The blockchain industry has been seeking a stable bridge between digital assets and real-world value. With the launch of Qi, this vision is becoming a reality. Qi is a stablecoin pegged to electricity costs, and Quai Network combines the energy market with **decentralized finance (DeFi)**, bringing new transformations to the financial system and mining incentive mechanisms. This innovation could reshape the crypto economy and bring a series of opportunities and challenges.

What is Qi?

Qi is an energy-backed stablecoin whose value is based on electricity costs, rather than traditional fiat currency (such as the US dollar). Unlike algorithmic stablecoins or fiat-backed stablecoins, Qi represents a fundamental resource — electricity, which is crucial for blockchain networks, data centers, and global industries. By anchoring value to electricity, Qi could provide a more stable and realistic economic foundation for the **Proof of Work (PoW)** ecosystem.

Qi Activation Details

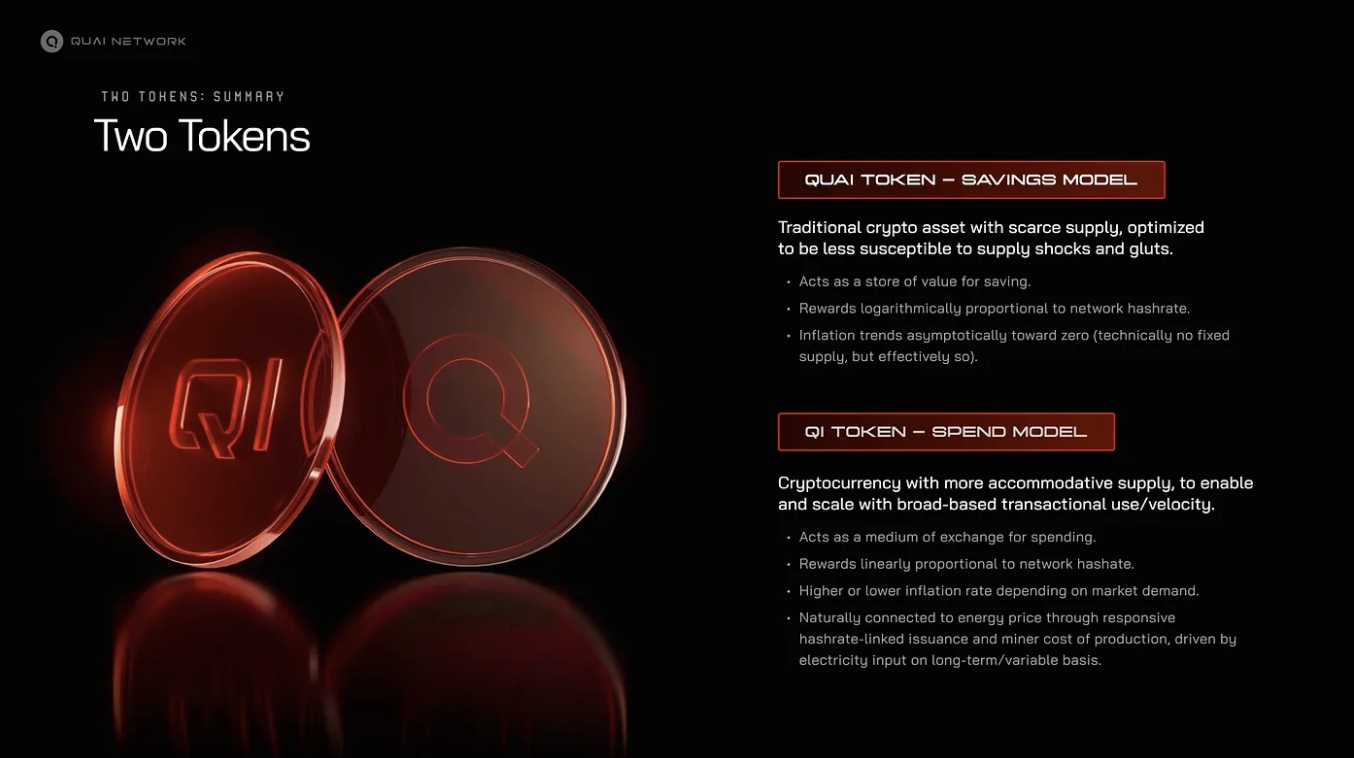

Qi will be officially activated at the Prime block height 211,680, expected to be on April 2, 2025. This coincides with the mainnet launch of Quai Network on January 29, 2025, which will introduce a dual-token system, including QUAI and Qi. Unlike traditional stablecoins, Qi can only be generated through mining, and there will be no large-scale Qi pre-allocation in the market.

Potential Impact of Qi

- Improving DeFi Stability

Stablecoins are crucial for DeFi, allowing users to store value and avoid the volatility risks of the crypto market. However, most stablecoins are either fiat-backed (regulated and controlled by banks) or algorithmic stablecoins (prone to de-pegging). Qi proposes a completely new stability model, with stability derived from a real commodity — electricity. This feature could make Qi more resilient than traditional stablecoins and better able to withstand traditional financial market turbulence.

2. Electricity as a Financial Asset

Qi could make electricity a fully tradable on-chain financial instrument. This means energy producers, miners, and investors can use Qi to hedge energy costs, create new financial products, and optimize energy usage. At the same time, Qi also opens the door to broader real asset tokenization, such as Renewable Energy Credits (REC) and electricity futures contracts.

3. Providing Better Miner Incentives

For PoW miners, electricity cost is the largest operational expense. Qi could introduce a new economic mechanism that allows miners to directly obtain assets linked to their primary costs, thereby reducing financial uncertainty. This can make mining more sustainable, especially for miners with low-cost or renewable energy.

4. Geopolitical and Economic Changes

An energy-backed asset could change the global financial landscape, especially in regions with significant electricity price differences. Countries with low electricity costs may gain advantages in mining and Qi-related financial activities. Additionally, governments and regulators might view Qi differently from traditional cryptocurrencies, which could bring unique regulatory considerations.

Pros and Cons of Qi for Miners

✅ Advantages:

✔ Cost Efficiency — Qi is directly linked to electricity prices, and miners can directly pay operating costs with Qi without converting to fiat or other cryptocurrencies.

✔ More Stable Earnings — Unlike traditional mining rewards, Qi could provide more stable value storage, reducing uncertainty from market fluctuations.

✔ Incentivizing Renewable Energy Use — Miners using renewable energy might benefit from a more sustainable, cost-effective model, and could even obtain Qi at preferential rates.

❌ Disadvantages: ✖ Liquidity and Adoption Risks — Qi's success depends on market acceptance. If exchanges, businesses, or energy providers do not widely accept Qi, its utility could be limited. ✖ Regulatory Uncertainty — Governments might impose restrictions on energy-backed digital assets, especially when they perceive Qi as threatening the status of fiat currency. ✖ Price Stability Risks — Although electricity is a fundamental resource, its price may fluctuate due to geopolitical and economic factors, potentially affecting Qi's stability.

Pros and Cons of an Electricity-Backed Stablecoin

✅ Advantages:

✔ Real-World Practical Value — Qi does not rely on the traditional banking system but is based on essential fundamental resources.

✔ Inflation Resistance — Fiat currencies may be affected by inflation, while electricity prices are based on supply and demand fluctuations, providing another form of stability. ✔ Promoting Energy Innovation — By linking financial incentives to energy, Qi could drive investment in more efficient energy production and distribution.

❌ Disadvantages:

✖ Electricity Price Volatility — Although Qi aims to provide stability, electricity price variations in different regions could affect its effectiveness.

✖ Regulatory and Compliance Issues — Governments might set regulatory limits on energy-backed financial instruments, creating uncertainty for users and businesses.

✖ High Adoption Barrier — For Qi to succeed, it requires widespread adoption by exchanges, miners, and energy providers, which may take time.

Conclusion

Qi presents a completely new stablecoin concept, with its value derived from electricity — an asset with global demand. If Qi can be successfully implemented, it could fundamentally transform financial markets, DeFi, and mining economics. However, its impact will largely depend on market acceptance, regulatory support, and its ability to maintain stability amid electricity market fluctuations.

As global exploration of blockchain and real asset integration continues to deepen, Qi represents an important step in making energy a digital financial instrument. Whether it can reshape miner incentive mechanisms and institutional DeFi remains to be seen, but it undoubtedly opens up new possibilities for the crypto economy.

🌐 Learn More: [ http://oula.network/zh/register?invitation=MBW1O9] 💬 Join Community: [https://t.me/oulacommunity] 🐦 Follow Twitter: [https://x.com/oula_network] 💻 Check GitHub: [https://github.com/oula-network/quai] 🐧 Linux Mining Guide: [https://oula-faq.gitbook.io/zh/en/mining-tutorial/quai-linux] 🚀 HiveOS Mining Guide: [https://oula-faq.gitbook.io/zh/en/mining-tutorial/quai-hiveos]