-friendly president, a crypto-friendly SEC chair, some major crypto-related announcements coming, and people are still bearish.

➾ Bearish scenario:

➔ 1. Topping signs:

While many on-chain indicators have not entered the overbought territory, the cryptocurrency market has shown some major topping signs:

Trump launching his meme coin

Market pre-positioning for strategic BTC reserve announcements

Dinosaur coins pumping

Coinbase becoming the #1 finance app

Presidents launching and abruptly withdrawing

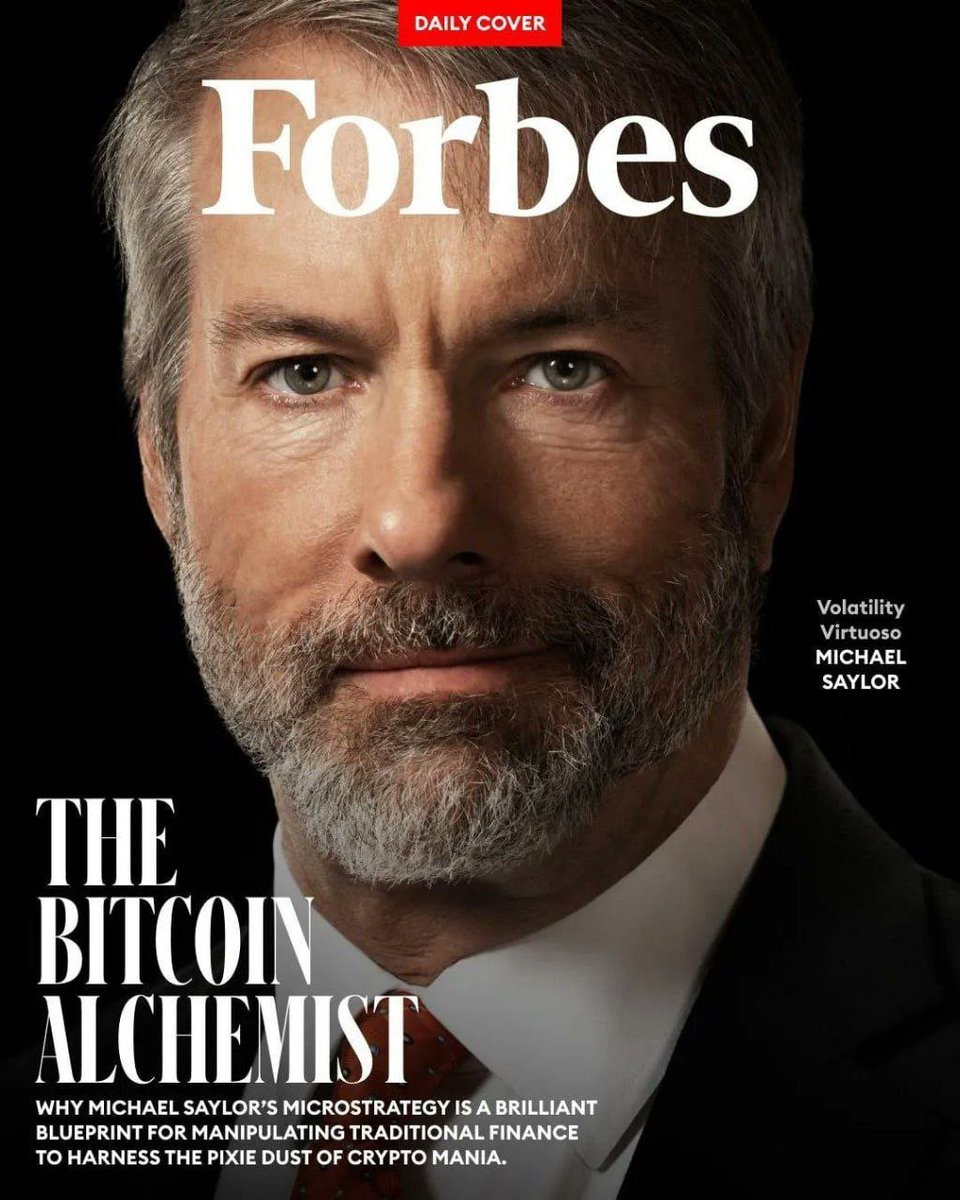

Saylor on the Forbes cover

I'm not saying these are definitive cycle tops, but historically, such events often lead to prolonged corrective and consolidation phases.

- Recession concerns

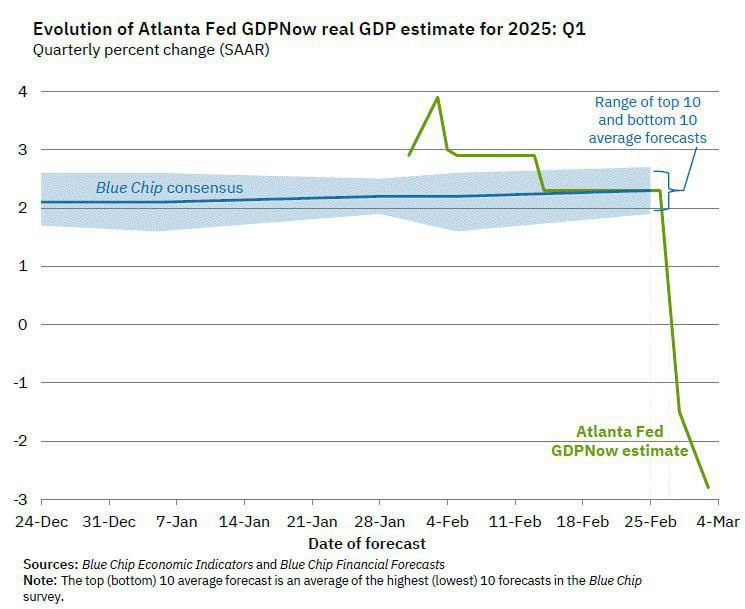

Yesterday, there were reports that the Atlanta Fed now forecasts actual Q1 GDP to be -2.8%.

Additionally, US manufacturing PMI came in below expectations, indicating signs of economic slowdown.

Combined with rising CPI and PPI, it seems the US is entering a period of stagflation, where economic slowdown and rising inflation coexist.

During stagflation, the Fed is unable to cut rates, as that would exacerbate inflation; and unable to hike rates, as that would lead to further economic slowdown.

If that's not enough, Trump's continued tariff announcements will certainly lead to a spike in inflation, which is bad news for risk assets.

$70K or $100K - Which one will arrive first?

So far, the cryptocurrency market has digested a lot of bearish news.

Most crypto participants expect a drop to $70K or lower, which actually makes me somewhat bullish.

Looking at the Open Interest (OI) and funding rates, the market seems healthier.

The current market conditions remind me of August 2024, when people were predicting a drop to $40K, but it never happened.

Remember, most people become bearish at the bottom and bullish at the top.

So, I think $100K is more likely to happen from here.

That's it!