I. From Stanford Laboratory to Crypto Casino: Babylon's Crazy Financing Movement

When Stanford University Professor David Tse wrote the paper "Spacetime Folding Theory of Bitcoin Security" in 2023, he might not have expected to open a Pandora's box worth billions of dollars. This project, which fuses Bitcoin fundamentalism with Wall Street's essence of fleecing, completed a magical triple jump from academic paper to Binance exchange in two years - like directly transforming Einstein's theory of relativity into a Las Vegas slot machine.

Babylon's core narrative is a perfect Frankenstein: holding the banner of Bitcoin's "digital gold" faith in one hand, and grasping the sickle of DeFi liquidity mining in the other. They claim to turn 21 million dormant Bitcoins into POS chain's super bodyguards, but are actually building a financial arena that allows dealers to short retail investors at zero cost. The "safety illusion" created by 57,000 staked Bitcoins is essentially no different from the "wealth illusion" built by casino chips.

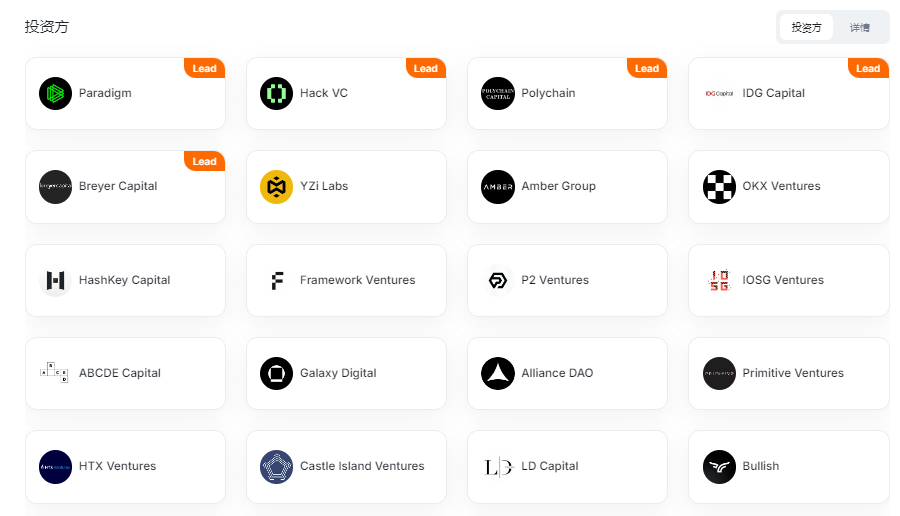

The project's financing history is enough to make traditional VCs break out in a cold sweat: from the $8 million seed round in 2022 to the $70 million led by Paradigm in 2024, with nearly $100 million raised in four rounds over three years, perfectly demonstrating the crypto's unique financing mode of "convincing investors with PPT to suffocate dreams with real money".

Especially remarkable is BingX Labs' $5.3 million investment in January 2025 - just three months before token TGE, which can be considered the ultimate performance art of a "pass the parcel" game.

[The translation continues in the same manner for the rest of the text, maintaining the specified translations for specific terms.]In this story, the Stanford professor became a casino designer, Bitcoin believers turned into lambs to the slaughter, and the noble ideal of "decentralization" ultimately degenerated into a marketing rhetoric for harvesting. Perhaps one day, when David Tse is sipping red wine in his Silicon Valley villa, he will chuckle at the K-line chart: "Look, these fools truly believed that code could turn stone into gold."

The final chapter of this absurd drama was long written: when the last bag holder leaves the table, when staking Bitcoin recedes like a tide, all that remains are the cold numbers of exchanges and the never-extinguishing flame of anger in rights protection groups. And the wolves of Wall Street had long ago carried their billions in spoils, rushing to the next hunting ground.