CME Futures Debut: Institutional Participation Accelerates Mainstream Adoption of the Ecosystem

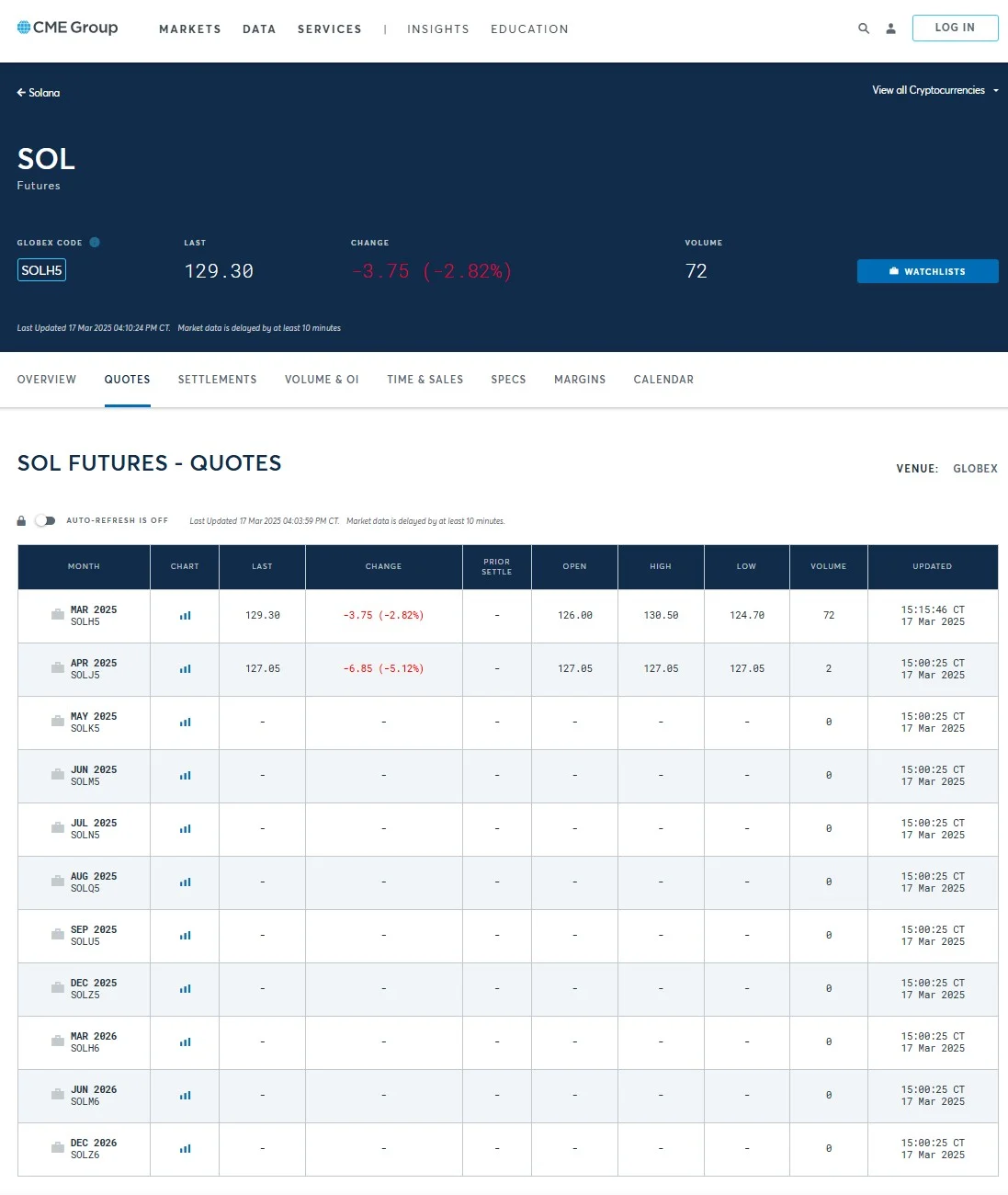

On March 17, 2025, the Chicago Mercantile Exchange (CME) officially launched Solana futures, with a trading volume of $5 million on the first day, marking an important milestone in the emerging crypto asset derivatives market. As the world's largest financial derivatives trading platform, CME has introduced standard contracts (500 SOL) and micro contracts (25 SOL), signifying Solana's formal entry into the core trading pool of traditional financial capital.

Historical experience shows that the launch of Bitcoin and Ethereum futures has triggered a restructuring of market liquidity, and the Solana futures contract traded at a $2 premium on the first day, reflecting the strong allocation demand of institutions for the underlying asset.

Three-fold significance of the market:

Regulatory Endorsement: CME is strictly regulated by the CFTC, and SOL is classified as a "non-security commodity", significantly reducing the risk of SEC regulation, paving the way for subsequent spot ETFs. Bloomberg analysts predict a 70% probability of SOL ETF approval, with institutions like VanEck already submitting applications, creating a regulatory arbitrage window.

Polymarket data shows an 88% probability of a Sol ETF being approved in 2025.

Liquidity Upgrade: After the activation of the market maker arbitrage mechanism, the daily trading volume of SOL is expected to jump from $3 billion to over $5 billion, and the volatility may decrease from 85% to 60%, attracting more conservative capital.

Valuation Paradigm Shift: The price discovery function of the futures market has freed SOL from pure speculative attributes, and technical indicators (such as 12 consecutive months of no downtime and TPS exceeding 5,000) have begun to be incorporated into institutional valuation models, with ecosystem TVL ($7.4 billion) and stablecoin scale ($11 billion) becoming new pricing anchors.

Five-Year Anniversary Celebration Meets Headwinds: FTX Unlocking Becomes the Biggest Short-Term Headwind

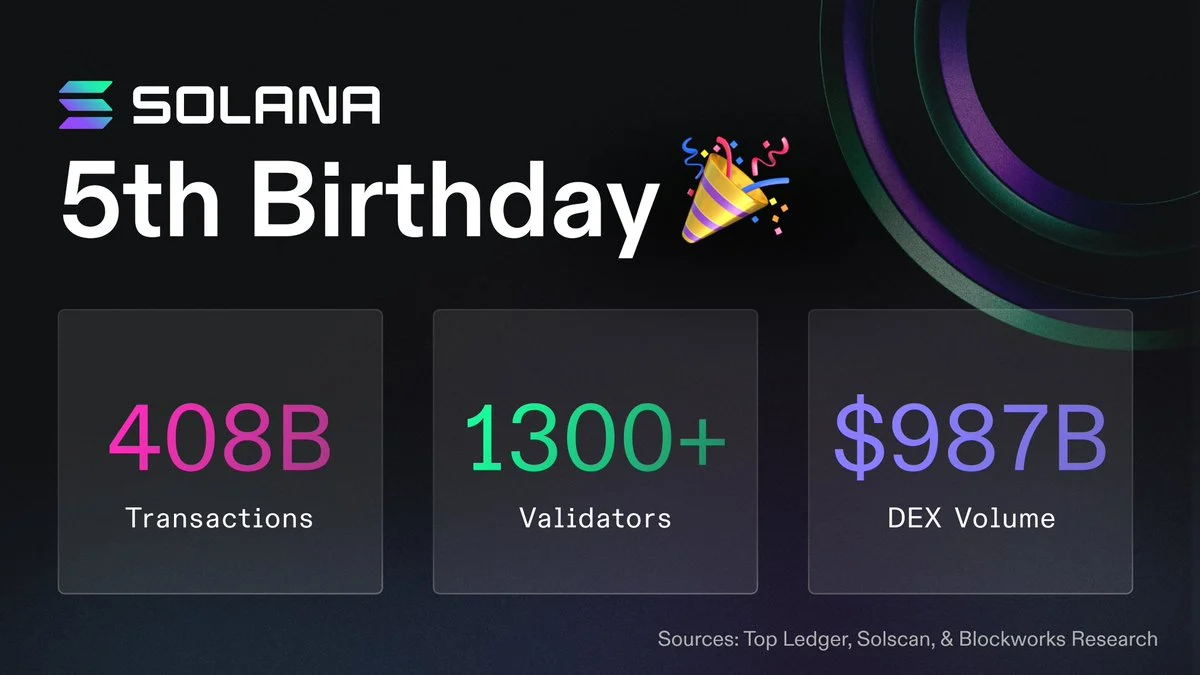

The Solana team posted a commemorative article on March 16, 2025, celebrating the five-year anniversary of Solana.

Solana's mainnet has reached the five-year milestone - cumulative processing of 408 billion transactions, over 1,300 validator nodes, and TVL firmly among the top three Layer1s, but the market's reaction to the positive ecosystem data has been lukewarm.

The core contradiction lies in the supply-demand imbalance caused by the FTX estate liquidation: The unlocking of 112 million SOL (worth $1.5 billion) on March 1 has formed persistent selling pressure, with 78.3 million SOL already in circulation as of March 18, and the remaining 55 million SOL still in staking.

This is the largest single unstaking event since the FTX bankruptcy in November 2023.

Spot On Chain data shows that Alameda Research-affiliated addresses are transferring 30,000-50,000 SOL to Binance daily, creating a "dull knife cutting meat" effect.

Meanwhile, Pumpfun, the most successful application in this SOL bull market, has also been selling SOL, according to Ember Analytics, Pump.fun transferred 196,000 SOL, worth $25.3 million, to the crypto exchange Kraken 3 hours ago.

Transmission Mechanism of Selling Pressure:

Cost Advantage Shock: Institutions like Galaxy and Pantera purchased SOL at $64-102 through OTC, and the current $128 price still has over 40% arbitrage space, giving market makers a strong incentive to sell.

Collapse of Staking Rewards: The FTX unlocking has caused the network's staking rate to plummet from 40% to 33%, with validator daily earnings plummeting from 0.83 SOL to 0.04 SOL, leading to the accelerated exit of small nodes and raising concerns about network "oligopolization".

Deterioration of Sentiment Spiral: The contraction of MACD green bars and the RSI hovering in the oversold area indicate fragile market confidence, and the death cross (50-day moving average crossing below the 200-day moving average) exacerbates short-term technical selling.

Technical Analysis Reveals Hidden Secrets: The Quantum Superposition of Descending Wedge and Davie's Double Top

The current SOL price predicament presents a typical "long-short quantum state" - the long-term value reassessment brought by CME and the short-term impact of FTX selling pressure are in confrontation.

On the daily chart, the convergence zone (115-130 USD) of the descending wedge pattern has become the frontline of the bull-bear battle.

This pattern has historically often appeared on the eve of trend reversals, combined with MACD bullish divergence and trading volume contraction, implying a weakening of selling momentum.

Key signal interpretation:

- Institutional Undercurrents: Grayscale's holdings have surged from 17% to 34%, VanEck predicts a year-end target price of $520, and Trump's political endorsement of SOL as a national digital asset reserve forming an implicit premium of $213.

- Technical Upgrade Expectations: The Firedancer testnet is about to go live, with TPS expected to break through the million level; the ZK-Rollup solution will reduce Gas fees to $0.0001, and the growth of Layer2 ecosystem TVL has become a new catalyst.

- On-chain Data Anomalies: A whale transferred 494,000 SOL to Coinbase Institutional in a single transaction, possibly for CME futures hedging positioning, and OTC block trading volume has increased by 300% quarter-over-quarter.

Market Forecast: Three-Stage Battleground and Trading Strategies

Stage 1 (March-April): Liquidity Reconstruction Period

The launch of CME futures has triggered a two-way capital battle: arbitrage players harvest the premium through "spot long + futures short", while compliant institutions establish strategic positions through futures. Referencing the history of Ethereum futures, this stage may see a 15-25% pulse-like rally, but the FTX's daily 30,000 SOL selling may keep the price in the $130-135 range. Key indicators to watch are whether CME's open interest exceeds $200 million and the progress of spot ETF applications.

Stage 2 (April-June): Ecosystem Validation Period

Firedancer upgrade data and Layer2 TVL will become new price anchors. If DEX monthly trading volume exceeds $200 billion and the staking rate rebounds above 40%, VanEck's $520 target will be within reach. Conversely, if MEV revenue exceeds 60%, triggering validator centrifugal force, the price may retest the $100 strong support.

Stage 3 (Second Half of the Year): Regulatory Arbitrage Window

If the SOL ETF is approved, it will replicate the capital suction effect of the Bitcoin ETF. Bloomberg's model shows that every $1 billion of net ETF inflow can push up the SOL price by 8-12%, combined with the growth of CME futures positions, the year-end target price is expected to reach $259-300.

Conclusion: The Survival Game of the Rule Rewriters

Solana's CME futures listing is akin to a coming-of-age ceremony, where the collision between traditional finance and crypto-native is reshaping market rules. When FTX estate liquidation meets Trump's digital sovereign bond strategy, when the death cross encounters the descending wedge breakout, the essence of this bull-bear battle is the re-pricing of capital's value capture capability of the blockchain. Historical experience shows that projects that can maintain balance on the tightrope of technological revolution and regulatory games will ultimately complete their value discovery in the liquidity tsunami. The current $125, perhaps, is the starting point of a new paradigm shift.