Author: Fairy, ChainCatcher

Editor: TB, ChainCatcher

"This is even worse than LUNA."

In the early morning hours of Beijing time, a sudden plunge left many crypto investors sleepless. The MANTRA token OM dropped by about 10% within a short hour, then directly plummeted from $5.21 to $0.50, a staggering 90% drop.

The community was in an uproar, with sharp comments: "Many people were still holding OM for interest, without even time to escape, which is even more fatal than LUNA's flash crash."

This sudden plunge is not just a technical issue, but more like a long-buried landmine that has finally exploded.

Checkered "History"? Unveiling MANTRA's Controversial Past

In the Web3 world, project valuation deviating from fundamentals is not uncommon, but when a DeFi protocol has a TVL of only $4 million yet boasts a fully diluted valuation (FDV) of $9.5 billion, it's hard not to raise market doubts about its rationality.

MANTRA's collapse may not be without trace, with numerous controversies and unsavory history in recent years:

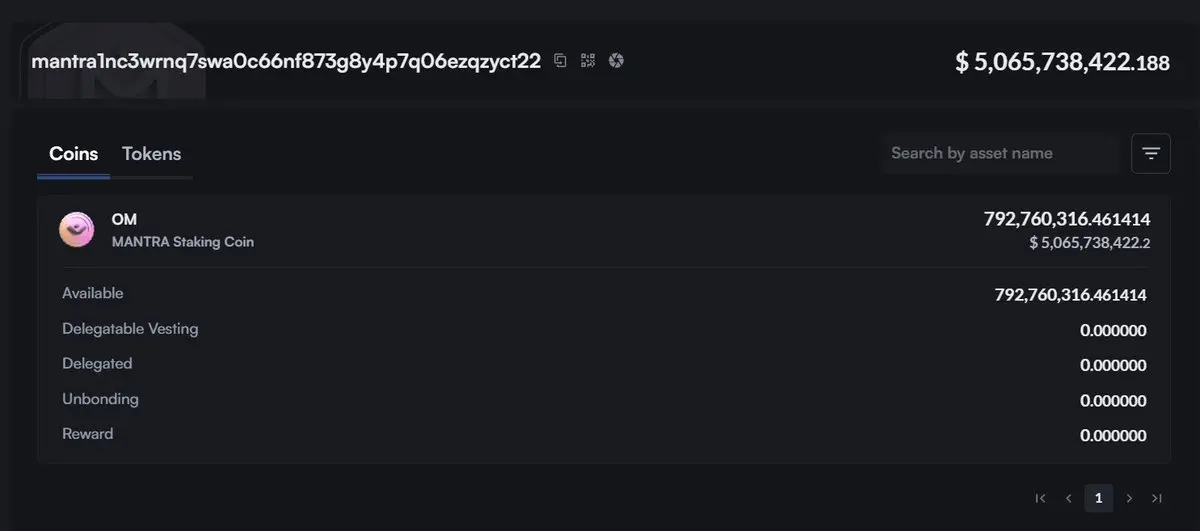

High project team control. Crypto analyst Mosi states that MANTRA controls most of the $OM circulation. The project team has concentrated 90% of $OM (792 million tokens) in a single wallet address.

An endless token relay game. Crypto KOL Rui points out that OM's underlying logic is more like a carefully packaged OTC fund game. Reportedly, over the past two years, OM raised over $500 million through OTC sales via ground push mode. Its operation involves continuously issuing new OTC tokens to absorb previous investors' selling pressure, forming a "new takes old, old exits new" cycle. Once liquidity dries up or unlocked tokens can no longer be absorbed by the market, the entire system may collapse.

The project team itself would also "cash out opportunistically" in each rally, opening contracts and cooperating with market pumps to gain additional profits.

Middle Eastern capital acquiring project shell. According to Ye Su, OM's FDV dropped to less than $20 million in 2023, nearly abandoned. Subsequently, a Middle Eastern capital acquired the OM project through a middleman, retaining only the original CEO and replacing the entire team. This Middle Eastern capital, with extensive luxury mansions, resorts, and various RWA assets, packaged OM as an RWAfi concept project. Leveraging the RWA theme's heat and high control tactics, OM achieved over 200x growth in 2024.

Involved in legal disputes, accused of asset misappropriation. According to the South China Morning Post, the Hong Kong High Court once required six MANTRA DAO members to disclose financial information, stemming from allegations of misappropriating DAO assets.

Defaulting on numerous promised fees and tokens. Crypto KOL Phyrex stated he invested in the project early but never received the promised Token. Even after winning a lawsuit in 2023, the MANTRA team never executed the court judgment, claiming they "moved from Hong Kong to the US". He accused: "Not a single penny or Token was ever paid."

Airdrop operations heavily criticized. According to Ice Frog, MANTRA project team frequently modified rules from early airdrop activities, gradually postponing token unlock schedules, ultimately disappointing user expectations. During airdrop distribution, the project team lacked transparency, always coldly treating community doubts, even implementing a "witch trial" elimination mechanism, revoking user airdrop qualifications under the pretext of "Sybil attacks" without ever disclosing specific determination criteria or data.

Collapse Truth Breakdown: Liquidation Turmoil and Whale Exodus

After OM's price experienced a cliff-like plunge, quickly triggering community panic and questioning, the MANTRA team urgently spoke out within hours, attempting to clarify that the project team had no direct relationship with this market volatility. Multiple analyses and speculations circulated in the market. The causes can be roughly summarized in two points:

Forced Liquidation Triggering Market Volatility

According to MANTRA co-founder JP Mullin, OM's market volatility was caused by reckless forced liquidations of OM account holders by centralized exchanges. He noted that these account position liquidations occurred very suddenly, without sufficient prior warning or notification.

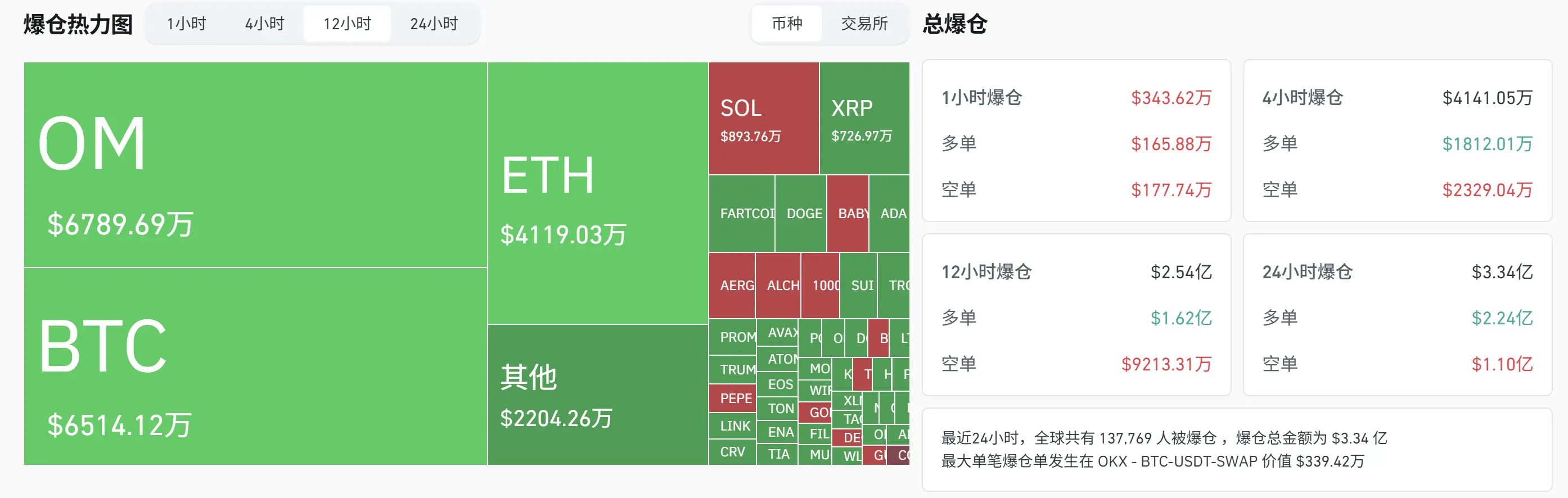

Data shows that in the past 12 hours, OM's collapse led to over $66.97 million in forced liquidations, with 10 positions having liquidation amounts exceeding $1 million.

Strategic Investors' Large-Scale Exodus

According to Lookonchain monitoring, before OM's collapse, at least 17 wallets transferred 43.6 million OM (valued around $227 million at the time), representing 4.5% of circulating supply, to exchanges. Two wallet addresses were associated with MANTRA's strategic investor Laser Digital.

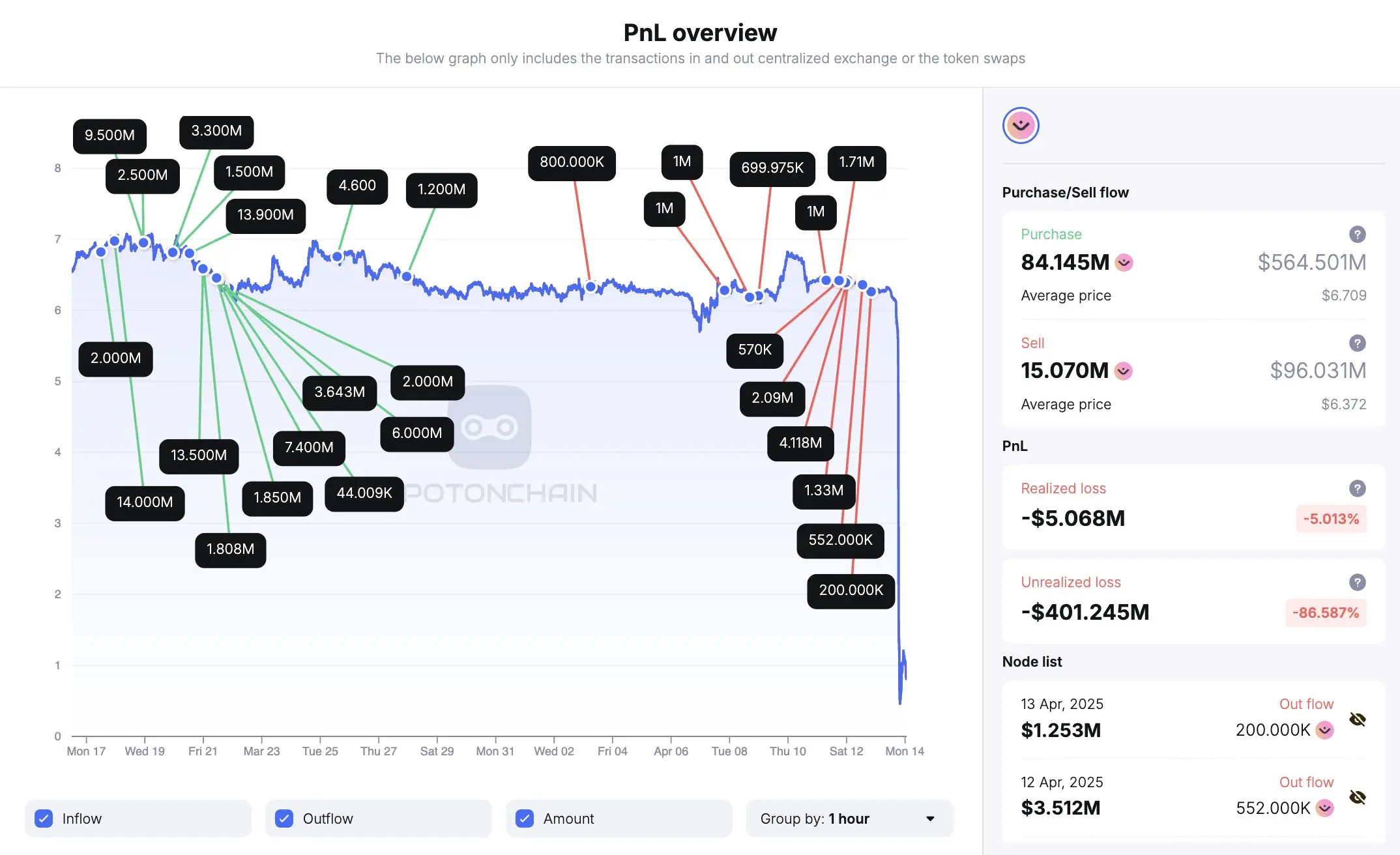

Additionally, according to Spot On Chain monitoring, 19 wallets, seemingly belonging to the same entity, transferred 14.27 million OM (about $91 million) to OKX at an average price of $6.375 within three days before OM's collapse. As early as late March, these wallets had purchased 84.15 million OM from Binance for about $564.7 million, at an average price of $6.711. These wallets might have hedged positions on other platforms, and these operations exacerbated this plunge.

OM's 90% collapse once again validates the brutal reality of "harvesting logic" in the crypto market. OM is not the first project to encounter this fate, nor will it be the last. In the crypto industry, where opportunities and bubbles coexist, maintaining vigilance and rational investment is key to steadily navigating the complex and ever-changing market environment.