Original | Odaily (@OdailyChina)

Author | Nan Zhi (@Assassin_Malvo)

Since BTC peaked in early February and fell below the $100,000 mark, market sentiment and trends have significantly declined. Especially after Libra collapsed Solana meme, the few active tracks in the market also fell silent, with SOL dropping from its high of $295 to a low of $95, a decline of 67.8%.

In this context, old VC tokens and meme tokens began to collapse, with tokens like ACT and OM experiencing dramatic halving after halving. Meanwhile, token valuation bubbles were burst, with newly listed VC tokens like SHELL having a circulating market cap of only $30 million, with few projects able to exceed a $100 million market cap at opening.

Therefore, tokens with high early valuations and low unlock percentages are likely to be quality short targets. This article will compile data on tokens listed on Binance Futures to provide readers with potential operational references.

Basic Situation

Statistical objects: Tokens currently tradable on Binance Futures market, listed after January 1, 2023

Data sources: Token market cap from CoinGecko, token listing time from Binance Futures API, token unlock percentage from token.unclocks and CoinGecko

Further explanation: token.unclocks' unlock percentage is calculated from project white papers and actual announcements, which is considered relatively more accurate, but with limited coverage. Therefore, CoinGecko's circulating market cap/FDV is also used as an alternative unlock percentage.

Results

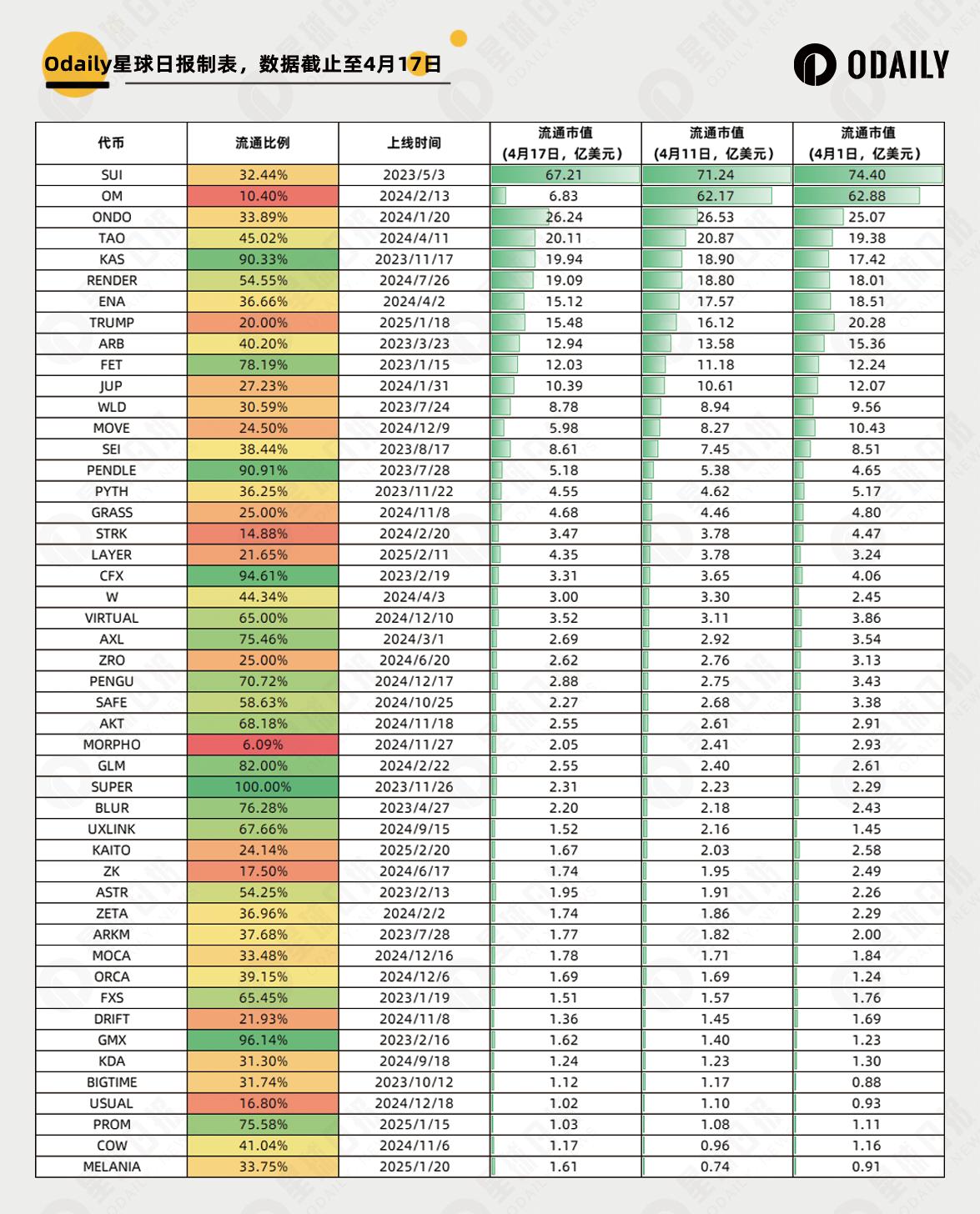

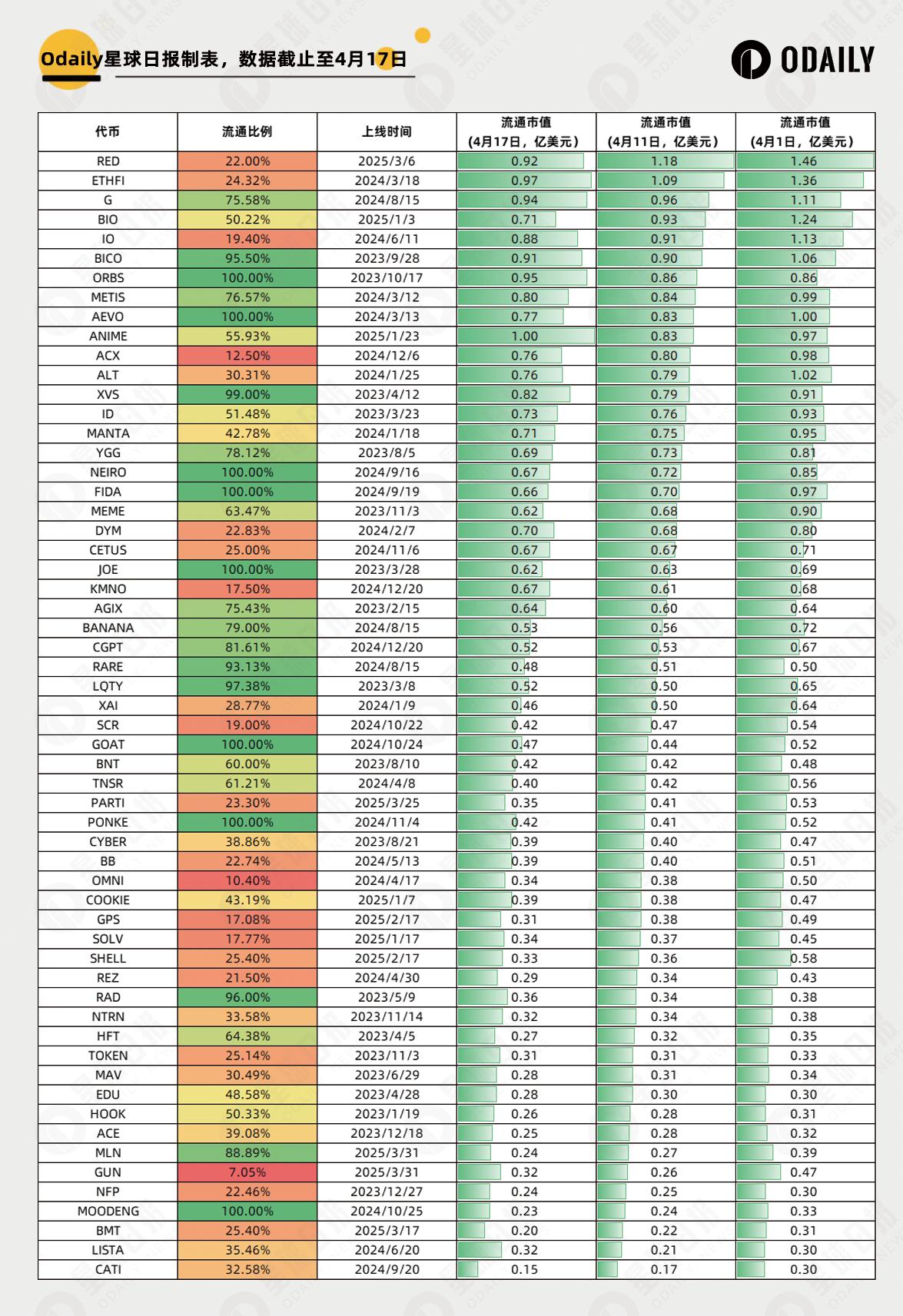

Binance Futures listed 216 tokens after 2023, with token.unclocks providing unlock data for 106 tokens. Tokens with circulating market cap over and under $100 million are divided as follows:

Market cap over $100 million

Market cap under $100 million

Theoretically, the higher the market cap, the lower the circulation percentage (red), the more worth shorting. For example, OM with only 10% unlock percentage but a market cap of $6.2 billion has an extremely high short selling probability.

Currently, tokens with market cap over $100 million and unlock percentage below 25% include OM, TRUMP, MOVE, STRK, LAYER, MORPHO, KAITO, ZK, DRIFT, and USUAL. There are even more tokens under $100 million with percentages below 2%, which readers can check in the table.

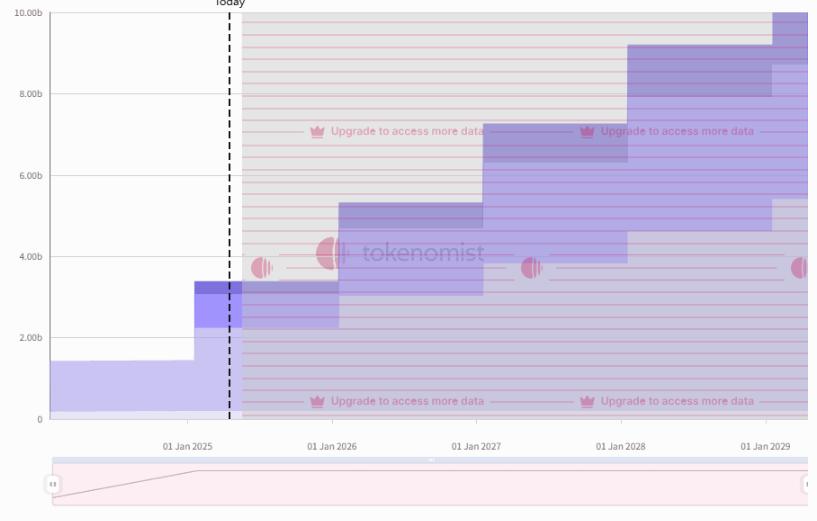

It's also important to note that low unlock percentage doesn't automatically mean shorting is advisable. One needs to consider token unlock details, such as ONDO, which has a low unlock percentage but only unlocks once a year (as shown below), meaning no selling pressure in the short term.

How else to choose besides percentage?

Initially, the author believed three types of tokens should not be shorted:

Historical volatile tokens (SUI, OM, etc.)

DeFi tokens with consistent, stable income (like PENDLE)

Korean influence tokens (UXLINK, IP)

However, in the past two weeks, these "historical volatile tokens" have entered the final stage, so some previously strong but recently underperforming tokens can also be considered for shorting.

CoinGecko Unlock Percentage Reference

Using CoinGecko's circulating market cap/FDV as unlock percentage and filtering tokens over $200 million market cap yields the following:

Most tokens show no substantial unlock percentage change, but a few tokens without data from token.unlocks were added, including IP, WAL, BERA, and PLUME.