Author: Michael Nadeau, The DeFi Report; Translated by: Deng Tong, Jinse Finance

In this report, we zoom out and compare how Ethereum is built today to how the Internet was built, while introducing Celestia — an effort to disrupt Ethereum and become the default Data Availability (DA) solution for Ethereum L2 and sovereign rollups.

Ethereum’s Challenges

Ethereum’s scaling roadmap presents investors with two major hurdles to overcome in this cycle that did not exist in the 21st century cycle:

The massive influx of L2 tokens over the past few years has diluted the amount of venture capital that could flow into ETH as a long-term investment.

From an execution perspective, L2 improves Ethereum’s base layer technology, which has led to a large portion of its economy moving to L2.

From an investor’s perspective, this result is understandable in a report released this week by Standard Chartered, which estimated that Base has taken $50 billion of market value away from Ethereum L1. As a result, Standard Chartered lowered its year-end price target from $10,000 to $4,000.

Given Ethereum’s lack of scalability at the L1 layer, it must be able to provide services for L2, as L2 is its primary client in the future.

Ethereum owns this market today. But looking ahead, competitive threats are emerging.

To fully understand what’s going on, we want to zoom out and compare the construction of Ethereum to the construction of the Internet itself. Explaining this first will help illuminate the challenges Ethereum currently faces.

We then introduce Celetia’s value proposition – which we cover in detail later in the report.

Early Internet

In the early days of the web, if you wanted to create a website, you had to host your own physical server — which was expensive and didn’t scale well.

We solved this problem by creating shared server hosting. This made it easier and cheaper to build a website by utilizing hosting services such as GeoCities.

The Internet began to expand, and it became cheaper for entrepreneurs to set up websites offering products and services.

Eventually, innovation was limited by the shared implementations provided by GeoCities. Virtual servers emerged - providing the scalability + customization/flexibility of your own server, but with the convenience of using shared hosting. Amazon Web Services was born.

With the advent of AWS came e-commerce, SaaS companies, and social media—all of which would have been impossible in the early days of the Internet.

Today, the same process is happening on public blockchains — which are introducing a new data structure to the internet through global accounting ledgers and digital property rights.

It started as a clunky, inefficient, and expensive user experience, then became lean, cheap, and fast.

Public Blockchain and Ethereum

Bitcoin was the first public blockchain. In the early days of web3, if you wanted to create new applications using this groundbreaking new technology, you had to start with your own blockchain. Bitcoin forks (peer-to-peer naming systems) were an early example. This era of public blockchains was similar to the early days of the web - when you had to host your own servers to build a website.

Ethereum came to prominence in 2015. We can think of L1 as the “GeoCities of web3.” Why? Ethereum enables developers to launch applications using shared infrastructure. No need to launch your own chain and bootstrap validators. This is similar to GeoCities, which allowed developers to build websites without hosting them on their own servers.

Of course, developers need more throughput and flexibility to build specialized use cases. Enter Ethereum L2s — execution environments built “on top” of L1, which Ethereum uses as infrastructure for data availability and security.

Now, Ethereum is starting to look like a “network of networks” — similar to the construction of the internet itself.

However, some challenges remain. In particular, Ethereum’s DA costs are still quite high. This opens the door for competitors such as Celestia to serve Ethereum’s L2 clients, similar to how AWS serves web2 applications in the current cloud era.

Now. Given Celestia’s early success, we have to ask the question: Is Celestia a threat to Ethereum’s L2 roadmap?

What would happen if Ethereum L2 moved to a solution like Celestia?

About Celestia

Celestia is a proof-of-stake blockchain (currently with 100 validators) that was specifically designed to solve the problem of data availability verification — in the past, verification required nodes to download all transactions in a block. They solved this problem with data availability sampling — guaranteeing data availability without requiring nodes to download the data.

Their target customers are other blockchains.

Now, let’s say you’re Robinhood. You have over 20 million users trading stocks and options on your platform each month. Meanwhile, cryptocurrency trading has become a significant portion of your business (35% of revenue in Q4).

Let’s say you decide to further integrate into the cryptocurrency infrastructure because you see a future where all assets will be tokenized for trading and settlement/accounting purposes.

Naturally, you decide that the best way to capture the most value while maintaining control and flexibility is to build L2 on Ethereum (which has the best network effects in crypto).

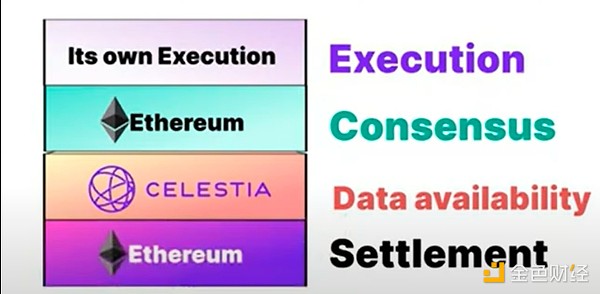

You'll need the following components to make it all work:

Execution: Processing trades, swaps, payments, and other user actions

Consensus: ensuring that no one is cheating and everyone is following the same rules (think of consensus as safety)

Data availability: Make the history of what happened available for audit or other applications to access

Settlement: Final Accounting/Scoreboard

If you are Robinhood, you will want to build your own sovereign L2 where you control execution. However, you may not want to build your own validator network for consensus/security. Maybe you will use Ethereum for this.

Of course you need to make all your data auditable/verifiable by others and accessible to other applications. You can use Ethereum for this as well. But Celestia is 100x cheaper+ and it lets you integrate with other L2s, even with Solana (in the future), and make your data available there.

Maybe you choose Celestia as your DA layer.

Finally, you need a place to settle all user activity as a "final scoreboard." Given Ethereum's security, decentralization, and lindy nature, you choose it as your official accounting ledger.

This is your technology stack:

What problem does Celestia solve for Robinhood?

Celestia makes it easier for Robinhood to:

Have your own execution environment.

Leverage Ethereum for consensus and settlement — This is what Ethereum excels at as the most secure and decentralized L1.

Data availability is achieved with Celestia at a much lower cost than with Ethereum (now 100x cheaper).

In the future, if Celestia is able to build an L2 network (with native bridging) that leverages it for data availability, then Robinhood could benefit from providing access to its data to everyone in that network. Furthermore, assuming Celestia can connect to L1 in a native, seamless experience (not an easy feat), Celestia could even provide access to its data to applications and users on other chains.

Key points:

You may have heard the term “money legos” when referring to the composability of DeFi applications. Celestia is committed to providing this experience for sovereign rollups that want to customize their technology stack, while making data usable across a variety of chains/applications/and execution environments.

L1s currently achieve network effects through shared standards (tokens, smart contracts, developer tools, etc.). Celestia seeks to create network effects between L1 and L2 as a key “middleware” protocol for the web3 technology stack. This is a great idea. It aims to create network effects through “blob fees” as the “default DA solution” - a standard that all L2s will choose when using Celestia. This could give it a “moat” due to its composability with other rollups and L1s - solving for fragmented liquidity and user bases between L1 and L2. Again, a great idea, no easy feat.

To succeed, it needs to acquire the largest L2 as customers (which it currently does not have) and become the default choice for all new entrants.

There are a number of reasons why Robinhood (and existing L2s) might want to stick with Ethereum instead of Celestia.

Security risks . Ethereum assumes that DA and settlement are unified when verifying aggregation. If Robinhood publishes data to Celestia but settles to Ethereum, Ethereum cannot natively verify Celestia’s DA guarantees. This increases the trust assumptions of Ethereum validators, who must rely on external monitoring by Celestia.

Additional complexity . Blob is built directly into Ethereum’s protocol, making it easier to implement and maintain.

Risk vs. Reward . Ethereum is the most decentralized and secure smart contract network available today. At this emerging stage, choosing a less mature alternative may be seen as high risk, low reward.

Celestia adoption

As mentioned before, Celestia needs to attract the largest, most successful rollups + most new entrants. Why? It needs to attract the largest customers and then connect them all together — so that a seamless user experience can be created for future builders who want access to all users and data on all chains while making the data verifiable by anyone.

If this momentum is achieved, Celestia (as the middleware connecting all chains through data availability) could become one of the most important protocols in web3 (similar to Bitcoin, Ethereum, and Solana).

Of course, there is still a long way to go.

Current progress

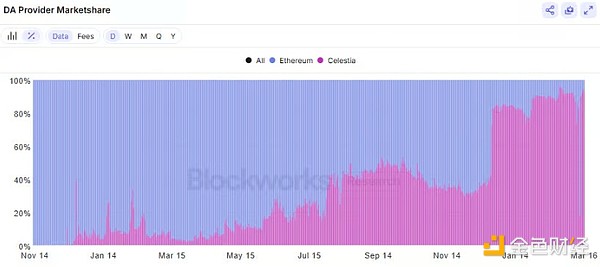

Celestia is less than 1.5 years old. But it is already the leading DA solution in the crypto space, currently accounting for 90% of the market share in terms of published data volume.

Top Customers

General purpose L2: 86.7% (Eclipse, Solana Virtual Machine (SVM) L2 constitutes the majority of data released to Celestia today)

Gaming L2: 2.8%

Finance L2: 1.7%

Social L2: .5%

Consumer L2: .12%

In total, about 30 rollups are publishing data to Celestia today. It secures about $500 million in value.

As mentioned before, Celestia has yet to get one of the top Ethereum L2s to leverage it for DA. We think their goal is to get the top L2s moving and then become the “default DA solution” for new entrants. From there, they can achieve network effects and a “moat” through a new standard around “blob fees” — enabling cross-chain composability.

That being said, we believe L2s like Base, Arbitrum, and Optimism have little incentive to leave Ethereum today.

Celestia Business Model and Fees

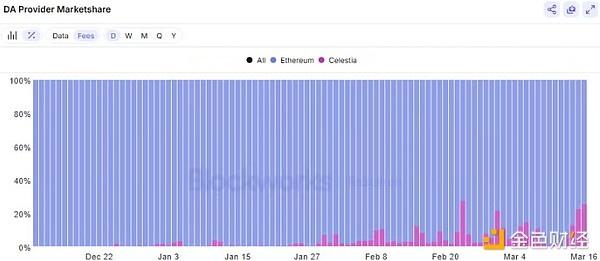

While Celestia has about 90% market share in publishing data, it only has 25% market share in terms of fees (because costs are lower than Ethereum). It currently has about $20,000-25,000 in fees per day.

Fees are set as low as possible to prevent spam. The goal is to build network effects today and control pricing power later.

Ultimately, Celestia’s pricing power will come from its network effect as the unifying standard for L2 and L1. Without network effect, there is no pricing power.

Addressable Market

It’s all about economies of scale. The Celestia addressable market includes all Ethereum rollups, sovereign appchains, and potential L2s that settle to Solana or other L1s.

Eventually, Celestia thinks there may be more chains than sites.

The goal is to charge fees of around 1/10th of a cent for large transactions.

Will Celestia become the “AWS of web3”?

Just as AWS facilitated the adoption of web applications by handling the heavy lifting of servers and scalability, Celestia can facilitate the adoption of custom blockchain applications by handling large-scale data availability.

With Celestia, developers can deploy their own chains (rollup or sovereign chains) without recruiting hundreds of validators or inventing new consensus protocols. This is similar to how startups use AWS to launch cloud servers instead of buying physical servers.

The end result of Web2 is a drastically lower barrier to entry. Therefore, Celestia believes that if web3 use cases can achieve network effects as the default solution for developers who need a custom web3 stack, then their addressable market could expand significantly.

AWS has had a huge impact on the popularity of websites and applications on the Internet by removing infrastructure barriers and reducing costs.

Celestia is looking to provide the same support for the proliferation of rollup and sovereign blockchains.

Summarize

The Internet is made up of a series of decentralized protocols that ultimately enable global information (data) sharing so that a single computer can access all the content in the world.

But it didn’t happen overnight. It was a process of combining key protocols like TCP/IP, HTTP, DNS, etc. with tools like AWS to create the Internet we have today.

In many ways, web3 is being built in a similar decentralized manner.

Ultimately, there needs to be a cross-chain and data “connective tissue” to provide a user experience in web3 similar to what we have in web2.

Celestia hopes to be that “connective tissue.”

They are betting on an optimistic future in which developers will want unfettered flexibility to build web3 applications while making data accessible to everyone.

We think they may have found a solution today.

But technology is not enough. They need to create a huge network effect between L2 and L1 through cross-chain composability to realize this vision.

This is not an easy task.

But given the current valuation, addressable market, team, backers, early lead, and lack of competition in the market today (except Ethereum), we believe Celestia is best suited to solve this problem.

Ultimately, we believe that betting on Celestia is a bet on web3 scaling (website-scale blockchain proliferation) and a hedge against Ethereum and its ability to successfully execute its L2 roadmap.