In econ it’s well known that “ambiguous devices” have all kinds of useful and interesting mechanism design properties. It turns out that a blockchain + a pathological RNG called Machine II can create a very general purpose “ambiguous device”. You can see a demo running in a TEE here.

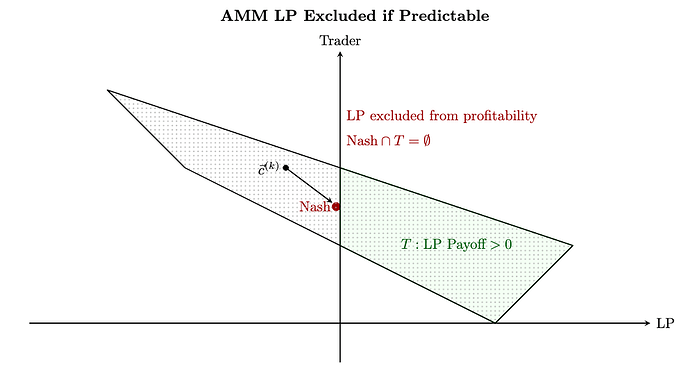

Here’s the idea for AMMs. Suppose we treat LPing as a classic Exclusion Game in which the LP wants to make profit but traders can “exclude” you from the profitability region (LVR let’s say). The game models the dilemma for the LP as basically:

- Charge high fees to get some arbitrage protection, but at the risk of scaring off retail.

- Charge low fees to attract retail but get arbed.

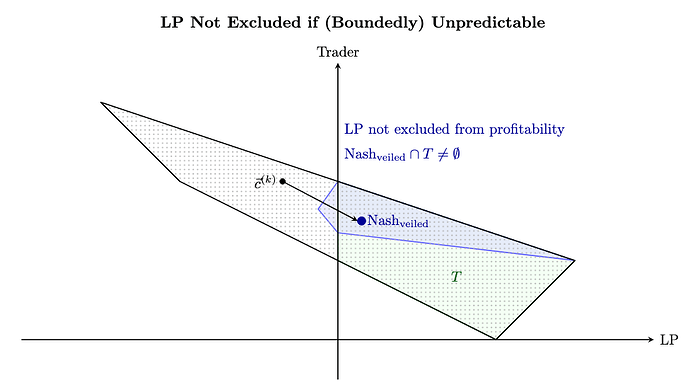

It turns out that in such a game, using an ambiguous device (“veiling your fees”) can really improve the situation for the LP. The math can be a little tedious and unfamiliar, so I think it’s useful to show pictures of what veiled fees do to the game.

Below is the “problem picture”, showing that the LP has no viable strategy to be profitable. The unique Nash Equilibrium pays \le 0≤0 and so they are excluded from the green region (TT).

When you introduce veiled fees the LP’s payoffs are not fixed but now lie in the full blue region. Clearly LP is no longer excluded from profitable region TT (in fact they can even reach the highest possible payoff way off to the right.) Further, the blue region is clearly truncated on the left, so the LP risks very little for this.

To establish actual payoff numbers, one needs to make an assumption about how exactly the LP treats their payoff uncertainty. Obviously the LP would have to be pretty averse to uncertainty to not see the blue region as an improvement over the Nash in the earlier figure.

If we assume neutrality for the LP, such that their best and worst payoffs are evaluated at the halfway point, the LP improves their payoffs from 0 (under the Mixed Nash) all the way to 1.4 (under the Veiled Nash).

You can read more in the draft paper here. I will say I’ve run this approach by a decent proportion of the high end crypto brain trust at this point and thus far no substantial objections have been raised. It’s a little shocking to some that you can pareto dominate a unique mixed strategy Nash Equilibrium (it was to me when I first saw it) but here in 2025 this is mainstream–if cutting edge–game theory.