Ethereum Short ETF Records Record Profit Up to 250%, Leading US Market as ETH Plummets 51% Since Beginning of Year.

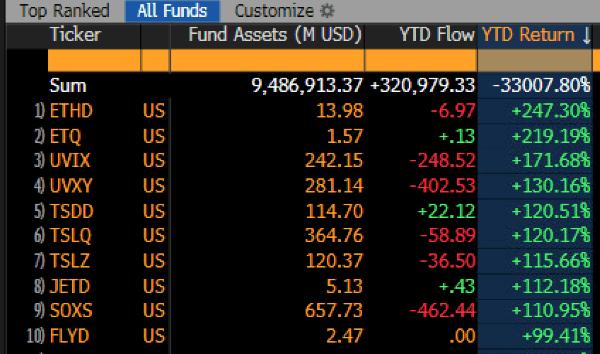

In a cryptocurrency market drowning in red, investment products betting on the downward trend of Ethereum are bringing exceptional profits to investors. The latest analysis from Bloomberg's ETF expert Eric Balchunas shows that the two top-performing ETFs in the US in 2025 are both inverse leverage products targeting Ethereum.

Inverse Leverage Strategy Brings Exceptional Profits

ProShares UltraShort Ether ETF (ETHD) is currently leading the market with a year-to-date profit of nearly 250%. This high-risk product uses financial leverage to double the performance inverse to the Bloomberg Ethereum Index in each trading session. Basically, when the Ethereum index drops 1%, ETHD increases by about 2%.

Not far behind, Rex Shares' T-REX 2X Inverse Ether Daily Target ETF ranks second with a yearly profit of around 220%. Unlike ETHD, this product directly shorts ETH spot instead of using the Bloomberg index, but still applies the same 2x leverage.

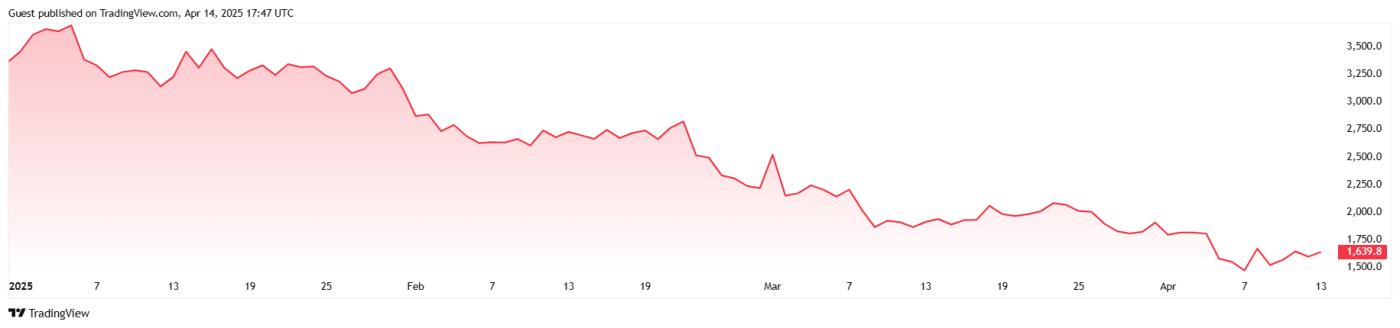

The success of these two funds directly reflects Ethereum's gloomy situation, with ETH having plummeted nearly 51% since the beginning of 2025. While many investors witness their portfolios being heavily impacted, those betting on the downward trend have earned significant profits.

Commenting on the situation, Eric Balchunas made a rather bitter observation: "The highest-performing ETF this year is ETHD with a 247% increase. Second place? Also an ETH short ETF with negative 2x leverage. Brutal."