Read Time: ~6 minutes

⚡Snapshot

During last week’s interest rate announcement, the Fed signaled that QT (Quantitative Tightening) will be slowing starting April 1st. The overall market rallied in the days after Powell’s comments. Even today with Trump’s tariff announcement on Venezuelan oil imports, markets are up. After weeks of a rocky market due to tariff announcements, the market seems to have shaken off that fear.

A sustained rocky market means less traders willing to take on leveraged positions.

When fewer traders use leverage, the funding rates on perpetual futures contracts (perps) falls - meaning it gets cheaper and cheaper to take on leverage.

Low funding means people have stopped trying to buy the dip. It means buyers, those who would typically buy using leverage, have capitulated.

Could this third period of muted funding rates move markets upward?

Consider this: The first instance of markets exploding higher was Cointelegraph’s announcement of Bitcoin ETFs, and the second was the election.

So to provide more context: funding averaging below risk free rates plus a catalyst could send the crypto market much higher.

With a pro-crypto administration in office, a positive catalyst could be right around the corner.

In This Article

Huge Announcement: Dynamo DeFi’s Injective Validator is live!

Introducing the Dynamo DeFi Crypto Fear & Greed Index Dashboard

Base leads TVL growth this week

Maximizing yield and airdrop points on JLP through RateX

📖 Recommended Reads

⚡Use this prompt template for career and life planning

Using LLMs to create the life you want

⚡Bitcoin hasn’t seen two consecutive bearish quarters since 2022

And Ethereum hasn’t had more than 3 consecutive down months since 2018

⚡Bullish on DeFi as more protocols activate their fee switches

dYdX is the latest project to announce token buybacks, following Aave, Hyperliquid, Raydium and others

⚡Funding just recorded third low period in two years

Last two times this happened, alts went vertical

⚡Digital asset investment products saw inflows for the first time in 5 weeks

$644M total inflows - Bitcoin received $724M and Ethereum saw outflows of $86M

⚡Secure Injective, Earn Rewards.

We're thrilled to announce Dynamo DeFi now runs an Injective validator! As the only blockchain purpose-built for finance, Injective offers:

Lightning-fast, ultra-cheap transactions

Advanced infrastructure for DeFi, exchanges, lending, and tokenization

Multi-VM support including the most performant EVM layer

Deflationary tokenomics with weekly burn auctions

Injective is leading the tokenization initiative - major equities are already onchain.

Why stake with us?

Competitive commission rate

Trusted team with years of educational experience

Professional infrastructure with uptime guarantees

Exclusive ecosystem updates and content

Getting started is easy – stake directly through Keplr, Leap wallet, or Injective Hub in just a few clicks

Stake Your INJ with Dynamo DeFi

Join our validator community and help build the future of onchain finance while earning attractive yields

🔢Onchain Analysis

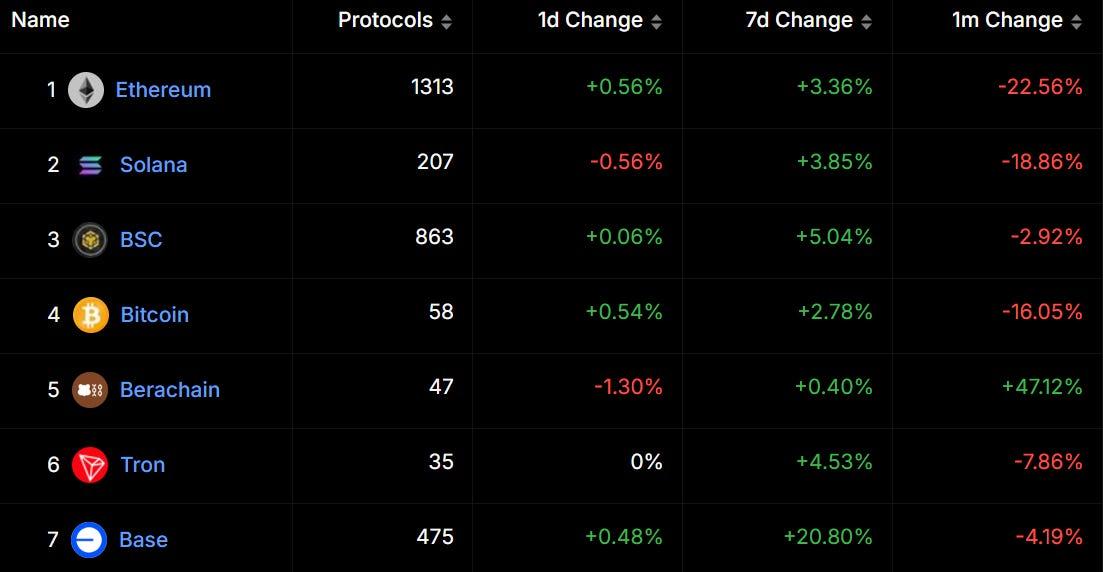

Base Leads 7d TVL Growth Among Major Chains

Base 7d TVL is up 20% this week.

No other chain in the top 15 saw that level of growth this week (Sonic was close at 16%).

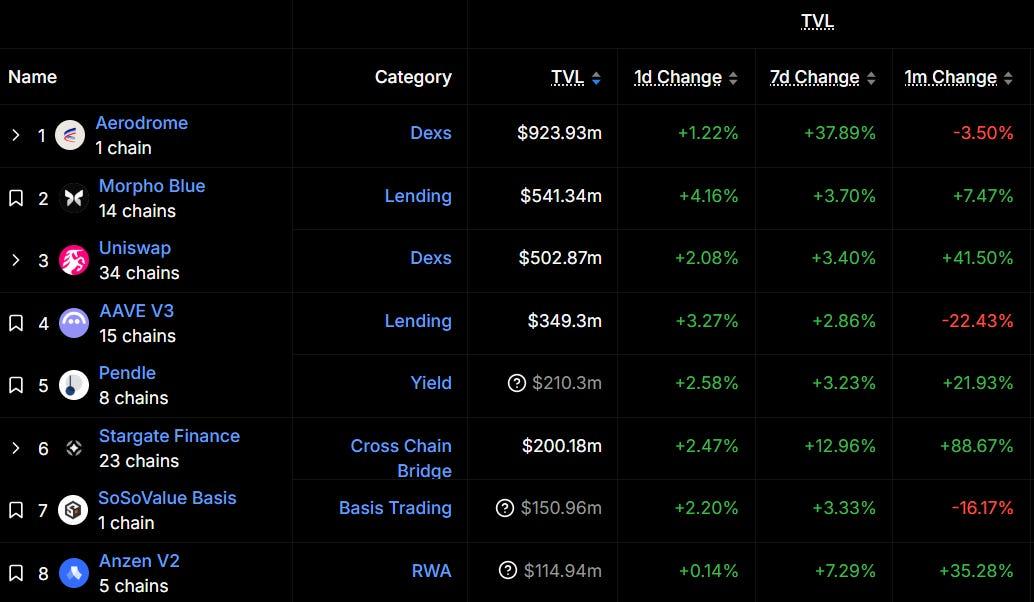

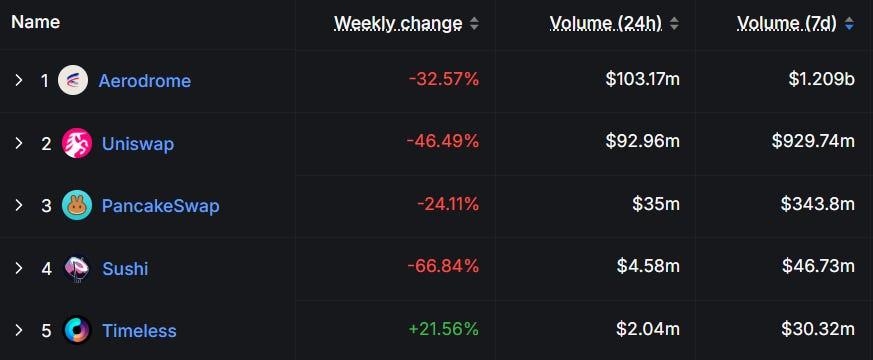

A significant portion of that growth came from Aerodrome, Base’s leading DEX.

While volume has been falling on most DEXs (PancakeSwap, Pendle & Maverick are the only major DEXs with weekly increases), Aerodrome is still capturing over 40% of Base DEX volume, processing over $1.2b in the last 7 days.

Volumes are near October levels, but Aerodrome still earned ~$9M in 7d revenue, which is over $100M annualized.

Activity doesn’t need to be at all-time highs for well-built protocols to make money. Don’t let token prices fool you - projects building for the long haul with solid fundamentals will continue to capture value as more finance comes onchain.

Given Aerodrome has 70% more TVL than the next highest protocol, the AERO token should continue to be a proxy bet for Base growth.

🚜Farm of the Week

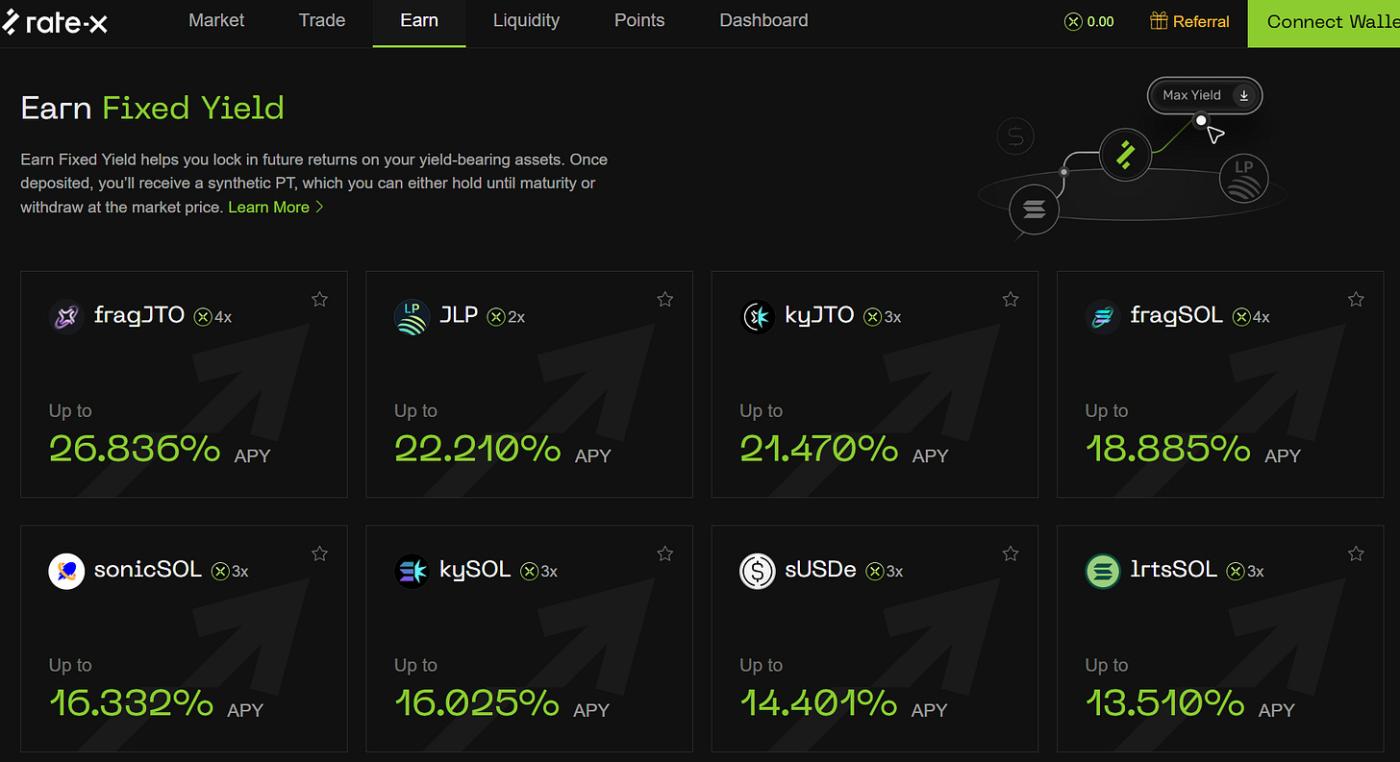

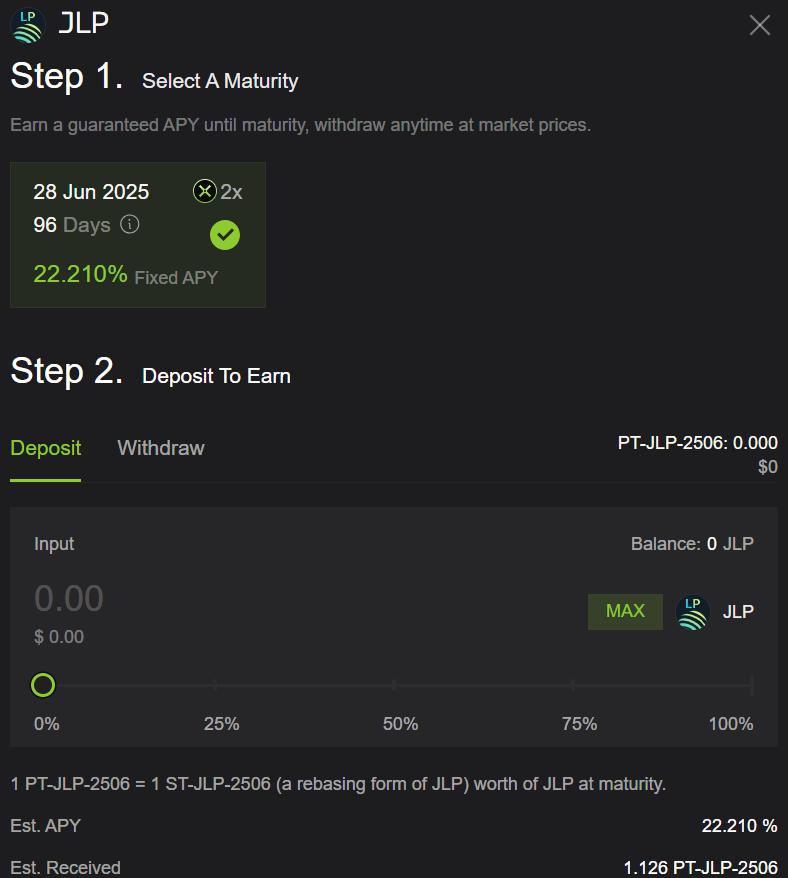

Using RateX to Maximize JLP Yield

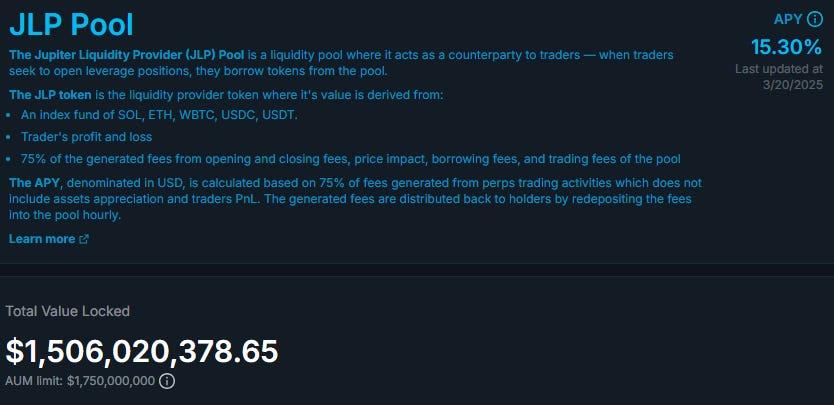

RateX is a yield trading platform on Solana. Similar to Pendle, RateX uses the concept of Principal Tokens to lock in a fixed yield on held assets. During quiet periods or market lulls, it’s a great way to earn yield.

We’ve talked about JLP as a yield-bearing basket of blue chip assets. Right now, holding JLP earns about 15% APY.

We’re going to use RateX to boost our JLP yield and earn points while doing it.

How it Works

Head to RateX and connect your favorite Solana wallet. Head to the Earn tab and click on JLP. In 96 days, you’ll receive your JLP back with an estimated 22% APY return.

In the meantime, you’ll receive a PT token that you can sell anytime before the expiration date.

The PT token earns 50% more than JLP alone (though JLP yield updates each week, and might go up if trading activity increases) and 2x RateX points. The points campaign runs until the end of 2025, and the points can be redeemed for future RateX tokens.

Risks

Stablecoins Reach Escape Velocity

⚡Capitalize on Volatility with Hyperliquid

Hyperliquid is the premiere decentralized perps exchange. It’s one of the best crypto products I’ve ever used.

It’s fully onchain, with zero gas fees and low trading fees (you’ll get a discount on trading fees by using this referral link)

If you think the market will drop, you can protect yourself against downside by shorting anything from Bitcoin to AI agent tokens with minimal slippage.

Get started on Hyperliquid in 2 minutes →

🛠️Tool Spotlight

LlamaSwap - The Aggregator of Aggregators

LlamaSwap looks for the best prices among aggregators like 1inch and CoWSwap, which guarantees the best swap prices. It’s free to use and available on over 15 chains.

LlamaSwap also offers Gas Refuel, an easy way to send gas to chains so your assets don’t get stuck without gas. LllamaSwap will find the best bridging routes from any chain.

More helpful DeFi Tools: The Dynamo DeFi Crypto Tools List

📅Key Events This Week

Macro Events

📊 S&P Global Manufacturing PMI data - March 24th

📊 CB Consumer Confidence data - March 25th

📊 February New Home Sales data - March 25th

📊 Atlanta Fed GDPNow data - March 26th

📊 US Q4 GDP data - March 27th

Token Unlocks: $520M Unlocking This Week

🔓Tokenomist: Track token unlocks and make better investment decisions. Use my code DDNM5 for 5% off Pro Plans.

🔓BICO (0.79%) - March 24th

🔓VENOM (2.90%) - March 25th

🔓 ALT (8.60%) - March 25th

🔓EIGEN (0.53%) - March 25th

🔓YGG (3.28%) - March 27th

🔓AXL (1.66%) - March 28th

🔓SLF (1.57%) - March 28th

🔓VELO (2.47%) - March 28th

🔓UDS (3.00%) - March 28th

🔓AGIX (2.40%) - March 28th

🔓OP (1.99%) - March 30th

🔓TRIBL (10.12%) - March 30th

Launches & Updates

Note that these launches are mostly unvetted by the Dynamo DeFi team and this isn’t an endorsement of any of them.

🚀 Berachain PoL release - March 24th (Source)

🚀 Skey network staking program - March 24th (Source)

🚀 Omni network staking upgrade - March 24th (Source)

🚀 Xandeum pNode launch - March 25th (Source)

🚀Nyan heroes playtest 4 launch - March 26th (Source)

🚀Celo L2 mainnet activation - March 26th (Source)

🚀Legend of Elysium launch on Steam - March 26th (Source)

🚀Walrus protocol mainnet - March 27th (Source)

🚀Deeplink network launch - March 27th (Source)

🚀Apollo zBTC token launch - March27th (Source)

⚡Favorite Resources

If you want to dive deeper, here are some of my favorite resources:

🛠️ The Dynamo DeFi Crypto Tools List: A comprehensive list of 100+ crypto tools to help with portfolio tracking, analytics, airdrops and more.

🚀 RocketX: The 1-stop-shop to get the best rates for on-chain & cross-chain swaps.

🛡️ Ledger: The smartest way to secure your crypto. Buy & sell crypto with full control over your assets.

For more frequent content, follow me on Twitter and YouTube.

Until next time,

Dynamo DeFi