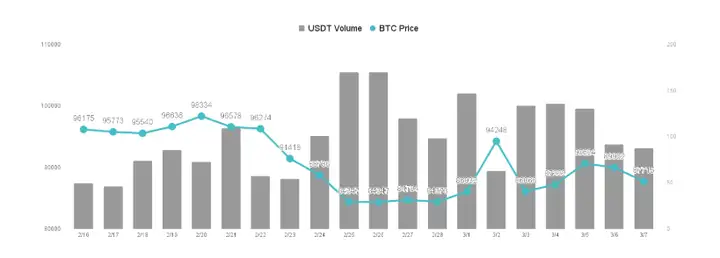

The cryptocurrency market in the past week has been mainly centered around "Trump's tariff policy changes" and the newly signed "Bitcoin Strategic Reserve Executive Order", which has caused Bitcoin prices to fluctuate wildly in the range of $80,182 to $93,323. This is not a good thing for the market, indicating that market liquidity is poor, and investors are prone to changing their investment preferences with policy, and they are mainly short-term speculators. The cryptocurrency market still needs some time to sort out.

VX:TTZS6308

The price of Bitcoin currently remains above $81,000, down 12.2% in the past week; Ethereum's performance is even weaker, with a weekly decline of 16.8%, continuing to lag behind the overall market performance. The main reason is that the Ethereum ecosystem is still being eroded by other DeFi main chains in terms of market share. Currently, investors' interest has turned to more policy-themed competing coins such as Ripple (XRP), Solana (SOL) or Litecoin (LTC).

The current market trend is also quite simple, and trading themes fluctuate completely with Trump's policies. As long as the tariff war intensifies, including Trump's unilateral announcement of tariffs and other countries' corresponding retaliatory tariffs, the crypto-evasion market will fall, and vice versa. Since it follows Trump's personal will, it is difficult to predict, and we can only reduce the contract leverage as much as possible to avoid forced liquidation due to excessive price fluctuations.

On the other hand, the general economic data were released last week, the most important of which was employment data. The U.S. Department of Labor reported that the unemployment rate rose to 4.1% last month, indicating an increase in the number of part-time workers. Economists believe that the Trump administration's trade policy changes have made it difficult for companies to plan for the future, causing the Nasdaq index to enter a downward correction range.

Nonfarm payrolls increased by 151,000 in February, lower than market expectations, and the January data was revised down to 125,000. Employment growth mainly came from the healthcare industry (52,000), the financial industry (21,000) and the transportation and warehousing industry (18,000). However, the federal government laid off 10,000 employees, and the overall government sector added only 11,000 jobs, indicating that government spending cuts have affected employment, verifying what we mentioned earlier that under the Trump administration's spending cuts, employment data will definitely weaken, thereby increasing the probability of a US interest rate cut.

In the general trend of interest rate cuts, in addition to the tariff war, another major event last week was the announcement by David Sacks, the White House cryptocurrency czar, on March 6 that Trump signed an executive order to establish a "strategic bitcoin reserve." The reserve will be supported by bitcoin assets obtained by the U.S. government in criminal or civil forfeiture proceedings. It is estimated that the U.S. government currently holds about 200,000 BTC. Although the market is currently falling due to insufficient expectations, this will not have a significant impact on medium- and long-term price growth.

Wait for the market to sort out sentiment, the bull market remains unchanged

In addition, the executive order requires a comprehensive inventory of the federal government's digital assets and stipulates that Bitcoin in the reserves will be treated as a store of value and will not be sold. In addition, the executive order will also establish a digital asset reserve in the United States, which will include not only Bitcoin, but also other cryptocurrencies confiscated by the government.

But the most surprising thing about the entire executive order is that it clearly states that the US government will not purchase additional cryptocurrencies other than Bitcoin, such as Ethereum (ETH), Ripple (XRP), Solana (SOL) and Cardano (ADA). The overall response of the cryptocurrency industry to this executive order is positive, and it is basically believed that cryptocurrencies are equivalent to valuable assets, especially Bitcoin, which is comparable to the status of digital gold.

Nevertheless, the cryptocurrency market plunged after the announcement, with Bitcoin prices plummeting by $5,000 in a short period of time, from $90,000 to $85,000, before recovering to $87,000, while Ethereum fell 5% to $2,150. XRP, SOL and ADA fell 8%, 7% and 10% respectively.

The reason for the sharp drop in the cryptocurrency market is also quite simple. Originally, a small number of institutional investors believed that the United States would use taxpayers' money to "actively" purchase Bitcoin, but now it has simply changed to not selling the confiscated Bitcoin and cryptocurrencies, which is inconsistent with market expectations. In addition, the currency only includes Bitcoin, and there is no "Altcoin" as Trump mentioned at the beginning. In the end, there was disappointment selling pressure, but it was not considered particularly serious.

The reason is that the original market expectations for Bitcoin reserves were not too high. The focus of the market has always been on a relaxed and clear regulatory environment, promoting the development of the U.S. DeFi industry, and attracting global blockchain-related startups to enter. Assuming that Bitcoin plummets because Trump’s Bitcoin reserve policy is not as expected, then it will be a very good buying opportunity, because Bitcoin is being sold irrationally by investors. With the friendly supervision of the Trump administration and the foreseeable trend of interest rate cuts in the United States in the future, coupled with the blunting of the negative impact of the tariff war, as long as the U.S. stock market rebounds, cryptocurrencies will also rebound in tandem. We are still optimistic about Bitcoin’s subsequent market performance.

The strategic reserve was approved, but the market has been declining. This is in line with what we said last week: don't be too optimistic about the market. If it falls below the 90,000 band, you must exit. The current market trend is also within expectations. Observe the strong support level of Bitcoin 80,000 and Ethereum 2,000 during the day. Players on the left can enter the market at this position, or use the pyramid building method; players on the right can wait for obvious bottoming signals to appear before making arrangements.