According to Glassnode, Bitcoin (BTC) is going through a prolonged distribution phase. Furthermore, both market momentum and capital flows have turned negative, indicating a decline in demand.

This shift, along with increasing investor uncertainty, is contributing to a broader deterioration in market sentiment and confidence.

Bitcoin Enters a Prolonged Distribution Phase

In its latest weekly report, Glassnode points out that Bitcoin's market structure has entered a distribution phase after reaching an All-Time-High (ATH). This phase marks the natural progression of Bitcoin's cyclical behavior.

This cycle is driven by alternating accumulation and distribution phases, with capital shifting between different investor groups over time.

"The latest distribution phase began in 01/2025, coinciding with a sharp Bitcoin correction from $108,000 to $93,000," the report states.

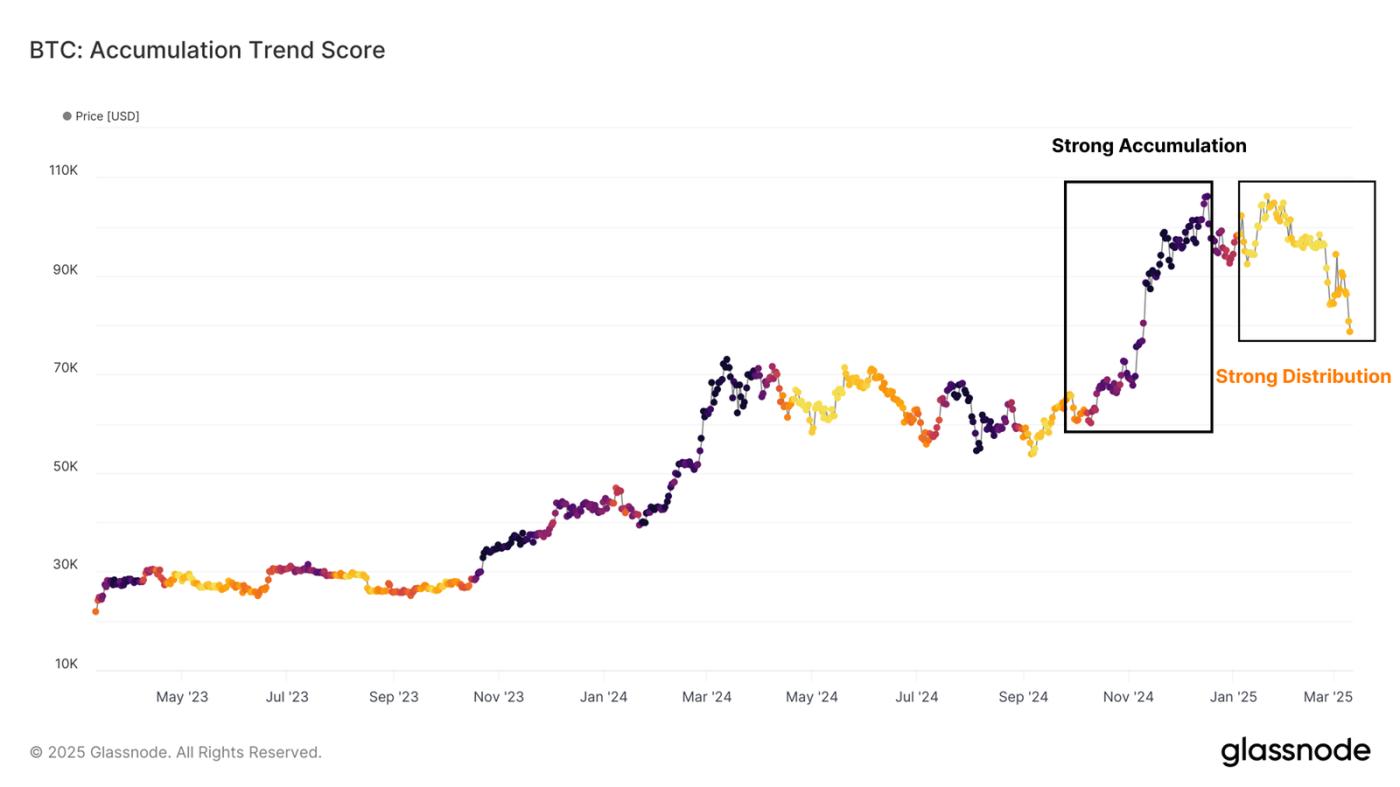

Additionally, Glassnode emphasizes that the Accumulation Trend Score remains below 0.1.

Bitcoin Accumulation Trend Score. Source: Glassnode

Bitcoin Accumulation Trend Score. Source: GlassnodeThis indicates that market participants are more focused on liquidating their assets rather than increasing their positions. Therefore, until this trend reverses, the market may continue to face downward pressure.

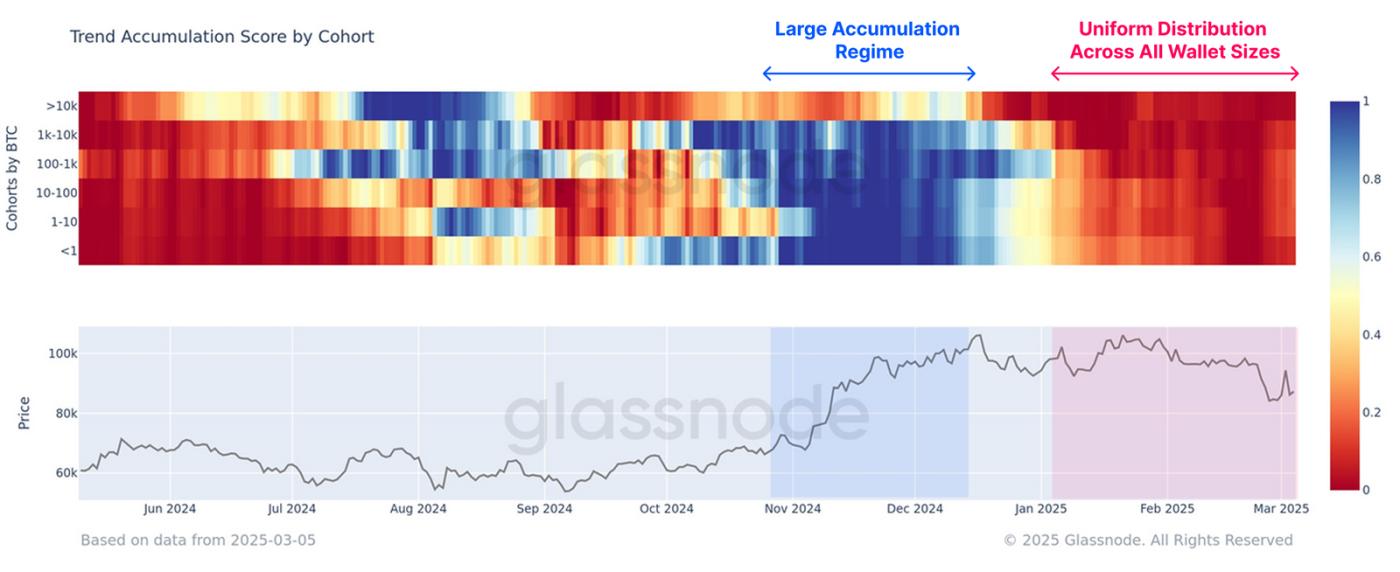

Meanwhile, the distribution is not limited to any particular investor group. According to Glassnode, over the past two months, all wallet types have been actively distributing.

This has significantly increased the selling pressure in the market. Furthermore, the report states that selling activity has become more pronounced since mid-01.

Bitcoin Distribution Across Wallets. Source: Glassnode

Bitcoin Distribution Across Wallets. Source: GlassnodeA large portion of the selling pressure is coming from coins being sold at a loss. This has further weakened the overall strength of the market.

"This suggests that the current market downturn has created a challenging environment for investors, with many exiting the market below their cost basis under the pressure of the decline," Glassnode explains.

Alongside the distribution, market sentiment has also shifted. Investor sentiment has leaned more towards caution. Glassnode reveals that accumulation has decreased as macroeconomic uncertainty has increased, particularly following events like the Bybit hack and escalating US-China trade tensions.

The analytics firm notes that during the price declines from mid-12 to 02, investors had been buying Bitcoin, particularly in the $95,000–$98,000 range. They believed the uptrend would continue.

However, by the end of 02, liquidity tightened, and external risks increased. As a result, the conviction to accumulate further began to wane.

"The lack of buying on the dips below suggests that capital rotation is underway, which could lead to a more protracted consolidation or correction before the market finds a solid support base," Glassnode added.

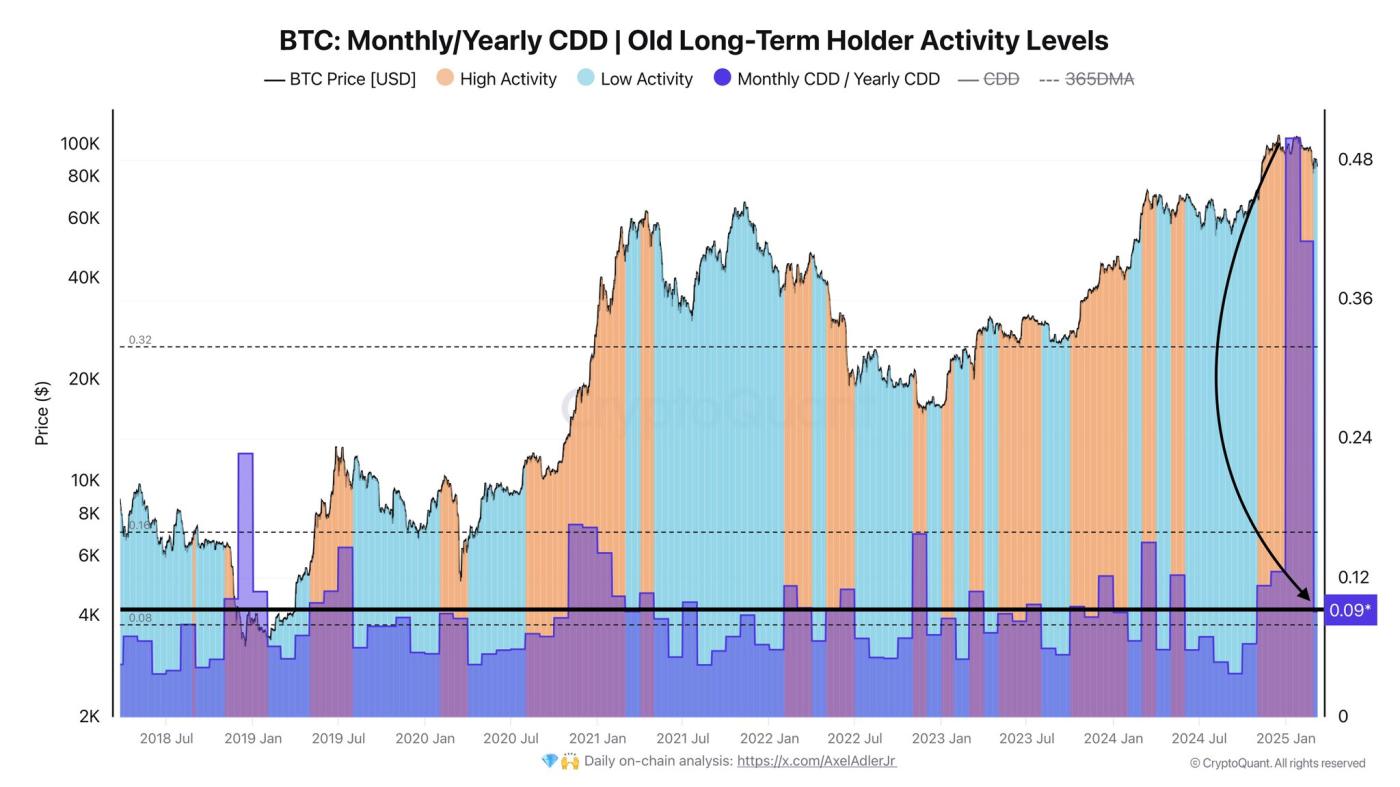

However, not everyone is pessimistic. An on-chain analyst, Axel Adler, has observed that the largest Bitcoin distribution by long-term investors in recent years appears to have ended.

According to his analysis, activity metrics have shifted from high selling to lower accumulation levels. This shift suggests that long-term investors may be regaining confidence, potentially signaling stability or future growth in the market.

"This reduction in supply typically precedes stability and a new market cycle, representing a potentially positive market signal," he posted on X.

Bitcoin Distribution by Long-Term Investors. Source: X/AxelAdelJr

Bitcoin Distribution by Long-Term Investors. Source: X/AxelAdelJrAs Bitcoin continues to navigate this phase, its price has shown significant volatility. BeInCrypto has reported that BTC has dropped below $80,000 amid recession concerns. However, it has seen a slight recovery as trade and geopolitical tensions have eased.

At the time of writing, BTC is trading at $83,424. According to data from BeInCrypto, this marks a modest 2.0% increase over the past day.