Author:DeFi Cheetah - e/acc

Translated by: TechFlow

With the official launch of the Proof-of-Liquidity (POL) mechanism led by @SmokeyTheBera and @codingwithmanny at @berachain, this article aims to provide readers with the most comprehensive overview of the POL mechanism and explore its potential impact on the entire ecosystem, especially the $BERA token price. The article covers the basic mechanism, issuance plan, tokenomics, and strategies for absorbing the highest inflationary reward sources.

[The rest of the translation follows the same pattern, maintaining the original structure and translating all text while preserving the original links and formatting.]How Bribery Enhances Capital Efficiency

For protocols, this bribery-based model changes the game. Instead of spending large amounts of funds to attract liquidity, protocols multiply incentive effects through bribery mechanisms.

For users, during the initial weeks of PoL launch, this means extremely high Annual Percentage Yields (APY). As protocols compete to attract liquidity, they will offer higher $BGT rewards, creating incredible "farming" opportunities. If you want to maximize returns, now is the best time to prepare, calculate, and seize the Berachain PoL incentive wave.

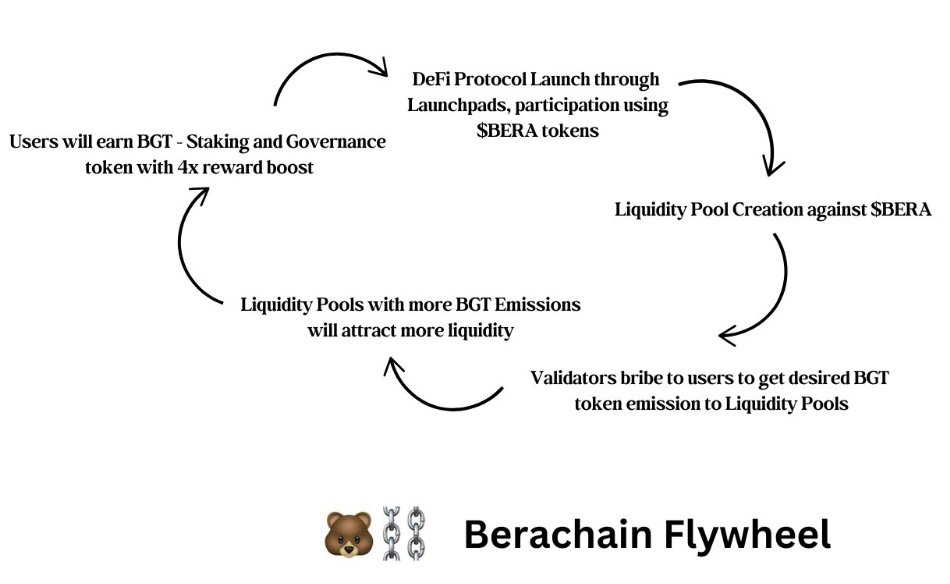

Self-Driven Ecosystem Flywheel

Berachain's ecosystem forms a positive feedback loop: more $BGT is delegated through bribery, more $BGT incentives are used to launch liquidity for trading pairs, attracting more liquidity pool funds, reducing slippage, promoting trading volume growth, thereby increasing platform fee income. This further attracts more $BGT emissions to corresponding pools, forming a self-sustaining growth flywheel.

Berachain's Proof of Liquidity (PoL) mechanism forms a self-reinforcing cycle:

More liquidity → Users receive more rewards

More $BGT delegation → Validators receive more incentives

More validator incentives → Higher network security and DeFi ecosystem growth synergy

PoL Creates a Positive-Sum Economy

Unlike traditional staking mechanisms, PoL not only improves capital efficiency but also continuously expands Berachain's economic activity. Its operation model is as follows:

Users provide liquidity → Receive $BGT → Delegate $BGT to validators;

Validators distribute emissions → Incentivize DeFi protocols;

More liquidity → Attract more users → Provide more rewards → Cycle repeats.

Why This Matters?

More liquidity: Improve trading conditions, reduce slippage, deepen lending markets.

Blockchains with stable and growing liquidity can better attract developers.

This flywheel effect ensures that as liquidity enters the ecosystem, it can attract more users, developers, and capital, thereby enhancing the network's long-term security and sustainability.

The "Magic" of Berachain's Token Economics

Regardless of how teams design and describe token economic models, the core point ultimately boils down to one thing: minimizing selling pressure and optimizing initial capital accumulation. This can be analyzed from two dimensions:

Inflationary Sources (Inflationary Faucets)

$BGT is partially exchanged for $BERA (partial exchange because the funds obtained are subsidized by incentive tokens from other protocols in the Bera ecosystem).

Deflationary Sinks

$BERA is staked to obtain block production qualifications and increase the probability of being selected to produce the next block;

$BGT is delegated to validators to obtain higher returns;

The irreversibility of $BGT exchange (especially when $BGT cannot be obtained in the secondary market, this mechanism deters holders from selling);

By launching more liquidity through the PoL mechanism, reducing slippage, promoting higher trading volume, thereby generating more fees and further enhancing the deflationary effect.

In traditional PoS (Proof of Stake) staking models, validator selection and reward increments are usually determined by the amount of native tokens staked relative to the total staked amount. Here, a clever design is used: by separating gas fees and security staking from governance and economic incentives, the key is to assign the economic incentive distribution function to a token lacking liquidity. This design raises the threshold for obtaining economic incentives (i.e., people cannot simply acquire tokens in the secondary market), thereby suppressing holders' motivation for large-scale selling.

Taking vote-locked tokens (like $veCRV) as an example, but $BERA goes further - while $veCRV can be converted from $CRV, and $CRV can be purchased in the secondary market, $BGT cannot be obtained from the secondary market nor converted from $BERA. This design creates a stronger suppression effect on $BGT holders: if users holding a large amount of soulbound $BGT tokens choose to sell most of their tokens, they will face extremely high barriers when they want to regain economic incentives for ecosystem project development. They must provide liquidity for certain trading pair liquidity pools (associated with whitelisted reward vaults) to regain $BGT and enjoy economic incentives.

Moreover, it's worth noting Berachain's dual-token separated PoS model: validators must stake $BERA, but this only determines their qualification for block production. Therefore, validators need to stake more $BERA to increase their probability of producing the next block. At the same time, validators also need to obtain more incentive tokens from protocols to attract $BGT delegators and compete for more $BGT delegation. This dynamic mechanism can produce a powerful deflationary effect, effectively absorbing the massive selling pressure from the initial high-inflation $BGT emission plan. The reason is that validators must continuously stake more $BERA to increase their block production probability, and users need to hold and delegate $BGT to obtain high returns.

However, a potential fatal risk currently conceivable is: if $BERA's intrinsic value exceeds $BGT's returns, $BGT holders might choose to queue for redemption and sell $BERA. The realization of this risk depends on a game dynamic where $BGT holders need to judge whether holding $BGT for returns is more profitable than directly redeeming and selling $BERA. This further depends on the prosperity of the Bera DeFi ecosystem - the more competitive the incentive market, the higher the $BGT delegators' yield, thereby reducing the possibility of this risk.

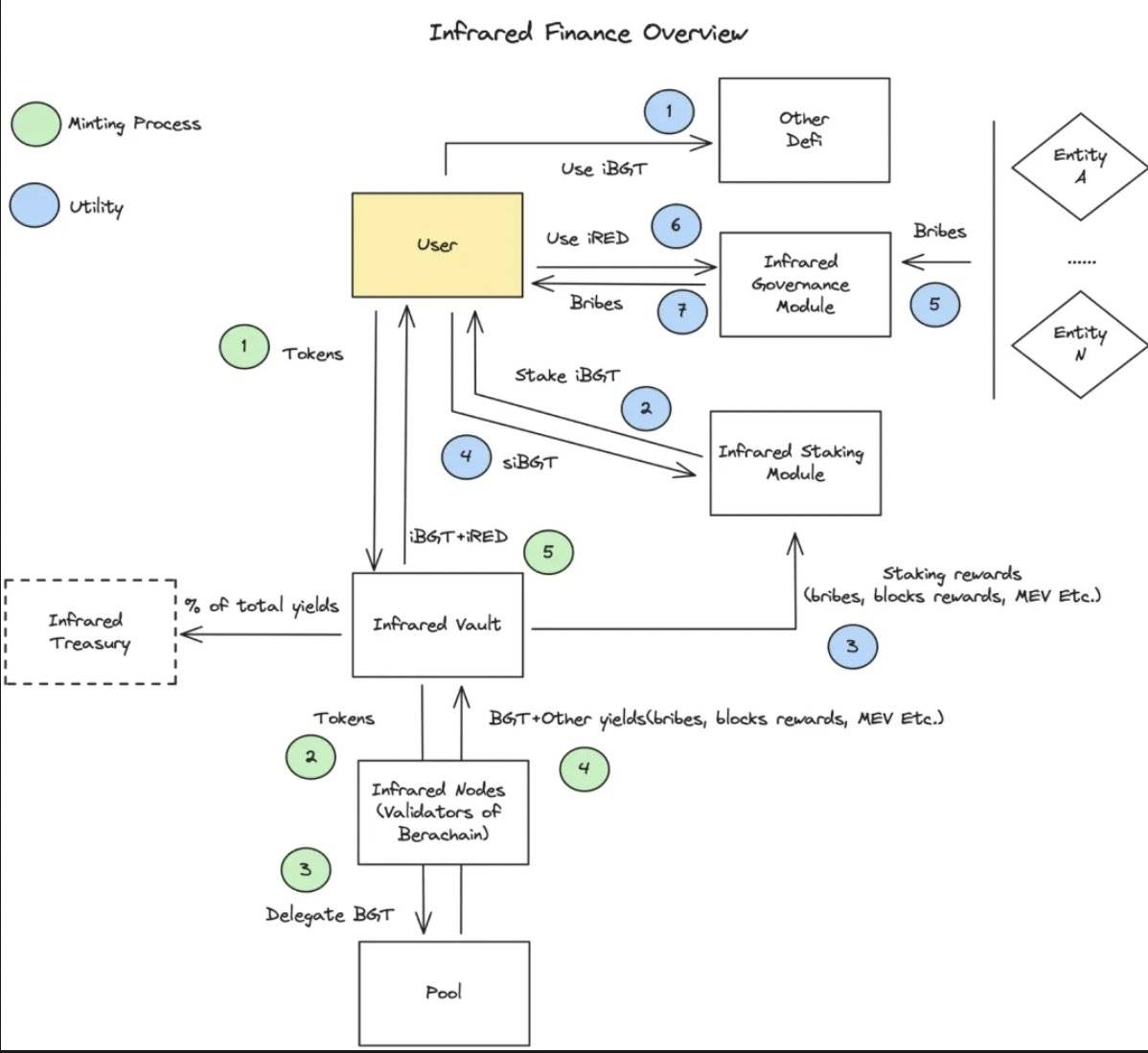

Infrared Finance - A Leading Liquid Staking Protocol with Over $2 Billion in TVL

Simply put, it provides $iBGT and $iBERA, liquid versions of staking $BGT and $BERA, allowing users to maintain liquidity for other DeFi activities like trading on decentralized exchanges (DEX) or participating in lending markets while obtaining staking rewards.

$iBGT is 1:1 backed by $BGT, and notably, unlike $BGT's soulbound nature, $iBGT can be directly transferred. @InfraredFinance operates as a validator, allowing users to deposit PoL assets into vaults to earn $iBGT, which can be used in Berachain's DeFi ecosystem. Users can also choose to further stake $iBGT to obtain staked $iBGT (i.e., $siBGT), thereby capturing $BGT returns. $siBGT can amplify returns from $BGT because $iBGT holders choose liquidity over returns, which creates a multiplier effect on $siBGT holders' returns. Simultaneously, $iBGT aims to establish its monetary premium, reflecting its potential utility as a liquidity token.

While not wanting to delve into the details of each protocol in the ecosystem, Bera's design clearly shows a strong DeFi focus. Since the Luna ecosystem's collapse, whether @AndreCronjeTech's @soniclabs and Bera can restore DeFi's former glory will be a topic worth watching.