Author: hitesh.eth

Compiled by: Tim, PANews

When I understood the true potential of Bitcoin in early 2017, it was like discovering a new spark in the digital era. This was not just a new alternative asset, but a completely new paradigm, a technology that redefines money.

A decentralized system not subject to arbitrary intervention by governments and central banks, providing financial autonomy for anyone who chooses to participate. It was not just an investment, but a financial revolution. I hoped everyone around me could understand what I saw.

I prepared a long message and sent it to 100 people via WhatsApp groups, suggesting everyone buy Bitcoin and recommending a consulting service to help them increase their Bitcoin holdings. Although I had achieved some initial success in Altcoin investments and believed I could easily double everyone's Bitcoin assets in a few months, my understanding of the market was still in its infancy, and I failed to fully comprehend how narrative logic and emotional changes drive price movements in this young market.

Based on the limited available data at the time, I gradually formed my market perception. Most Altcoins launched between 2015 and 2017 lacked extensive trading history to reference. Their price charts presented seemingly perpetual upward trends, with minor pullbacks appearing like a "pause button" before launching into a new round of growth.

This 'buy-hold-wait-appreciate' model was intoxicating: buy, hold, wait, and watch your holdings continuously increase in value. The "design" concept of the cryptocurrency market seemed to be only rising, and this idea took root in my mind. The market volatility did not scare me; I felt it was just part of the process.

Theoretically, I believed I could remain calm during market pullbacks, but the first major adjustment in the second quarter of 2017 completely shattered this illusion. This was not a simple pullback, but a crash. Top-performing tokens from the first quarter hit new lows, dropping 70-80%, and our beliefs instantly collapsed.

Watching my assets gradually shrink, excitement turned to panic, and optimism turned to doubt. But I continued to persist, believing this was just the pain before the next round of growth. However, I did not double my Bitcoin position but instead reduced 70-80% of my holdings, returning to the starting point.

Market uncertainty followed. Bitcoin surged from $10,000 to $20,000, while Altcoins struggled to recover. Market sentiment around Bitcoin was chaotic, today hailing it as the future of currency, tomorrow flooded with "death" reports: Chinese bans, regulatory crackdowns, hacker attacks. Every negative news would create waves in the market. My initial firm belief began to waver. Were we truly on the edge of a financial revolution? Or was this just another speculative bubble destined to burst?

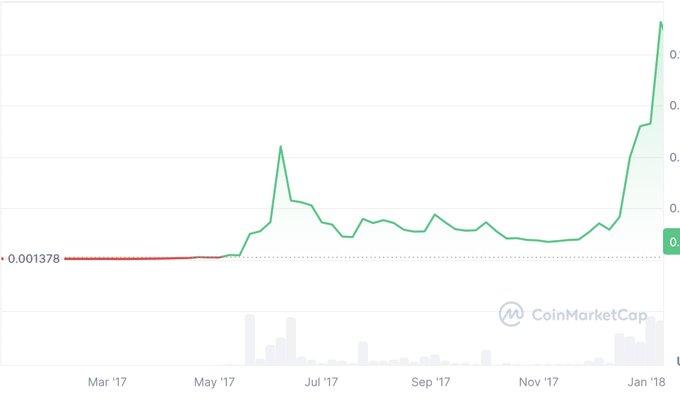

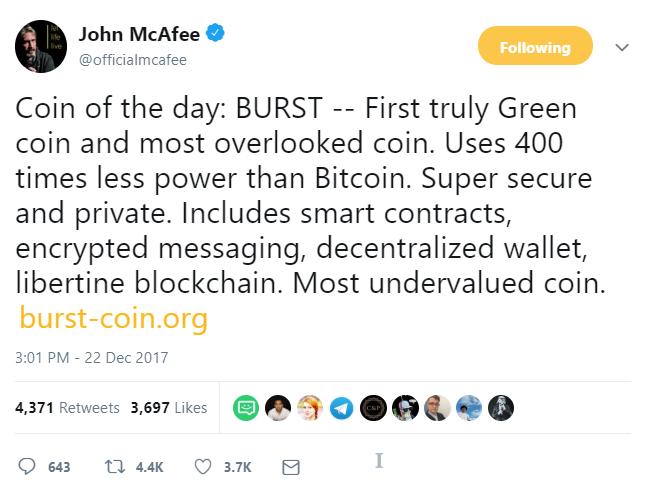

Until January 2018, a month that completely refreshed my market perception. Altcoins not only rebounded but experienced explosive growth. TRX multiplied 100 times in just a few weeks, and numerous previously criticized projects made strong comebacks, with some rising tenfold or more. The market fell into a frenzy, and everyone felt like an investment genius.

The anxiety of the past months dissipated with the emergence of a green candle. Just like that, a new perception formed in my mind: perhaps this is how the market operates. After a catastrophic pullback, its return will be more intense.

This belief veiled a layer of deception before our eyes. We tried to convince ourselves with a "new normal": we persuaded ourselves that this was the new norm, believing each massive drop was just a setup for the next massive surge. We waited for "green months" to return, believing patience would be rewarded. But so far, this has never materialized. The market continued to bleed, and the once-exciting capital game gradually evolved into a slow and painful reality: we were already trapped by our own high expectations. This cycle played with us.

Each cycle has moments of extreme excitement. In the previous cycle, we saw the same scenario occur in the Non-Fungible Token space. Some NFT series surged 100 times in a short time, with these "crazy 30 days" occurring three consecutive times. It felt just like 2018. Hype, belief that "this is just the beginning", FOMO - everything was stunningly similar. When the market continued to rise after two pullbacks, we thought, "This might be how the market works" and chose HODLing. However, the ending repeated itself: we lost everything. My losses in Non-Fungible Tokens were devastating, as usual.

People often say "learn from mistakes", but the market always finds a way to make you forget. Your mind will deceive you, making you believe that this time is truly different. "Now I know how this game works, I won't make the same mistakes again." But invisible traps always exist. That illusion of controlling everything and cracking the wealth code makes you participate in the market for too long. Ultimately, the market is the winner. Over time, you might learn to minimize losses, but the result will always be a loss.

Recently, we witnessed history repeating again. This time it's the AI Agent track. Surging 100 times shortly after public launch, ICO seemingly making a sudden comeback. It all feels like yesterday in a different guise. We again believe this cycle of revelry might continue for weeks or even months.

We keep making mistakes, keep falling, we know what we're doing, but cannot stop it from happening. In fact, we cannot control our emotions.

Perhaps now, you're emotionally thinking everything has ended, and only a few coins will rebound. But the market is always contrary to expectations, and it will use the same old trick again. You might be forced to sit at the table or get out, and in my view, this is the inevitable fate facing most retail investors.

The only way to win in this capital game is: maximize gains when you're at the table, minimize losses when you're out. Of course, it's easier said than done.