Followin' the official Quai network team has confirmed that the Qi token (energy token) will be activated at Prime block height 211,680. The activation time depends on the block height, not a fixed date. Initially estimated on March 19, 2025, the latest estimated activation time is now around April 2, 2025. 🔹 Latest estimated activation date: around April 2, 2025 🔹 Current Prime block height: 125,210 🔹 Remaining blocks: 86,470 🔹 Time per Prime block: about 23 seconds As the Quai network moves towards this important milestone, the official team will continue to focus on transparency and provide regular updates to the community. You can check the Prime block height and other Quai-related data on stats.quai.network. This article will provide a detailed analysis of how Qi works, including its issuance mechanism, supply model, and integration into the Quai mining ecosystem.

What is Qi?

Qi is a dynamic and highly responsive digital currency within the Quai network. Unlike traditional cryptocurrencies with fixed supply models, Qi adopts a flexible supply mechanism that can be adjusted based on market demand to maintain its role as a unit of account and medium of exchange.

Core features of Qi:

- Native token of UTXO sharding: Qi is the primary token in the Quai network's UTXO sharding.

- Fixed denominations: Qi uses a structured unit system to standardize transactions.

- No script functionality: This feature ensures the security and stability of Qi within its designated shard.

Qi issuance mechanism: How rewards are determined

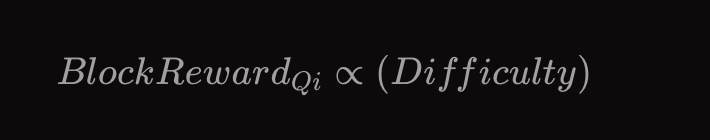

One of the most unique features of Qi is its reward structure, which is directly linked to mining difficulty. Qi rewards are proportional to the "hash" difficulty - this means that the higher the hash computation required for mining, the higher the Qi reward at the current difficulty. The relationship between hash rate (mining difficulty) and Qi issuance is key to understanding the optimal times for mining.

- High difficulty and high hash rate periods: When mining difficulty is high, the network requires a significant amount of computational power to mine blocks. During these periods, Qi rewards will be higher, and mining Qi may be more profitable. Miners who have invested in high hash rate equipment should consider mining Qi during these times to maximize their rewards.

- Low difficulty and low hash rate periods: During low difficulty periods, mining other coins may be more profitable, as fewer resources are required. In these periods, miners may choose to focus on mining Quai or other coins to maximize their profits.

- Mathematically, the block reward follows the formula:

Block reward Qi ∝ (mining difficulty)

The exact proportionality constant for Qi issuance will be made public before the Quai mainnet launch.

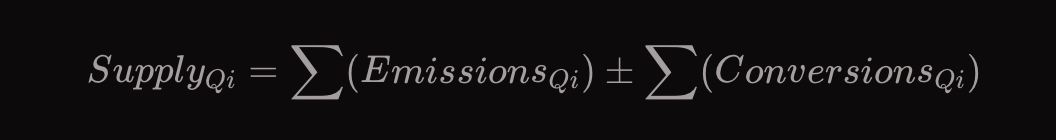

Qi supply: A flexible, miner-driven model

The total supply of Qi is determined by the following dynamic formula:

Factors affecting Qi supply:

- Miner choice: Miners can choose to receive block rewards in the form of Quai or Qi. The circulating supply of Qi depends on the miners' choices.

- Token conversion: Both users and miners can convert between Qi and Quai based on the current block reward ratio, affecting the total Qi supply.

- Actual supply: Although the block reward function determines the potential Qi issuance, the actual circulating supply is influenced by miner choices and conversion dynamics.

Dual incentive structure

This flexible supply model gives miners a strategic role within the Quai network's economic framework. Unlike fixed supply models, Quai's adaptive distribution mechanism allows the supply to be adjusted based on network demand and miner incentives.

What does this mean for miners?

For miners participating in the Quai network, Qi provides a new way to optimize their rewards. By strategically balancing the issuance of Quai and Qi, miners can leverage the constantly changing network conditions to maximize their earnings. Additionally, the ability to convert between Qi and Quai at the current block reward ratio enhances the liquidity and usability of Qi. As the Quai mainnet launch approaches, understanding the role of Qi within the network will be crucial for miners to develop the best strategies. With its dynamic supply mechanism, proportional reward distribution, and seamless conversion functionality, Qi will be an integral part of the Quai economic ecosystem.

Conclusion

In summary, Qi will play a crucial role in the Quai Network ecosystem by providing a dynamic and responsive reward system that adjusts based on mining difficulty. The flexible supply mechanism allows miners to make strategic decisions based on network conditions to optimize their rewards. By understanding Qi's issuance and its relationship to hash rate and rewards, miners can make informed choices on when and which coins to mine. Under the dual incentive structure and adjustable supply mechanism, Qi will be the cornerstone of Quai's decentralized economy, providing long-term opportunities for both miners and users.