We're excited to announce Dynamo DeFi is now running an Injective validator! This is a significant step in our mission to provide accessible and trusted DeFi services while supporting one of the most innovative blockchain platforms in the industry.

What is Injective?

Injective is the first and only blockchain purpose-built for finance, offering advanced infrastructure for Web3 finance projects to seamlessly launch innovative applications using its modular, plug-and-play technology.

Key Injective Features

Finance-Focused Blockchain: Purpose-built for DeFi applications with pre-built modules for exchanges, lending, and tokenization

High Performance: Lightning-fast transaction speeds (~0.76 seconds per block), 10,000+ TPS, and extremely low transaction fees (approximately $0.0003)

Multi-VM Environment: Supports both WebAssembly and Solidity, with the most performant EVM layer built into the chain

Cross-Chain Compatibility: Works with IBC-enabled blockchains, Ethereum, and non-EVM chains like Solana

MEV-Resistant Order Book: Built-in protection against maximal extractable value

Deflationary Tokenomics: Features a unique burn auction that programmatically burns INJ weekly

Injective is leading the tokenization initiative:

Notable Partnerships and Investors:

Injective has established itself as an industry leader with backing from prominent institutions including:

Binance (Incubation partner)

Pantera Capital

Brevan Howard

Mark Cuban

Libre and Nomura's Laser Digital (For institutional fund issuance)

Why Validators Matter on Injective

Validators are the backbone of Injective's Proof-of-Stake consensus mechanism. They:

Secure the Network: By staking INJ tokens as collateral, validators have a financial incentive to maintain network integrity

Process Transactions: Validators validate transactions and create new blocks on the chain

Participate in Governance: Validators play a crucial role in the on-chain governance process

Support Interoperability: Help maintain Injective's connections with other blockchains

Promote Decentralization: A diverse set of validators ensures no single entity controls the network

The more distributed and reliable the validator set, the more secure and resilient the Injective network becomes.

Why Stake With Dynamo DeFi?

Our Validator Highlights

Competitive 5% Commission Rate: Maximizing your staking rewards

Trusted Team: Founded by a dedicated educator in the crypto space with years of experience and a team of operators that run one of the largest Injective validators

Community-Focused: Our mission has always been to help people understand and navigate DeFi

Educational Resources: Access to exclusive Injective ecosystem content and updates

Reliable Infrastructure: Professional node operation with uptime guarantees

Check out our validator page here.

Benefits For You

Earn Staking Rewards: Current estimated annual yields for INJ stakers are attractive compared to traditional finance options

Participate in Governance: Your staked INJ gives you voting power in protocol decisions

Support the Network: Help secure and decentralize the Injective blockchain

Stay Informed: Receive the latest updates on Injective ecosystem developments through our content

Contribute to Growth: Be part of building the future of onchain finance

The Dynamo DeFi Story

I started Dynamo DeFi in 2021 with the goal of helping friends and family understand how to use DeFi.

That evolved from screen recordings to more in-depth educational videos to a newsletter to an online community to educational resources.

As our audience has grown, I’ve realized that there’s an opportunity to do even more. Finance is transitioning from analog to digital. This means there will be a need for educational resources, tools, infrastructure, and more. And I want Dynamo DeFi to have a role in that.

So, I’m excited to anonunce that we’ve now launched our first validator. My first validator is on Injective, a network built for finance.

Injective's focus on DeFi aligns perfectly with our vision. As blockchain technology evolves, we believe Injective stands out as one of the most promising platforms for building the future of finance.

Our Commitment

By running an Injective validator, we're deepening our commitment to the ecosystem. We plan to create and release content highlighting:

DeFi opportunities within Injective

New protocol launches and integrations

Potential airdrops and rewards

Technical explainers and tutorials

Market analysis and insights

All of this will be available in both written and video formats, making these opportunities more accessible.

How to Stake Your INJ With Dynamo DeFi

Staking your INJ tokens is a straightforward process. Follow these step-by-step instructions:

Option 1: Stake via Keplr Wallet

Set Up Keplr Wallet:

Install the Keplr browser extension

Create a new wallet or import an existing one

Ensure Injective is enabled in your wallet

Fund Your Wallet:

Send INJ tokens to your Keplr wallet address

Ensure you keep a small amount (0.1 INJ) for transaction fees

Access Staking:

Go to the Keplr Dashboard

Select Injective from the chain dropdown

Navigate to the "Stake" tab

Select Dynamo DeFi Validator:

Find "Dynamo DeFi" in the validator list

Click on our validator name

Stake Your Tokens:

Enter the amount you wish to stake

Review the transaction details

Confirm the delegation

Option 2: Stake via Leap Wallet

Set Up Leap Wallet:

Install the Leap browser extension or mobile app

Create a new wallet or import an existing one

Fund Your Wallet:

Send INJ tokens to your Leap wallet address

Remember to keep a small amount for fees

Access Staking:

Navigate to the "Stake" section

Select Injective from the network list

Click the "Stake" button

Select Dynamo DeFi Validator:

Find and select "Dynamo DeFi" from the validator list

Complete Staking:

Enter your desired staking amount

Review the transaction

Confirm and submit

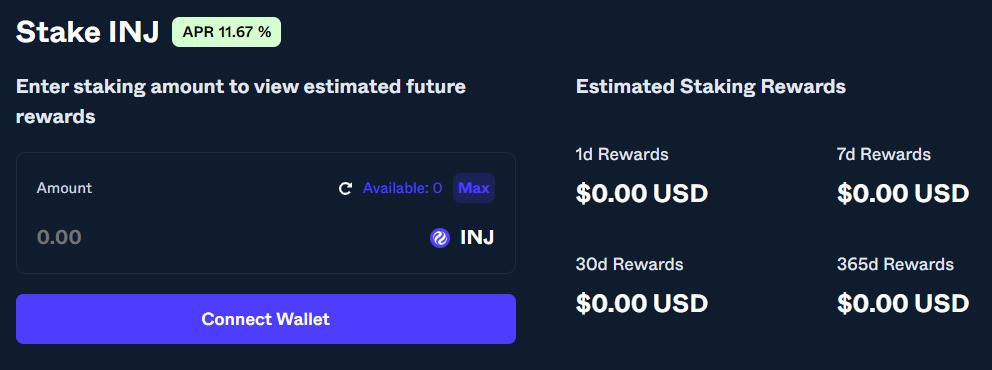

Option 3: Stake via Injective Hub

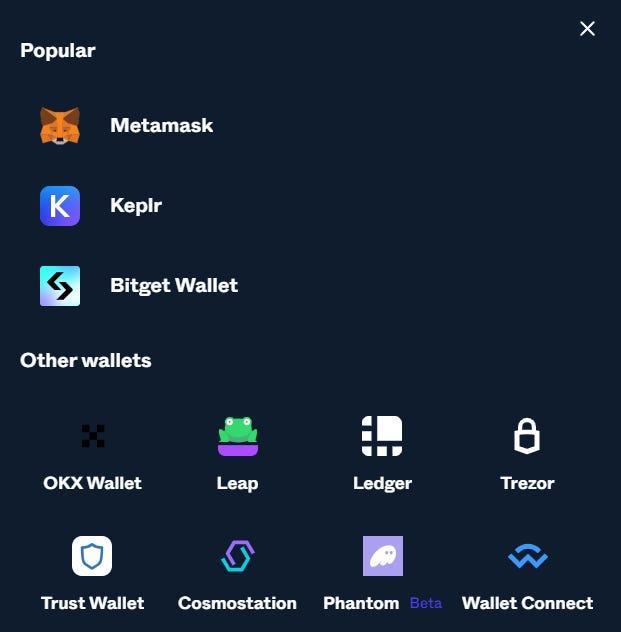

Connect Your Wallet:

Visit hub.injective.network

Connect your Keplr, Leap, or other supported wallet

Navigate to Staking:

Go to the "Staking" section of the Hub

Find Dynamo DeFi:

Locate "Dynamo DeFi" in the validator list

Delegate Tokens:

Enter the amount to stake

Confirm the delegation transaction

Managing Your Staked INJ

Claiming Rewards:

Rewards accumulate automatically and can be claimed at any time

Claim through the same interface you used to stake

Consider re-staking rewards to compound your returns

Redelegating:

You can move your stake to a different validator without waiting

Note that after redelegating, you must wait 21 days before redelegating those tokens again

Unstaking:

When you decide to unstake, there is a 21-day unbonding period

During this period, you won't earn rewards, and your tokens will be locked

After 21 days, your tokens will be automatically returned to your wallet

Frequently Asked Questions

General Staking Questions

Q: What is the minimum amount required to stake INJ?

A: There is no minimum stake requirement, but you should leave some INJ (at least 0.1) in your wallet for transaction fees.

Q: How often are staking rewards distributed?

A: Staking rewards accrue with each block (approximately every 0.76 seconds) and can be claimed at any time.

Q: What is the current staking APR for INJ?

A: Staking yields vary based on network parameters and the total amount of INJ staked. Check the Injective Hub for current rates.

Q: Is there risk in staking?

A: Yes, the main risks include:

Validator slashing (if the validator misbehaves)

Price volatility of INJ during the 21-day unbonding period

Smart contract risks

Validator-Specific Questions

Q: What is Dynamo DeFi's commission rate?

A: We charge a 5% commission on rewards, which is competitive within the Injective ecosystem.

Q: How do I know Dynamo DeFi is reliable?

A: We have built our reputation through years of educational content and community building in the crypto space. Our focus is on transparency, reliability, and accessible education.

Q: Will Dynamo DeFi participate in governance?

A: Yes, we actively participate in governance proposals and will share our voting rationale with our community.

Q: What happens if the validator goes offline?

A: We employ professional node infrastructure to ensure high uptime. In the unlikely event of extended downtime, we would notify our delegators immediately.

Technical Questions

Q: Can I stake INJ from an exchange?

A: No, you need to withdraw your INJ to a self-custody wallet like Keplr or Leap first.

Q: Which wallets support INJ staking?

A: Keplr, Leap, Cosmostation, MetaMask (when connected to Injective Hub), Ledger, Trezor, Ninji Wallet, and Trust Wallet all support INJ staking.

Q: If I delegate to Dynamo DeFi, do you have control over my funds?

A: No, validators never have custody of your delegated tokens. Staking is non-custodial, meaning you maintain control of your assets at all times.

Q: How do tokenomics affect staking returns?

A: Injective has a unique "Moving Change Rate Mechanism" that adjusts the token supply rate based on the percentage of INJ staked. This dynamic system, combined with the Burn Auction that removes INJ from circulation, creates a deflationary environment that can positively impact staking returns over time.

Join the Dynamo DeFi Community

Staking your INJ with Dynamo DeFi means more than just earning rewards, it’s joining a community dedicated to learning and growing in the DeFi space.

Stay tuned for exclusive content about the Injective ecosystem, including:

Weekly newsletters

Educational videos

Market analysis

Protocol deep dives

Opportunity alerts

Ready to stake with us? Follow the guides to get started today!

Click the image below to go straight to the Injective Staking Hub:

This guide is for informational purposes only and does not constitute financial advice. Always do your own research before making investment decisions.