Author: Haedal Protocol

Compiled by: TechFlow

1. Why do we need LSD?

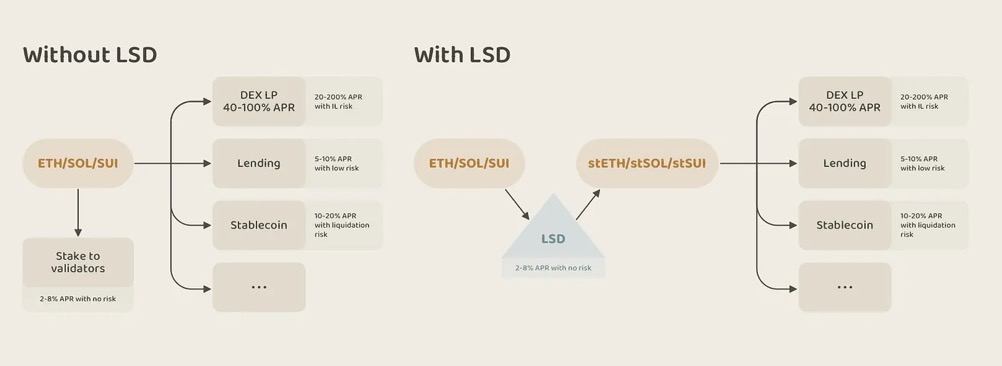

LSD (Liquid Staking Derivatives) is one of the most classic and fundamental protocols in the DeFi market. Nowadays, most blockchains rely on staking their native tokens to ensure network security and incentivize participants through staking rewards. This model, together with transaction fee revenue and lending fee revenue, constitutes one of the most basic revenue mechanisms in the entire crypto field, and is also a core component of DeFi.

However, simple token staking is not efficient in terms of capital efficiency. At this point, Lido introduced an innovative solution: Liquid Staking Tokens (LST). In this system, the staked tokens are wrapped into a "certificate token" that can circulate freely in the DeFi market. Essentially, it decouples the functionality and financial value of the native token, allowing the two to coexist.

This model unlocks huge potential for crypto users. By staking tokens like ETH, SOL or SUI on the native chain, users not only receive staking rewards, but also obtain 1:1 equivalent LST. These LSTs can then be used in various DeFi applications, such as decentralized exchanges (DEXs), lending platforms, and collateralized debt positions (CDPs). This way, it has spawned many "one-token, multi-yield" strategies and compound strategies, attracting more capital and holders.

Image: LSD allows users to simultaneously earn staking rewards and DeFi yields, and achieve both in a composable manner

For each ecosystem, the native token is its most unique and valuable asset. How to unlock the huge financial value locked by validators while ensuring network security is crucial for any ecosystem.

2. The status and challenges of LSD in the Sui ecosystem

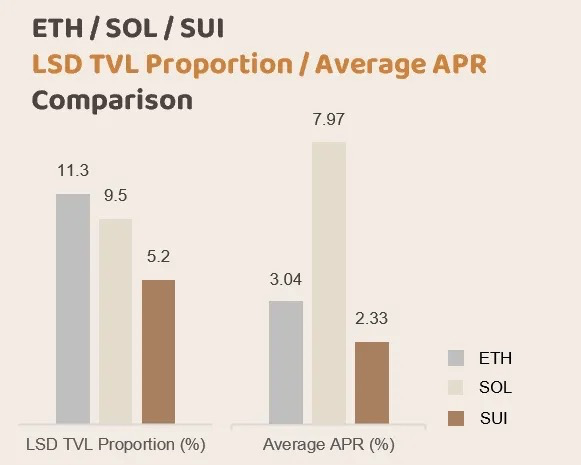

As a relatively new ecosystem, Sui's LSD development history is short. The following statistics show that Sui's LST staking ratio is still relatively low compared to its market capitalization, especially compared to ETH and SOL. The fundamental reason is that Sui's current staking annual percentage rate (APR) is relatively low.

Currently, the average APR of LST in the Sui ecosystem is around 2.33%, and the direct staking APR of many validators even fails to reach this level. In comparison, Lido's APR is around 3.1%, while Jito's APR is as high as 7.85%. For holders of Sui's native tokens, such returns are not enough to incentivize them to move their tokens from centralized exchanges (CEXs) to the Sui chain environment.

In the fierce competition between public chains, on-chain liquidity is crucial. From the successful experiences of ETH and SOL, high-yield, low-risk LSTs, and the corresponding DeFi scenarios, are a necessary prerequisite for the prosperity of any ecosystem's DeFi. Therefore, we emphasize that the top priority for any LSD protocol is to increase the APR level of LSTs in the Sui ecosystem.

3. The evolution of LSD product strategies

To increase the APR, LSD protocols should consider both cost reduction and revenue increase.

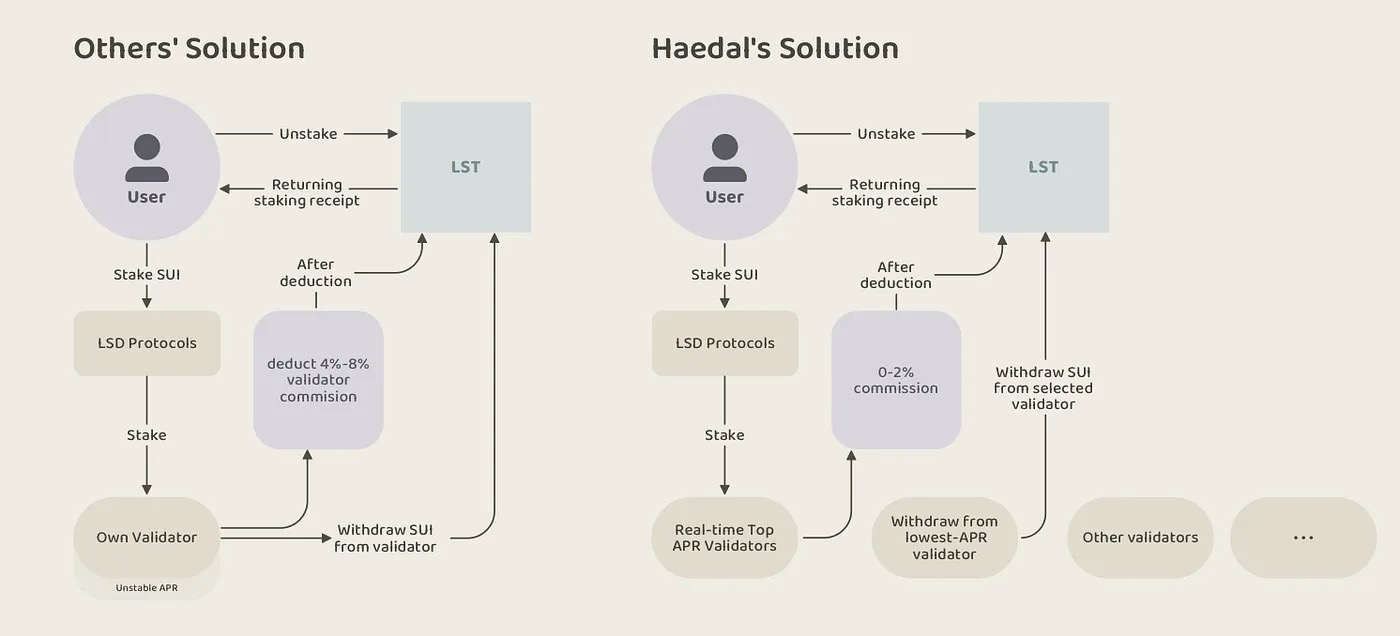

Cost reduction is a direct strategy. We need to learn to be "smart stakers", choosing the most cost-effective validators, i.e., those with the highest yields. This mainly depends on two factors: the validator's APR and the commission rate they charge. The base APR is usually determined by these two dynamic factors.

Currently, most LSTs on Sui are validator-based, meaning each LST token is tied to a specific validator. While this is not inherently problematic, it cannot guarantee that the validator's APR is the highest. Additionally, most validators charge a 4%-8% commission, further reducing the final APR of the LSTs.

Haedal Protocol provides a dynamic validator selection feature. It continuously monitors the status of all validators on the network and selects the validators with the highest net APR (usually charging 0%-2% commissions) during the staking process. Similarly, when users unstake, Haedal will select the validators with the lowest APR for withdrawal. This dynamic approach ensures that haSUI always maintains the highest native APR in the entire ecosystem.

While cost reduction can help us achieve higher APRs within the system constraints, it cannot break through the economic model's issuance limits. On the other hand, increasing revenue means finding other revenue sources for this protocol, especially through the DeFi ecosystem.

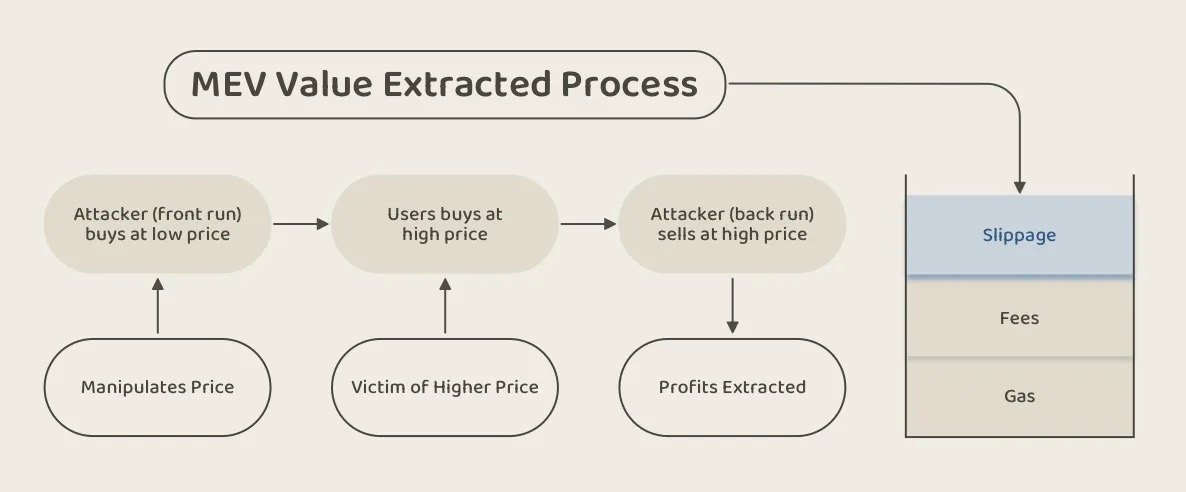

As mentioned earlier, there are only three stable and sustainable revenue sources in the crypto world: staking, lending, and trading. LSD protocols are naturally suited to leveraging trading to increase revenue. For example, the well-known LSD project Jito on Solana has chosen to optimize trading revenue through MEV (Maximum Extractable Value).

On-chain transaction costs are high. Users face slippage, transaction fees, and gas fees in every transaction. MEV services (such as those provided by Jito) profit from user slippage. Jito provides efficient MEV infrastructure for Solana validators, optimizing transaction order to capture MEV opportunities and distributing the resulting profits.

Image: Sandwich attacks severely impact the transaction experience and outcomes

However, we believe that MEV is a product of DeFi's immaturity. If we become obsessed with MEV and treat it as a fixed transaction cost, it may lead to on-chain transaction costs being ten or even a hundred times higher than centralized exchanges, making it difficult to compete with centralized products. Additionally, the slippage costs caused by MEV are something users are unwilling or unable to bear.

Given the recent community and developer discussions about MEV on Sui, it is clear that the focus is shifting towards anti-MEV. We fully agree with this view and see MEV as a challenge to the entire ecosystem, not a solution. Therefore, we propose a new solution: extracting value directly from the transaction flow process. We call this product Hae3.

4. Hae3: Extracting Value from the Ecosystem's Transaction Flow

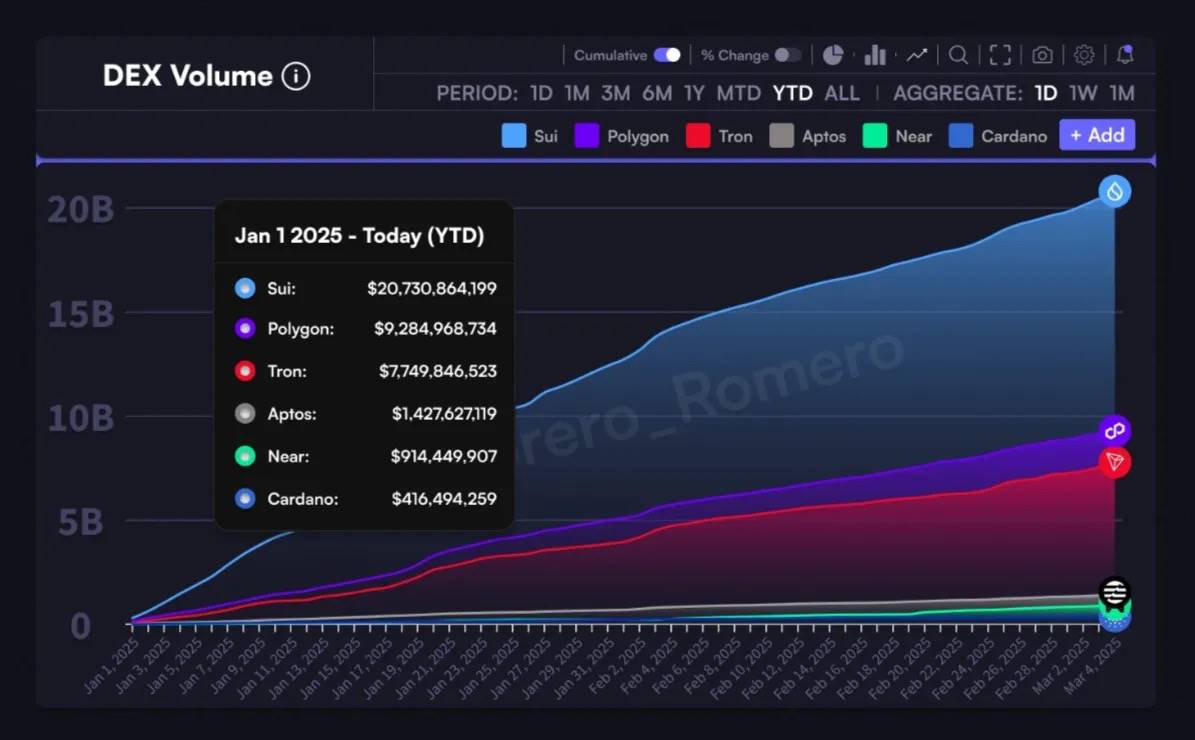

In recent years, Sui's on-chain transaction volume has grown rapidly. According to Defilama data, since the fourth quarter of 2024, Sui's DEX trading volume has far exceeded that of established mainstream ecosystems like Polygon, Tron, and Avalanche.

Acknowledgment: https://x.com/Torero_Romero

This surge in transaction volume means significant fee revenue, which is a healthier and more sustainable way of profiting. We believe this is the true "dividend" of the blockchain world.

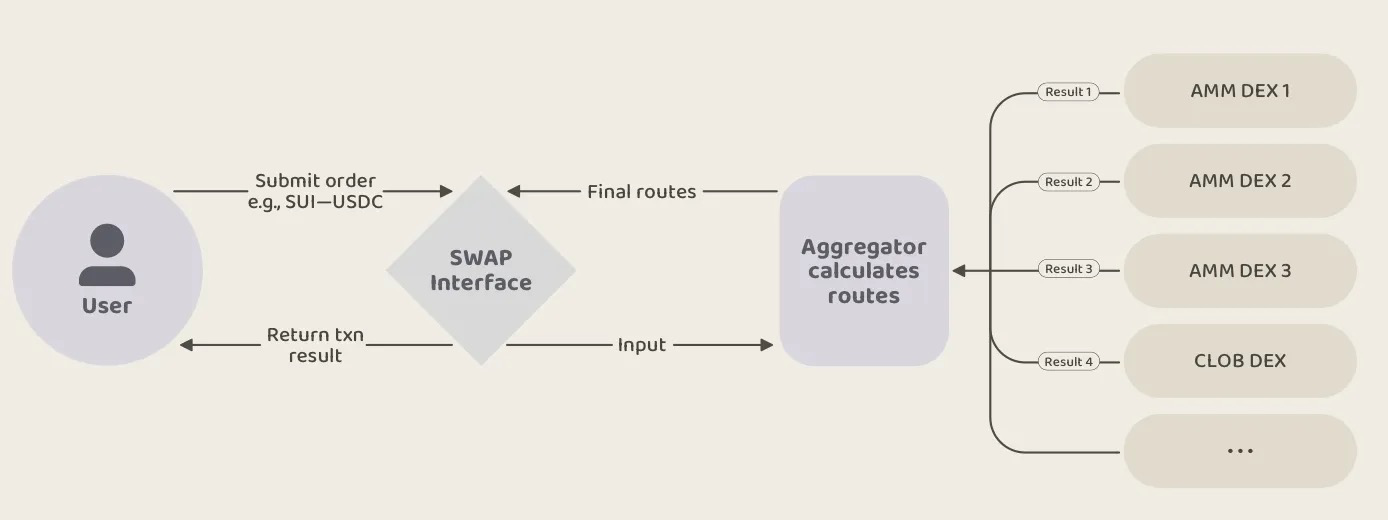

Currently, most transactions on Sui are initiated through aggregators (as is the case in most ecosystems). After a user initiates a transaction, various AMM DEXs (such as Cetus) and CLOB DEXs (such as Deepbook) provide quotes based on their liquidity pools or order books. The routing system calculates the optimal path and completes the transaction.

In this context, how can we capture the transaction flow and extract profits from it? Haedal proposes two strategies:

4.1 Haedal Market Maker (HMM): Oracle-based market-making algorithm

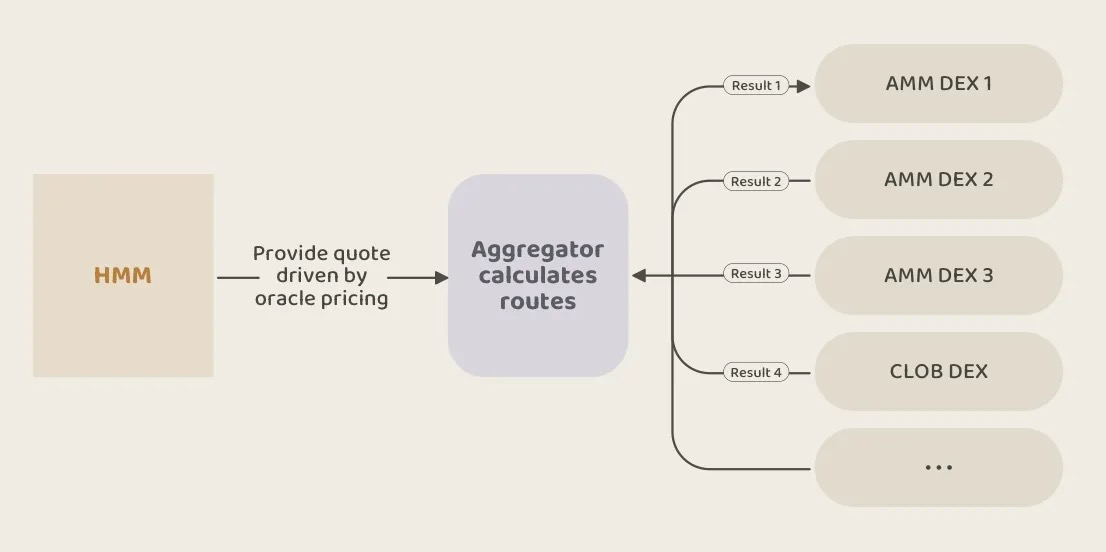

In a previous article, we introduced Haedal Market Maker (HMM). The core idea is that the pricing of the top 200 mainstream market assets is still dominated by centralized exchanges (CEXs), while the liquidity pool prices on decentralized exchanges (DEXs) often lag behind the latest market prices. By utilizing oracles that combine multiple data sources to generate fair market prices, we can gain a competitive advantage in our quotes during the price aggregation and transaction routing process.

Based on this approach, we have developed HMM, an oracle-based market-making algorithm, and integrated it into the aggregator. HMM has the following three core functions:

Providing Centralized Liquidity Based on Oracle Pricing: Unlike other DEXs that determine prices based on the state of the liquidity pool, HMM's prices are always based on oracle pricing. The oracle provides price updates at a high frequency (every 0.25 seconds) to ensure that the liquidity in the aggregator is always consistent with the "fair market price".

Automatic Rebalancing and Market Making: The liquidity of HMM will be automatically rebalanced based on the state of the assets, capturing market fluctuations and utilizing a "buy low, sell high" strategy, which may potentially convert Impermanent Loss into Impermanent Profit.

Anti-MEV: HMM is inherently capable of defending against MEV (Maximum Extractable Value) attacks, ensuring that trading profits are not eroded by front-running or sandwich attacks.

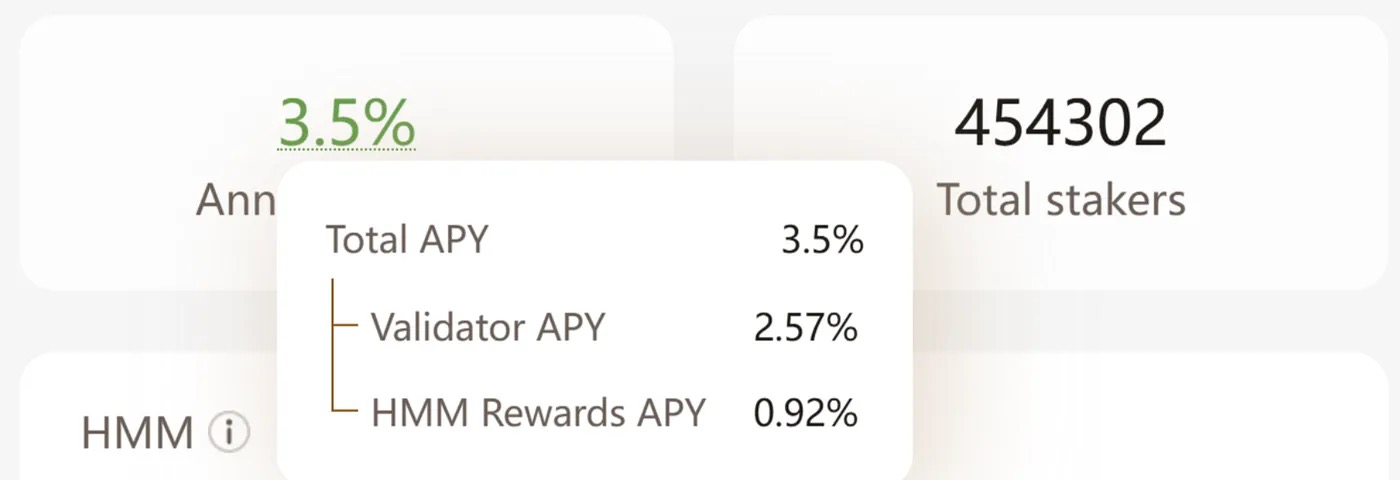

After two months of beta testing, HMM has captured approximately 10-15% of the total DEX trading volume in the aggregator, while its total locked value (TVL) is only around $850,000. This performance has significantly improved the APR of haSUI, which is currently stable at 3.5%, far exceeding other LSTs in the Sui ecosystem. It is worth mentioning that HMM has contributed an additional 0.92% APR growth to haSUI.

4.2 haeVault: Enabling Regular Users to Participate in Liquidity Provision like CEX Market Makers

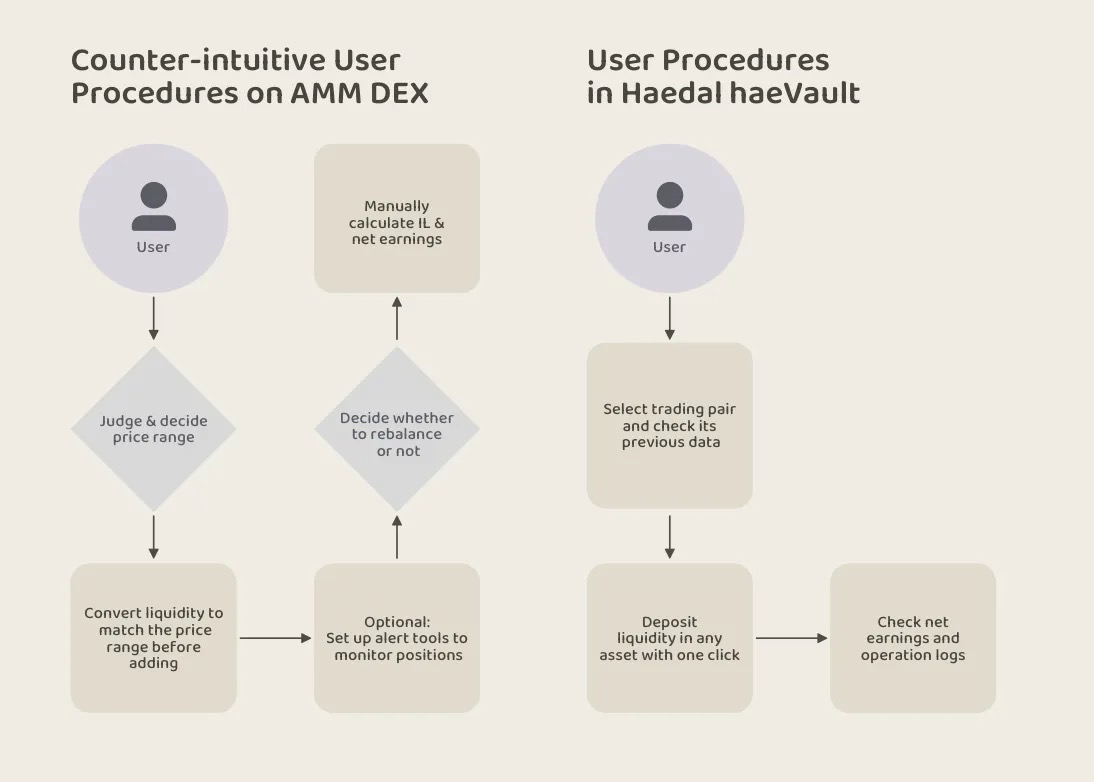

One of the main problems with current DEX products is that the barrier for regular users to become liquidity providers (LPs) is too high. In the mainstream CLAMM algorithm (the most commonly used AMM algorithm on Sui), if users want to provide liquidity for the SUI-USDC liquidity pool, they need to handle the following complex tasks:

Determining the Price Range: Users need to make subjective judgments on the price range.

Adjusting Liquidity: Dynamically adjust liquidity based on the set price range.

Monitoring Position Status: Continuously monitor whether their liquidity is "out of range".

Deciding Whether to Rebalance: Determine whether to perform rebalancing operations on their positions.

For most users, this entire process is neither natural nor efficient, greatly increasing the participation threshold. Due to concerns about Impermanent Loss and incorrect decision-making, most regular users are unwilling to invest a large amount of funds in DEXs to earn high returns, or they only choose to provide liquidity in extremely conservative price ranges, which often significantly reduces their return performance. For reference, the average APR of the SUI-USDC liquidity pool on Sui is around 150%, while full-range or ultra-wide-range liquidity providers may only be able to obtain 10%-20% APR. Some users even have a more persistent pursuit of low or zero Impermanent Loss risk, so they tend to choose lending or staking, which typically only offer single-digit APRs.

So, who is earning these high returns in the DEX market? The answer is professional on-chain LPs. By simulating the market-making strategies of CEXs, professional LPs usually provide liquidity in ultra-narrow ranges and execute rebalancing and capital hedging operations through self-built monitoring bots and programs. They have been earning super-high returns that ordinary users can hardly reach.

Is there a way to allow regular users to easily participate in liquidity provision and enjoy strategies similar to professional market makers? This is the mission of haeVault.

haeVault builds an automated liquidity management layer on top of AMM DEXs. It can automatically adjust liquidity based on token price fluctuations and rebalance positions based on key indicators. haeVault simulates the professional strategies of CEX market makers, but is designed specifically for DEX LP users. While CEX market makers profit from "buying low and selling high", haeVault earns trading fee income through its active liquidity on DEXs.

Core Functions of haeVault:

Ease of Use: Users only need to deposit any asset with one click to participate.

Transparency: Users can clearly see their own profit and loss (PnL).

Fully Automated Management: Apart from deposit and withdrawal operations, users do not need to perform any other actions.

High Yields: With the help of professional strategies, users will receive more competitive returns compared to other LPs.

Unlike HMM, haeVault will be directly open to all users, and its design is naturally suitable for attracting a large amount of capital. Once haeVault accumulates sufficient TVL, it has the potential to capture a large amount of trading fee income from mainstream assets on DEXs.

Currently, we plan to launch the Alpha version of haeVault in a few weeks, so stay tuned.

4.3 haeDAO: Community and Protocol-Controlled Liquidity

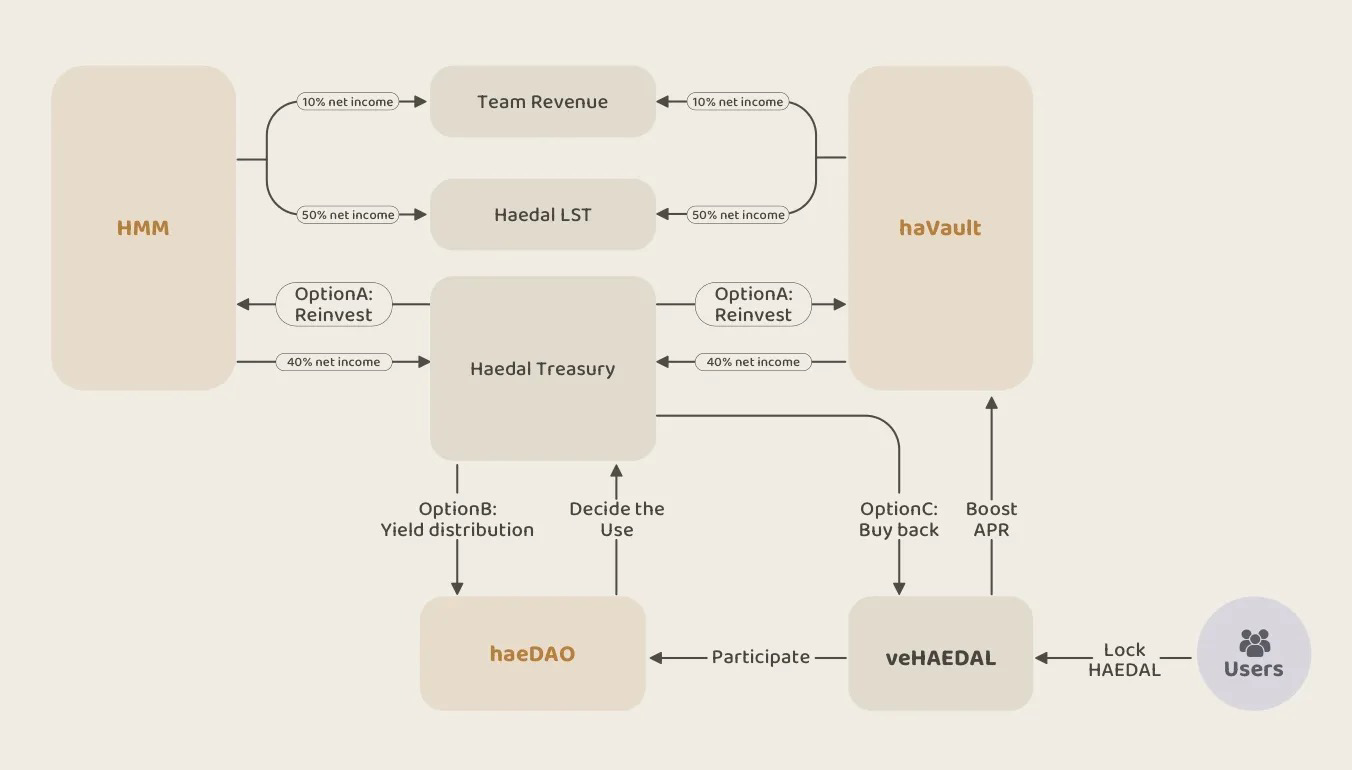

HMM and haeVault will deeply integrate with existing aggregators and DEX systems to provide better liquidity depth and reduce slippage for transactions on Sui. As the TVL of these two products continues to grow, we are confident that Haedal will capture a large amount of trading fee income in the Sui ecosystem.

Profit Distribution Mechanism:

50%: Used to improve the APR of Haedal LSTs.

10%: Allocated to the team to ensure the long-term sustainability of the protocol.

40%: Allocated to the Haedal Treasury as the protocol's own liquidity (POL).

Initially, the treasury funds will be reinvested into Haedal's products to expand liquidity. As the products mature, we will introduce HaeDAO to manage the treasury and empower Haedal's tokens and community.

Haedal tokens (HAEDAL) can be locked to obtain veHAEDAL (tentative name), which will grant the following rights in haeDAO:

- Governance of the Haedal Treasury: Decide on the asset allocation of the treasury, the liquidity distribution among different product modules or protocols, and the reward distribution methods.

- Boosting haeVault Yields: Users' weights in haeVault can be increased to enjoy higher annualized yields.

- Proposals and Voting: Some major decisions of the protocol, such as key product directions and treasury usage, will be made through DAO voting.

We plan to launch HaeDAO in the second quarter, which will be the final piece of the Hae3 product portfolio. Hae3 will provide perfect auxiliary products for Haedal LSTs, including two powerful yield-boosting products, a continuously growing treasury, and a mature DAO community. We believe that the Hae3 ecosystem will generate a sustainable and ever-expanding treasury, which will drive the long-term sustainable development and growth of the Haedal ecosystem in the context of Sui's rapid expansion.

5. A Few More Words

Haedal will soon support Walrus' LST (named haWAL), which will be launched after Walrus' TGE (Token Generation Event). The smart contract development has been completed, and we are currently undergoing third-party audits. haWAL will also be integrated into the Hae3 empowerment system, providing users with abundant staking and yield opportunities.

Just as we believe in Sui, we also believe that Walrus will become an important participant in the Web3 space, reshaping decentralized storage and becoming a crucial infrastructure for the next generation of dApp building. Haedal is ready to work hand-in-hand with Walrus to achieve mutual success.

6. Final Thoughts

The current 3.5% APR of haSUI is just the starting point for Haedal. As Jito said on their staking page: "Staking will boost yields to 15%." We deeply respect pioneers like Jito. Haedal will bring this vision to the Sui ecosystem and do even better. Let's Haedal together!

Follow our social platforms to stay up-to-date with the latest news 🌍