Author: Nian Qing, ChainCatcher

Recently, U.S. stablecoin regulation saw significant progress, with the U.S. Senate Banking Committee passing the "Guiding and Establishing National Innovation for U.S. Stablecoins Act" (GENIUS Act) by a vote of 18:6. Embracing compliance has become a trend for stablecoins.

Although most stablecoins are issued on Layer 1 chains like Ethereum, TRON, and BSC, these public chains lack inherent compliance mechanisms. This may deter traditional financial institutions. Currently, some payment-focused public chains like Stellar support KYC through built-in account control and anchoring mechanisms. With increasingly strict regulations, more public chains with built-in KYC/AML mechanisms may emerge to meet global compliance requirements.

Recently, Keeta, a public chain focused on RWA and stablecoin payments, conducted its TGE on the Base network. It has received little attention domestically but has gained significant traction overseas. In early March, due to the project's abrupt token issuance without marketing groundwork, many people spread FUD, claiming it was a scam project with a stolen Twitter account. Subsequently, the project team began releasing a whitepaper and conducting marketing, with the team and founder Ty Schenk diligently hosting Spaces and addressing doubts on Twitter. The FUD gradually subsided.

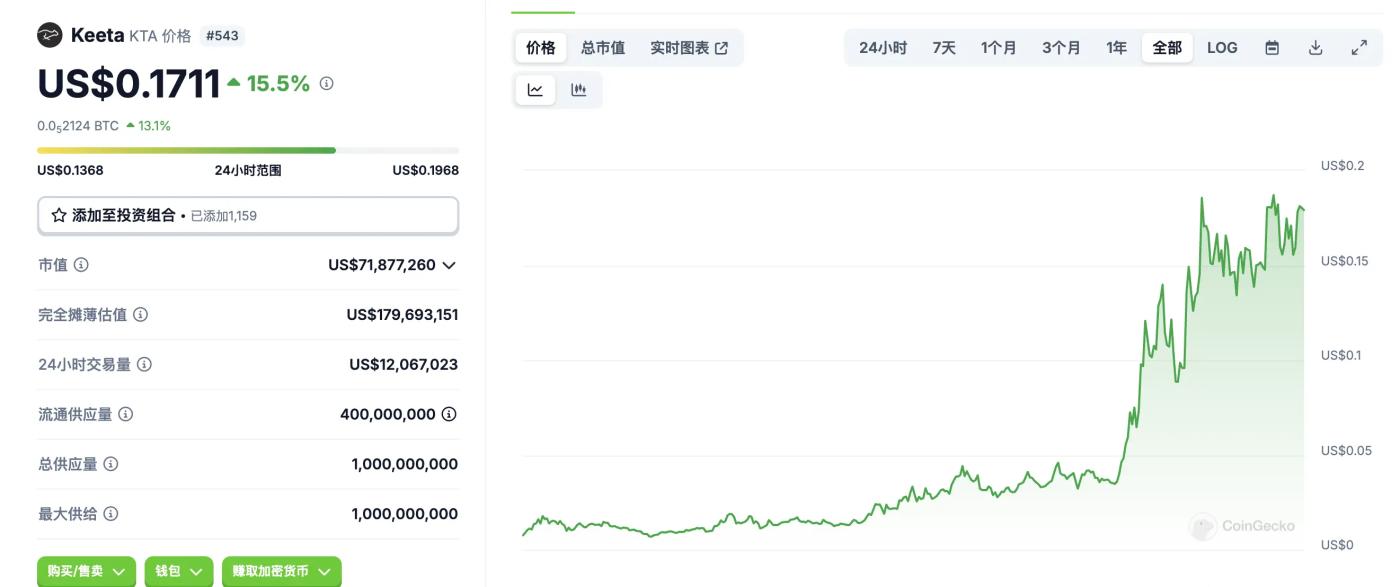

On March 17, Keeta's token KTA saw a significant surge, with a single-day increase of over 50%. Since its launch on March 6, KTA has risen by over 2,500%. Currently, its TVL exceeds $70 million, with approximately 6,500 token-holding addresses. Keeta's approach can be described as "quietly launching TGE and then stunning everyone".

First, What is Keeta?

Keeta is a next-generation Directed Acyclic Graph (DAG) delegated Proof of Stake (dPoS) blockchain system that makes cross-border payments instant, compliant, and low-cost to eliminate TradFi bottlenecks. Summarizing the whitepaper, Keeta's goals are two core competencies: "extremely fast speed" and "regulatory compliance".

"Extremely Fast Speed"

Keeta promises to support up to 10 million transactions per second (TPS) and achieve 400-millisecond transaction settlement. This high throughput and low-latency design make it suitable for large-scale payment and asset trading scenarios.

10 million TPS is indeed an exaggerated number, with most high-performance new chains only daring to promise up to 100,000 (community comments suggest this figure is like reading a science fiction novel).

According to Keeta's whitepaper, its high performance is mainly guaranteed by: (1) no memory pool; (2) client-guided verification skipping queues; (3) two-stage voting ensuring speed/security; (4) cloud servers (such as Google Cloud or AWS).

A clear drawback of this underlying technology is its heavy reliance on centralized cloud service providers. Additionally, 10 million TPS may be impossible to test in real application environments (even if boasting, you can't verify it).

Built-in Compliance Mechanism

Keeta officially claims to be the "first blockchain network fully compliant with traditional financial regulations", improving efficiency through automated compliance screening and ensuring all transactions comply with local laws through built-in Anti-Money Laundering (AML), Bank Secrecy Act (BSA), and Know Your Customer (KYC) protocols.

Token issuers can define any rules, such as whitelisting individuals, enforcing transaction limits, or requiring specific certifications, which will be supported by the network. Additionally, token issuers have complete control over their stablecoin governance, such as adjusting token policies, implementing new rules, or even modifying identity requirements, ensuring full flexibility.

To support identity verification requirements, Keeta's on-chain certificates can be instantly verified without third parties. Trusted KYC providers on the network can provide certificates to verify specific individual attributes like age or location. A single certificate can be used to instantly verify an individual's identity across multiple parties.

Furthermore, to support the cross-network movement of fiat-backed stablecoins, Keeta network's anchoring system can connect to traditional payment channels (like ACH, SEPA, and SWIFT) without compromising security or compliance. Other blockchain networks can also connect as anchoring systems, enabling atomic swaps between stablecoins and native assets of anchored networks.

Team and Funding Situation

In 2023, Keeta raised $17 million in seed funding with a $75 million fully diluted valuation (FDV), with former Google CEO Eric Schmidt participating in this round. According to early reports, Keeta initially aimed to serve enterprises, or B2B business, initially by invitation in the United States, Canada, Mexico, Brazil, the United Kingdom, and the European Union. Unlike SWIFT, Keeta's target is to serve a broader user group with payments below $1 million.

Keeta's co-founder and CEO Ty Schenk has been a software engineer since his teenage years, with most of his previous work related to crypto payments.

Keeta's CTO Roy Keene is the former lead developer of Nano, who left to create a new project due to wanting to change Nano's incentive mechanism and institutional adoption.

Keeta Token Economics

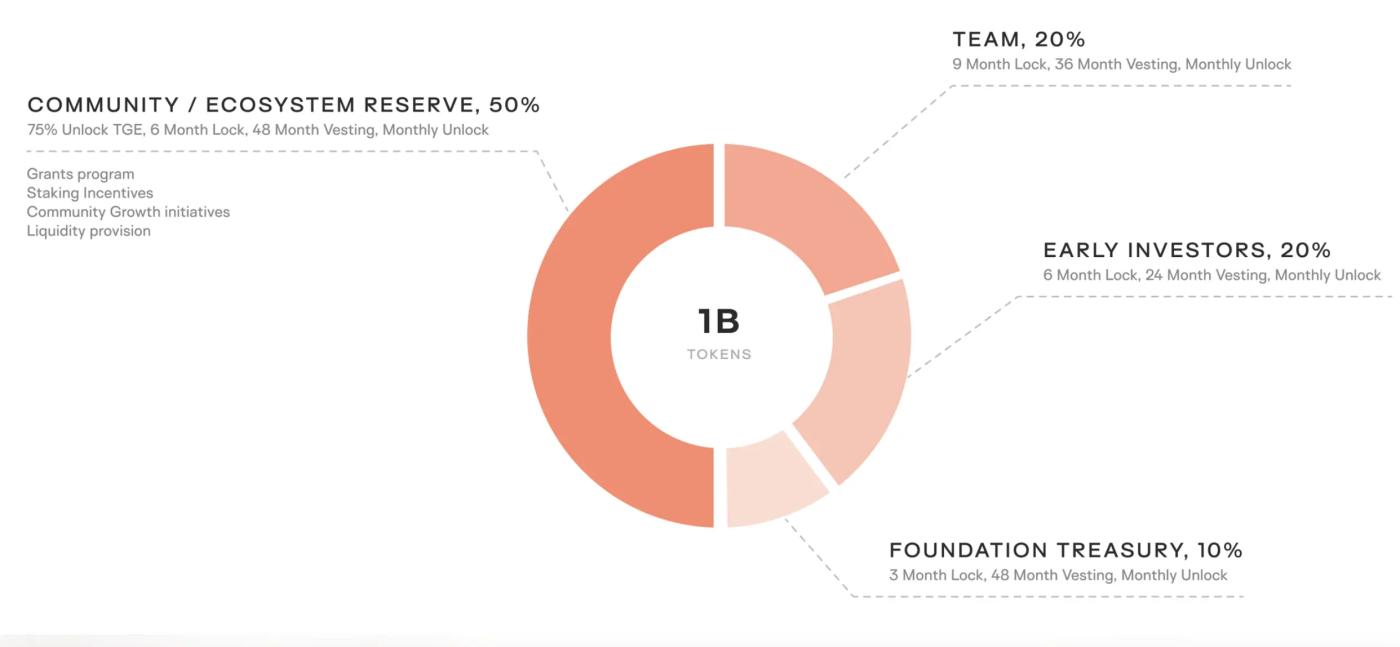

The image shows Keeta's total token supply of 1 billion tokens, with token allocation divided into four main parts:

- Community/Ecosystem Reserve: 50%

- Team: 20%

- Early Investors: 20%

- Foundation Reserve: 10%

Each token portion has specific lock and vesting plans, as follows:

- Community/Ecosystem Reserve: 75% unlocked at TGE, 6-month lock, 48-month vesting, monthly unlocking.

- Team: 9-month lock, 36-month vesting, monthly unlocking.

- Early Investors: 6-month lock, 24-month vesting, monthly unlocking.

- Foundation Reserve: 3-month lock, 48-month vesting, monthly unlocking.

Additionally, the Community/Ecosystem Reserve's uses include: staking rewards, community growth plans, liquidity provision

Keeta's KTA initial price on Base's DEX Aerodrome was around $0.0076, likely calculated based on the previous round's $75 million valuation. Currently, 400 million tokens are in circulation, with a fully diluted valuation of $168 million.

Project Planning and Roadmap

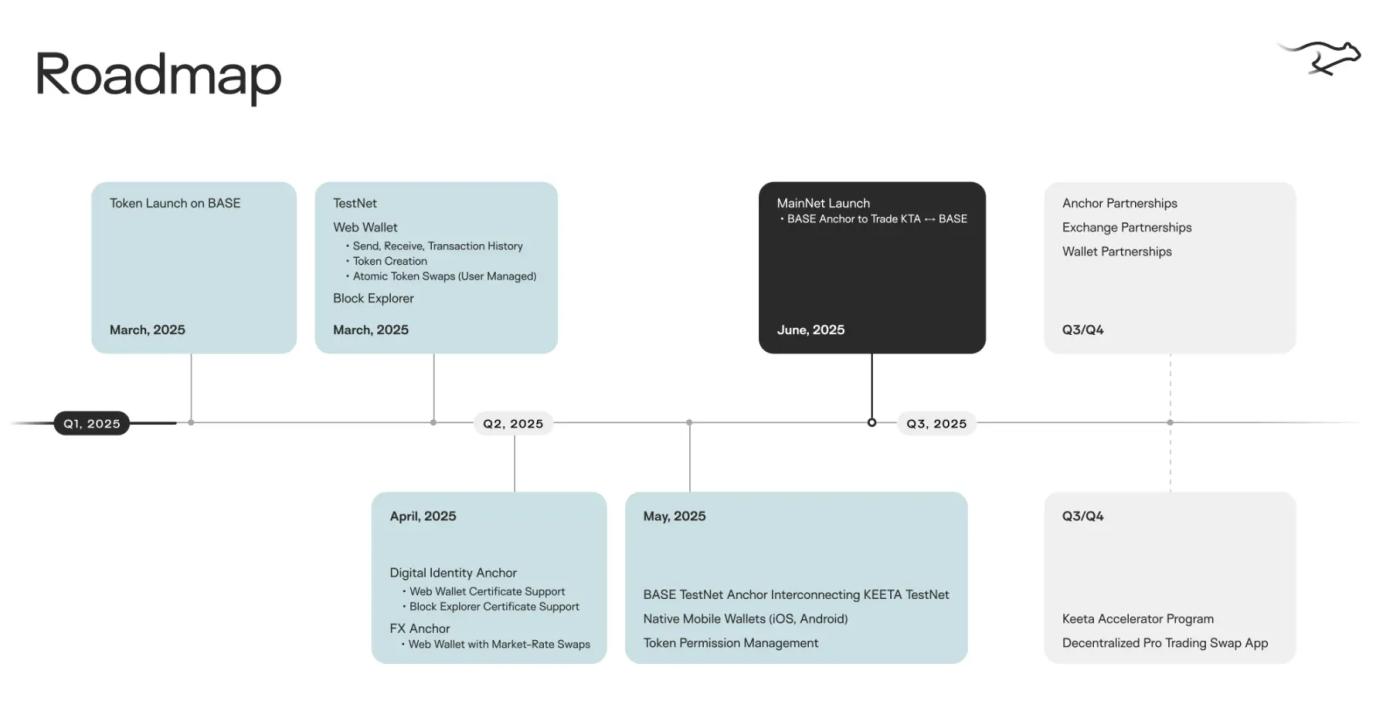

According to the roadmap, the Keeta Network testnet will be released by the end of this month, accompanied by a web wallet and block explorer. The mainnet will launch in June, with more testnet features to be introduced in the months before the mainnet release, such as digital identity anchoring, web wallet certificate support, block explorer certificate support, and native mobile wallet.

Why Did an L1 Choose to TGE on L2 Base?

This is currently the biggest controversy surrounding Keeta. Some community members question why Keeta's team would choose to TGE on Base when they have their own Layer 1, calling it somewhat redundant, as assets will need to be anchored back to their own chain after mainnet launch, which seems unnecessary.

The team has responded to such doubts on multiple occasions, stating that fair launch is driven by their focus on community building, hoping the community can participate early in the project's construction and growth. Moreover, compared to Keeta, which has no user base, Base has a larger communication foundation and traffic, and its GSA fees are cheaper than Ethereum's mainnet. The KTA token will remain on Base until mainnet launch, and the team will utilize the new anchoring function, at which point it will become the native token on Keeta's L1.

Summary: Token and Business Slightly Disconnected

Although compliance-oriented stablecoin infrastructure will have enormous development potential with U.S. regulations, the crypto payment track is already quite crowded. With the entry of traditional payments, startups may face further challenges.

Additionally, a key issue is that Keeta's actual business leans more towards traditional financial system B2B services. Its token price may face a disconnect between actual business and token price, similar to payment networks like Stellar and Ripple.

For instance, XRP in Ripple's past business lacks practical utility, and its future role in the ecosystem remains unclear. Compared to its software business, what truly made Ripple a fortune was selling coins. In 2019, the media website Owler analyzed Ripple's total revenue, with 80% coming from coin sales.

Under this premise, how will Keeta empower KTA? Will it follow Ripple's old path?