📝 Editor’s Note: Setting the Scene

Welcome to OurNetwork's fourth Mega issue on Polygon, a network which has come a long way since we first collaborated in May 2024.

Stablecoins have been a key source of momentum for Polygon — aside from having nearly $2B in stables on the network, Polygon is a leader in stablecoin velocity, an emerging indicator of economic health and widespread adoption.

Polygon also continues to be a consistent choice for payments adoption from both crypto-native projects and legacy institutions. In fact, the state of Wyoming recently chose Polygon for its upcoming stablecoin.

Polygon Labs, a key development firm in the Polygon ecosystem, is a core contributor to the Agglayer, a cross-chain settlement layer that connects the liquidity and users of any blockchain for fast, low cost interoperability and growth. Agglayer solves a key pain point of crypto — the high friction of moving assets across chains. Multiple teams, including Lumia, a Polygon CDK-powered Layer 2 focused on Real World Assets, are already connected to the Agglayer.

There's a lot to unpack in this one — a major shoutout to work from the data studio spaceharpoon to get this report together. Let's get into it.

– ON Editorial Team

Stablecoin Velocity 🏦

👥 spaceharpoon | Dashboard

📈 Polygon’s Stablecoin Velocity Beats Ethereum & Solana, Showing Efficiency & Challenging TVL as Top Metric for Chain Health

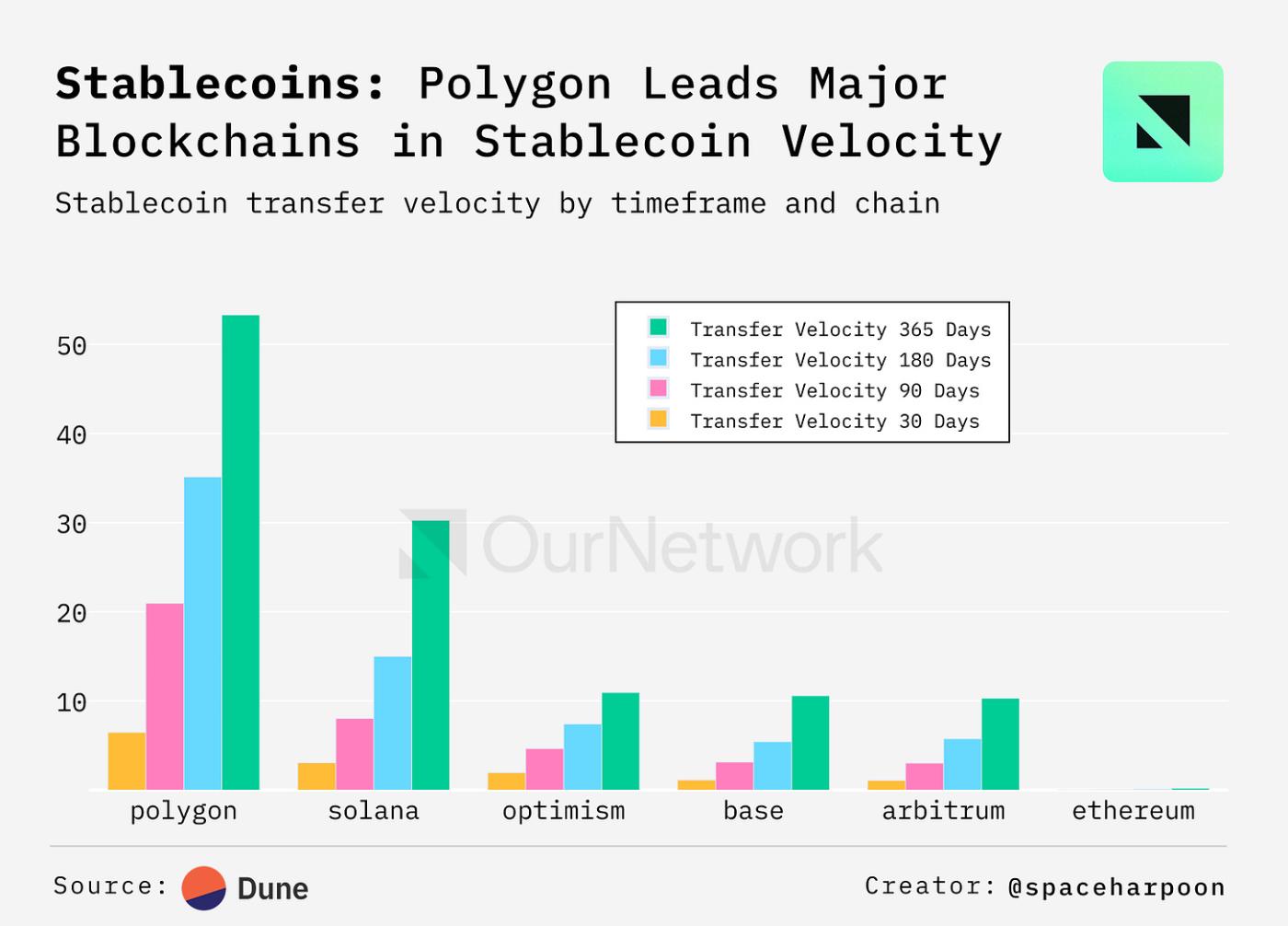

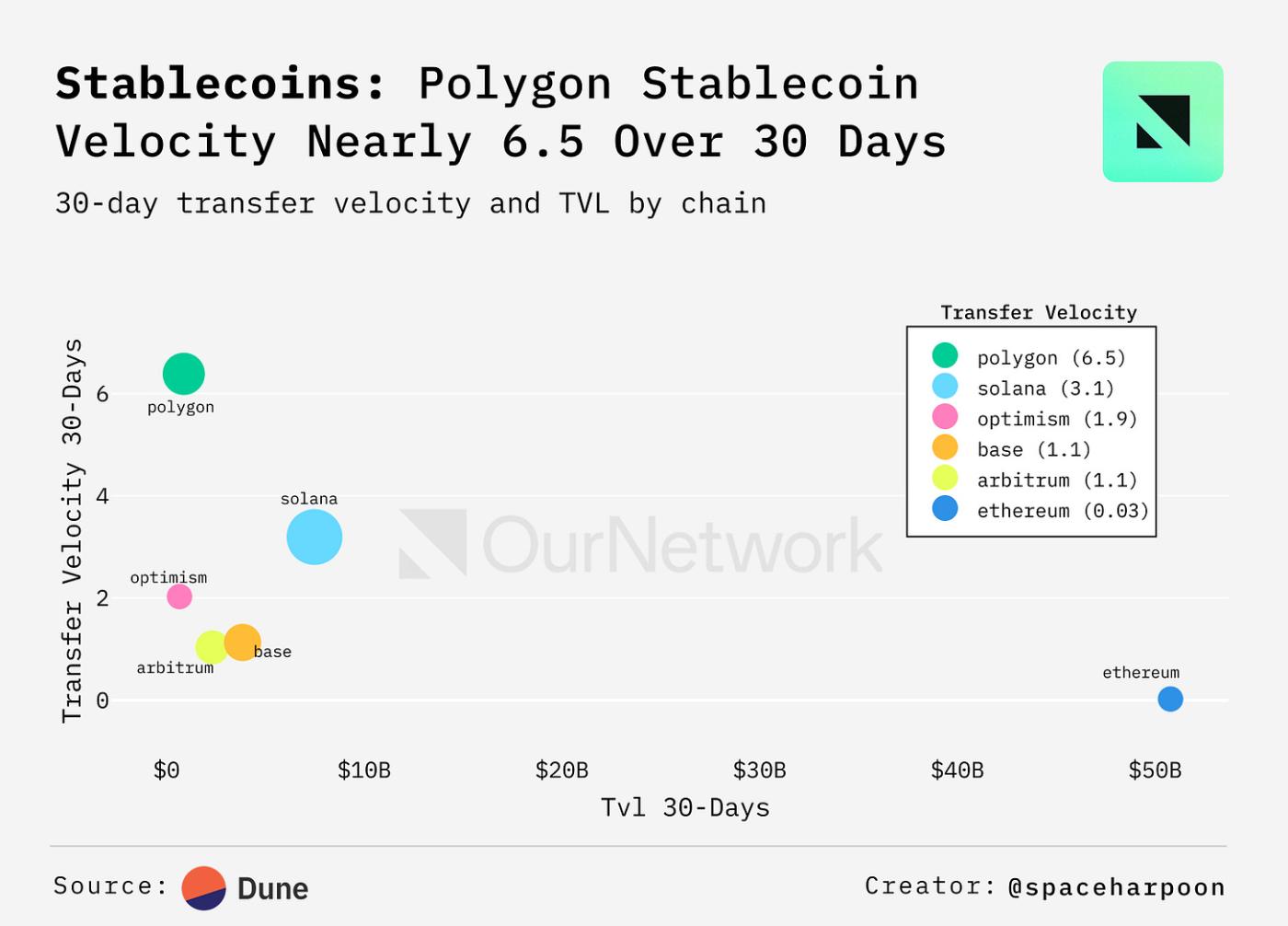

Polygon dominates stablecoin transfer velocity with ~50 transactions per $1 of total value locked (TVL) over 30 days, far ahead of Solana, Optimism, Base, Arbitrum, and Ethereum. Its efficiency challenges TVL’s focus, as high velocity shows active use. Experts suggest a "Network Utility Score" to measure economic activity better. Polygon’s low-cost, fast transactions drive USDC, USDT, and USDS activity, setting a new standard for chain health.

Polygon’s stablecoin velocity hit 6.46 over 30 days, leading despite modest TVL, while Ethereum’s $50B+ TVL shows near-zero activity, per the scatterplot below. Solana trails at 3.05. Polygon’s efficiency drives payments, questioning TVL’s value — should velocity redefine chain health?

Quick Links: Disclosures

Thanks for reading OurNetwork! Subscribe for free to receive new posts and support our work.