A Confession of a Front-line Market Maker, A Dark Forest Self-Rescue Guide for Project Teams, Hoping to Be of Some Help :)

Let me introduce myself: I'm Max, a 00s kid who feels quite old, originally a poor finance student from Hong Kong, but I've been in the crypto industry (thanks to the industry for saving me) since 2021. Although I haven't been in the industry for long, I entered the industry as a project team member at first, then started my own business and ran a developer community and accelerator, so I've always been quite close to the front-line entrepreneurs. Now I'm responsible for our market making business line at @MetalphaPro, thanks to the boss for giving me the title of Head of Ecosystem, but I'm actually in charge of BD and sales. In the past year or so, I've handled the listing and subsequent market making of more than a dozen coins on @binance, @okx, @Bybit_Official, and second-tier exchanges, so I have some shallow experience.

It's been a turbulent spring recently, and the topic of market makers has also been in the spotlight. I've always wanted to talk about the special role of market makers in the industry in a systematic way, and I took this opportunity to do some sorting out. My business is not very proficient, and if there are any omissions, please forgive me. This article represents my own views and is 100% written by me. If you find it helpful, I hope you can help me by following, liking, and helping the worker to hit his KPI, thank you.

Starting from the "observation label" of GPS...

I was chatting with a project team founder I've known for over a year, who plans to list on an exchange in Q2, when I heard that Binance had put an "observation label" on GPS. This young man is very capable and handsome, but you can hear the fatigue in his tone - the project has raised a few Mil, achieved some good results, and everything seems to be going well, but for the founder, the money raised is actually debt, a year of constant pivoting, the market is so difficult, trying to close a new round of financing on one hand, negotiating with top-tier exchanges on the other hand, and worrying about the recent token price crashes, how to account to investors, the bitterness, worries and confusion can only be understood by those who have done projects... Just as we were chatting, Binance's notice suddenly caught our eye, and although we didn't have any market making cooperation with the project, we've been in touch with the team members for the past two years, and we were suddenly full of emotion.

I won't analyze or comment too much on this matter, as I don't want to be a long-tongued nuisance. Let's wait for Binance and the project team's notifications and announcements. But over the past two years, I've seen too many project teams and retail investors being scammed by market makers, so I took this opportunity to write this article, hoping to help project teams and industry friends. Okay, enough chit-chat, let's get down to business.

The Business Model of Market Makers: Not as Mysterious as Rumored, Just "Placing Orders"

Market making is not a new term in the crypto industry, as there are also "market makers" in the traditional finance industry, but this service has a more relaxed name, called Greenshoe. Although the mechanism is slightly different, the responsibilities are basically the same, which is to provide two-way quotes in the IPO to maintain market liquidity and relatively stable prices. However, due to strict compliance regulations, the Greenshoe business is a very standard trading desk business with little "oil and water", and not even a large trading desk will PR it as a separate business. But ironically, this standard business has become a mighty sickle in the eyes of many people in the crypto industry.

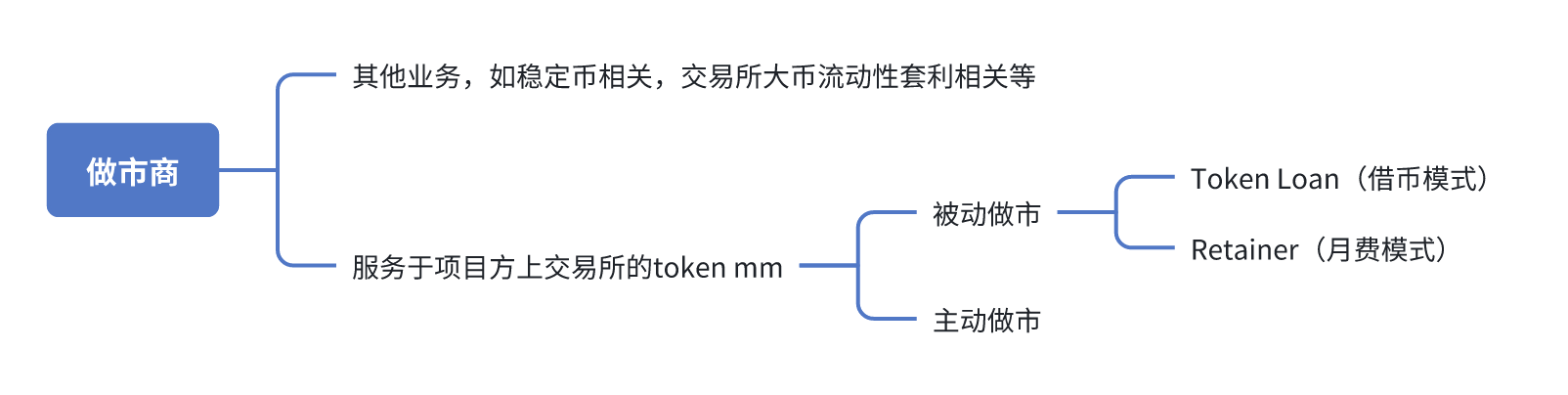

However, if market makers really follow industry standards to provide liquidity, there's nothing to do with the so-called "sickle". The so-called provision of liquidity is mainly to make two-way quotes on the trading order book. Of course, the crypto industry's broad sense of market makers also has some other categories and businesses, but today we'll just focus on the narrow category that serves the token listing of project teams, which can be roughly divided into the following business models:

Active Market Makers

Much of the demonization of market makers in the industry actually comes from the existence and operations of active market makers in the early days of the industry. There's a Cantonese saying "doing the kitchen", which in Mandarin is called "doing the yard", and active market makers satisfy all the fantasies of the "market makers". Generally, active market makers will cooperate directly with project teams to manipulate market prices, inflate or suppress, and profit from it, harvesting the market's retail investors, and sharing the profits with the project teams. Their cooperation terms are also diverse, involving borrowing tokens, accessing APIs, leveraging, profit sharing, etc. There are even rogue market makers who don't communicate with the project teams, but directly use their own capital to grab the tokens, and then operate the market themselves after accumulating enough tokens.

Who are the active market makers in the market? In fact, the active market makers who are PR-ing, holding events, and are relatively well-known, are all passive market makers, at least they have to claim to be, otherwise they will have compliance issues, let alone do marketing openly (but it's not ruled out that some market makers have done some active cases in the early days of the industry, or are still secretly doing it now).

Most active market makers are very low-key, and don't have a name, because they are non-compliant. As the industry has become more regulated, the previously high-profile ZMQ and Gotbit have been pointed out by the FBI and are in serious compliance trouble, and the remaining active market makers are also more incognito. Some of the bigger ones have done some so-called "successful cases", so they have "local status", and their main deals are through personal referrals.

Passive Market Makers

Passive market makers, including ourselves and many other peers, belong to this category, and their main job is to make maker orders on the order book of centralized exchanges to provide market liquidity. The business model is mainly divided into two types:

- Token Loan

- Retainer

Token Loan

This is the current mainstream and most widely used cooperation model. In simple terms, it's a model where the tokens are lent to the market makers for a certain period of time, and the market makers provide market making services.

A typical token loan deal consists of several aspects:

- Loan amount x%: Generally a percentage of the token's total supply

- Loan term x months: The duration of the loan, and the service will be settled according to the pre-signed option upon expiration

- Option structure: The settlement price for the market makers at the end of the service

- Liquidity KPIs: The depth of the orders the market makers will maintain on the order book, possibly involving different exchanges and price ranges.

How do market makers make money in this model?

Market makers make money in two parts, one is the spread between the buy and sell orders they place, which is generally a small part; the other is the option given by the project team to the market makers, which is generally the main part.

If you're familiar with finance, you may know that every option (option) has value on the first day it's signed, which is a percentage of the value of the borrowed tokens. For example, if I borrow a total of 100w tokens, the value of this option on the first day is 3%, which means that if I strictly neutrally follow the algorithm (delta hedge) to place orders, I can realize a relatively certain $30,000 gain. So in general (excluding extreme cases like the token price skyrocketing or quickly going to zero, as these market conditions can't be effectively delta hedged), the trading desk's profit from signing this cooperation is $30,000 + some spread earned from order placement.

Does it feel like market makers aren't making as much as imagined? But in fact, the profit margin I'm talking about is not completely divorced from reality, as market makers are also very competitive now, and the option prices with competitiveness also have less and less water.

Retainer (Monthly Fee Model)

This is currently the second relatively mainstream model, which means that the project party does not lend the tokens to the market maker, but retains them in their own trading account, and the market maker accesses the market making through the API. The advantage of this model is that the tokens are still in the hands of the project party, and all the operations in the trading account are transparent to the project party, so the project party can withdraw the funds from the account at any time, so there is no need to worry about the risk of the market maker doing harm. However, in this model, the project party needs to prepare tokens and U in the account for two-way order placement, and generally needs to pay a monthly service fee to the market maker. In this case, the market maker places orders according to the customer's liquidity KPI, and the monthly service fee is what they earn. The funds in the account are not related to the market maker, and in the extreme case of poor liquidity/needle insertion, the order placement will lose money, and these losses are borne by the project party. I think Token Loan and Retainer each have their own advantages and disadvantages. Some trading platforms will only focus on one of them, and some like us can do both. The project party should choose based on their own needs and project situation.Several common misconceptions

Market makers are responsible for "pulling the market", "drawing lines" and "building mouse traps" Qualified passive market makers are relatively neutral and will not actively participate in market manipulation, market capitalization management, or harvesting. Market makers providing liquidity is "wash trading" The order book on the exchange has two types of orders, maker orders and taker orders. Passive market makers mainly place maker orders, and the proportion of taker orders will be very small. Even if the maker orders placed on the order book are deep, if there are no counterparty takers to trade, it cannot directly increase the trading volume. However, if the market maker trades with their own maker orders, i.e., "self-trading", there may be compliance risks, and top exchanges will also strictly scrutinize this behavior. If the self-trading ratio is too high, the market making account and tokens may face warnings and actions from the exchange. So it seems that passive market makers are not very useful? Not directly responsible for coin price or trading volume, it may seem that way. But good liquidity is the foundation of everything. Small-scale money cares more about price trends, while large capital inflows first look at trading volume and depth. A token with active trading and healthy prices is closely related to the product strength and marketing capabilities of the project party, and indeed requires close cooperation from market makers. Even if we take a step back, top-tier exchanges will rarely let you list without professional market makers, otherwise it will likely be a mess at launch, so market makers need to be registered in advance. So at this stage, cooperating with passive market makers is a must-have step for every project party that wants to list on top CEXes. It sounds like market making is just order placement, and the threshold is not high, so the project party can do it themselves? Yes and no. If you do have an in-house trading team and the project is relatively large, some second-tier exchanges may allow you to do it yourself. But if you don't, or need to build a new team, I still recommend letting professionals handle it. On the one hand, the cost and risk of building a team is not worth it compared to finding a reliable market maker. On the other hand, if you are not familiar with market making, you will actually lose a lot of money when facing various extreme market conditions.The ecological position of market makers: opening liquidity is the most valuable resource

After popularizing the business models, let's talk about the current situation, which may better help you understand. What will the crypto world be like in 2024-2025? From the perspective of liquidity, I see it this way: 1. BTC has an independent market, rising all the way up, with sufficient top-tier liquidity. There has been a recent pullback, but the foundation is not shaken, with miners' mining costs starting with 5 or 6, very happy, and traditional institutions rushing in are also happy. 2. The tail-end PVP is fierce, and liquidity was once relatively abundant. @pumpdotfun, @gmgnai, @solana, @base and @BNBCHAIN's small players are losing money with great enthusiasm (I've also contributed a bit, damn it), and outliers and insiders are also happily making money. 3. Waist-level liquidity is depleted. This wave with trump and libra has almost drained the liquidity and buying power of the waist-level tokens, and it has been structurally and irreversibly absorbed from the inside to the outside. Tokens with market caps from hundreds of millions to tens of billions are in an awkward position, with new tokens listed on top-tier exchanges having no buyers, and trading volume and depth mostly occurring at launch, quickly falling below the VC's primary price, and most likely losing money when VC unlocks and team tokens unlock. This cycle, these waist-level tokens seem to be having the toughest time. But another cruel fact is that over 90% of the so-called "web3 native" practitioners in our industry, including VCs, project parties, accelerators, BD, marketing, developers, etc., are actually doing business with these centralized exchange waist-level tokens. If you look at investment and financing, product development, market promotion, haircut, and exchange listing, it is actually centered around these centralized exchange waist-level project parties. So this cycle, many practitioners have not made money, and their days have not been good either. Only market makers, I think, hold the scarcest resource of the waist-level tokens: "opening liquidity". Yes, just having liquidity is not enough, the liquidity needs to come early, be there at launch, otherwise, when the project goes to zero, having a lot of tokens is useless. A project's opening circulating supply may be 15%, and 1-2 percentage points, or even more, are given to market makers. This opening, immediately unlocked liquidity is an extremely valuable resource in the current market. Therefore, not only are market makers becoming more and more competitive, but many VCs and project parties have also joined the fray to temporarily build teams to do market making. Some teams even lack basic trading capabilities, but they still take the tokens first and figure it out later, since they'll end up going to zero anyway, and they're not afraid of not being able to pay back.The dark forest of Gresham's law: honest, contributing personalities are no match for "scumbags"

Under this market evolution, the ecology of market makers has become very unique today: on the one hand, there are more and more market makers, and the bidding has become outrageous; on the other hand, the service quality and professional capabilities vary greatly, and various after-sales problems often occur, the most common of which is withdrawing liquidity and defaulting to dump the market. First of all, let's make it clear that market makers are not prohibited from selling tokens. In fact, if the token price skyrockets, the algorithm will naturally shift the order placement towards the sell side, because the tokens I borrowed need to be settled with U in the end (those who don't understand can re-read the token loan option part). But a qualified passive market maker should place orders normally according to the algo, rather than being a taker and dumping hard, which is extremely damaging to the project. Why would market makers do this? Going back to the option part we just discussed, if a market maker gets a token loan quota, and places orders normally according to the algo, if the market is lukewarm, they should successfully realize the value of the option and make 3%. But if they believe the project will go to zero at the time of settlement, they can realize 100% of the profit by dumping the market at launch, which is 33 times the normal market making profit. Of course, this is the most direct and extreme example, and the actual operations will be much more complicated, but the underlying logic is that they see the token as bearish, and want to sell it off when the price is high and liquidity is good, and then buy it back for settlement. Of course, in addition to being unethical and non-compliant, this also carries additional risks. On the one hand, the market maker completely fails to provide liquidity according to the KPI within the contract period, because they don't have a healthy inventory; on the other hand, if they bet the wrong way on the token, they will lose a lot of money and be unable to pay back.Why is this behavior so common?

Compliance in the industry is still in its early stages. In the case of the token loan model, while market makers provide project parties with daily reports, weekly reports, and dashboards to report on service conditions, and there are also third-party supervisory institutions and tools in the market, the activities of the Bits in the market maker's account are still a black box, and the market lacks effective regulatory measures. After all, the only ones who have conclusive evidence and can see every trade made by the market makers are the centralized exchanges themselves, but many of the market makers are customers of the centralized exchanges' V8 and V9, bringing in hundreds of millions in commissions and deposits each year, and the exchanges have an obligation to protect the privacy of their customers, so how could they possibly disclose the trading details to the project parties to help them safeguard their rights? At this point, I can't help but admire @heyibinance @cz_binance for their decisive action. As far as I know, this is the first time the trading details of market makers have been fully disclosed, including the precise timing down to the minute, the operational details, and the cash-out amounts. Whether this behavior should be done is worth considering, but the original intention must be good.

The project parties, including the entire industry, still need to strengthen their understanding of market makers. In fact, what surprised me the most was that I have talked to many top-tier investors, founders of projects that have raised tens of millions of dollars, and even employees of exchanges, and they are not very familiar with this profession of market makers, which is also an important reason why I decided to write this article. Because most project parties are actually "first-timers", but the market makers are "scumbags" who have been through it all. As a frontline practitioner, sometimes when I see project parties choosing the so-called "better terms", I also ask myself, should I also match the outrageous terms offered by competitors and get the deal done first? In this dark forest of market makers, it is difficult to hold the bottom line, and the pretentious scumbags are always more attractive than the honest and upright, and it is only when everyone's understanding of the industry is aligned that we can avoid the continued occurrence of bad money driving out good.

How to choose your market maker

There are a few important questions and tips that I think are important.

Is it always a bad idea to choose a proactive one?

Actually, when project parties ask me this question, I won't categorically say don't choose them. If we put aside compliance, I think this is a debatable question. Some projects have indeed brought better charts, more trading volume, and more cash-outs through close cooperation with proactive market makers, but the number of those who have messed it up is also countless. Here I just want to express one point of view, you need to be aware that those who can truly help you pull in real money will also not hesitate to cut you, and the market's liquidity is limited, at the end of the day, you are opponents, the market's money either you earn it or your proactive market maker earns it.

Should you choose token loan or retainer for the cooperation model?

Currently, the token loan model is still more mainstream, but the market share of the retainer model is slowly rising. This is a matter of the project party's taste and needs, for example, projects with strong capital control may not want to have uncontrollable large liquidity from the outside, and so on.

Try not to choose only one passive market maker

Don't put all your eggs in one basket, you can choose 2-4 market makers, and compare the terms with each other. If one of them goes down, the others can fill in. In addition, market makers usually propose various additional value-adds in order to win the deal, choosing multiple parties can get you more help. However, to avoid the problem of "three monks have no water to drink", it is recommended to assign different exchanges to the market makers, as mixing them together will make it much more difficult to monitor.

Don't just choose your market maker based on their investment

You can accept the investment of market makers, and having more runway is always a good thing. But you also need to understand that the investment of market makers is not the same game as VC investment, because they control a considerable portion of the opening liquidity, market makers can easily lock the price and hedge the tokens that are still locked up, so the token loan taken by market makers may not be 100% a good thing for the project party.

Don't just choose your market maker based on liquidity KPIs

Liquidity KPIs are very difficult to verify in practice, so don't just choose a market maker based on liquidity KPIs, no matter how beautifully the terms are written, if they can't deliver, it's useless. Before lending the Bits, you are the father, but once the Bits are lent to the market makers, you become the son, and they have many ways to fool you.

Change your mindset: be the "scumbag" yourself

Remember that you are the client, before signing the MM, compare the terms more, discuss how to monitor and prevent the market maker from defaulting, and choose the solution that suits your project's development. You can use the terms of one party to pressure the other, go back and forth to compare the terms, and don't have any ambiguity in the terms, if there are any unclear points, just ask directly.

A few thoughts

I am a junior in the industry, and I feel very fortunate to have the opportunity to perceive and touch the industry in such depth. I often feel the dirtiness and chaos of the industry, but also the vitality and energy. I have never considered myself to be the smartest of the bunch, there are many excellent young people in the industry of the same age as me who have quickly found their place, but more young people are actually very confused, and if it weren't for the web3 industry, it would be difficult for them to find a channel for upward mobility.

I also have a highly principled boss and a professional trading team doing the backend. The stable asset management business allows us to not rely on the market making business to support the team, but to use the market making business to make friends. I have also been following my own pace, with the logic of making friends with project parties, missing out on some deals, but also talking to a few deals that I'm proud of, and some projects that didn't turn into business, but I've also become friends with the project parties.

I've rambled on a lot, and I was very conflicted about the process of releasing this article, on the one hand afraid that my business is not skilled enough or that my expression is not good enough, misleading the project parties and readers, and on the other hand, market makers have always been taboo in the industry, and I'm also afraid that I'll talk about this and not get the scale right, and step on someone's toes.

But I really believe that as the industry develops and compliance gradually becomes the mainstream, the role of market makers will no longer be demonized and will return to the sunshine. I hope this article can play a small part in that.