Written by: Pzai, Foresight News

On April 14, the ETH/BTC exchange rate dropped to 0.01924, creating a new low since January 2020. As a mainstream asset in the previous bull market, Ethereum's performance in this cycle has led to dissatisfaction among many investors. Facing Bitcoin's strong performance in this cycle, Ethereum seems to be experiencing a dual test of confidence and value. Some community members have noted: "Although OM plummeted 90% today, its performance this year still outperforms ETH." In the recent week, some whales on the chain have also been stirring, and this article will review the on-chain and exchange data from the past week to provide a comprehensive overview of token trading.

On-chain Data: "Retreat" Signals Emerge

In the past week, some whales have been "pouring" into the market. According to Arkham data, an OG address group that initially purchased 100,000 ETH in 2015 has accumulated sales of 4,180 ETH on Kraken since April, valued at approximately $7.05 million. Another 0x62A address sold 4,482 ETH at an average price of $1,572 on April 12, also valued at $7.05 million. Such price decline has triggered numerous on-chain liquidations, such as a whale who sold 35,881 ETH at an average price of $1,562 on April 10, reduced leverage, and then sold the remaining 2,000 ETH at $1,575, with the address currently holding 688 ETH.

Since Bitcoin's halving in 2024, Ethereum has dropped 40% relative to Bitcoin, marking the first time it has been consistently weak within a year of halving. In comparison, the SOL/ETH exchange rate has risen 49% this year, reaching 0.0817. This indicates that SOL's performance still significantly outperforms Ethereum in 2025. According to defillama data, Ethereum's DEX income in the past 24 hours was only $1.1 million, and its TVL has dropped from a high of nearly $80 billion to $46.9 billion, a decline of almost half. In the previous cycle, Ethereum successfully became the second-largest asset through multiple new assets (such as NFTs and DeFi) and application advantages. However, now, with the MEME trading fever shifting to Solana and other chains, its on-chain circulation has relatively slowed.

On-chain Activity Indicators

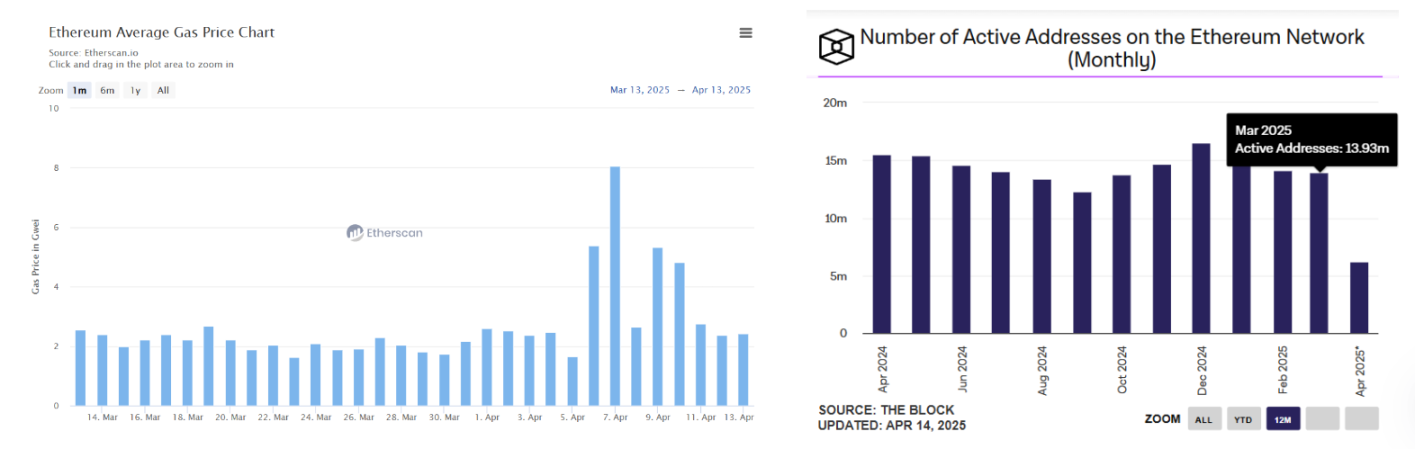

In the past month, except for the market crash on April 7, Ethereum's mainnet Gas has long maintained a level of 2 Gwei, reflecting a decline in on-chain activity. Additionally, the monthly active addresses on Ethereum's mainnet have been in a fluctuating trend, with active addresses in March falling below 15 million.

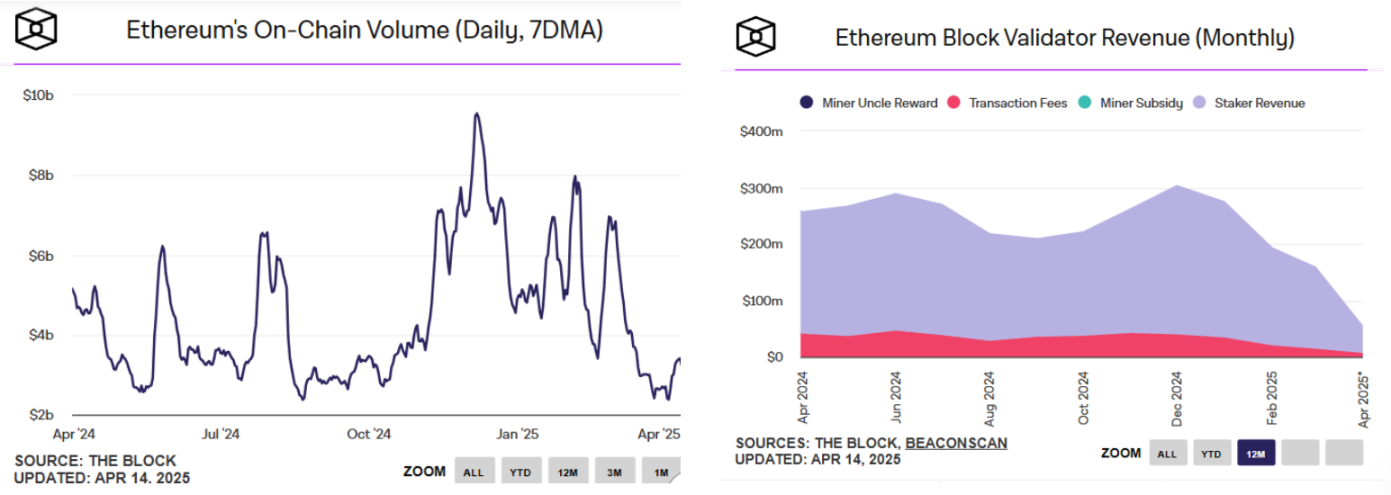

According to The Block data, Ethereum's daily average transaction volume is below $3 billion, and coupled with the coin price impact, the mainnet validator monthly revenue in March has fallen below $200 million. From an investor sentiment perspective, the lower on-chain opportunities have led some investors to adopt a wait-and-see attitude towards Ethereum's short-term growth potential.

CEX and ETF Data

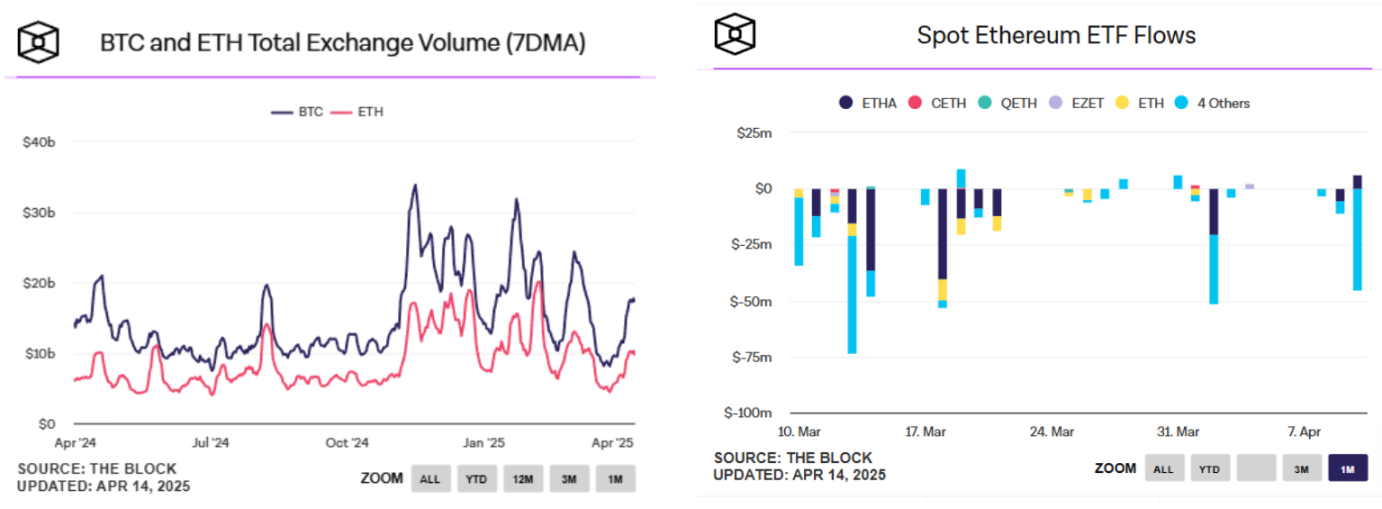

From exchange data, it can be seen that Bitcoin's trading volume peaks are significantly larger and more volatile, indicating that market funds are more flowing into Bitcoin spot and derivatives trading. In ETF data, Ethereum spot ETF has recorded outflows on multiple days in the past month, with the highest single-day outflow reaching $75 million. The performance differences further reveal that the current crypto asset risk appetite shows significant differentiation, and the capital withdrawal from Ethereum spot ETF exposes market concerns about the slowing pace of the crypto ecosystem, especially under the background of intensified Layer2 competition and new public chains diverting developer resources, with some institutional investors choosing to shift.

Macro Environment: Bitcoin Dominates, Ethereum Awaits Opportunity

In the market environment where Bitcoin serves as the "Beta" of US stocks, Bitcoin's total market cap percentage is gradually exceeding 60%, reaching 62.46% today, indicating a clear "Bitcoin season" with high fund concentration and Altcoins performing weaker than Bitcoin. Additionally, the crypto fear and greed index remains in the "panic zone," reflecting investors' preference for "risk-averse" needs, with Bitcoin becoming the target. Moreover, in the future strategic reserve plans of the United States, most states' proposals only include Bitcoin within the reference range, further promoting Bitcoin's status as the mainstream crypto asset. If the ETH/BTC exchange rate falls below 0.018 in Q2 2025, it may trigger more leveraged position liquidations, further suppressing the price.

In the Ethereum ecosystem, the potential "Trump liquidity" is also a market focus. On March 25, the Trump family prominently launched the USD1 stablecoin pegged to the US dollar through "World Free Finance" (WLFI), with the first batch to be issued on Ethereum and Binance Smart Chain. As one of the stablecoins dedicated to institutional liquidity, this liquidity window is expected to provide sufficient inflow for Ethereum. The current new low of the ETH/BTC exchange rate is a result of the market's weighing of short-term risks (halving siphoning, regulatory uncertainty) and long-term value (ecosystem innovation, market expectations). With Ethereum's upcoming Pectra upgrade and key developments like account abstraction, and Vitalik's call to build Ethereum L1 as the "world computer," can we see Ethereum's revival? Let's wait and see.